Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 25, 2025

By Keith Nissen

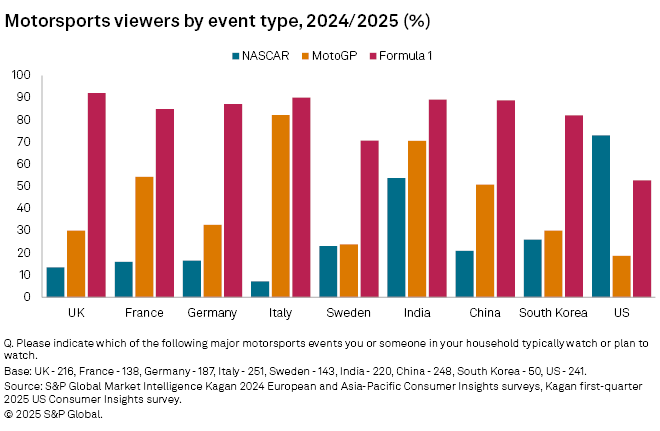

➤ Nine out of 10 motorsports viewers outside the US watch Formula One events, while approximately three-quarters in the US watch NASCAR.

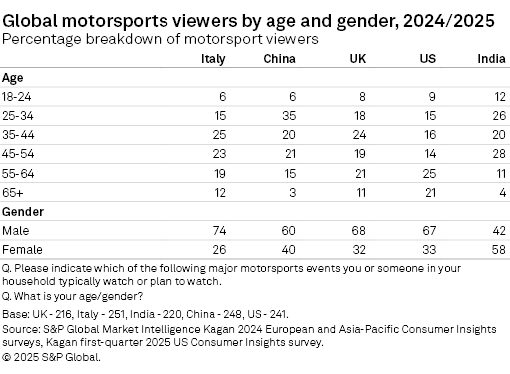

➤ In Europe, most motorsports viewers are in the 35–54 age group. China and India skew a bit younger. The majority in the US are in the 55+ age bracket. Except for India, the surveys found that two-thirds to three-quarters of motorsports viewers were men.

➤ Motorsports viewers in the US also watch other sports. They are much more likely to watch ice hockey, combat sports and professional wrestling than average Americans.

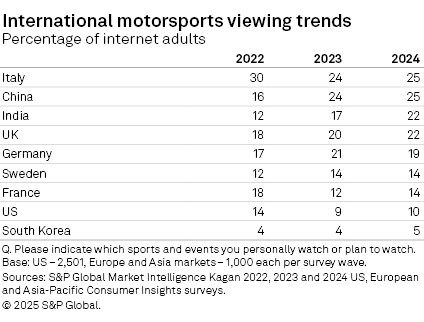

➤ Motorsports viewing in Europe and parts of Asia is double that of the US. Internationally, motorsports viewers tend to be younger than those in the US.

Motorsports are popular worldwide. The results from S&P Global Market Intelligence Kagan Consumer Insights surveys conducted in the US, Europe and Asia show that viewing motorsports events is most popular in Italy and China, where one out of four (25%) internet adults said they watched NASCAR, Formula One or MotoGP races. The surveys also found that motorsports are very popular in India (22%), the UK (22%) and Germany (19%). In comparison, only 10% of surveyed internet adults in the US and 5% of those in South Korea reported watching motorsports last year.

Survey results also highlight that Formula One races are by far the most popular motorsports events throughout Europe. Approximately nine out of 10 motorsports viewers in the UK, France, Germany and Italy indicated they watched Formula One races. Formula One races were also the most popular motorsports events in Sweden, China, India and South Korea. The National Association for Stock Car Auto Racing (NASCAR) series is primarily an American sport, with nearly three-quarters (73%) of US motorsports viewers watching NASCAR events. India is the only other market surveyed where NASCAR has a substantial viewership. Grand Prix motorcycle racing (MotoGP) has its strongest following in Italy (82%), India (70%), France (54%) and China (52%). Only 19% of US motorsports viewers said they watched MotoGP events.

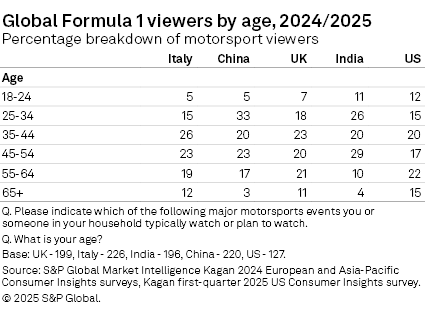

The survey data shows that the age distribution among motorsports viewers differs slightly from market to market. For instance, in Italy nearly half of motorsports viewers were between 35 and 54 years of age. Motorsports viewers in China and India tend to be skewed toward slightly younger adults, with 35% of Chinese viewers between 25 and 34 and 38% of viewers in India under 35 years of age. In contrast, 46% of motorsports viewers in the US were 55 years of age and older.

Motorsports is typically dominated by male viewers. Most often, between two-thirds and three-quarters of motorsports viewers in the US, Europe and Asia were men. Female viewers were slightly higher in China (40%) and represented the majority (58%) of motorsports viewers in India.

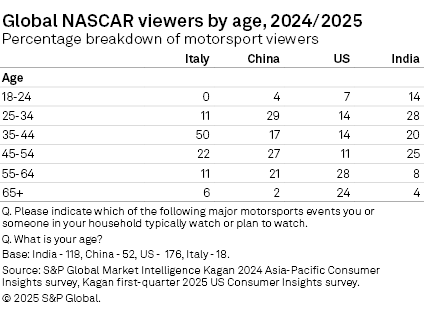

The age distribution of NASCAR viewers generally mirrors that of overall motorsports viewers. For example, NASCAR viewers in China and India tend to be younger adults (25–44), while NASCAR is most popular among older (55+) viewers in the US.

Similarly, approximately half (49%) of Formula One viewers in Italy and 43% in the UK were in the 35–54 age group. The majority (53%) of Formula One viewers in China and 46% in India were between 25–44 years of age. Viewing of Formula One events by Americans tends to be split fairly evenly with 47% under 45 years of age.

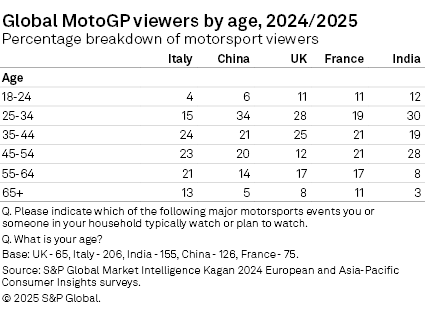

The overall motorsports demographic trends generally apply to those watching Grand Prix motorcycle racing, as well. Nearly half of MotoGP viewers in Italy fall into the 35–54 age category. MotoGP tends to attract younger viewers, as evidenced by the UK, India and China where four in 10 viewers were under 35 years of age.

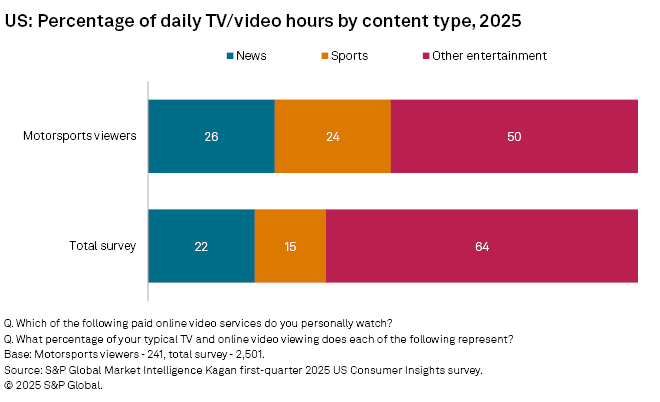

The US survey data shows that motorsports viewers tend to spend more time, on average, watching sports than most consumers. Overall, Americans spend 22% of their daily TV/video hours watching news programs, 15% watching sports and approximately two-thirds (64%) watching other entertainment. The survey found that motorsports viewers spend more time watching sports (24%), and substantially less time watching other entertainment than average Americans.

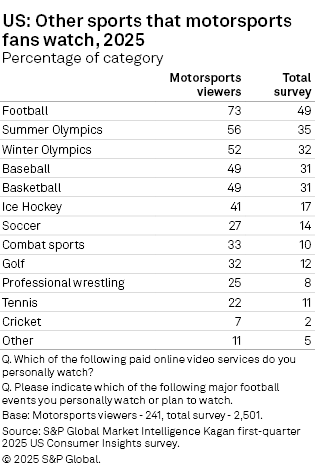

The survey results show that nearly three-quarters (73%) of motorsports viewers watch football (primarily NFL games) compared to 49% of US internet adults overall. Viewing of the Summer and Winter Olympics, baseball and basketball by motorsports viewers was also higher than the overall US adult population.

Motorsports viewers that watch ice hockey were 23 percentage points higher than the overall survey. Similarly, motorsports viewers were more than three times as likely to watch combat sports or professional wrestling as the average American.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

The Kagan first quarter 2025 US Consumer Insights survey was conducted during March 2025, consisting of 2,501 internet adults. The margin of error is +/-1.9 ppts at the 95% confidence level. The 2024 Kagan European Consumer Insights survey was conducted in December of 2024, consisting of 1,000 internet adults in France, Germany, Italy, Sweden, Poland and the UK. The Asia-Pacific Consumer Insights survey was conducted in June 2024, consisting of 1,000 internet adults in China, India and South Korea. The margin of error for both international surveys is +/-3.0 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.