Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 21 Sep, 2023

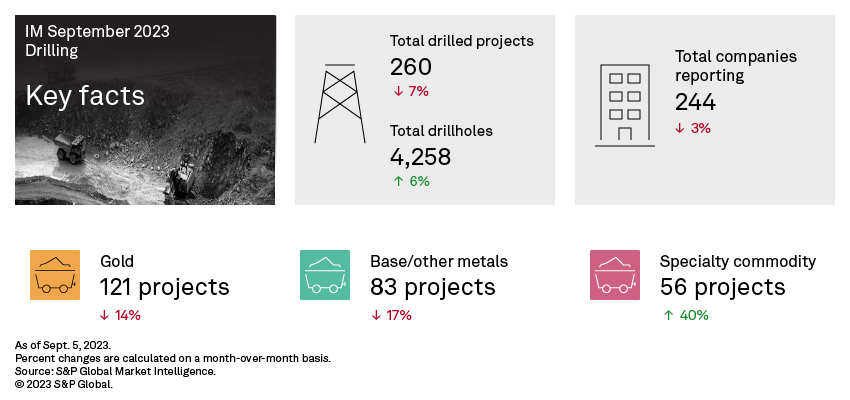

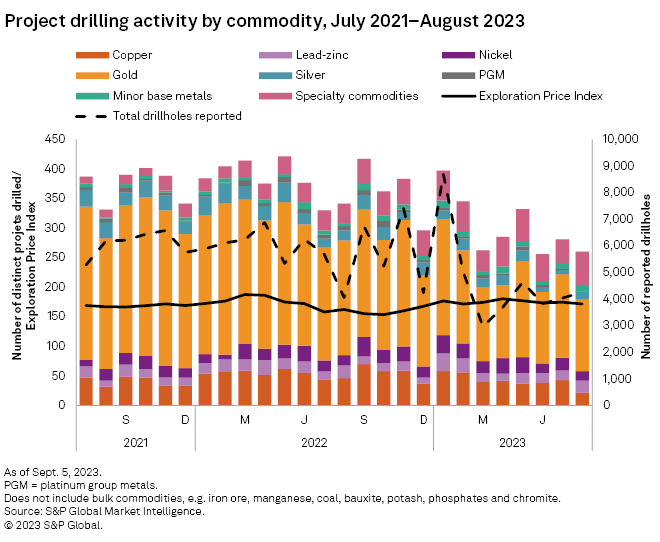

The number of projects drilled declined in August to 260, near 2023's lowest total of 256 recorded in June. Countering that, the total number of distinct drillholes reported increased 6% month over month to 4,258. A year-to-date comparison shows that the total reported drilled projects and drillholes were lower than in 2022 by 21% and 20%, respectively. Month-over-month increases in drilled projects for silver and specialty commodities proved insufficient to cushion the declines from base metals and gold drilling. The total early-stage and minesite projects drilled were down 7% and 29%, respectively. Only late-stage projects increased, albeit by a slight 2%.

Access August drill results data in the accompanying Excel spreadsheet.

After recovering in July, the total number of gold projects drilled once again fell to its joint lowest level for 2023. The yellow metal's total of 121 — the same as in June and 14% less than in July — stems from lower reporting in early- and minesite-stage projects and lesser projects from the US and Australia. Year to date, 1,146 gold projects have been drilled, a decline of almost 40% from the 2022 year-to-date total, mostly from decreases in drilling activity in early-stage assets. Drilled projects for silver almost doubled to 13 from 7 in July, although the year-to-date total also remained well below the 2022 total.

Base metals projects fell to a 20-month low of 69, with copper weighing down the monthly total after halving to 22 from 43. Year to date, base metals proved more resilient than gold, buoyed by a 20% year-to-date increase in nickel projects, resulting in a decline of only 6% versus the 2022 year-to-date total. Out of the three main commodity groups, only specialty commodities posted an increase, up 40% month over month to 56, the highest monthly total for the group since our records began in 2014. The strong numbers for specialty metals brought by increases in lithium, graphite and uranium are reflected in the group's year-to-date total of 382 projects, 69% more than in 2022. As of August, early-stage lithium projects had the highest year-over-year growth in activity. Australia leads the aggressive drilling for lithium this year, followed by Canada in a distant second.

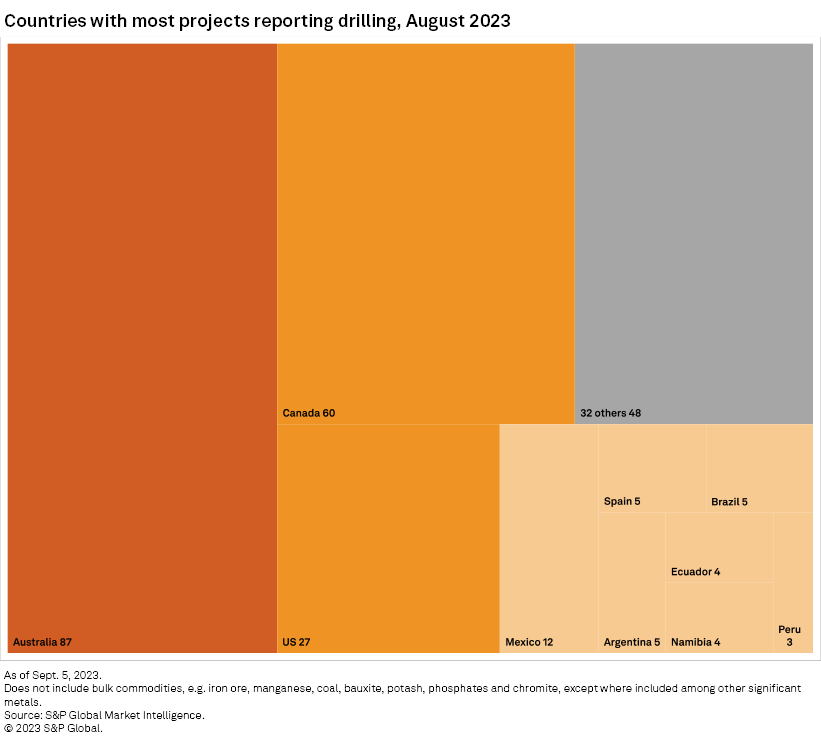

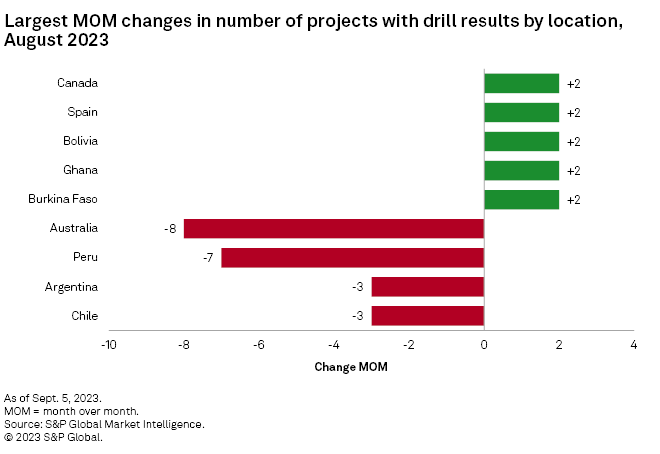

Australia remained the top country despite reporting the largest decrease, while Canada maintained the second spot. Australia recorded 87 drilled projects, weighed down by less copper and gold activity despite increases in specialty metals and lead-zinc. Canada inched up 3% to 60, buoyed by graphite, uranium and niobium. The US remained a distant third, with its monthly total unchanged from July at 27, as increases in lithium and base metals negated the decline in gold.

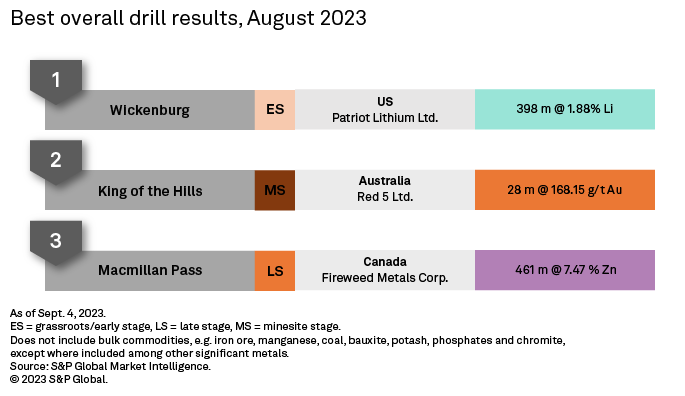

The second-best result came from ASX-listed intermediate company Red 5 Ltd.'s King of the Hills gold mine in Western Australia. The company reported a 28-meter intersect grading 168.15 grams of gold per metric ton. The result is part of the underground drilling conducted to potentially extend the project's mine life, and further underground drilling is planned for fiscal year 2024.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.