Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 30, 2025

By Paul Manalo

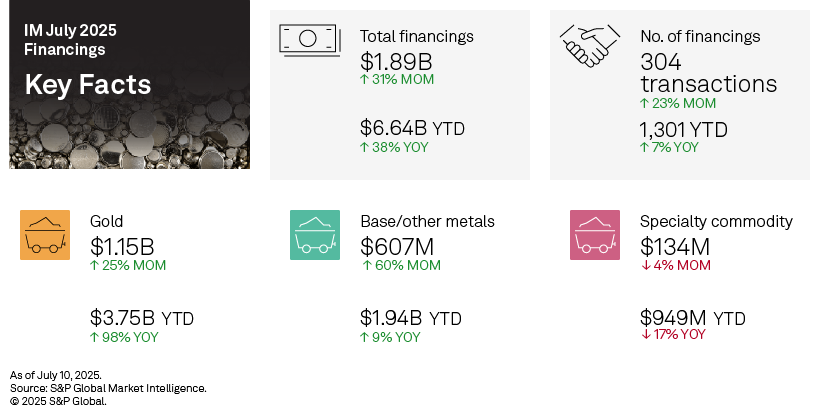

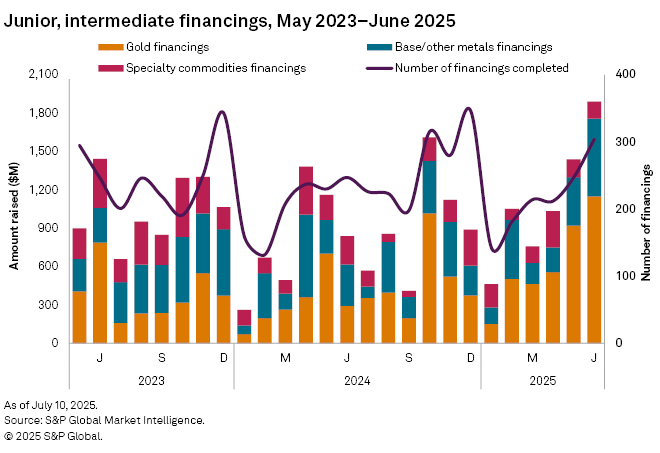

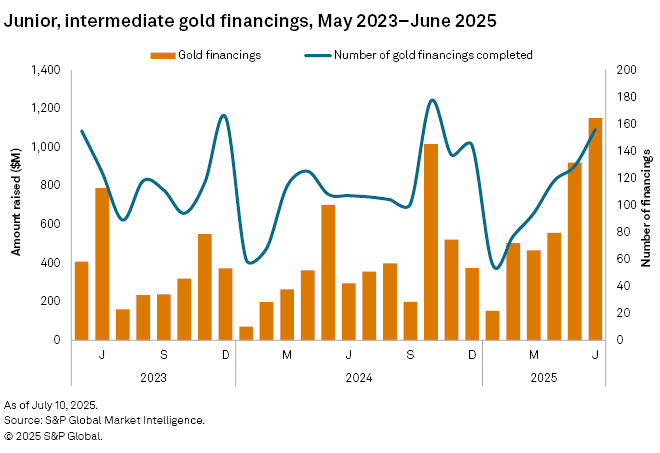

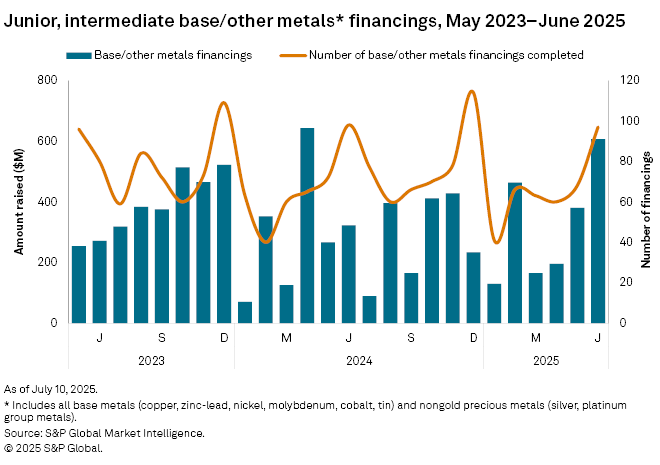

Funds raised by junior and intermediate companies increased to $1.89 billion in June, marking the highest level since March 2022 — the fundraising peak before the downward trend post Russia's invasion of Ukraine. The rise was a 31% increase from the $1.44 billion reported in May, making June the third consecutive month of growth.

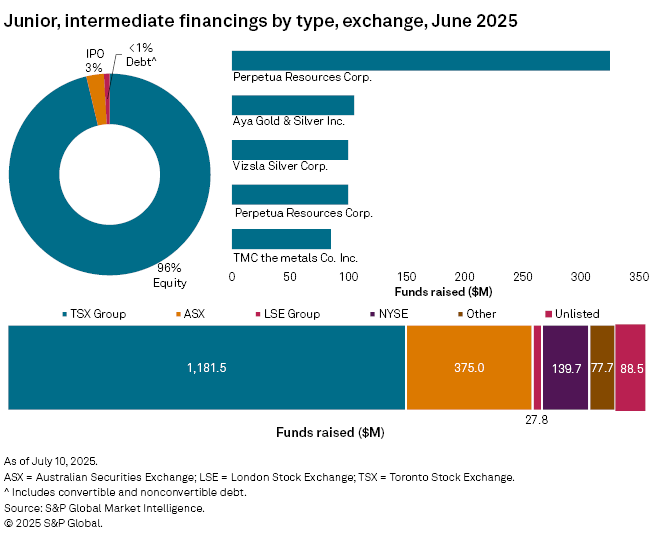

A rise in high-value financings for gold and silver primarily drove the increase, with a significant portion allocated for development work. Additionally, the number of transactions rose to 304, up from 247 in May. Significant financings — transactions valued at over $2 million — went up to 116, compared to May's 96. However, there were six transactions valued at over $50 million, a slight decrease from seven in May.

June 2025 financing data is available in the accompanying databook.

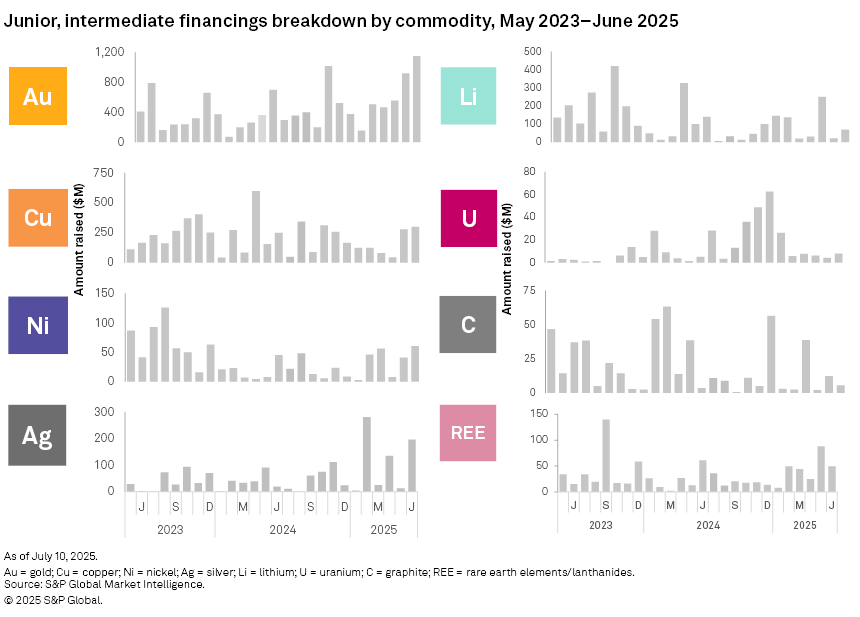

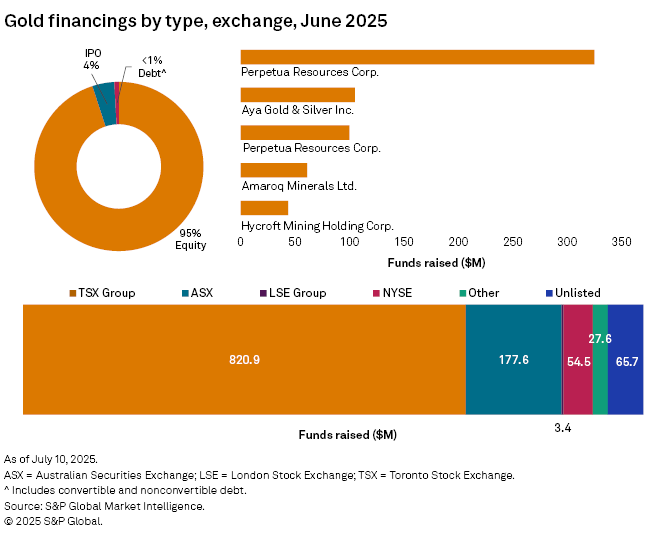

Gold financings reach record-high

Gold financings rose 25% month over month to $1.15 billion, marking the highest level in our records dating back to January 2014. Since the beginning of 2025, gold financings have increased each month with the exception of March, driven by several high-value transactions. The total number of transactions climbed to 156, up from 129 in May; however, the number of significant transactions decreased slightly to 62, down from May's 67. Additionally, there were four transactions valued at over $50 million, compared to five in May.

The largest gold financing, and the largest overall, was a $325 million domestic follow-on offering by Idaho-based Perpetua Resources Corp. In addition to this transaction, Perpetua completed a smaller private placement totaling $100 million. Both are part of the company's plan to raise $2 billion for the development of its Stibnite mine in Idaho, which received its final federal permit in May 2025. Perpetua began construction of the mine in June 2025, with an estimated start of production in 2029. The latest estimates indicate that the mine will produce 297,000 ounces of gold annually.

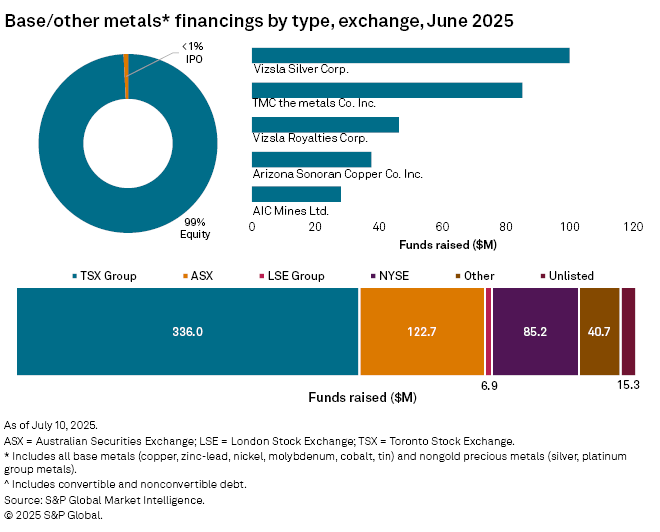

Silver boosts base, other metals group

Funds raised for base and other metals group jumped 60% to $607 million in June. While copper and nickel increased, silver significantly boosted the group's total by reaching $196 million. The number of transactions in this category rose to 97, up from 68 in May, and the number of significant financings increased to 37 from 20. Additionally, there were two transactions valued at over $50 million, up from one in May.

The largest financing in this category and the third-largest overall was a $100 million follow-on offering by Vancouver-based Vizsla Silver Corp. The company plans to use the net proceeds to advance the Panuco project in Mexico, which is undergoing a feasibility study expected to be completed in the second half of 2025.

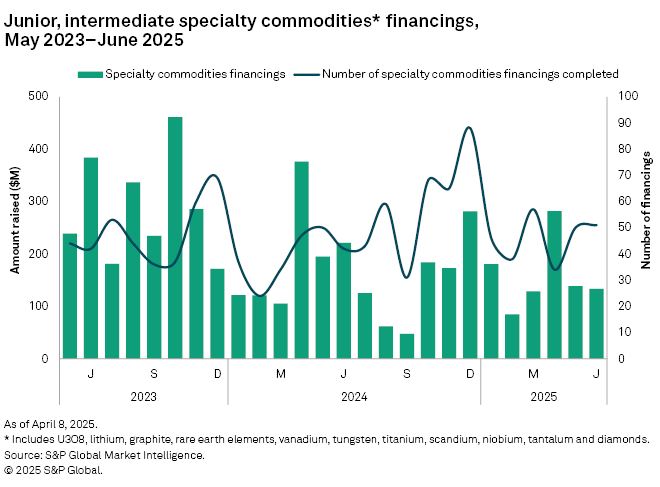

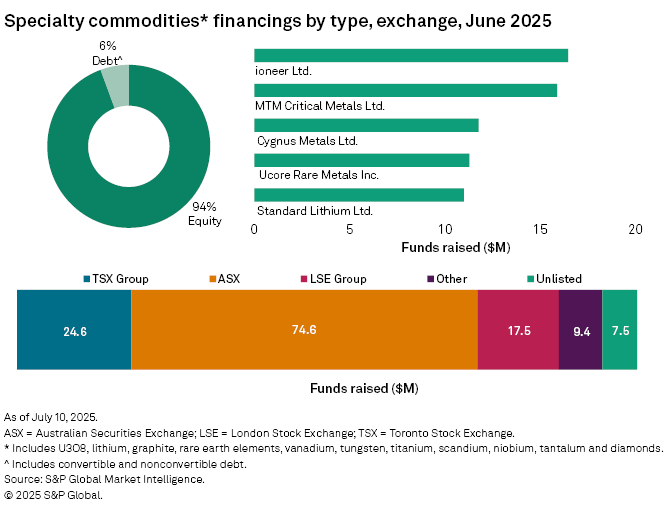

Lithium up, specialty group financings remain scarce

For the second consecutive month, the specialty commodities group declined, with funds raised down 4% to $134 million. Lithium financings slightly increased, rising to $69 million, but were offset by declines in rare earth, graphite and tungsten financings. The total number of transactions increased by one to 51, and the number of significant financings nearly doubled to 18. However, there were no transactions valued at over $50 million in June, down from one in May.

The largest transaction in this category was a A$25 million private placement of common stock by Sydney-based Ioneer Ltd. The company plans to allocate the proceeds to advance project readiness, cover environmental and permitting expenses, and fund other costs associated with the Rhyolite Ridge lithium project in Nevada.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.