Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — August 29, 2025

By Paul Manalo

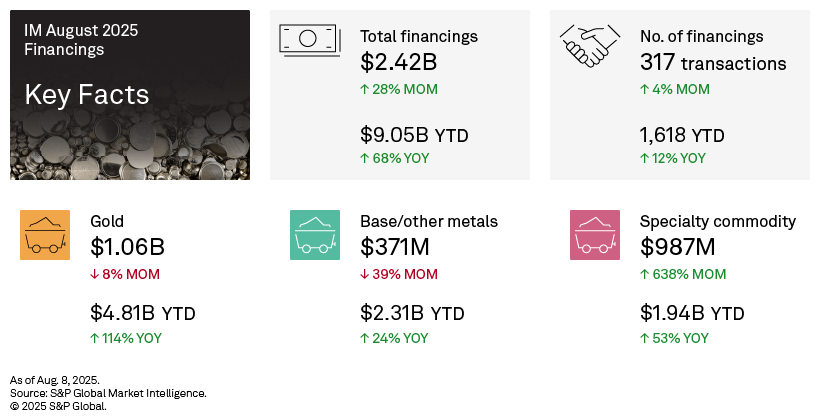

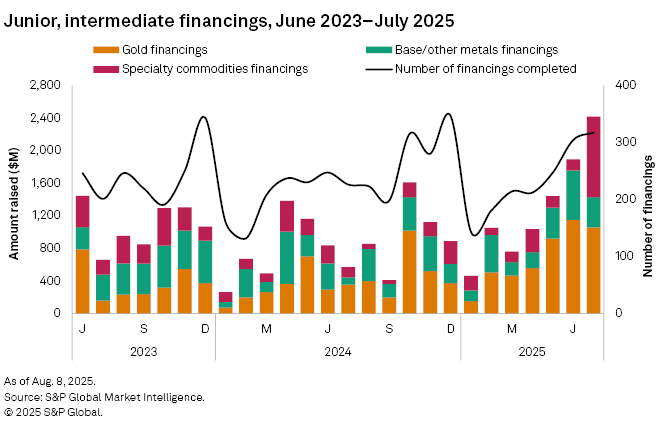

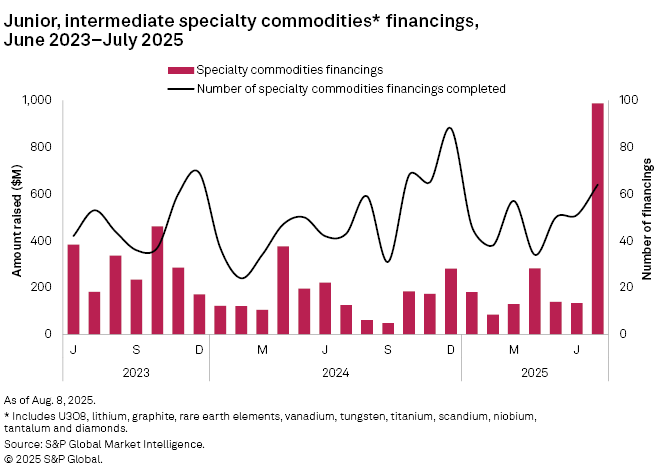

Funds raised by junior and intermediate companies increased to a new multiyear high of $2.42 billion in July, marking the highest level since the record high of $3.69 billion in March 2021. This represents a 28% increase from the $1.89 billion reported in June, making July the fourth consecutive month of growth.

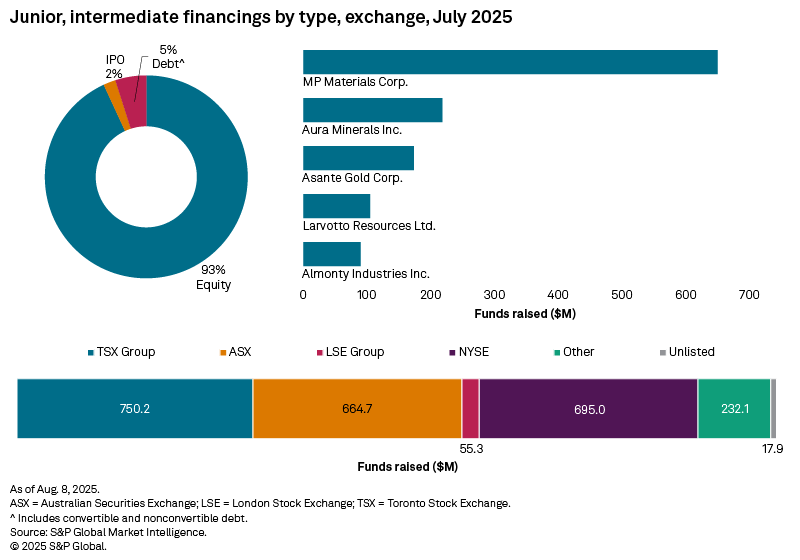

Gold financings continued to account for the largest share, despite a slight decline in funds raised. The increase in funds for specialty commodities, particularly rare earth elements, contributed significantly to the rise in July, offsetting declines in base metals financings. The number of transactions in July rose to 317, up from 304 in June. Notably, significant financings — transactions valued at over $2 million — rose to 121 compared to 116 in June. However, there were five transactions valued at over $50 million, a slight decrease from six in June.

July 2025 financing data is available in the accompanying databook.

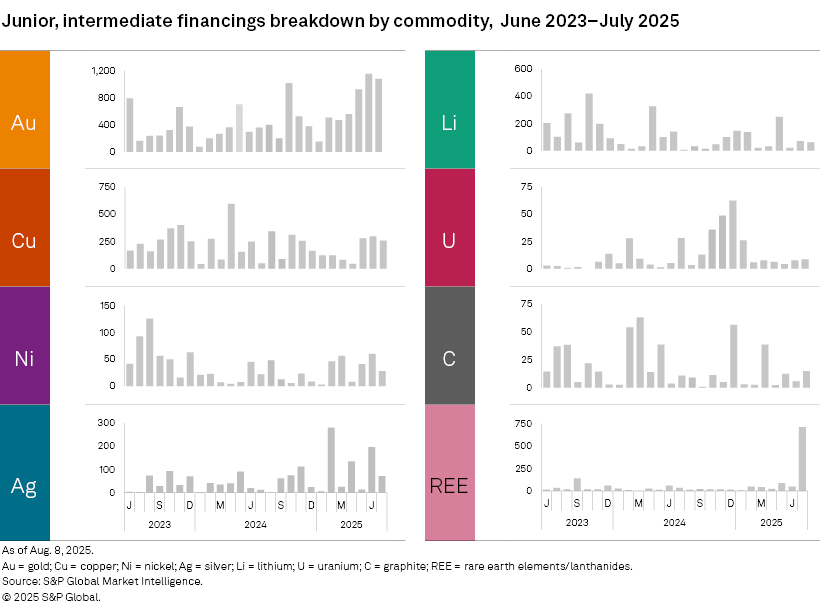

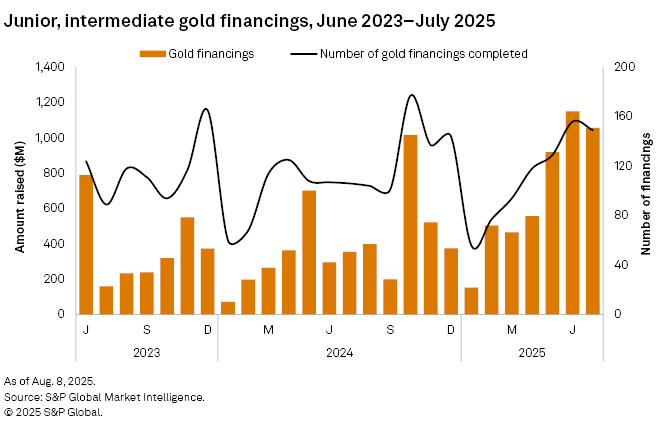

Gold fell slightly but remains above $1B

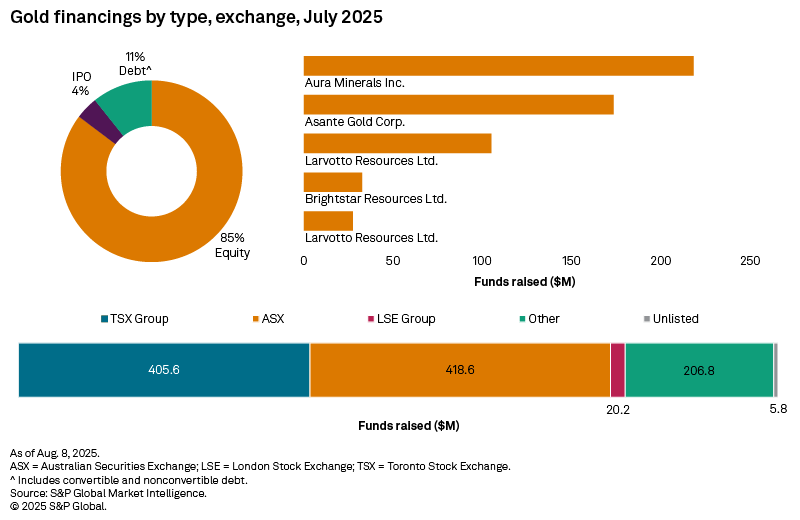

Gold financings fell 8% month over month to $1.06 billion, following a record high in our data dating back to January 2014. Since the beginning of 2025, gold financings have increased each month except for March, driven by several high-value transactions. The total number of transactions decreased to 149 from 156 in June, while the number of significant transactions fell by one to 61. There were three transactions valued at over $50 million, compared to four in June.

The largest gold financing, and the second-largest overall, was a $218 million follow-on offering by Florida-based Aura Minerals Inc. The proceeds will be used to finance the acquisition of Mineração Serra Grande SA in Brazil from AngloGold Ashanti, as well as the development of the company's Era Dorada and Matupa projects in Guatemala and Brazil, respectively.

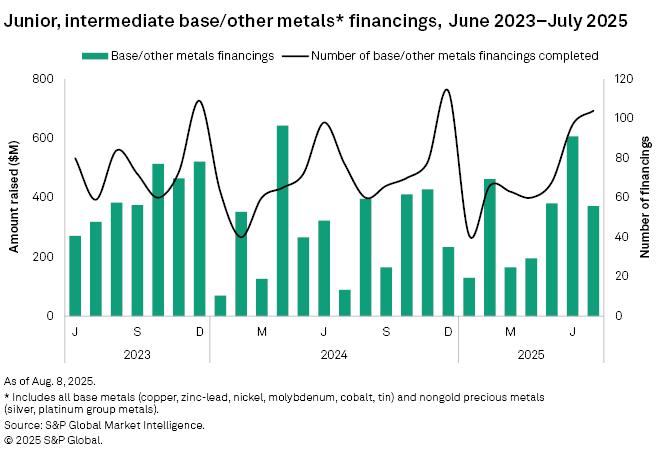

Base and other metals group tempered totals

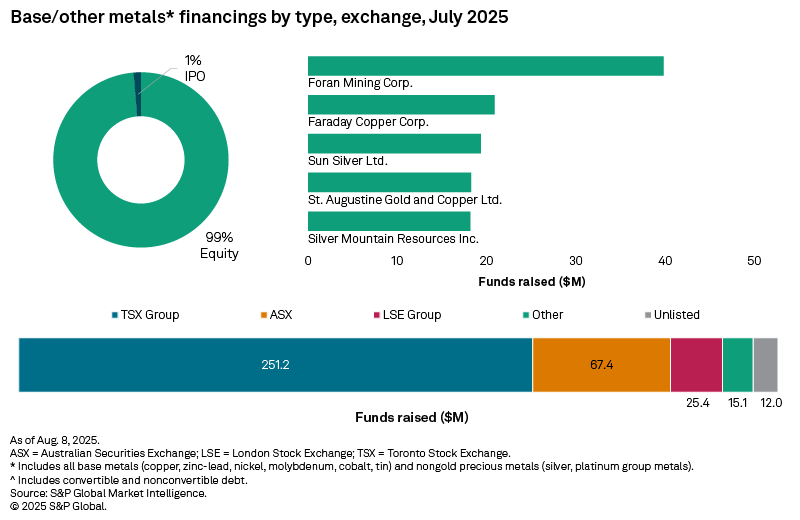

Funds raised for the base and other metals group fell 39% to $371 million in July. All major commodities in this group declined, with silver and copper experiencing the largest drops, at $125 million and $40 million, respectively. Despite the decrease in total funds raised, the number of transactions in this category rose to 104, up from 97 in June, while the number of significant financings increased to 41 from 37. There were no transactions valued at over $50 million, down from two in June.

The largest financing in this category, and the eighth-largest overall, was a C$55 million private placement offering by Vancouver-based Foran Mining Corp. This transaction is part of the company's plan to raise C$350 million for the construction of the McIlvenna Bay copper mine in Saskatchewan, as well as to advance exploration at near-mine and regional targets.

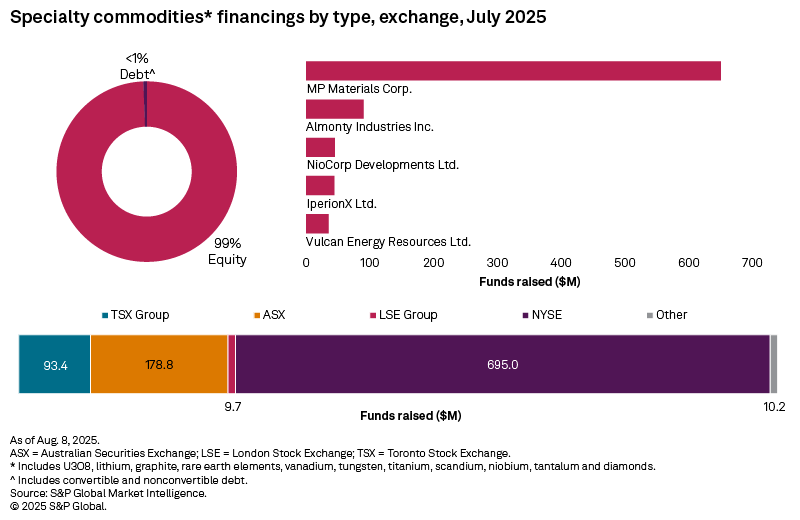

Lithium fell slightly , but rare earth and tungsten boost specialty group

After declining for two consecutive months in June, the specialty commodities group posted a huge increase in July, up by more than sevenfold to $987 million. Lithium financings fell 13% to $60 million, but the largest boosts were from rare earth elements and tungsten financings. The total number of transactions increased to 64 from 51 in June, and the number of significant financings increased to 19 from 17. There were two transactions valued at over $50 million in July, up from none in June.

The largest transaction overall was a $650 million follow-on offering placement of common stock by Nevada-based MP Materials Corp. The company plans to allocate the proceeds to fund the acceleration and expansion of operations of the 10X Facility, a magnet manufacturing plant aiming to boost the US production of rare earth magnets. The company owns the Mountain Pass rare earth mine in California and the Independence magnetics facility in Texas.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.