Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Technology, Media & Telecom — 12 Feb, 2018

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

The UK And Germany

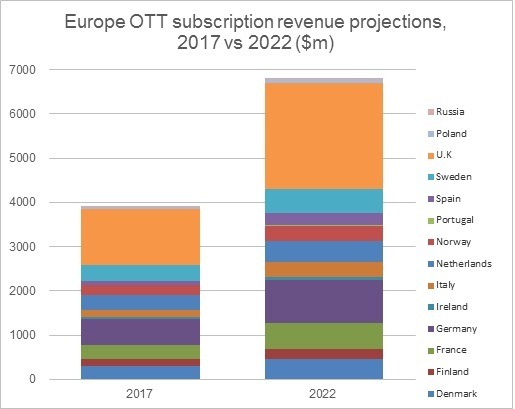

The over-the-top subscription online video-on-demand market in Europe should keep growing over the next five years, with Kagan, a media research group within S&P Global Market Intelligence, projecting the market to reach $6.8 billion in revenues in 2022, up from $3.9 billion in 2017. The main factors contributing to this development are the presence of localized Netflix Inc. throughout the region, the expansion of Amazon.com Inc.'s Amazon Prime Video as a stand-alone service, the debut of international OTT services such as Turner's HBO and Naspers Ltd.'s Showmax as well as the strengthening of offerings from local media providers (i.e. Sky plc's NOW TV, ProSiebenSat.1 Media SE's Maxdome, etc.).

In this report we take a closer look at 14 European markets, including Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, United Kingdom, Poland and Russia. Netflix leads in active paying users in all countries but Germany, Poland and Russia. The online giant has been investing heavily in local content in the majority of the European markets where it operates. In Germany, Amazon Prime Video is ahead of the competition, having capitalized on the earlier success of Amazon Prime. On the other hand, in Eastern Europe, local services have been able to dominate even when facing bigger international entrants. The majority of these services adopt a hybrid AVOD/TVOD/SVOD model focusing predominantly on advertising to generate revenues.