Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 9, 2026

By Manan Tulsian and Jigar Saiya

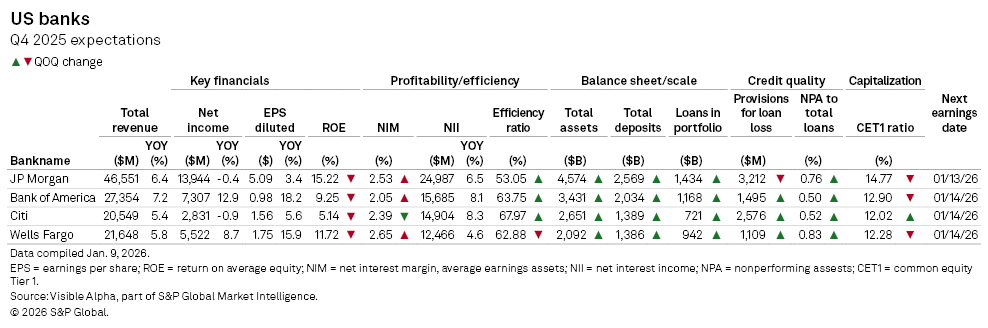

US big banks kick off fourth quarter earnings season on Tuesday, January 13, with JPMorgan Chase & Co. (NYSE: JPM) reporting first, followed by Bank of America Corp. (NYSE: BAC), Citigroup Inc. (NYSE: C), and Wells Fargo & Co. (NYSE: WFC) on Wednesday. Based on Visible Alpha consensus estimates, the big banks are expected to end fiscal 2025 on a relatively strong footing, building on resilient earnings through the first three quarters of the year.

All four of the large US banks are expected to deliver mid-single to high-single digit year-on-year revenue growth, reflecting resilient fee income and stable net interest income (NII). Bank of America is seen leading the earnings momentum, with net income projected to rise nearly 13% year-on-year, supported by strong operating leverage and balance sheet growth. Wells Fargo also shows healthy earnings growth, with net income expected to grow 8.7% year-on-year, driven by improved efficiency and higher NII.

In contrast, JPMorgan and Citi present a more subdued earnings picture. JPMorgan’s net income growth is expected to be modest (+0.5% YOY), suggesting margin pressure and elevated costs offsetting revenue gains. Citi’s earnings are expected to be slightly negative, driven by ongoing profitability challenges amid restructuring efforts.

All four banks have announced sizeable share buybacks in 2025, helping lift EPS growth above the pace of net income expansion.

Credit quality is expected to remain broadly stable across the four banks, with non-performing assets (NPAs) holding below 1% of total loans for all major lenders. However, most banks are building reserves in response to slight quarter-on-quarter NPA increases. Capital ratios remain comfortably above regulatory minimums. JPMorgan and Bank of America are expected to see slight quarter-on-quarter declines, reflecting balance sheet expansion and capital deployment, while Citi posts a modest improvement, aligning with its capital optimization efforts.

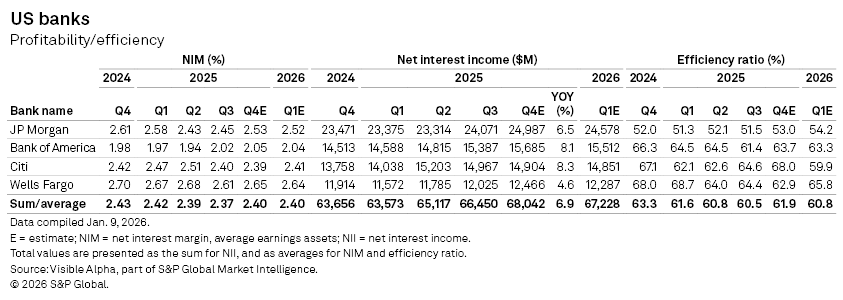

Profitability and efficiency:

Analysts expect NIMs to improve modestly in Q4 2025, averaging 2.40% across the four banks, up from 2.37% in the prior quarter. NII trends remain constructive, supported by balance sheet expansion and higher average earning assets. Aggregate NII is expected to rise nearly 7% year-on-year in Q4 2025, with Bank of America and Citi projected to deliver the strongest NII growth (both above 8% YOY), reflecting loan growth and international contributions.

However, NII momentum is expected to moderate into Q1 2026, signaling a more normalized earnings environment as rate tailwinds fade.

Efficiency trends highlight increasing divergence in operating leverage across the large banks. Wells Fargo is expected to see the clearest structural improvement, with its efficiency ratio declining steadily from 68% in Q4 2024 to 62.9% in Q4 2025, reflecting cost discipline and operational streamlining.

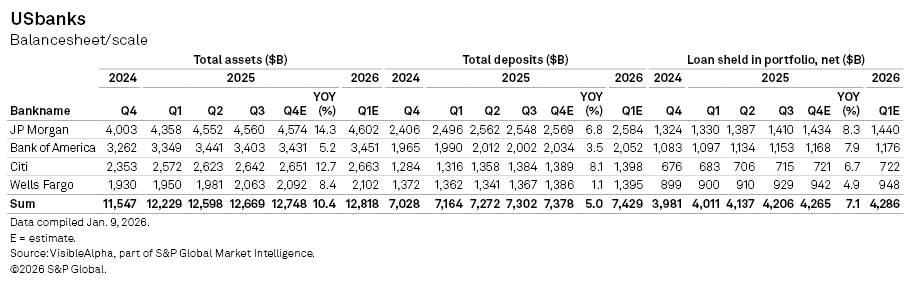

Balance sheet and scale:

All four major banks show healthy asset growth into Q4 2025, reflecting both organic balance sheet expansion and exposure to strong market activity. JPMorgan leads in scale, with total assets approaching $4.6 trillion in Q4 (+14.3% YOY), supported by a combination of lending growth, robust trading, and investment banking activity. Citi is also expected to see strong asset growth (+12.6% YOY), reflecting portfolio expansion, especially in international markets, and ongoing investment banking activity.

On the deposits front, analysts expect steady growth, supporting lending capacity and NII. A faster pace of monetary easing by the Fed could further lift growth in 2026. Meanwhile, loan portfolios are projected to expand across all banks, with the group’s Q4 net loans totaling $4.3 trillion. Loan growth could accelerate further if interest rates decline, and the economic outlook remains stable.

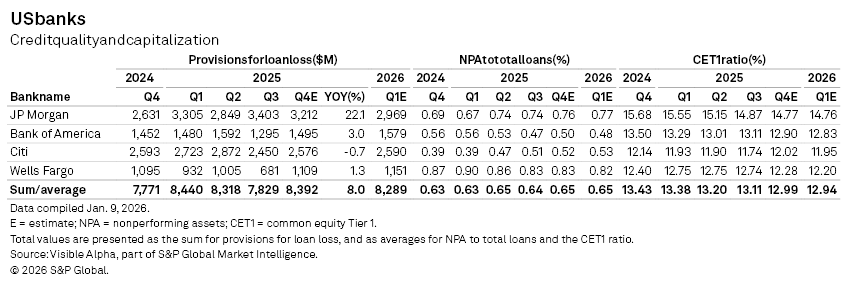

Credit quality:

Credit quality is expected to remain broadly stable in Q4 2025. Aggregate provisions for loan losses are expected to total $8.3 billion in Q4, up 6.3% year-on-year, signaling a cautious stance despite a generally healthy credit environment. NPAs are expected to remain low across the banks, averaging 0.65% in Q4, indicating strong underlying credit quality.

Capital levels remain robust, with common equity tier 1 (CET1) ratio expected to remain above regulatory minimums across the group, averaging 13% in Q4, providing strong buffers for lending and shareholder returns.

Overall, US big banks are expected to end 2025 with solid balance sheets, stable credit quality, and selective earnings momentum, positioning the group to navigate a more normalized rate environment in 2026.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings