Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan. 13, 2026

By Steve Piper

US coal market prices edged higher in December, extending a steady rally dating back to October. The gains to year-end 2025 accrued mainly to export benchmarks.

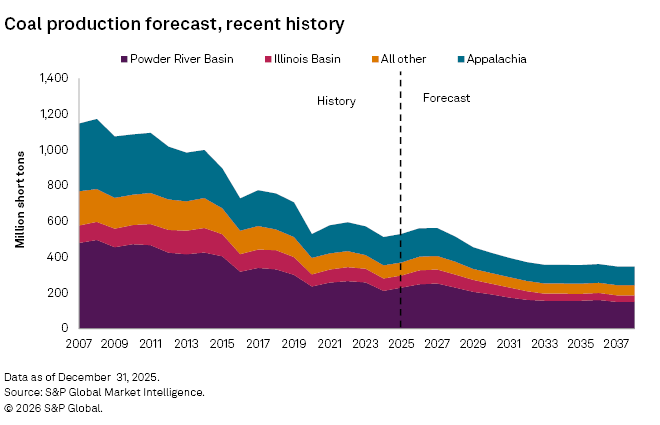

Through 2027, firm natural gas prices are expected to support increased coal generation, driving stable or growing coal production. After 2027, the US coal market is forecast to face pressure from the expansion of zero-carbon electricity, incentivized in part by broad-based tax credits. Overall, the S&P Global Market Indicative Power Forecast projects 38.4 GW of coal plant retirements by 2035, with much of the planned retirement activity deferred until after 2030.

Coal plant generation share through 2035 is forecast to decline slowly to just 7.5% from 18.7% of total generation in 2026. The rapid phaseout of tax credits under the recently approved US tax and spending bill — also referred to as the "One Big Beautiful Bill Act" — is forecast to slow the wind and solar generation growth, allowing coal plants to run more often after 2030. The most production uplift will take place at the Powder River Basin (PRB), followed by the Illinois Basin (ILB), as the reduced growth of wind and solar generation mainly affects the generation mix in the Midcontinental US.

➤ US coal prices again moved higher in December, even as production and shipments trended essentially flat year over year for the month.

➤ The S&P Global Market Indicative Power Forecast anticipates 38.4 GW of coal plant retirements by 2035, amid market pressure to retain existing generation due to greater reliability needs and slower forecast growth in solar and wind energy.

➤ The production outlook varies by region, with the Powder River Basin and Illinois Basin expecting stable to slightly growing production through 2027, while Appalachian coal production is forecast to decline, due to reduced domestic demand and limited export growth.

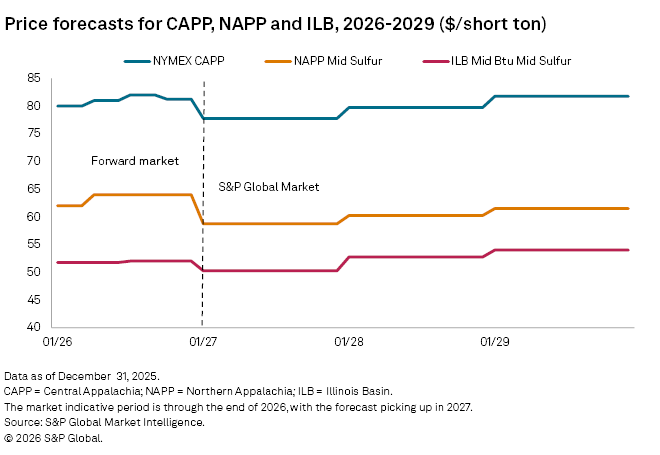

Coal prices clawed higher in December, with export benchmarks showing the most gains. CAPP region export benchmarks added $1.00/short ton to $82.00/short ton (1.2%), NYMEX CAPP added $2.00/short ton (2.6%) to $80.00/short ton and NAPP Pittsburgh Seam 13,000 Btu per pound held flat at $62.00/short ton. Illinois Basin 11,500 mid-sulfur moved $0.50/short ton higher to $51.75/short ton, while the NYMEX Powder River Basin benchmark held at $15.00/short ton.

The cold snap driving heating demand across the eastern US in late November mostly abated by mid-December. Henry Hub spot gas prices held mostly firm, opening December at $4.59/MMBtu and falling to a low of $3.31/MMBtu over the holiday season before rallying to close the month at $4.40/MMBtu. Spot prices averaged $4.28/MMBtu for the month. Storage withdrawals continued strong through mid-December, with working gas at 3,579 Bcf as of Dec. 12 — 32 Bcf above the five-year average and 61 Bcf below the same week of 2024.

Except for the Northeast US, regional gas market prices were subdued. Chicago Gate averaged $3.91/MMBtu, a $0.37/MMBtu discount to Henry Hub. TCO Pool's discount averaged $0.44/MMBtu for a monthly average of $3.84/MMBtu, while TETCO M3 went to a premium of $1.00/MMBtu for a monthly average of $5.28/MMBtu. SoCal Border averaged $3.20/MMBtu during the month, $1.08/MMBtu below Henry Hub.

The US Energy Information Administration (EIA) estimated September 2025 coal stockpiles at 105 million short tons, essentially unchanged from August. The mild summer and associated weak coal demand provided some cushioning against subsequent drawdowns during November-December.

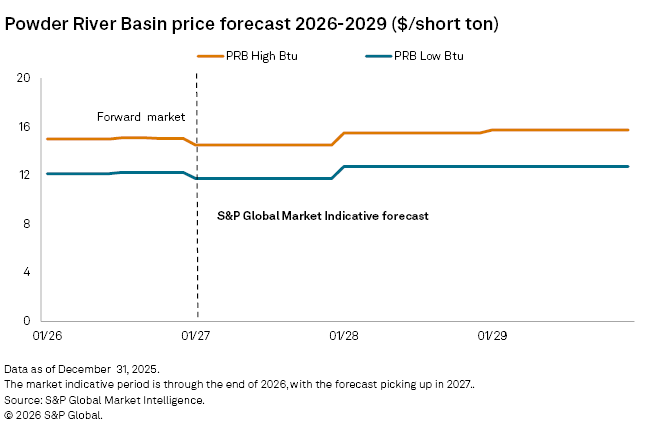

Current forward pricing for PRB coal is flat and stable, reflecting sufficient inventories at power plants and mining capacity to increase production as needed against firmer natural gas prices. After 2027, lower natural gas prices and declining coal demand is forecast to restrain price growth.

Bituminous coal price levels are primarily influenced by export markets, with today's price levels making domestic coal generation generally less competitive against Northeast natural gas. Firmer eastern natural gas prices nevertheless boosted eastern coal demand in the first half of 2025, mitigating a decline in Asia-Pacific seaborne coal demand compared to 2024..

Pricing benchmarks exceeding $65/short ton suggest sustainable returns for eastern bituminous coal, with Atlantic Basin export above that threshold and coal competing in Pacific Basin export markets generally below. After declining in 2024, bituminous coal demand for electric generation is expected to remain stable through 2027 on higher electricity demand and more supportive natural gas prices. Declines in steam coal demand are expected to resume after 2027, and overall eastern US coal demand is forecast to decline 47 MMst in 2025–30.

Outlook for US coal production, demand

For the four weeks ending Dec. 27, coal shipments averaged 9.9 MMst, 1.6% above 2024 levels. This continues the fourth-quarter trend of elevated inventories keeping shipments in line with 2024, following elevated shipments during the first half of 2025. Shipments ended 2025 at an aggregate 535 MMst, implying an inventory drawdown from year-end 2024 of 5-10 MMst.

The chart below compares the current production forecast with recent history. We forecast increased coal demand against higher natural gas prices through 2027. Gas-to-coal switching during the first quarter of 2025 reduced coal inventory surpluses from 2024-end, setting up production growth in 2025. We now forecast 2025 coal production at 530 MMst, an increase of 18 MMst (3.4%) from 2024 levels. Coal generation is forecast to further gain market share from natural gas through 2027, until relative coal and gas pricing normalizes and expanding green energy again puts pressure on coal generation. The overall coal market, comprising domestic demand and exports, is forecast to decline by 141 MMst between 2025 and 2030.

Production outlook — Powder River Basin

Production reports of the Mine Safety and Health Administration (MSHA) through the third quarter of 2025 indicate production of 172.2 MMst, an annualized rate of 229.6 MMst. Production is now forecast at 230 MMst in 2025, with higher inventories potentially constraining fourth-quarter production. Production is forecast to grow through 2027 against higher natural gas prices. By 2030, S&P Global Energy projects that coal retirements in the Midwest and expansion of wind generation in PRB's core markets will gradually shrink the coal demand to 192 MMst, declining further to 156 MMst through 2035.

Production outlook — Illinois Basin

MSHA's September quarter 2025 production reports indicate production of 50.6 MMst, or an annualized rate of 67.5 MMst. We forecast annual production will grow to 78 MMst through 2027, after which the expansion of wind generation and announced coal retirements are forecast to erode ILB coal demand. Coal production in the ILB is forecast to fall to 60 MMst by 2030, declining further to 39 MMst by 2035.

Production outlook — Appalachian basins

MSHA's production reports for the year's third quarter indicate year-to-date production at 118.8 MMst, or an annualized rate of 158.4 MMst. Appalachian coal demand tends to be more sensitive to global seaborne markets; PRB and ILB tend to be driven by domestic natural gas prices. As the latter two are forecast to experience improved demand versus natural gas generation, gains in Appalachian coal will be more limited. We forecast 2025 production at 159 MMst, just 0.6% higher than 2024. As remaining domestic demand erodes after 2027, with only modest offsets from export growth, Appalachian production is forecast to fall to 112 MMst by 2030.

Further information

Market indicative coal forecasts by S&P Global Energy represent forward curves for spot-traded instruments, analogous to a strip of contracts. The shorter tenors — current year and prompt year, plus additional years, if available — are driven by the observed/assessed market. The longer tenors — typically forecast years three to 20 for physically assessed markers — are driven by fundamental estimates of cash costs of production, accepted returns to capital, regional productive capacity, and forecast supply and demand. For the long-tenured portion of the curve, S&P Global Energy forecasts prices for specific coal markers and defines the remaining markers via historical spreads.

Regulatory Research Associates is a group within S&P Global Energy.

S&P Global Energy produces content for distribution on S&P Capital IQ Pro.

For further details on coal prices, supply and demand, visit the S&P Coal Forecast Summary page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.