Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan. 23, 2026

By Dan Lowrey

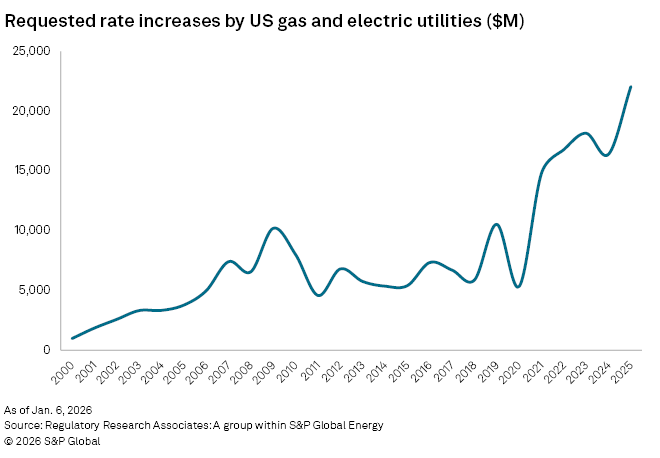

US investor-owned energy utilities requested rate increases from state regulators totaling $22.06 billion in 2025, as tracked by Regulatory Research Associates. This is the highest amount of nominal requests since RRA started tracking rate case proceedings in the early 1980s. Rate requests pulled back slightly in 2024 to $16.39 billion after three years of rising requests in 2021, 2022 and 2023.

➤ Another year of record utility rate requests was established in 2025. After filing record-setting rate requests in 2021, 2022 and 2023, utilities moderated their proposals in 2024, with requests totaling $16.39 billion. But in 2025, that total jumped to $22.06 billion, the highest annual total of electric and gas rate increase requests since RRA began tracking rate cases.

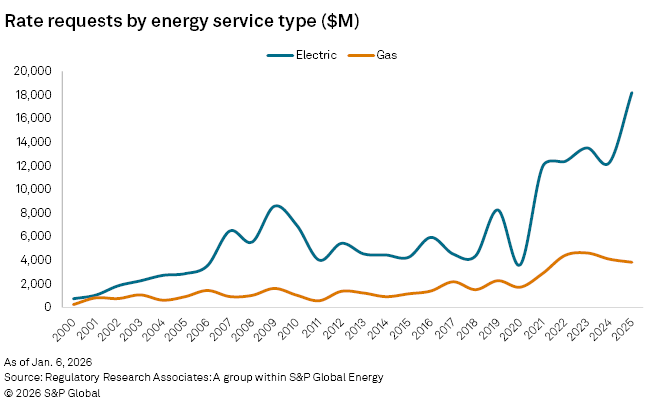

➤ Rate requests in 2025 were again dominated by electric utilities, which requested $18.23 billion in aggregate rate increases, while gas utilities requested $3.83 billion. The electric rate filings reflect the utilities' significant capital expenditure plans for upgrading transmission and distribution (T&D) systems and installing new renewable generation and technologies to accommodate the clean energy transition, as well as fossil and nuclear generation, to support large loads. The gas filings continue to reflect investment to replace aging infrastructure. Inflation and the rising cost of capital continue to be highlighted as factors in recent case filings.

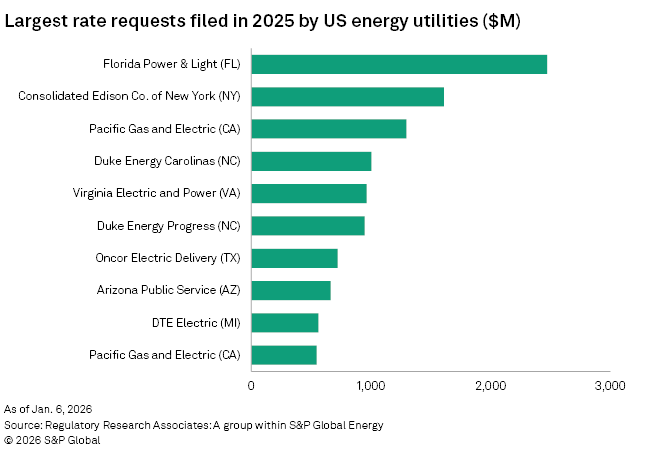

➤ The growing prevalence of multiyear rate plans is a large driver of the aggregate increase. Some of the largest rate requests in the period were attributable to multiyear plans from Florida Power & Light Co. (FPL) and Consolidated Edison Co. of New York Inc. (CE), which seek to invest in sustainability, safety and reliability, support growth and storm-hardening efforts.

➤ Historically, rate case filings have been more numerous in the late spring and early summer months, while more rate case decisions are usually rendered later in the year.

These general rate cases and limited-issue rider proceedings have been driven by the need to invest in infrastructure to upgrade aging T&D systems; build new gas, solar and wind generation; and implement new technologies, including smart meters, smart grid systems, cybersecurity measures, infrastructure to support electric vehicles and battery storage. The rate requests reflect the move to shutter aging fossil fuel plants amid a nationwide push toward clean energy and protect customers against growing climate-related risks such as wildfires and damaging storms. Most recently, growing needs for investment in T&D and generation to support large load customers, including data centers, have been behind some requests.

Rate requests in 2025 amounted to the highest annual total ever tracked by RRA. The busiest time for new rate case filings tends to be late spring or early summer, with the least activity observed in the fall. By contrast, the fourth quarter is generally the busiest time of the year for rate case decisions, particularly in December.

The 2025 total was 35% above the total requests in 2024 despite a 13% drop in total case filings in 2025. Rate increases requested by utilities in 2025 were 413% higher than the amount sought in 2020 at the beginning of the COVID-19 pandemic when many utilities withdrew or postponed rate cases to reduce the economic impact on struggling businesses and residents.

|

RRA Energy Rate Requests — Energy Access the Excel companion for detailed data on rate case requests by individual utilities.

|

Rising inflation, particularly for labor and costs related to the supply chain, has been a constant topic of discussion in ongoing rate cases. For example, FPL, which filed the largest rate ask in 2025, cited higher operations and maintenance expenses tied to inflation and customer growth among the key factors driving revenue requirements in 2026. FPL indicated that costs incurred in support of the capital investments have been impacted by historic inflation and the unexpected significant migration to Florida from around the country, underscoring the importance of maintaining financial strength and flexibility 2026–29.

There are regulatory constructs in certain states that may protect investor-owned utilities from rising costs. For more information, refer to State regulatory constructs offer insight on inflation threat to utility income.

Continuing wildfire mitigation efforts and storm hardening investments are driving rate case activity, particularly in the West. Public Service Co. of Colorado (PSCO) filed an application Nov. 21, 2025, seeking a $526 million rate increase. PSCO states the increase request is primarily driven by $2.068 billion of electric distribution plant additions and associated costs since its last rate case; technology and nonlabor wildfire mitigation operations and maintenance expense; and recovery of seven deferrals totaling $283.3 million. The deferrals are related to advanced grid initiatives, excess liability insurance, revenue decoupling, the 2020 wildfire mitigation plan, EV charging infrastructure, innovative clean technology projects and coal combustion residuals.

In addition to FPL and CE, some of the largest rate requests were made by Pacific Gas and Electric Co., Duke Energy Carolinas LLC, Virginia Electric and Power Co., Duke Energy Progress LLC and Oncor Electric Delivery Co. LLC.

Number of cases

There were 135 new electric and gas rate cases, including limited-issue rider proceedings, filed in 2025, down from 156 initiated in both 2024 and 2023.

With high inflation and higher interest rates, rate case decisions remained elevated in 2025 with about 151 cases decided, down slightly from 155 cases decided in 2024, according to RRA data.

Available initial data highlights a slight slowdown in rate case activity in 2026. As of Dec. 16, 2025, RRA-covered companies have announced an additional 25 planned rate case filings through 2026. By comparison, companies had announced the filing of 30 new rate cases as of the same date in 2024. For more information, refer to Inflation, capital spending drive strong US rate case activity.

Affordability concerns persist

As we enter 2026, affordability remains a key issue shaping the US power and utility sector, moving from a background concern to a binding constraint on what utilities can earn and build. This shift is driven by mounting pressure at state and federal levels, with energy prices having risen much faster than inflation and customer dissatisfaction at historic highs. Utilities are navigating multibillion-dollar capex programs, which risk further upward pressure on bills unless offset by new strategies. The upcoming election cycle and federal policy discussions are amplifying the focus on affordability, with industry groups and utility executives highlighting the need to moderate rate growth and maintain customer trust. RRA is watching closely how affordability concerns could reshape regulatory and market dynamics.

In response, regulatory styles are evolving, with commissions increasingly adopting frameworks that force utilities to balance investment and operational efficiency within strict limits. The sector's reliance on data centers as growth drivers is becoming more pronounced, with these customers now bearing a larger share of costs, a trend that utilities must communicate transparently to regulators and the public. States with politically exposed commissions are tightening scrutiny on utility spending and bill impacts, while federal agencies like Federal Energy Regulatory Commission and Department of Energy are expected to play a more active role in transmission planning and reliability funding.

Cognizant of rising affordability concerns, utilities have been taking steps to highlight for commissions their efforts to reduce costs and improve efficiency even as they ask for higher rates. In a rate case application filed Nov. 25, 2025, South Jersey Gas Co. (SJG) indicated it conducted an affordability analysis, which it says concludes that its prices for gas services are currently affordable for most residential customers and will remain affordable if the proposed rate change is approved. SJG included $4.3 million in annual savings and other cost reductions in its revenue request, and uses competitive bidding and cost tracking to ensure capex are reasonable.

The surge in requested rate increases comes amid rising capex by the energy utility sector. 2025 is anticipated to be another record year for utility capital investments, with the aggregate forecast capex of $214.293 billion for the 47 tracked energy utilities when results are tallied, according to an RRA analysis. This figure would exceed the $173 billion spent in 2024 by about 23%.

Spending is driven by pent-up demand to replace and modernize aging infrastructure, as well as renewable portfolio standards of multiple states that call for large expansions in low-carbon energy generation capacity. Additionally, federal infrastructure investment plans aim to convert the nation's power generation network to zero-carbon sources while investing in new generation to support strong electric growth. For the most recent report on capex, refer to Energy utility capex forecast nears $1.2 trillion in 2025–29.

Data centers — which underpin AI, digital services and cloud infrastructure — are rapidly becoming a significant new driver of power demand in various regions. This trend is expected to result in substantial capital investments for years to come, including massive investment in natural gas generation, new nuclear capacity and reviving retired coal plants or those planned for retirement. In the US, demand from data centers is projected to increase at double-digit rates through the end of the decade, fundamentally altering the overall demand landscape and placing additional strain on utility electric grids.

Multiyear rate change proposals

Legislation passed at the state level over the past several years has driven an increase in multiyear rate change requests, whereby utilities can request incremental rate increases over several years. RRA considers these plans to be a constructive ratemaking approach. In 2025, at least 16 rate cases that were filed requested multiyear rate changes. That is down from 25 such cases filed in 2024 and 21 multiyear rate case filings in 2023, which was equal to the number of multiyear requests filed in both 2021 and 2022.

Just as in 2024 and 2023, some of the largest rate cases filed in 2025 were multiyear requests. In aggregate, FPL initiated a large rate case (Docket 20250011-EI) with the Florida Public Service Commission, seeking a multiyear increase in electric base rates totaling $2.472 billion between 2026 and 2027. The rate increase is intended to fund investments to support system growth and reliability, diversify the company's power generation fleet, add solar generation and energy storage capacity, and improve resilience and security at critical facilities. On Nov. 20, 2025, the PSC voted to approve a settlement agreement authorizing FPL a $1.65 billion rate increase in 2026 and 2027, or two thirds of FPL's ask.

Long-term perspective

From a historical perspective, the nominal $22.04 billion requested by utilities in 2025 significantly exceeded rate requests in the early 1980s, when the country was undergoing a major boom in baseload plant construction. Prior to 2021, the highest requested annual rate increase total occurred in 1981, when utilities put forth petitions for about $13.1 billion in rate increases. Adjusting for inflation, however, the rate requests in the early 1980s still outpace current rate requests.

Comments on RRA's methodology

RRA endeavors to follow all "major" rate cases for investor-owned utilities nationwide, with major defined as a case in which the utility's request would result in a rate change of at least $5 million or in which the commission approves a rate change of at least $3 million. In addition to base rate cases, the rate case history database includes details regarding certain limited-issue rider proceedings, primarily those that involve significant rate base additions that are recognized outside of a general rate case. In some of these cases, the rate change coverage criteria may not apply.

Moreover, some US utilities operate under formula-based rate plans where rates are adjusted annually (or on some other periodic basis) without a full rate case filing and generally without revisiting the authorized return. These proceedings are generally not included in the database and, therefore, would not be included in the tally of cases or the aggregate rate change stats. Details are discussed in the footnotes to the case in which the formula rate plan was established.

Regulatory Research Associates is a group within S&P Global Energy.

S&P Global Energy produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.