Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 19, 2026

By Melissa Otto, CFA

The preview

While the market awaits the outcome of a possible Warner Brothers acquisition, the shares are likely to remain sensitive to the newsflow around a potential deal. The fight for great content and audiences by both Netflix and Paramount is likely an indication of YouTube’s continued growth and strength. With AI innvations coming and content creators continuing to gain viewers globally, legacy studio and media franchises may need to reimagine their business models to stay relevant. The investment of $200 million by famed investor, Tom Lee, to Beast Industries seems to be an early indication of where the future of video content is headed. YouTube channel, Mr. Beast, currently has over 460 million YouTube subscribers.

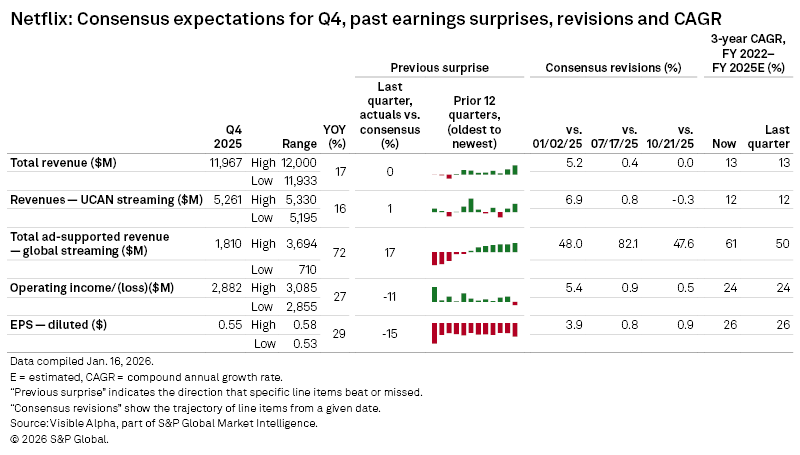

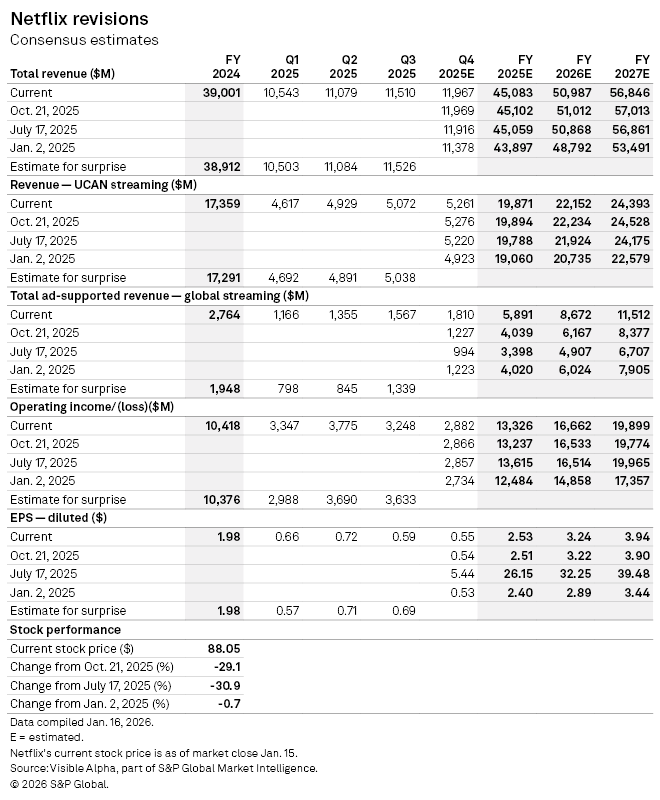

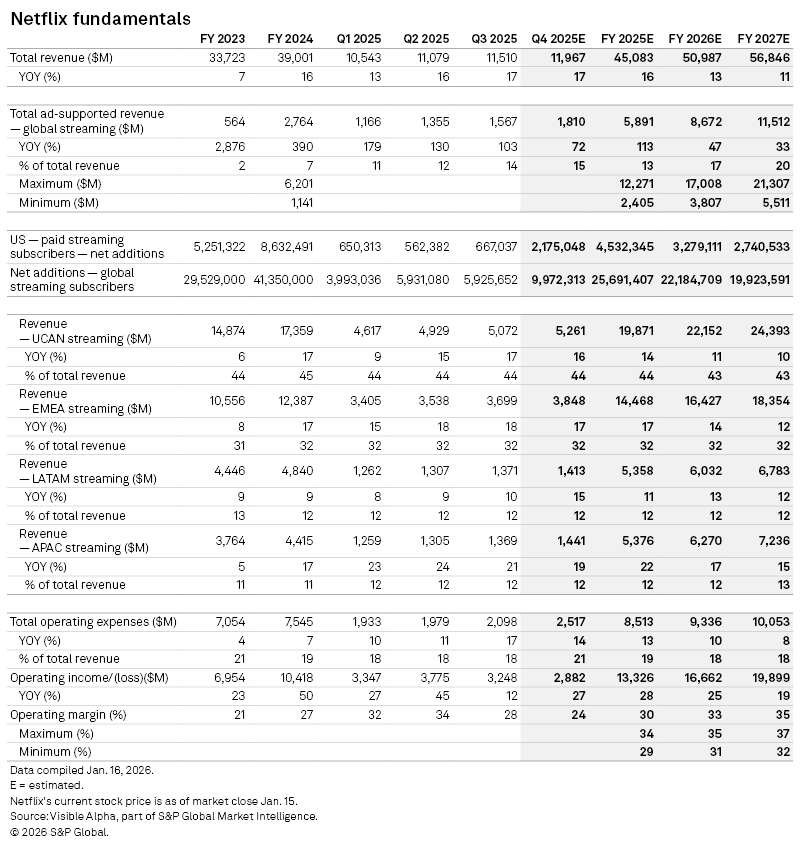

Expectations for Netflix Inc. (NASDAQ: NFLX) into Q4 have remained stable since July 2025. Last quarter, the company highlighted the slate for Q4, but it was not a catalyst for revenue expectations. Visible Alpha consensus is expecting $12.0 billion in revenue for Q4 and $45.1 billion for FY 2025. Revenues are expected to be supported by continued new membership and monetization. Offering a range of pricing and plans combined with continuing growth in the ads business is expected to further increase monetization. Consensus expects the operating margin to increase to 24.1% in Q4 and to 29.6% for FY 2025, down 70 bps from previous expectations of 30.3% due to assumptions about higher expenses.

The company expects to grow revenues by increasing engagement trends and reducing churn while offering a more diverse entertainment offering. Gaming and the growth of ads could be key drivers in 2026. According to consensus, analysts now expect the company to generate a 32.7% margin, on expected revenue of $51.0 billion and $16.7 billion in operating profit in FY 2026.

In the spring quarter, Management highlighted that the Ad Tier enables lower prices. The Company stated in the earnings call that they expect that ads revenue will roughly double year-over-year again in FY 2025. Q4 2025 expectations for the ad-supported revenues has nearly doubled since July, suggesting increasing optimism in this emerging area of revenue generation. FY 2025 expectations have moved higher from the initial forecast of $4.0 billion back in early 2024, the expected trend has improved and is now at $5.9 billion for the full year.

Netflix remains upbeat about the long-term opportunity, given the size of its user base. Co-CEO Gregory Peters explained that 2025 will be the year that the ads business will step up to the plate to swing. Currently, consensus projects total ad-supported revenue for FY 2026 to expand to $8.7 billion, up over $2.5 billion from the expected $6.2 billion last quarter. There is a significant range of views on the magnitude of impact the ad-supported revenues will have on operating profit growth. For FY 2027, the analyst estimates for ad-supported revenue further increased to over $3 billion to $11.5 billion, but the operating profit has remained stable at $19.9 billion. The management commentary on the potential for operating profit and margin growth from the ad-supported revenues will be an important dimension to the FY 2026 outlook for the business.

Based on Visible Alpha consensus, the operating profit margin is expected to grow from 26.7% in FY 2024 to 35.0% in FY 2027. Currently, consensus estimates the operating margin now to exceed 32.7% by the end of FY 2026. However, there is significant debate among analysts with respect to FY 2026 margin estimates, which range from 31% to 35%. The debate in the market seems to be around how quickly the Company will achieve a 35% operating profit margin. This margin growth is expected to take FY 2027 expected diluted EPS from $3.94/share or 22x FY 2027 P/E, significantly lower than the 30x it traded in summer. The current consensus target price has ticked down slightly to $130 or 48% upside from the current levels.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment