Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan. 30, 2026

By Jason Holden, Ying Li, Althea Keziah Liwanag, Princess Rochelle Gan, and Jessica Anne Dela Cruz

The mining industry in 2026 seems to be splitting into two clear pathways. For precious metals producers, it is looking like it could be a banner year, with prices expected to climb much faster than costs, leading to potentially record-breaking profits. For the battery metals sector, especially lithium and nickel, it might be a tough year, with lower prices due to excessive supply meaning that many mines run the risk of turning unprofitable. One commonality for all stakeholders is higher operating costs due to inflation, energy prices and lower-grade ore. Additionally, the iron ore market is the one to watch, with the Simandou project in Guinea coming online in 2026 and shaking up the global cost structure. Our analysis focuses on identifying which metals and miners are best positioned to succeed in this new environment.

➤ Persistent inflation, rising energy costs and fundamental geological challenges — such as declining ore grades — are forging a new, elevated cost standard across all metals.

➤ Precious metals such as gold and silver are heading for record profits, as prices are expected to climb faster than costs. There is a very different story for battery metals such as lithium and nickel, with profits becoming severely squeezed.

➤ The anticipated entry of the Simandou project is expected to be a game changer. Due to its large-scale, high-grade output, it is expected to be a powerful deflationary force on the iron ore sector.

➤ In response, mining companies are focusing heavily on running their business efficiently through aggressively cutting operational costs and streamlining their portfolios by selling off noncore assets.

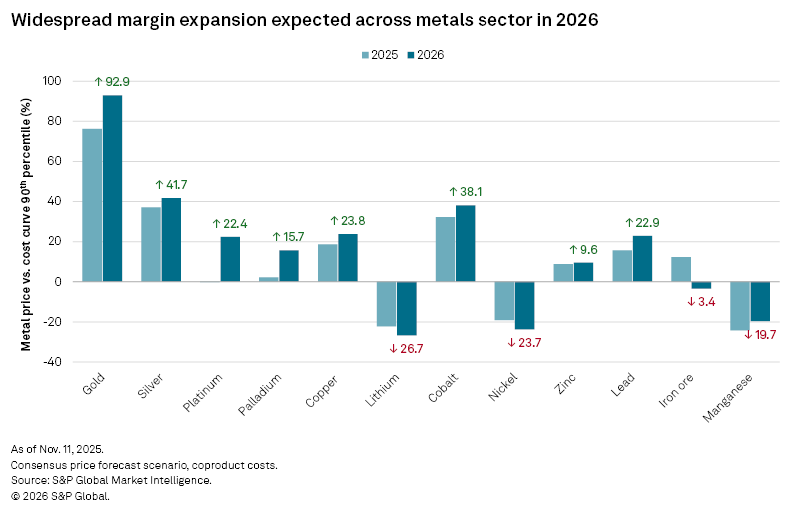

This analysis projects the 2026 all-in sustaining costs (AISCs) for 12 key metals, leveraging an updated consensus forecast for metal prices, exchange rates and inflation. The chart below highlights potential profitability pressures by comparing the 2026 forecast metal price against the 90th percentile of the industry's cost curve for 2025–26. For metals showing a negative percentage, the forecast price is insufficient to cover the highest-costing 10% of operations globally, signaling a high-risk environment for those producers. All costs are reported on a paid metal basis.

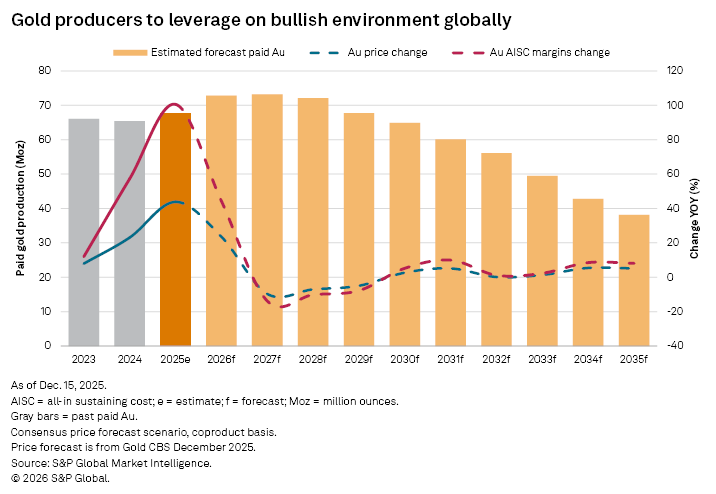

As global markets reopened following the COVID-19 pandemic-related shutdown, negative AISC margins were observed in 2021, with rising miners' costs and stabilizing gold prices. But since 2023, margins have shown a consistent upward trend, with the strongest year-over-year increase anticipated in 2025 at 101%. This is supported by a robust average gold price of $3,436 per ounce and a modest 6% rise in AISC to $1,521/oz of paid gold.

Major producers are prioritizing cost-reduction strategies to capitalize on the record-high gold price environment. Newmont Corp. exemplified this approach, reporting its fourth consecutive quarter of over $1 billion in free cash flow in October 2025, driven by cost-saving initiatives introduced earlier in the year. These included addressing operational efficiency, workforce optimization and energy efficiency measures. In addition, Newmont streamlined its portfolio in 2025 by divesting noncore assets — including Telfer, Musselwhite, Eleonore Cripple Creek & Victor, Akyem and Porcupine — while focusing on core projects, such as developing Cadia East, expanding Tanami and commissioning Ahafo North, which achieved commercial production in October 2025. Additional ounces from the newly opened Ahafo North mine and increased output from the Nevada Operations gold mines are expected to offset production declines from concluding assets, such as Yanacocha and Ahafo South's Subika open pit.

Global gold production is anticipated to have risen in 2025, with growth continuing through 2027 before tapering off beyond 2030, as major mines mature and ore grades decline. New large-scale projects, such as Barrick Mining Corp.'s Reko Diq copper-gold development in Pakistan, will add incremental supply but are unlikely to fully offset the decline. Phase 1 of Reko Diq, scheduled for commercial production in 2028, is expected to produce 297,000 ounces of gold per year, with Phase 2 increasing output to 520,000 oz/y.

For 2026, global gold production is estimated to grow 7% year over year to 72.8 million ounces. Producers are well-positioned to capitalize on favorable market conditions, supported by a projected 24% increase in gold prices, and a 5% decline in global average AISCs, resulting in record-high margins of approximately $2,800/oz.

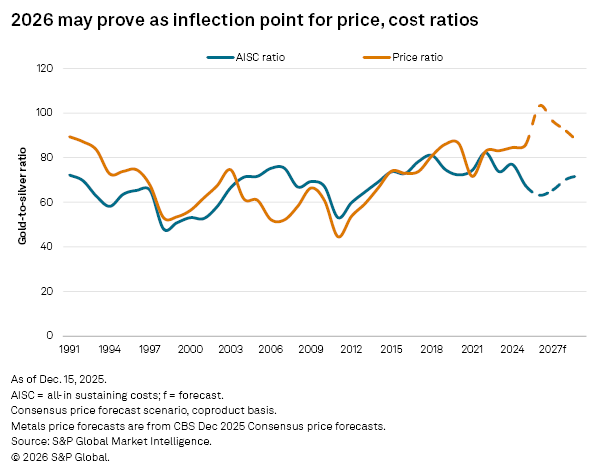

Silver also performed exceptionally in 2025, outperforming gold at times. Both metals recorded their highest end-of-day prices for 2025, with gold posting a 71% year-to-date gain on Dec. 26 and silver surging 154% on Dec. 30. Silver remains in a bullish environment, backed by strong industrial demand from green energy initiatives, tightening supply and its role as a safe-haven asset. Analysts also reference the gold-to-silver ratio — a metric indicating the number of silver ounces required to purchase one ounce of gold — to assess silver's relative value. In 2025, the ratio was above 80, signaling silver's constant undervaluation and room to appreciate. But in late November, the ratio gradually declined to below 70.

This value relationship extends to production costs, where the AISC ratio of producing gold versus silver historically ranged between 48 and 72 in the 1990s but has trended higher in recent decades. Since 2015, it has fluctuated between 63 and 82, indicating that gold has become increasingly expensive to produce than silver. The peak was observed in 2022, when gold production costs per ounce were 82 times higher than silver. This was driven by an 11% year-over-year increase in gold AISCs, while silver costs rose less than 1%. In 2023, the ratio declined to 73, as gold miners experienced a smaller cost increase than silver producers. For 2025, the ratio is estimated at 67 — 12% lower than 2024 — and is expected to decline further in 2026, as gold production costs decrease 3%, while silver costs rise 4%, reaching $23.44/oz of paid silver.

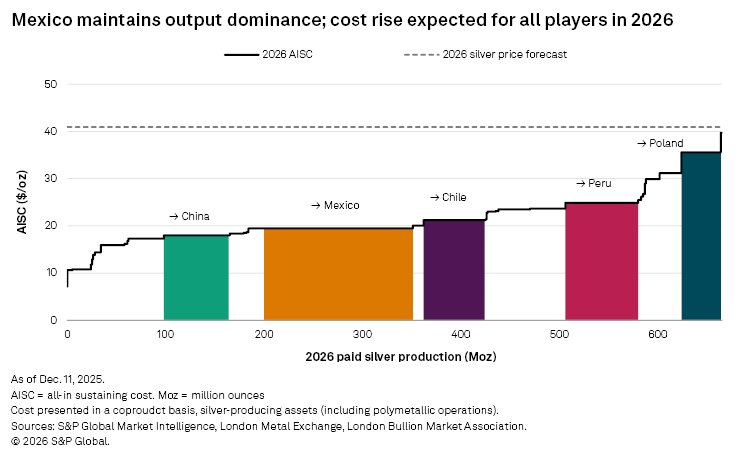

The global weighted average AISC for silver is forecast to increase 3.8%, rising to $23.44/oz in 2026 from $22.59/oz in 2025, reflecting a broad trend of rising costs. However, the impact varies significantly among major producers. Mexico, the world's largest silver producing country, is expected to have a marginal cost increase of approximately 0.8% to $19.84/oz, allowing it to remain highly competitive. Similarly, China is forecast to experience a 5.1% increase to $17.81/oz, maintaining its position as a major, low-cost producer. In contrast, other key countries face more significant cost pressures: Peru's AISC is projected to jump a substantial 14.2% to $25.16/oz; Chile's is set to rise 6.7% to $20.78/oz; and Poland's costs are expected to climb 10.6% to $34.44/oz from an already-high $31.15/oz, reinforcing the country's position at the high end of the global cost curve.

PGM miners' relief in 2026, with price gains outpacing cost inflation

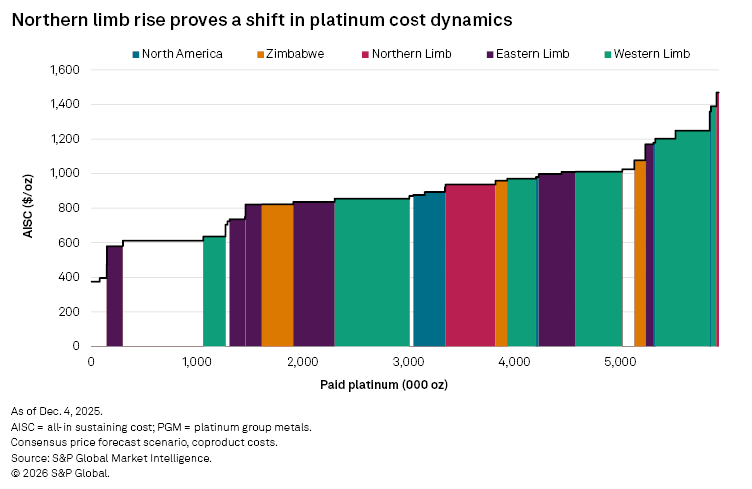

The issue of rising production costs will remain a dominant theme for miners of platinum group metals (PGMs) in 2026. The average primary platinum AISC is forecast to increase 7.7% to $1,006.14/oz in 2026. While higher consensus prices have provided some reprieve, the upward trend in costs is expected to continue. Factors such as persistent inflation, higher energy and labor costs, and the geological challenges of mining deeper, lower-grade ore bodies will continue to exert upward pressure on the AISC. At a consensus price of $1,315.05/oz in 2026, less than 1% of global platinum production — around 50,000 ounces — is estimated to be operating at a loss. This situation is remarkably better than it was in 2024, when about 30% of production was at risk. In 2025, operational improvements are taking effect, with higher realized prices and fewer power cuts by Eskom, South Africa's state-owned power utility, than in previous years. The high-cost, at-risk ounces are concentrated in the country, highlighting regional disparities in the industry's cost structure.

Unlike the established mines on the Western and Eastern Limbs of the Bushveld Igneous Complex, new Northern Limb projects are characterized by thicker, shallower and more continuous PGM reefs. This favorable geology enables the use of large-scale, highly mechanized mining methods, which are significantly more productive than the conventional, labor-intensive techniques required in deeper operations. Consequently, new mines, such as Platreef, benefit from superior economies of scale, resulting in a lower position on the PGM cost curve, once operations have scaled up. Norilsk is at the bottom of the cost curve due to the high nickel content and economies of scale.

Current consensus prices for palladium are forecast at $1,163/oz for 2026, an 8.8% year-over-year increase. While there is some headroom, with prices due to increase faster than costs and many companies having already implemented cost-cutting measures, there is still a likelihood of further reductions in primary production, as older shafts reduce output and new project constructions are deferred.

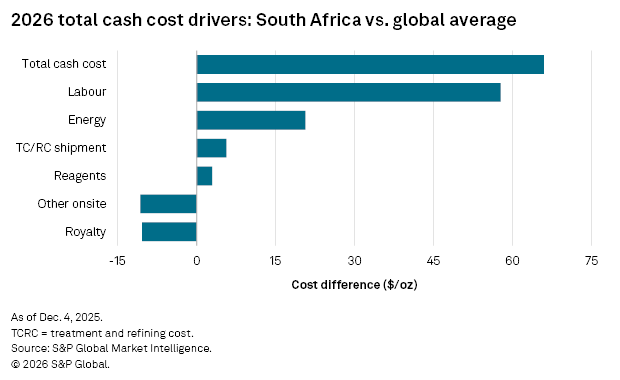

The chart above shows South Africa's PGM mining costs when compared to the global average. Labor and energy costs are expected to remain high, while royalties are reduced as margins are squeezed. Many of South Africa's PGM producers used the high-price period of 2021–22 to significantly reduce debt, resulting in low leverage and a more resilient financial position. This financial strength allowed them to endure the current weak price cycle, sustain operations and support underperforming assets without making as many major cuts to their production strategies as previously forecast. In early 2025, producers benefited from a weakened South African rand, which lowered their operating costs in local currency relative to their US dollar revenues. However, this advantage was short-lived; by mid-2025, the currency strengthened back to approximately 18 rands to the dollar, which diminished the profitability gains experienced earlier in the year.

Global iron ore: a market reshaped by new supply

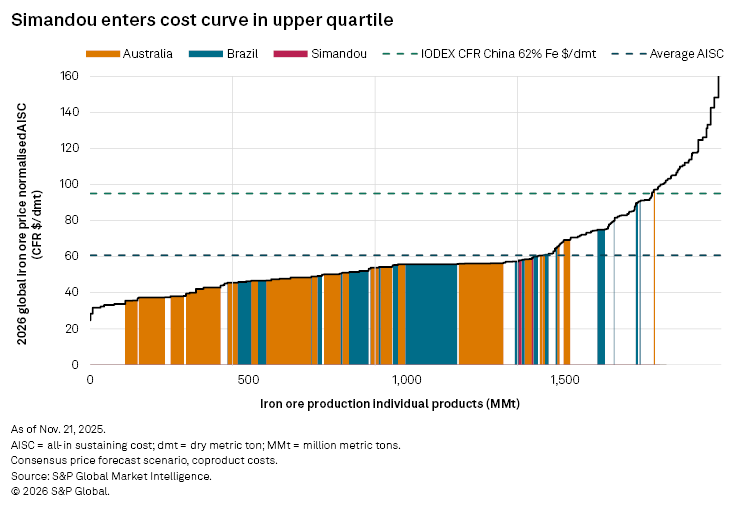

The weighted average AISC on a CFR basis is forecast at $60.82 per dry metric ton in 2026, a notable rise from 2025's $59.38/dmt. This increase signals operational cost pressures continuing to influence the iron ore industry despite a forecast benchmark price decline. The 2026 cost curve illustrates a market increasingly bifurcated between established, low-cost incumbents and marginal producers, who will face significant pressure from the introduction of large-scale, high-grade new supply.

Macroeconomic factors remain a critical driver of the cost structure. For 2026, a projected 6.25% year-over-year increase in fuel costs will directly impact mining, processing and transportation expenses for all. With the 62% Fe benchmark price projected to soften to $96.95/dmt, margins will tighten, particularly for operators positioned in the upper quartiles of the cost curve.

The first quartile of the seaborne market remains dominated by the vast, low-cost operations in Australia and Brazil. Australia's iron ore production — the largest in the world — demonstrates remarkable cost efficiency. Australian fines are positioned firmly in the first and second quartiles, with a weighted average AISC (CFR) of $47.04/dmt, alongside Australian lump forecast at a competitive $50.86/dmt. Assets such as Rio Tinto Group's Gudai-Darri mine, with a total cash cost (CFR) of about $27.07/dmt for its fines product, and Fortescue Ltd.'s Chichester Hub at $33.13/dmt, exemplify the advantages that Pilbara producers leverage through economies of scale, integrated infrastructure and proximity to Asian markets.

Brazil follows closely, anchoring the lower end of the cost curve with its high-grade products. Brazilian fines are forecast at an AISC (CFR) of $53.37/dmt, slightly higher than their Australian counterparts, partly due to longer shipping routes to China. Brazilian pellets, a significant value-added product segment, are projected at $61.62/dmt. While these costs place Brazil in a highly profitable position, they remain sensitive to domestic inflation and exchange rate volatility.

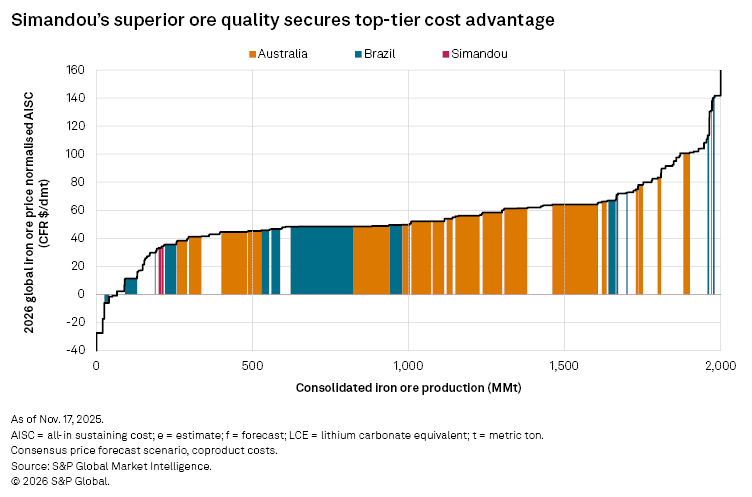

Is the iron ore market ready for the Simandou effect?

The most significant development on the 2026 cost curve is the anticipated market entry of the Simandou project in Guinea, an event poised to be a structural game changer. On a pure AISC (CFR) basis, Simandou's initial output is projected to land in the third quartile, but this masks its true competitive strength. Our analysis places Guinean fines — a proxy for the initial output from Simandou — at an AISC (CFR) of $58.40/dmt. While not as low-cost as the most efficient Pilbara operations, its competitiveness is undeniable, especially given its high-grade 65.3% Fe content, which will command a premium in a market increasingly focused on decarbonization and furnace efficiency.

If we compare Simandou Blocks 3 & 4 on the price-normalized cost curve, the project drops into the first quartile, where the high-grade fine product means the property becomes more valuable, with higher margins resulting from stronger prices.

The initial estimated production of 13.8 million dry metric tons from Guinea in 2026 is just the beginning of a ramp-up that will introduce tens of millions of metric tons of high-grade ore to the seaborne market. This new volume will act as a powerful deflationary force, effectively displacing higher-cost production. The project's entry will steepen the cost curve, pushing out marginal volumes from some junior miners and from countries like China. Producers with AISC profiles above the $60-$70/dmt range will find their margins severely compressed.

China's domestic concentrate, with a projected AISC of $79.94/dmt, remains a structurally inflated cost, but state support and strategic imperatives often insulates it. However, its exposure to seaborne price fluctuations makes China a key swing producer. Other countries with significant production in the third and fourth quartiles include Canada, where concentrate AISC is projected at $99.80/dmt, and South Africa with fines and lump at $78.34/dmt and $80.25/dmt, respectively. While viable during periods of high prices, these operations will face risk as the market absorbs Simandou's output. The forecast $96.95/dmt benchmark price leaves a slim — and, in some cases, negative — margin for these producers, once all sustaining capital costs and overheads are accounted for.

Manganese price rally buffers South Africa's cost pressures, bolstering 2026 margins

Manganese plays a crucial role in steel production, but its demand is expected to surge eightfold from 2020 to 2040, largely due to its increasing use in batteries as part of the global energy transition. The largest deposits are found in South Africa and Gabon, the top two producing countries.

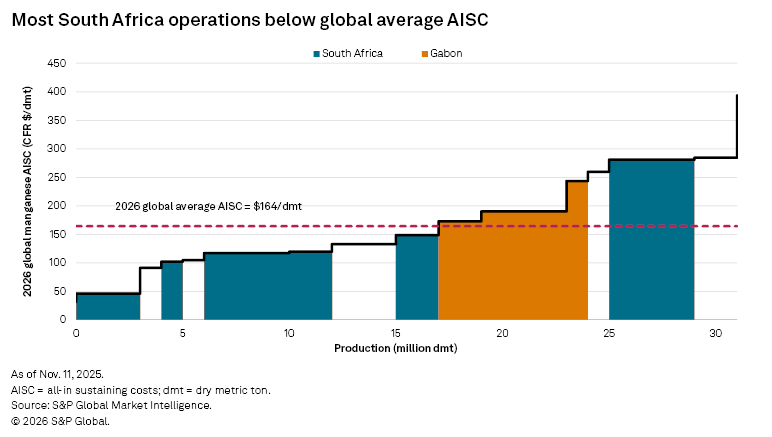

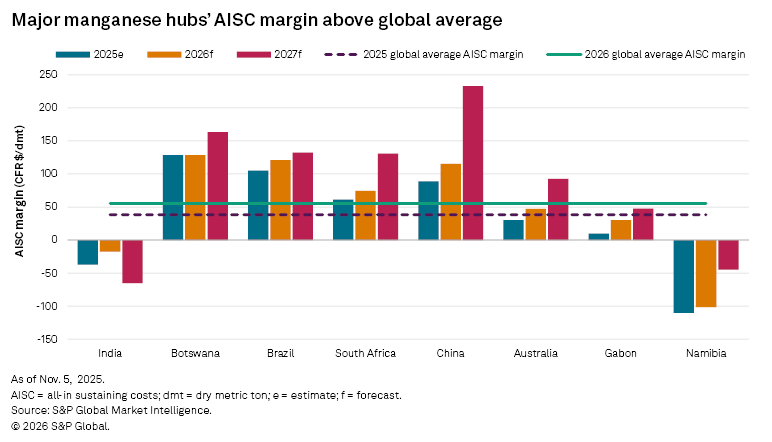

South Africa dominated global manganese production in 2024, with 37% of total production. Gabon and Australia followed, with 23% and 14% of the global share, respectively. Most of the manganese projects in South Africa operate at costs below the global average AISC of $164/dmt. However, projections for total cash costs for South Africa operations in 2026 indicate a 6.3% increase. South32 Ltd. reported a 14% increase in South Africa Manganese's operating unit costs in 2024–25, reaching $3.06 per dry metric ton unit due to a stronger South African rand and increased maintenance costs. For the financial year 2026, the guidance reported by the company indicates operating unit costs forecast to increase a further 2% due to general cost inflation.

Eskom, the national power utility, has approved a revenue percentage increase of 5.36% for financial year 2026–27, resulting in a price increase estimated at 8.76%. Mining operations connected to the national grid, such as Kalagadi and Nchwaning/Gloria, will bear these additional costs in 2027.

Aside from power costs, state-owned logistics company Transnet SOC Ltd. has announced price increases due to tariffs set by the National Energy Regulator of South Africa (NERSA). Vehicle fuel prices are also expected to increase an estimated 3.80 cents per liter, impacting transportation costs. United Manganese of Kalahari (Pty) Ltd., one of the largest producers in South Africa, recently signed a 10-year contract with Transnet for transporting its manganese ore.

Compared to 2025, the global average manganese AISC margin is estimated to increase approximately 45% year over year in 2026. Despite the escalating costs, however, a forecast rise in prices for ore is buffering the increases. About 75% of production in 2026 is expected to be cash-positive on the cost curve, followed by a largely positive trend persisting in 2027, with the three leading producing countries experiencing significant margin growth. The outlook for manganese producer margins, despite rising input costs, looks more favorable in 2026 than 2025 due to a stronger price forecast.

Inflation, deteriorating geology forge a new, higher cost floor for copper

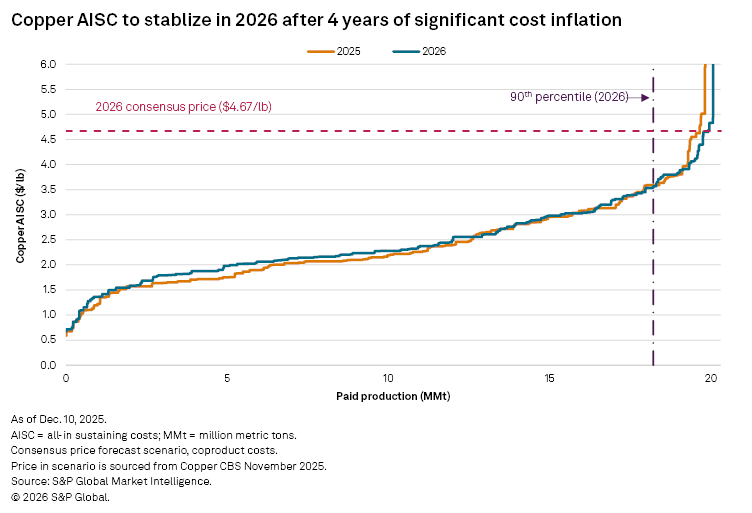

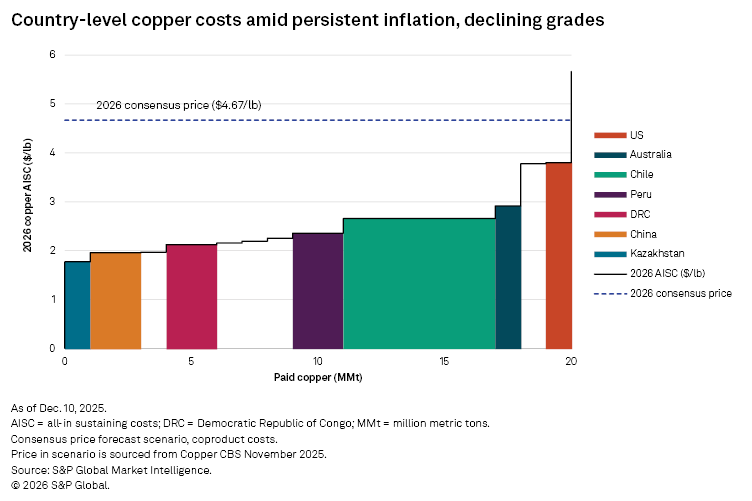

Operating costs have undergone a significant inflationary period since 2021. The total cash cost (TCC) per metric ton of ore treated surged a cumulative 27.8% from 2021 to 2024, to $30.21/t from $23.64/t. This was mirrored in the AISC on a coproduct basis, which climbed 23.0% to 268.67 cents/lb over the same period. The most acute inflation occurred in 2021–22, when a 24.2% jump in energy costs and broad post-pandemic price pressures pushed the TCC up 14.7%. We forecast this pressure will persist, with the TCC rising another 3.3% in 2025–26 to a peak of $32.24/t. While we project costs will stabilize post-2026, they will do so at this new, elevated level, with AISCs expected to reach 270.53 cents/lb by 2029.

In its fiscal year 2025, BHP Group successfully lowered copper unit costs, with Escondida's costs notably decreasing to $1.19/lb, primarily driven by a 16% production surge that offset rising operational expenses. However, looking ahead to fiscal year 2026, cost pressures are expected to persist. The company's guidance projects Escondida's unit costs to be $1.20-$1.50/lb, and Spence's costs to be $2.10-$2.40/lb, indicating that it will be challenging to maintain fiscal year 2025's low costs amid ongoing inflation.

Following a significant operational incident in September 2025, Grasberg faces elevated cost pressures in 2026, as the delayed and phased ramp-up of its main Grasberg Block Cave will limit production. This will force the mine to absorb high fixed and remediation costs over lower copper production, delaying its return to a low-cost profile until production fully recovers in 2027. The situation at Grasberg is a prime example of how operational disruptions can temporarily push a Tier 1 asset up the cost curve, exacerbating the impact of background inflation.

Compounding these inflationary pressures are fundamental geological challenges. The copper mining stripping ratio, a key driver of mining costs, is rising. After hitting a historical low of 1.47-1 in 2021, the ratio rebounded to 1.78-to-1 in 2024 and is estimated to reach 1.80-to-1 in 2025. Simultaneously, declining ore quality is forcing operators to process more material to yield the same amount of copper. The average mined copper head grade fell 13.4% to 0.52% Cu between 2012 and 2022 — a trend mirrored in the global average reserve grade. This decline suggests that higher copper prices since 2020 have enabled miners to process lower-grade material, which in turn contributes to higher per-unit production costs.

Nickel market to remain under pressure

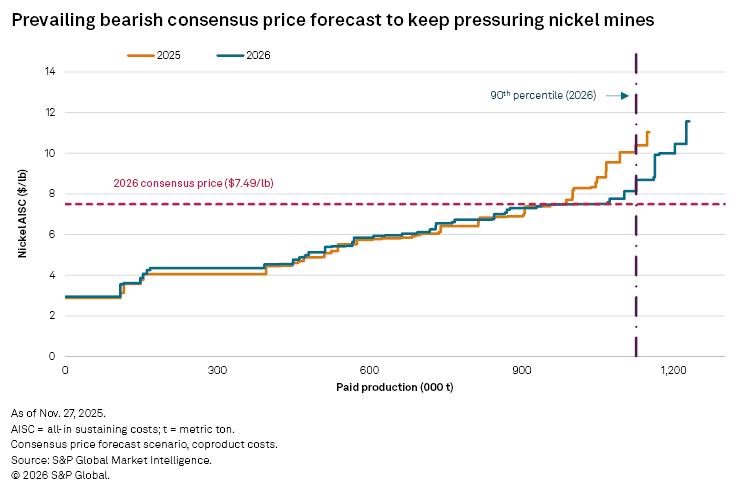

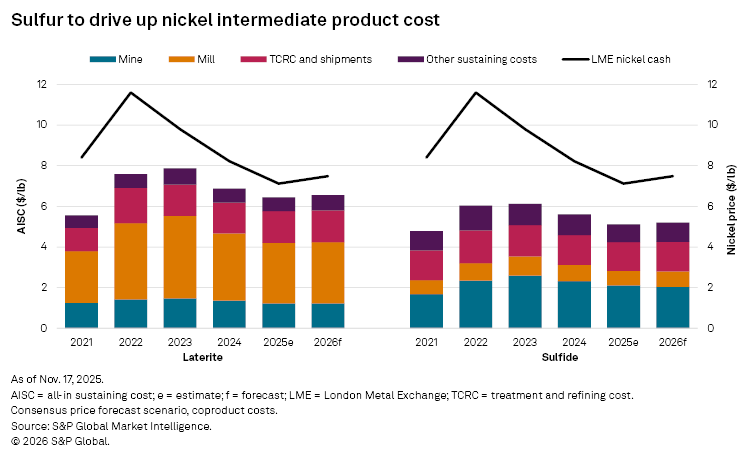

The average nickel AISC is forecast to rise 3.9% in 2026 to $5.89/lb, alongside the consensus nickel price increasing slightly to $7.49/lb; this will result in the AISC margin remaining squeezed at $1.60/lb. At this forecast price, approximately 14% of global production on the cost curve could be operating at a loss, suggesting the potential for further closures ahead.

Mines producing low-cost polymetallic sulfides are expected to dominate the first quartile of the cost curve in 2026, while properties mining nickel sulfides in Australia and Canada will continue to face cost pressures. The rapid decline in nickel prices has eroded nickel mining margins in Australia, leading to the shutdown of some nickel sulfide producers in recent years, including larger mines such as BHP Group Ltd.'s Nickel West divisions, First Quantum Minerals Ltd.'s Ravensthorpe mine and Glencore PLC's Koniambo mine. With the market persistently oversupplied, nickel prices are expected to remain low through 2026, and there is no scheduled restart for these high-cost mines.

The AISC on a coproduct basis of nickel sulfides varies significantly due to different ore grades and byproduct credits. In 2026, the projected AISC margin of sulfides is approximately $2.29/lb, compared to an estimated $0.93/lb for laterite operations. Nickel sulfide mines in Canada and Australia are facing challenges of declining ore grades and greater mining depths among others, driving a sustained rise in operation costs.

For laterite processing, projected higher onsite cost in 2026 is largely driven by coal cost for rotary kiln electric furnace (RKEF) plants and reagent cost, such as sulfuric acid and limestone, for high pressure acid leaching (HPAL) plants. Early-years, high-cost HPAL operations, including Murrin Murrin, Ambatovy and Goro HPAL mines, are expected to continue incurring losses in 2026.

Zinc costs dip alongside falling production levels

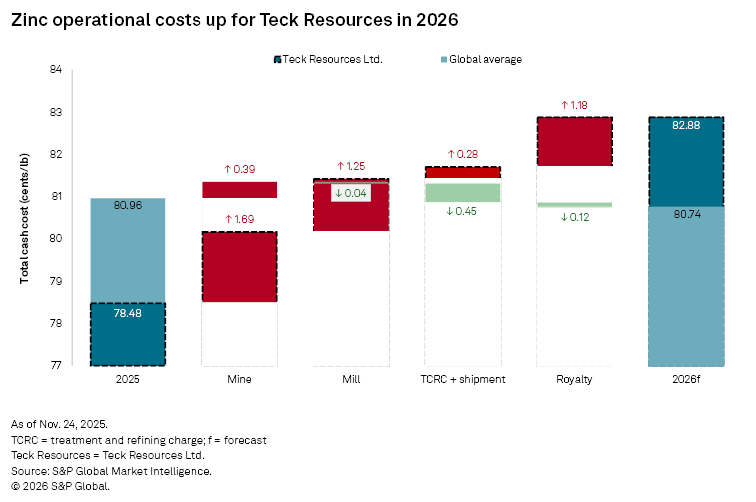

The global zinc AISC is projected to decline in 2026, driven primarily by strong byproduct credits and shifting treatment charge (TC) dynamics that mask underlying operational pressures and cost inflation faced by key producers such as Teck Resources Ltd.

Zinc prices have been volatile since 2020. After facing notable declines, the market has begun to recover, with prices remaining elevated in 2025. However, the zinc market is also experiencing alarmingly low inventories at the London Metal Exchange and ongoing backwardation. While these indicators primarily pressure physical premiums and the spot price, the underlying supply scarcity is also influencing the entire value chain, including concentrate negotiations. Despite these hurdles, the AISC is expected to decrease 0.83% in 2026, dropping to 93.15 cents/lb from 93.93 cents/lb. TCs have trended upward, but with a constrained pace of growth. The projected 1.56% decline in paid zinc production is expected to tighten the concentrate market further. This gives miners greater leverage over smelters, likely driving down TCs and providing a key source of relief to the global average AISC.

In conjunction with the strengthening prices of byproducts — particularly silver, which is forecast to reach $40.92/oz in 2026 — this will potentially improve and reduce the global AISC average under the coproduct costing method.

The estimated number of mines operating at a loss is 23 in 2025, dropping to 16 in 2026, translating to 674,000 metric tons. There is also a notable decrease in estimated production in 2026 due to several mines pausing operations in 2025 and some completely shutting down in 2026. Notably, Glencore's Lady Loretta mine, part of the Mt. Isa zinc operations, is scheduled for closure in 2025. But in July 2025, Austral Resources Australia Ltd. executed a nonbinding memorandum of understanding with Glencore to acquire Lady Loretta. This move will enable Austral to explore the region's copper potential, as its mining claims border its Lady Annie and Mount Kelly copper operations.

While global average zinc costs have declined, Teck Resources is estimated to produce less zinc and at a higher cost, as indicated in its cost and production guidance for 2026–28. Its Red Dog property, one of the world's largest zinc mines, is beginning to wind down due to declining head grades. In its guidance, Teck has set the production target for 2026 at 375,000-415,000 metric tons, compared to 430,000-470,000 metric tons in 2025. Additionally, Teck's total cash cost guidance for zinc operations in 2026 is projected to be between 80 cents/lb and 0.90 cents/lb. Contrary to the global average projected for 2026, the company's zinc operations are expected to encounter higher operating costs, increased TCs and refining charges and rising royalty expenses.

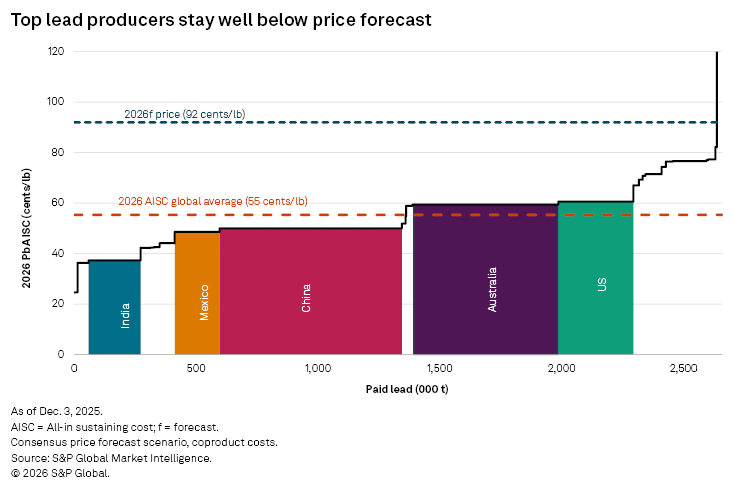

The global average lead AISC mirrors zinc, with a 1.04% decrease to 55.34 cents/lb from 55.92 cents/lb. Lead prices have remained volatile, reflecting uncertainty in the market, particularly related to US trade measures. With a 2026 lead consensus price forecast of $0.92/lb, 12 mines are expected to operate at a loss, translating to 94,700 metric tons of paid lead production — an improvement from 20 mines in 2025. Top producers of lead are well-positioned to maintain profitability, with China leading in production and benefiting from lower production costs.

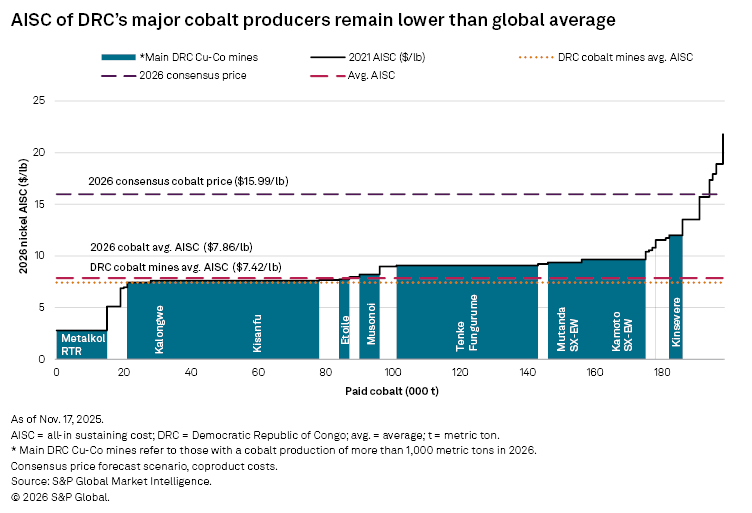

Cobalt from DRC primary copper mines most cost-competitive

Compared to 2025, cobalt operations cost will increase in 2026, resulting in an estimated AISC of approximately $8.55/lb — a 5.5% year-over-year increase. More than 98.1% of cobalt capacity will be cash-positive on the cost curve, based on a forecast rebound in cobalt prices to approximately $15.99/lb in 2026 from $14.81/lb in 2025. Most cobalt is produced as a byproduct of copper and nickel mining, with a small amount coming from PGM mines. Byproduct output from copper mining is also more competitive on a dollars-per-pound paid cobalt basis. Democratic Republic of Congo (DRC) is the most productive region for cobalt supply, dominating the lower quartile, while nickel-cobalt mines in North America are concentrated on the upper end of the cost curve. With the rise in copper prices as well as demand for concentrate, cobalt production is expected to rise along with copper mine output in 2026, even if DRC tightens cobalt exports bans with quotas.

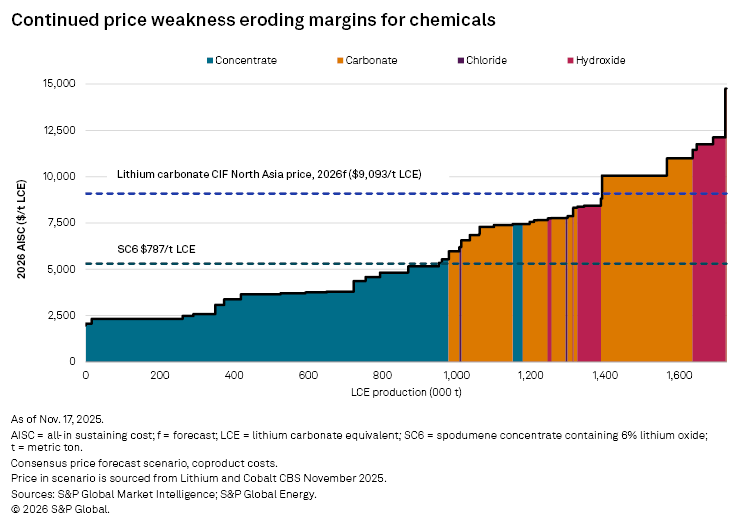

Low prices compel lithium producers to intensify cost-cutting in 2026

The average lithium AISC is forecast to increase 0.8% in 2026 to $5,887/t lithium carbonate equivalent (LCE), alongside the consensus lithium carbonate price declining to $9,093/t LCE. Approximately 47% of chemicals — with lithium carbonate and hydroxide — on the cost curve are estimated to be operating at a loss in 2026, based on this forecast price. As of November 2025, the Platts-assessed lithium spodumene concentrate with 6% lithium oxide content (SC6), FOB Australia averaged $787/t for 2025; approximately 23% of concentrate production sits above this price level on the 2026 cost curve on an AISC basis. Platts is part of S&P Global Energy.

Compared to 2024, the lithium mining industry demonstrated greater resilience to low lithium prices in 2025, with a more optimistic outlook regarding closures. Only the Mt Cattlin mine went into care and maintenance during the first half of 2025 as a direct result of market conditions, while Contemporary Amperex Technology Co. Ltd.'s Yichun lepidolite mine was temporarily suspended due to license expiration. Additionally, the preproduction Jadar project has been shelved, following Rio Tinto's strategic portfolio review. Argentina has experienced severe inflation since 2023, leading to a significant increase in brine operations costs, with an expected weighted AISC at $7,223/t LCE in 2026.

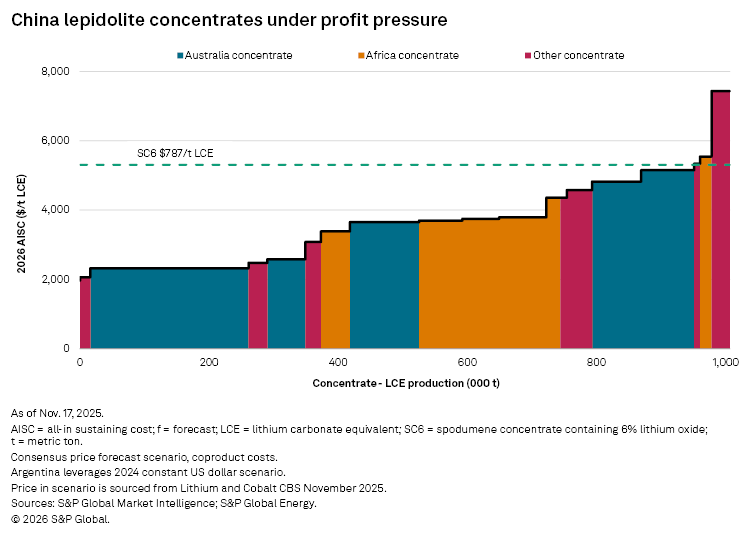

The most cost-competitive operations are concentrate producers in Australia. Their advantage is primarily driven by low-cost assets, such as Greenbushes, Wodgina as well as the PLS Group Ltd.'s Pilgangoora lithium mine, despite some smaller Australian assets occupying the higher end of the cost curve. Additionally, these three key operations are supported by railway and ports infrastructure, which significantly reduces shipment costs. However, some of the higher-cost operations in Australia, such as Kathleen Valley and Mount Marion, are likely to face profit pressure in 2026.

The right-end side of the concentrate production cost curve is shared among mines in Africa, Australia and China. Among the concentrate assets, low-grade lepidolite mines in China rank as the highest-cost operations. In addition, their producers are also subject to strict new environmental regulations, further increasing the risk of reduced production in China of lepidolite concentrates.

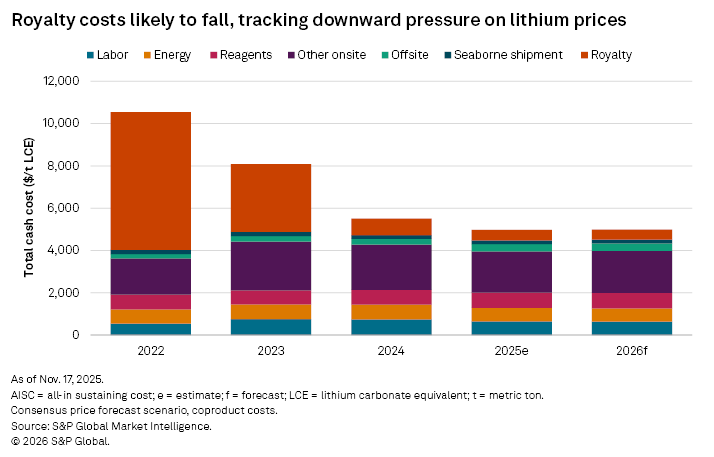

The decline in lithium prices has led to a corresponding reduction in royalty payments. Concurrently, lithium producers are seeking to reduce operational costs to maintain production. Onsite costs for global lithium operations are projected to continue declining through 2025–26, indicating stability at brines and hard-rock mines, following their expansion in recent years.

Cost-cutting approaches vary regionally. Australian mines mainly reduce onsite costs by improving recovery rates and reducing expenditure on labor and equipment. For instance, at the high-cost Kathleen Valley operation, Liontown Ltd. is emphasizing operational efficiency, workforce reduction and enhanced plant recovery to lower costs. The company already raised its recovery rate to 64% from 58%, with a further increase to 70% expected in the March quarter of 2026.

In Africa, producers are primarily renegotiating royalty rates and fiscal terms to maintain project profitability. Atlantic Lithium Ltd., for example, secured revised terms with Ghana in late 2025, lowering royalties to approximately 5% from the previous 10%. Meanwhile, Chinese brine operators are reducing processing plant expenses to improve competitiveness.

The 2026 outlook confirms that while rising costs are a universal challenge, their impact is far from uniform. The mining sector is clearly bifurcating into groups: one including producers of precious metals and manganese is positioned to capitalize on value, as prices outpace inflation; the other, led by lithium and nickel, is being forced to cut costs to survive a period of oversupply. The impending arrival of Simandou's high-grade iron ore adds another layer of complexity, signaling a deflationary shift for bulk commodities. For producers across all sectors, the path forward demands a relentless focus on operational efficiency and cost control. Success in 2026 will not be defined simply by managing inflation, but by navigating the unique price and supply dynamics of each specific metal market.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language