Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 26, 2026

By Melissa Otto, CFA

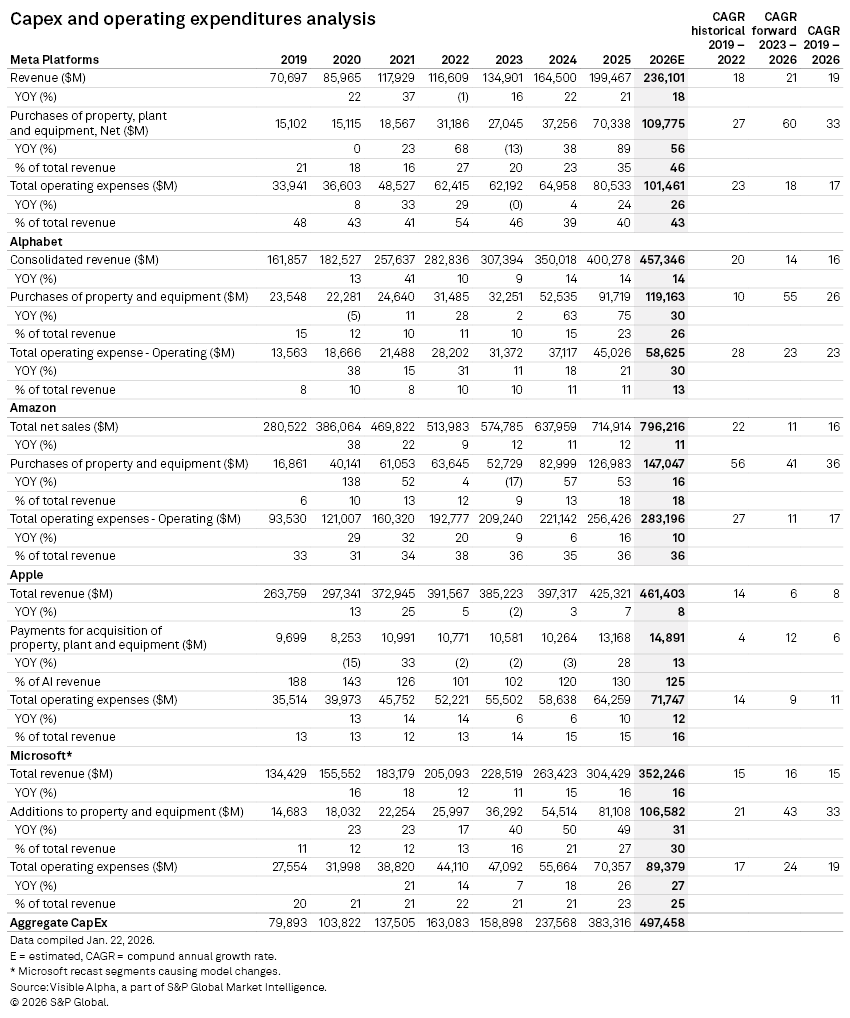

Big tech companies' growing need to invest in technology infrastructure to support generative AI is continuing to raise expectations for capital expenditures in 2026. Looking at aggregate consensus figures for Meta Platforms, Alphabet, Amazon, Apple and Microsoft, capex grew by more than $45 billion in 2025, to $383 billion. In 2026, consensus estimates project the group's capex will grow by more than $100 billion to almost $500 billion. The strong growth in capex has caused some concerns, as it is projected to outpace revenue growth. So far, Apple Inc. (NASDAQ: AAPL) has been the biggest wildcard among its peers, with comparatively low expectations for its capex, despite the company's indication that it will spend more on AI. As Microsoft Corp. (NASDAQ: MSFT) and Meta Platforms Inc. (NASDAQ: META) prepare to report quarterly earnings on Jan. 28, investors are looking to gauge how much the two companies will ramp up capex in 2026.

Microsoft

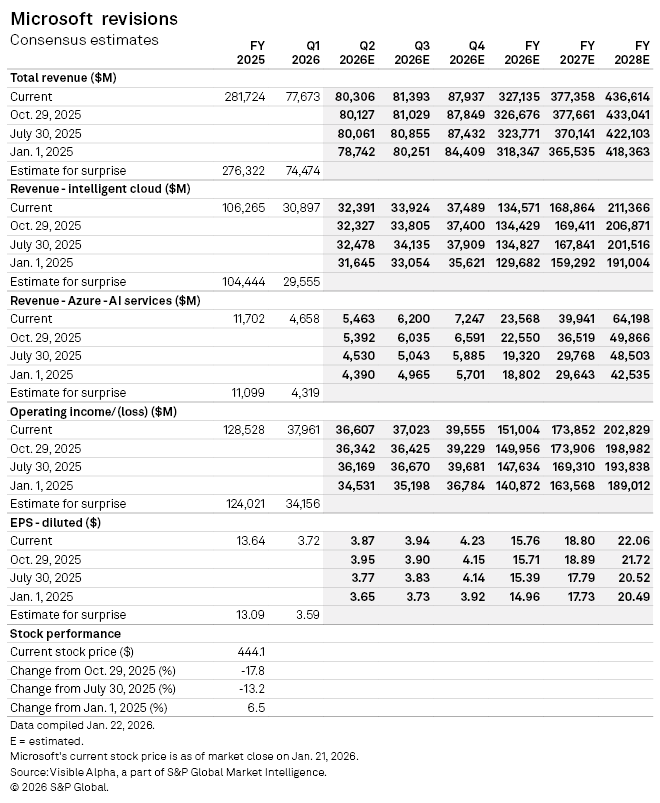

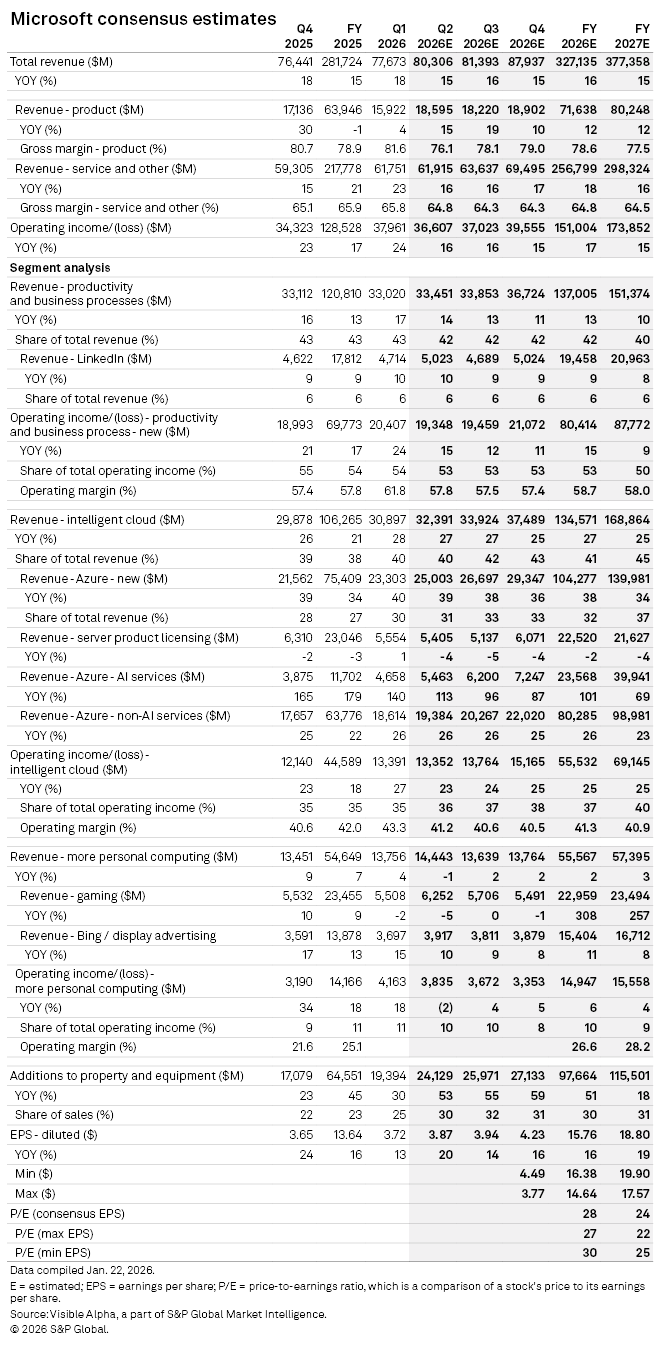

According to Visible Alpha consensus estimates, expectations for Microsoft's fiscal second-quarter 2026 total revenue have remained stable since late July 2025, driven by a resilient view of the company's core business segments. Revenue for the new Azure AI Services segment is projected to remain strong in fiscal year 2026, with a consensus estimate of $23.57 billion, up from $18.80 billion in January 2025. Expectations for this segment in the fiscal second quarter have increased by over 20% since July and nearly 25% since January 2025. Profitability is also expected to remain resilient for the company, while earnings per share expectations are more volatile.

We will be closely watching what the company says about the outlook for Azure and OpenAI, as Microsoft's fiscal year 2026 capex expectations have increased steadily since 2019. According to consensus projections, the company's capex is expected to more than double from $44.5 billion in fiscal year 2024 to $97.7 billion in fiscal year 2026.

Microsoft's stock has traded down 17.8% since its last earnings release and is up 6.9% since January 2025, underperforming the S&P 500's 13.8% return. The consensus price-to-earnings ratio for 2025 has fallen from 31x in July to 24x.

Could the Q2 release and FY 2026 outlook begin to drive outperformance in the stock?

Meta Platforms

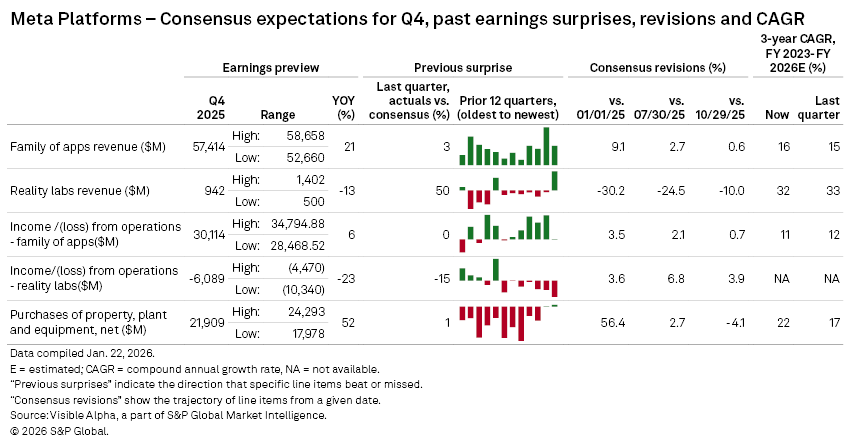

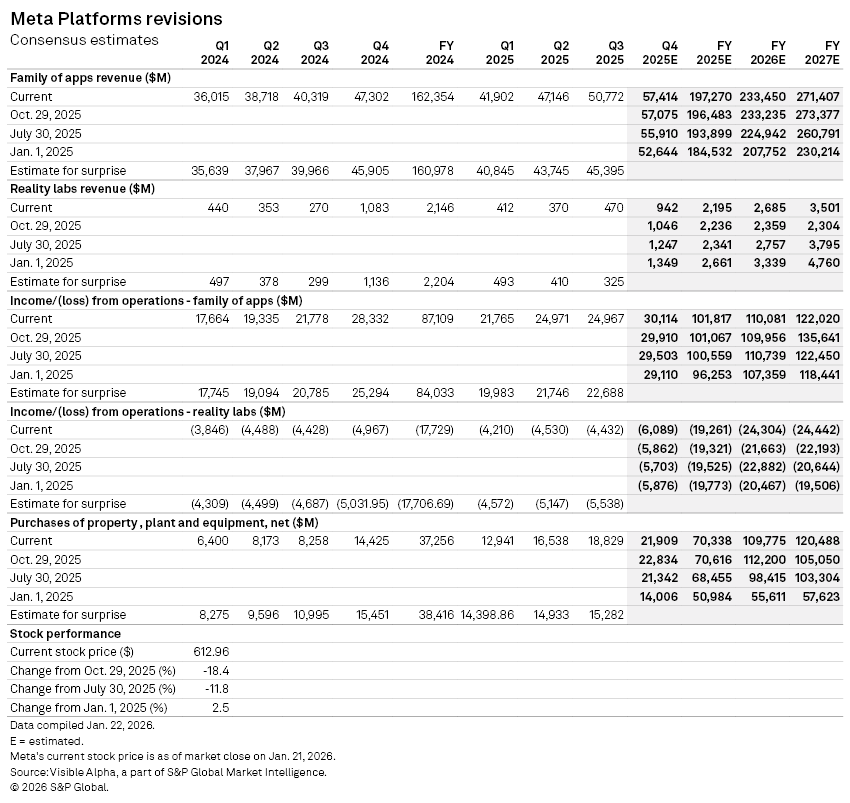

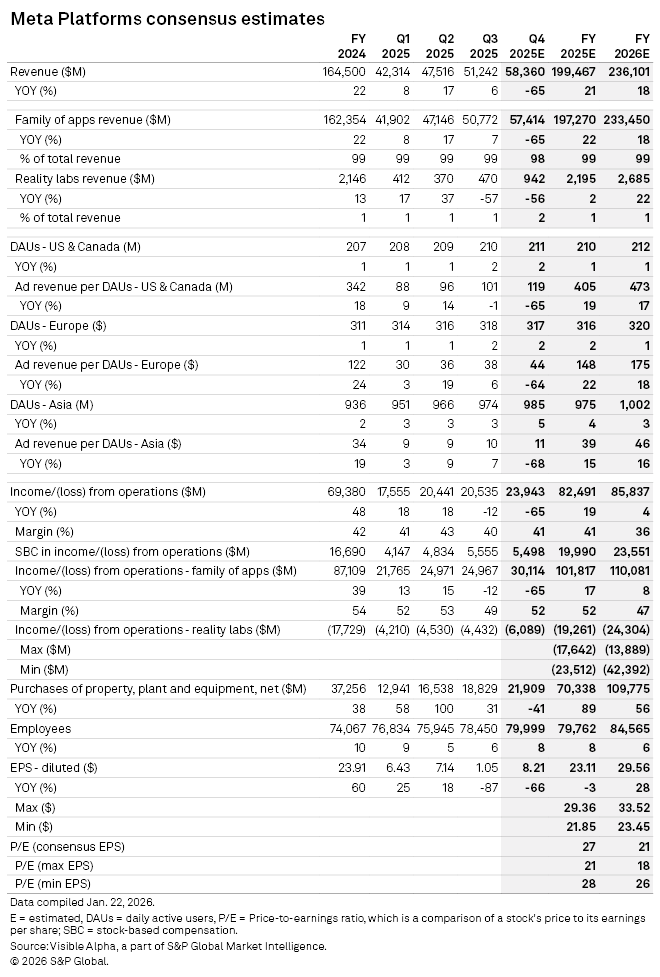

According to Visible Alpha consensus estimates, Meta's total fourth-quarter 2025 revenue is expected to be $58.36 billion, driven by solid performance in the Family of Apps segment, especially in the US and Europe. The company's operating profit is expected to be $23.94 billion, driven by increasing profitability in the Family of Apps segment, offset by about $6.0 billion in losses for Reality Labs.

For 2026, earnings expectations for operating income from the Family of Apps have increased by over $1.0 billion to $110.08 billion, driven by higher ad revenue per daily active user in the US and internationally. Management commentary on the company's outlook in the earnings call will be key to assessing the potential direction of revisions for 2026. In addition, the projected losses from Reality Labs for 2025 remained steady and increased for 2026, driven by continued anticipated losses in the division.

In the first quarter of 2025, CEO Mark Zuckerberg highlighted that the company planned to invest in servers and data centers to support AI. Capex consensus of nearly $110 billion for full-year 2026 is a year-over-year increase of $40 billion from 2025. There are questions about whether Meta will further increase its capex.

Meta's stock has underperformed since January 2025, rising only 2.6% compared to the S&P 500's 13.8%. The consensus price-to-earnings ratio for full-year 2026 has dropped to 21x from 25x in 2025.

Will Meta be able to deliver a profit surprise in Q4 2025 and begin to outperform?

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment