Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 28, 2026

By Jinesh Gopani, Kritika Arora, and Arnish Shah

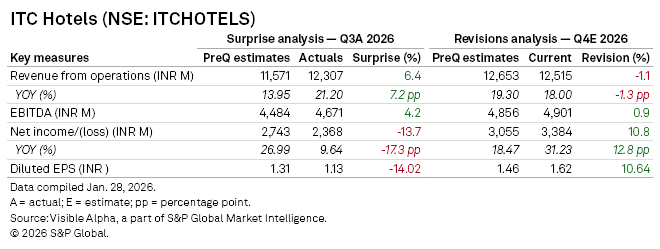

Indian luxury hotel chain ITC Hotels Ltd. (NSE: ITCHOTELS) delivered a mixed set of results in Q3 2026, with notable beats on revenue and EBITDA but softer-than-expected net income.

Total revenue from operations rose to INR 12,301 million, beating Visible Alpha consensus estimates of ₹11,571 million by 6.4%. EBITDA came in at ₹4,671 million, 4.2% ahead of expectations.

Despite the top-line outperformance, net income and diluted earnings per share lagged analyst forecasts, falling 13.7% and 14% short respectively, reflecting a one-off cost impact linked to new labor regulations.

Looking ahead, analysts have slightly trimmed the revenue guidance to ₹12,515 million from ₹12,653 million, reflecting a 1.1% downward revision, while other performance metrics have seen upward revisions.

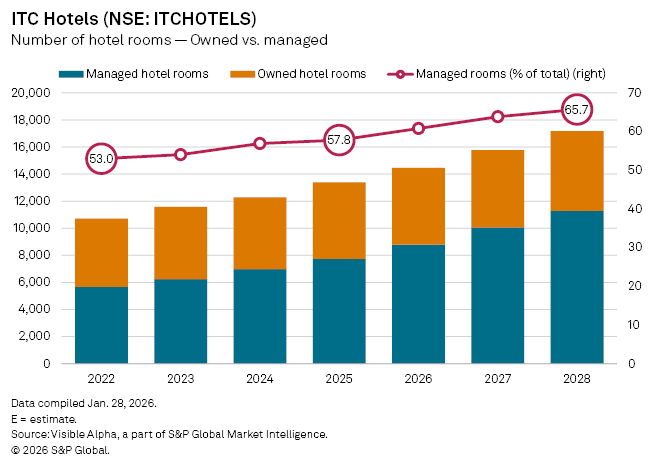

Since its demerger from ITC Limited (NSE: ITC) in January 2025, ITC Hotels has outlined an ambitious expansion strategy targeting over 220 hotels and more than 20,000 keys by 2030.

Central to this growth plan is an asset-light model, leveraging management contracts and franchise agreements to scale operations efficiently. As of fiscal 2026, 61% of the group’s hotel rooms are managed rather than owned, up from 53% in 2022, with Visible Alpha consensus projecting this to rise to 66% by 2028.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment