Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 14, 2026

By Karan Sadh

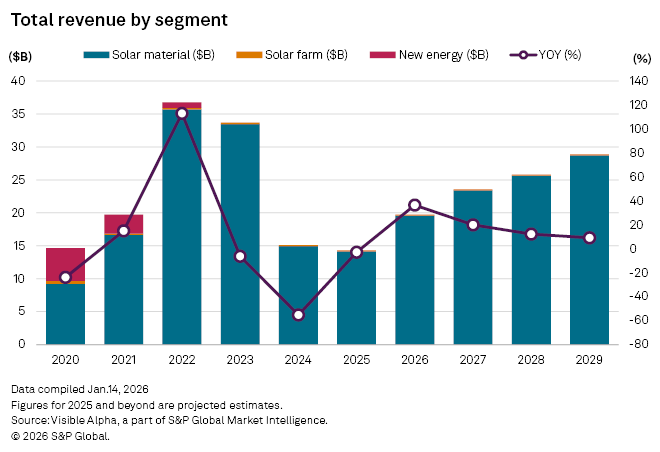

Chinese polysilicon producer GCL Technology Holdings Ltd. (HKG: 3800) is poised for a rebound as polysilicon prices begin to stabilize. Visible Alpha consensus estimates show revenue in fiscal 2025 declining 2.8% year-on-year to CNY14.7 billion, still negative, but a sharp improvement from the 55% drop recorded last year. Growth is expected to return in earnest in 2026, with revenues projected to rise 37% as pricing normalizes and volumes recover.

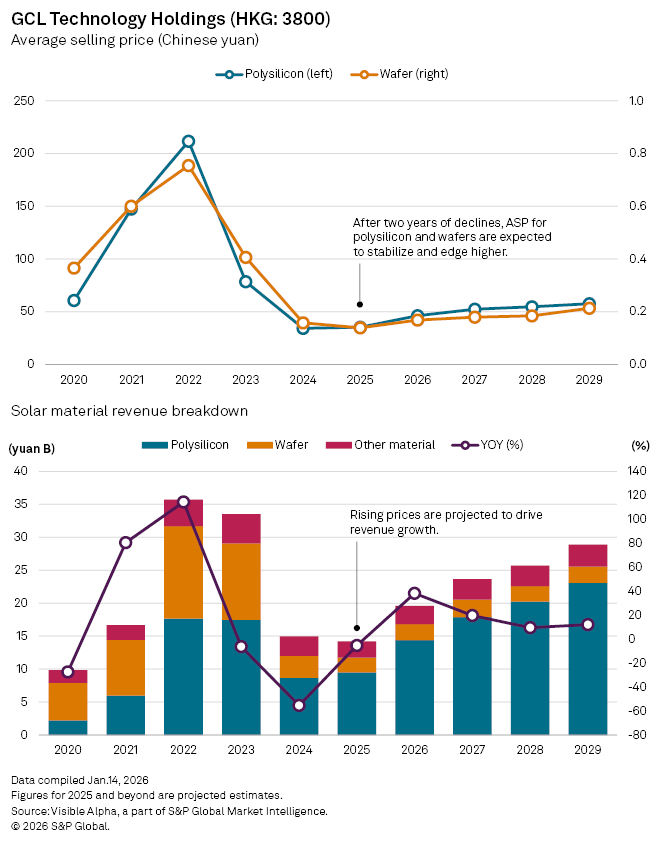

The rebound is overwhelmingly driven by GCL’s solar materials division, which is expected to account for about 97% of group revenue in 2025. Polysilicon, the core input for solar wafers, makes up roughly two-thirds of this segment. Average selling prices for polysilicon fell 63% year-on-year in 2023 and a further 56% in 2024, as severe oversupply pushed prices sharply lower. Analysts expect prices to stabilize, edging up 3% in 2025 to about CNY35.3 per kg. This modest improvement is expected to push polysilicon revenue up 10% to CNY9.5 billion, providing crucial support to the top line.

Other parts of the portfolio remain under pressure. Wafer and other material revenues are expected to decline again in 2025; however, the two segments are projected to rebound in 2026, fueling stronger overall growth.

Total solar materials revenue is forecast to decline 5.3% year-on-year to CNY14.2 billion in 2025 before surging 38% in 2026. Solar farm revenues, by contrast, are expected to see modest growth of 2% to CNY143 million in 2025.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.