Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 15, 2026

By Sourav Kataria and Nitin Kansal

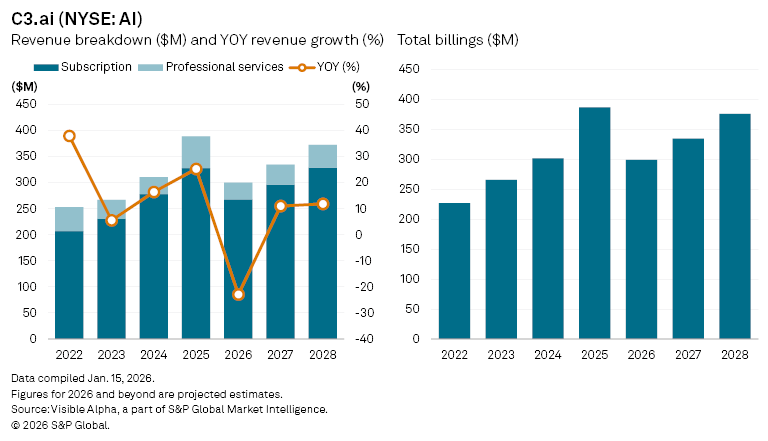

C3.ai Inc. (NYSE: AI), the enterprise AI software group, is bracing for a difficult fiscal 2026 as growth stalls following a strong prior year. Visible Alpha consensus estimates point to a 23% year-on-year fall in revenue to $300 million, reversing the 25% growth seen in fiscal 2025, as customers delay spending, and sales cycles lengthen amid a broader reassessment of enterprise AI budgets.

The slowdown is already evident in the current year. In the second quarter of fiscal 2026, revenue fell 20% from a year earlier, and analysts expect a further 23% decline in the third quarter, to roughly $76 million.

For the full year, subscription revenue, which accounts for the bulk of C3.ai’s top line, is forecast to decline 18% year-on-year to $268 million. Professional services revenue, typically tied to implementation work, is expected to drop a steeper 48% to $32 million as fewer new projects are initiated. Total billings, a key indicator of future revenue, are projected to contract 23% to $299 million, highlighting the near-term pressure on demand.

C3.ai (NYSE: AI), an enterprise AI software provider, is set for a challenging fiscal 2026, with Visible Alpha consensus estimates projecting a 23% year-over-year decline in revenue to about $300 million, following robust 25% growth in 2025.

Despite the near-term reset, analysts see signs of stabilization beyond 2026. For fiscal 2027, total revenue is expected to rebound 11% year-on-year to $333 million, supported by a 10% recovery in subscription sales and a 21% increase in professional services. Billings are forecast to rise 12% to $342 million, suggesting that customer activity could pick up as enterprises move from experimentation to broader adoption of AI applications.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment