Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 03, 2025

By Dan Lowrey

The Public Service Comm. of South Carolina has voted to adopt a settlement authorizing Duke Energy Progress LLC a $51.2 million increase in electric rates in early 2026. The authorized increase is more the two-thirds of the $73.7 million increase requested by the company, and is based upon a return on equity that exceeds national averages tracked by Regulatory Research Associates.

➤ The South Carolina Public Service Commission (PSC) approved a $51.2 million increase in electric rates for Duke Energy Progress LLC (DEP), which is almost 70% of the company's original request of $73.7 million. This adjustment reflects an above industry-average return on equity (ROE) of 9.99%, designed to balance the interests of the utility and its stakeholders.

➤ In an effort to alleviate the financial burden on residential customers, the adopted settlement introduces a Customer Assistance and Relief Effort (CARE) rider, allocating $750,000 annually for energy cost management. Additionally, a Production Tax Credit (PTC) rider is expected to provide $20 million in benefits over the next two years, linked to clean energy incentives under the Inflation Reduction Act.

➤ Regulatory Research Associates considers South Carolina's regulatory climate to be relatively balanced from an investor perspective. The state has not restructured the electric industry, and utilities remain vertically integrated and traditionally regulated. Recently authorized equity returns have approximated industry averages at the time established, and electric fuel clauses are in place.

The authorized 9.99% ROE in Docket 2025-154-E reflects a compromise that balances the interests of the company and its stakeholders. The agreed-upon capital structure consists of 53% equity and 47% debt, designed to maintain financial health while supporting growth initiatives. Other rate case parameters disclosed in the adopted settlement include an overall return on rate base of 7.20%, a rate base of $2.183 billion and a test year ending Dec. 31, 2023.

The 9.99% ROE exceeds national averages tracked by RRA and is 39 basis points above DEP's currently authorized ROE of 9.60%. The average ROE authorized for electric utilities in rate cases decided in the first nine months of 2025 was 9.66%, below the 9.74% average for full year 2024.

In an effort to assist residential customers, the approved settlement introduces a customer assistance and relief effort (CARE) rider, allocating $750,000 annually to help manage energy costs for those in need. Additionally, the agreement includes a production tax credit (PTC) rider, expected to return $20 million in benefits to customers over the next 24 months, linked to clean energy tax incentives under the Inflation Reduction Act.

The commission also voted on Nov. 20 to approve a separate large-load stipulation entered into between DEP, consumer and environmental groups. This aims to address the increasing energy demands of large customers, such as data centers. A significant component of this agreement is the commitment to jointly petition the PSC to open a generic docket by June 1, 2026, focusing on new energy loads of 50 MW or greater. This initiative seeks to create a regulatory framework that meets the needs of large energy users while ensuring reliable service for all customers, ultimately supporting economic development while protecting ratepayers.

A petition would permit interested parties to submit comments to the PSC on various topics concerning new large-load customers, including minimum contract terms, collateral requirements, exit policies, and the treatment of generation and transmission costs. Additionally, it would allow input on interconnection costs, opportunities for grid-enhancing technologies, flexible interconnection tariff provisions and options for managing clean behind-the-meter resources, including clean transition tariffs for selecting new clean energy resources.

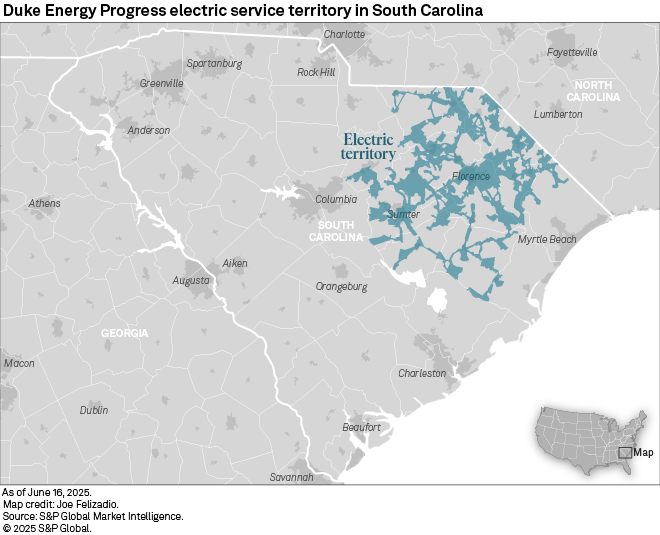

DEP is a unit of Duke Energy Corp. Duke plans to combine its DEP and Duke Energy Carolinas LLC subsidiaries operating in South Carolina and North Carolina.

Rate case background

DEP filed its general rate case application with the PSC on June 12 seeking an increase in jurisdictional rates of $74.8 million, premised upon a 10.85% return on equity (53.00% of capital) and a 7.65% return on a rate base valued at $2.253 billion for a test year ended Dec. 31, 2023, adjusted for actual costs through Dec. 31, 2024.

The rate request is driven primarily by transmission and distribution investments to improve grid reliability and resiliency, as well as the increased cost of capital required to support continued capital investments. Additional drivers include investments in generation fleet maintenance and improvements, coal ash environmental compliance costs and an increase in annual storm reserve funding.

Targeted investments include equipment designed to remove nitrogen oxides, sulfur and sulfur dioxide from emissions produced by DEP's fossil fuel generating fleet, seismic stability work at the Blewett Falls hydroelectric plant, coal ash basin closure activities in accordance with applicable federal and state regulatory requirements and capital improvements to enhance safety and preserve performance and reliability of the Brunswick, Harris and Robinson nuclear plants. The company is actively seeking to extend the operating life of the Robinson nuclear plant in Darlington County for up to 20 additional years.

The company requested authority to amortize coal combustion residuals (CCR) compliance costs over a seven-year period, through an annual amortization expense of approximately $7 million, and to include the regulatory asset balance in rate base. In prior cases, the commission has authorized continued deferral of CCR compliance costs with a debt return. DEP requested similar treatment in this case to ensure consistency in both the cost recovery framework and the deferral framework previously authorized. The commission approved the company's request to amortize the costs over seven years and defer costs after Jan. 1, 2025, subject to review for reasonableness and prudency in a future rate proceeding.

To help manage the volatility associated with pension expense, particularly given the influence of interest rates and market performance, DEP proposed to establish a pension rider. The rider was envisioned to annually reconcile the difference between the pension expense amount collected in base rates and the actual expense amount to account for recent market impacts to the value of the company's pension plan. The commission approved the pension rider.

With respect to rate design, DEP initially proposed to increase the monthly basic customer charge on the residential class to $13.00, up from the $11.78 charge that has remained unchanged since 2019, to better reflect customer-related costs and improve alignment with the available time-of-use rates for residential customers. However, the company withdrew that request during settlement discussions.

On June 23, the company filed supplemental testimony requesting a revised increase in rates of $73.7 million, premised upon a 10.85% return on equity (53.0% of capital structure) and a 7.65% overall return on rate base of $2.249 billion and test year ended Dec. 31, 2023.

The South Carolina Office of Regulatory Staff (ORS) filed testimony Sept. 16 supporting a $32.6 million increase in rates, premised upon a 9.50% return on equity (53.00% of capital structure) and a 6.94% overall return on rate base of $2.132 billion for a test year ended Dec. 31, 2023. On Oct. 17, ORS filed surrebuttal testimony supporting a revised $32.0 million increase in rates, premised upon a 9.50% return on equity (53.00% of capital structure) and a 6.94% overall return on rate base of $2.145 billion and test year ended Dec. 31, 2023.

On Oct. 27, DEP and stakeholders in the case agreed via settlement to raise electric base rates by approximately $51.2 million, establishing the revenue requirement for the utility in the test year. The revenue requirement settlement was signed by DEP, the South Carolina Office of Regulatory Staff (ORS), the South Carolina Department of Consumer Affairs (DCA), the South Carolina Energy Users Committee, the Federal Executive Agencies/Department of Defense, Nucor Steel – South Carolina and Walmart Inc.

The large-load stipulation was entered into by DEP, DCA, the South Carolina Small Business Chamber of Commerce, the South Carolina Coastal Conservation League, the Southern Alliance for Clean Energy, Upstate Forever, Vote Solar and the Sierra Club.

SC regulatory climate viewed as balanced

RRA views the regulatory environment for energy utilities in South Carolina as relatively balanced and accords South Carolina regulation of energy utilities an Average/2 ranking. In June, RRA raised the ranking of South Carolina from Average/3 to Average/2 after passage of sweeping energy legislation impacting regulated utilities. The legislation updated the ratemaking paradigm in the state, allowing multiyear rate plans of up to five years, among other things.

The state has not restructured its electric industry, and utilities remain vertically integrated and traditionally regulated. Recently authorized equity returns have approximated industry averages at the time established, and electric fuel clauses are in place.

In the gas industry, large-volume customers have had the option to purchase their gas supply from competitive suppliers for many years; however, no efforts have been made to extend retail choice to smaller customers. Gas utilities are subject to annual "make-whole" rate adjustments if their earned equity return is outside a band of plus or minus 50 basis points around the last authorized return. Purchased gas adjustment clauses are in place, and weather normalization mechanisms have been utilized for the two major gas utilities for several years.

For additional details, refer to the commission profile.

Research Regulatory Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.