Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 03, 2025

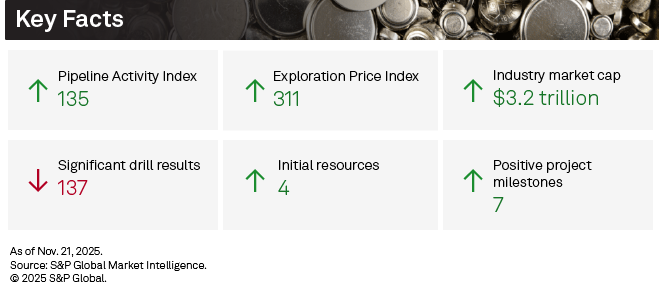

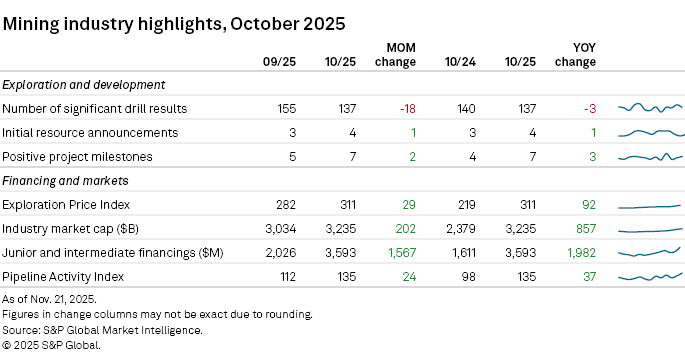

The S&P Global Market Intelligence Pipeline Activity Index (PAI) increased 21% month over month in October to 135, up from 112 in September. Gold exploration led the gains, with the gold PAI up 24%, to 190 from 154, while the base and other metals PAI increased 19%, to 92 from 77.

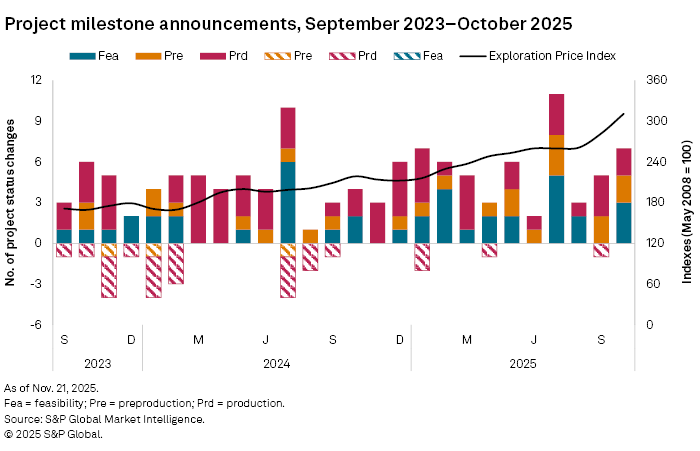

Of the metrics that comprise the PAI, only significant drill results declined in October, while all other components increased. The Exploration Price Index (EPI) hit a record high of 311, up from 282 in September, driven by surging gold prices that peaked at US$4,300 per ounce during the month, with most other precious and base metals also recording price gains. The aggregate industry market capitalization extended its record high, rising to US$3.2 trillion and reflecting sustained investor appetite.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

The EPI measures the relative change in precious and base metals prices, weighted by each metal's overall exploration spending percentage as a proxy for its relative importance to the industry at a given time.

Detailed data on the PAI metrics is available in the accompanying Excel databook.

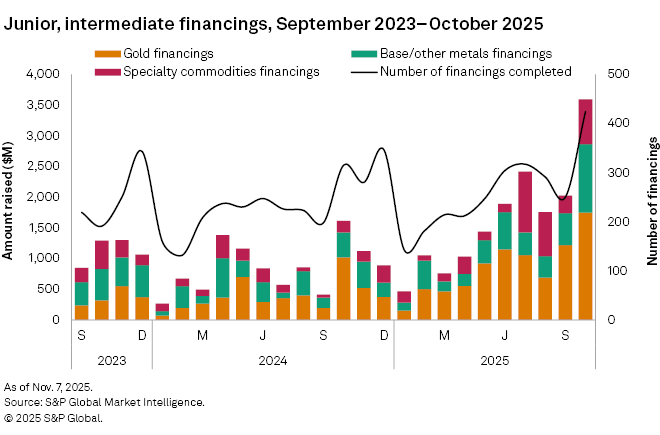

Funds raised surpass $3B amid strong gains across all groups

Funds raised by junior and intermediate companies surged 77% to $3.59 billion in October, representing the second-highest level in our records dating back to January 2014, and not far short of the March 2021 peak of $3.69 billion. Gold fundraisings achieved a new record-high, while all three commodity groups posted gains, led by the base and other metals group, which more than doubled month over month. The number of transactions also hit a record, climbing 70% to 424 from 250 in September. Significant financings — transactions valued at over $2 million — rose to 205, up from 117 in September. There were 16 transactions valued at over $50 million, up from 10 in September, reflecting that October's jump was broader in scope, rather than being driven by a few high-valued financings.

Gold fundraisings increased for the second consecutive month, rising 44% to $1.75 billion in October, marking the highest level in our records dating back to January 2014. The total number of transactions climbed to 183 from 101, while the number of significant transactions nearly doubled to 102 from 52. There were eight transactions valued at over $50 million, up from seven in September.

Funds raised for the base and other metals group rose to $1.12 billion in October, more than double September's $523 million and the highest level since September 2021. Although silver and nickel declined, these decreases were offset by copper's $540 million increase, with additional support from gains in zinc and cobalt. The number of transactions in this category climbed to 151 from 85 in September, establishing a new record for the group. The number of significant financings rose to 61 from 43, while the number of transactions valued at over $50 million increased to five from three in September.

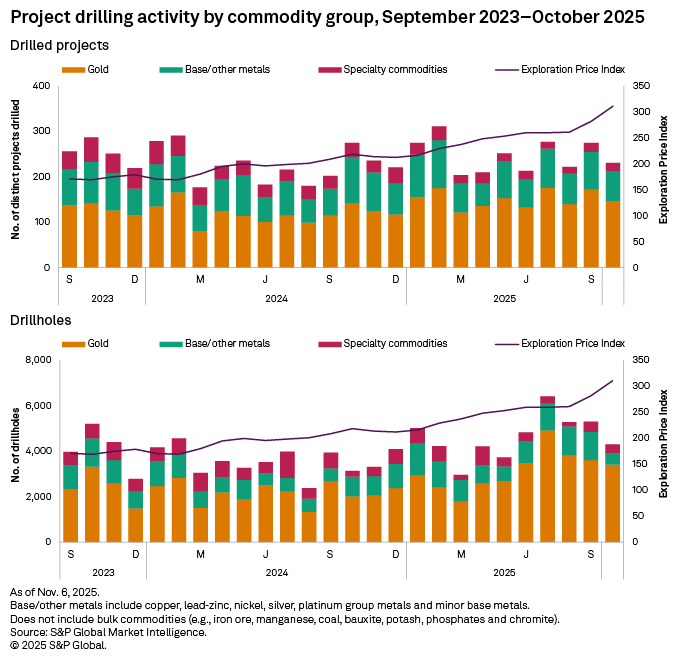

Drill results pullback MOM

Drilling metrics showed a decidedly mixed performance in October, with a total of 4,037 drillholes reported in 231 projects by roughly 218 operators. The headline hole count and the project tally contracted sharply from the 5,307 holes and 275 projects logged, respectively, in September. Year-to-date totals remain ahead of the same stretch in 2024, reflecting that — even in a down month — companies are staying active as prices for gold and other key commodities hold near-multiyear highs. Projects across all stages of development also portrayed a mixed performance; early-stage and late-stage projects decreased 31% and 9%, respectively, while minesite projects increased 3% month over month.

October's top results came from the Araxa advanced rare earth element project in Brazil, operated by Australian Securities Exchange-listed St George Mining Ltd., with an intersect of 98.4 meters grading at 3.07% total rare earth oxides, including 0.43% niobium. The company recently reported a collaboration with Brazil's government for the funding of a new large-scale pilot plant construction, which will be the foundation for the new St George Technological Center at the Federal Center for Technological Education's Araxá Campus.

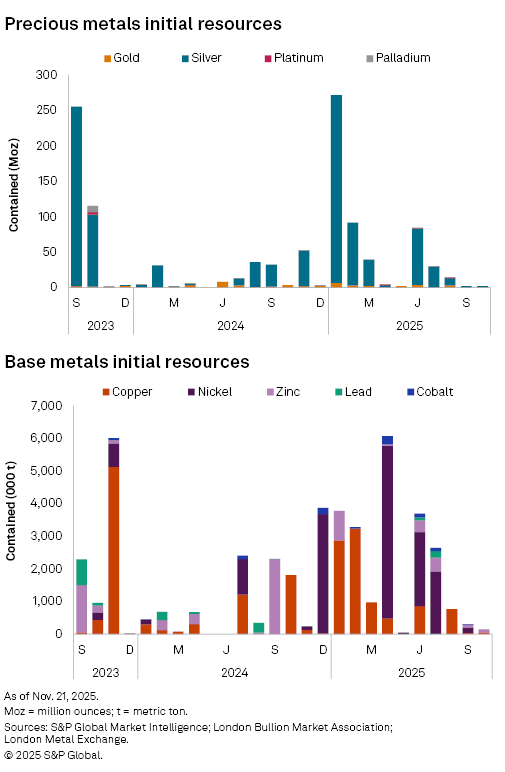

Africa assets dominate initial resource announcements

In October, four initial resource announcements were made: two for gold-focused assets and two for copper projects.

The largest announcement came from Alternative Investment Market-listed Oriole Resources PLC for the MB01-S zone at its CLP gold project in Cameroon. The company announced a maiden inferred resource of 24.8 million metric tons grading 1.09 g/t Au, containing 870,000 ounces gold.

The second-largest announcement came from AIM-listed Rome Resources PLC regarding its Mont Agoma copper-tin project in the Democratic Republic of Congo. The company announced a maiden inferred resource of 3.16 MMt grading 1.45% Cu, 2.72% Zn and 14.3 g/t Ag, containing 45,900 metric tons copper, 86,200 metric tons zinc and 1.46 million ounces silver.

Positive milestones up by 2

In October, seven positive milestone announcements were recorded: five for gold-focused assets and one each for silver and copper. By stage of development, three were at feasibility, two at preproduction and two at production. No negative milestones were reported.

Among the feasibility-related milestones, NYSE-listed McEwen Inc. completed an independent feasibility study for its Los Azules project in Argentina in early October. The asset holds the largest contained copper, totaling 16.2 MMt across reserves and resources.

With preproduction-related milestones, Toronto Stock Exchange-listed Perpetua Resources Corp. broke ground on early works at its Stibnite project in Idaho, US, after posting US$139 million in construction phase financial assurance and receiving the final record of decision to start construction. Stibnite holds the most contained gold, totaling 7.9 Moz across reserves and resources. The project is expected to produce about 450,000 ounces of gold annually over its first four years.

On production-related milestones, NYSE-listed Newmont Corp. announced commercial production at its Ahafo North project in Ghana in late October, following a successful first gold pour on Sept. 19. Ahafo North holds the most contained gold at 7.2 Moz and is expected to deliver between 275,000 and 325,000 ounces annually over the next five years, within a 13-year mine life.

EPI breaks 300-mark, mining equities continue ascent

Amid robust metals prices, the EPI reached 311 in October — its first surpassing 300 in our records dating back to January 2008 — up 10% month over month and 42% year over year. Mining equities also continued to rise, with aggregate market capitalization reaching $3.2 trillion, increasing 7% month over month and 36% year over year. These trends indicate sustained bullish sentiment across the sector, supported by persistently elevated gold and copper prices.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language