Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 12, 2025

By Dyan Sy, Althea Keziah Liwanag, and Naditha Marie Manubag

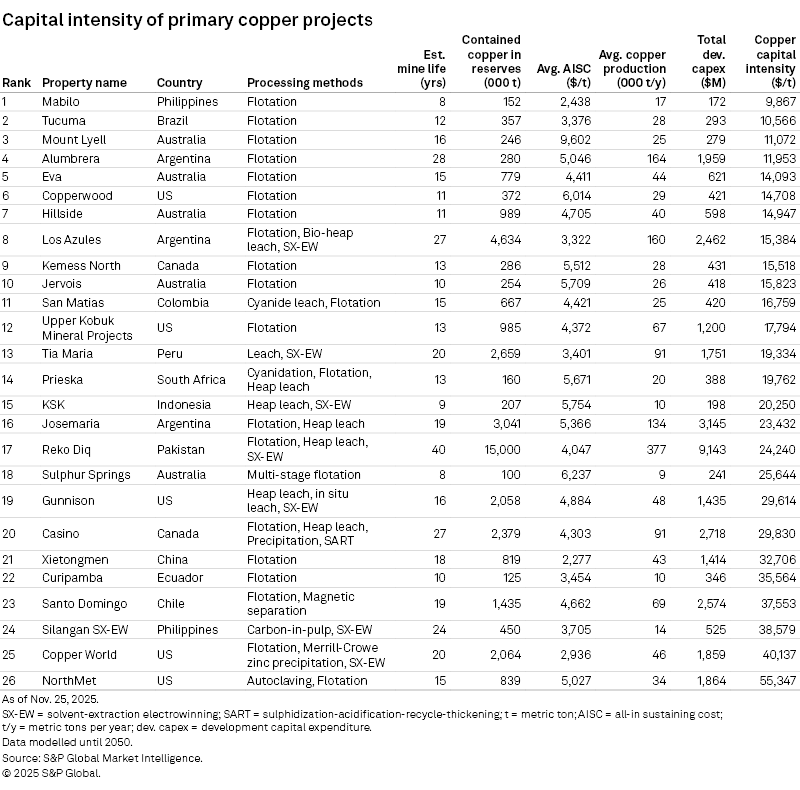

The accelerating global energy transition has enhanced the demand for copper, yet bringing new supply online has become increasingly costly. A key metric for measuring this financial challenge is capital intensity, which for this analysis is defined as the total development capital expenditure divided by a mine's average annual copper production. Our findings show a clear trade-off between upfront capital and long-term operating costs, and a more expensive future for copper supply.

➤ The weighted-average capital intensity for 26 upcoming copper projects, scheduled to start by 2030, is $22,359 per metric ton of annual paid copper. This marks a substantial increase in the upfront investment required to bring new production online, signaling a more expensive future for copper supply.

➤ The US and Canada region hosts the most capital-intensive projects, with the Copper World, Gunnison and Casino projects driving the regional average up.

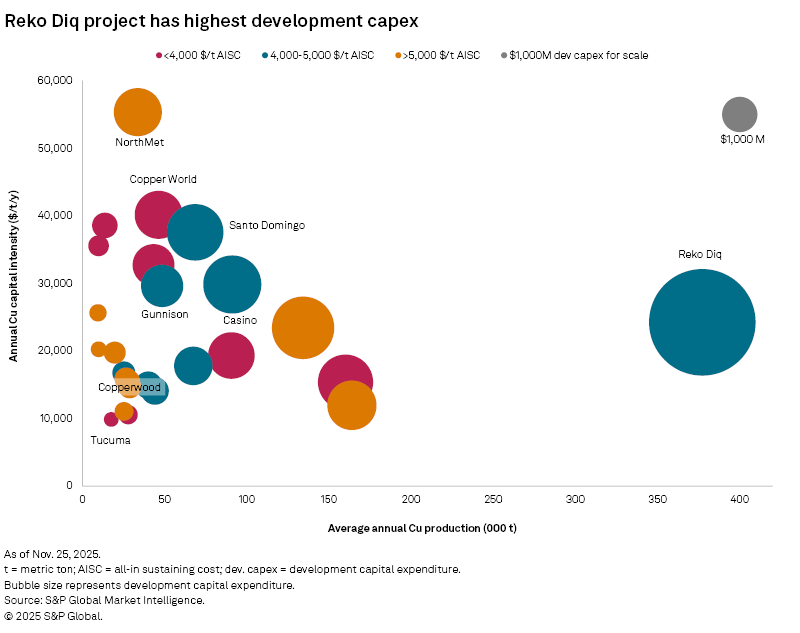

➤ Large projects, such as Reko Diq, can achieve near-average capital intensity due to their massive production scale. This contrasts with smaller mines like Copperwood that have low initial capex but may face higher long-term operating costs.

Our analysis of 26 primary copper projects, with target start date within five years, have an average capital intensity of $22,359 per metric ton of paid copper per year. The development capex for this pipeline ranges from $172 million to $9.14 billion, marking a substantial increase from our previous study, which recorded a lower capex range between $53 million and $5.45 billion.

Out of the 22 projects previously analyzed, 13 have postponed their target start dates but are still included in our latest review. These delays have resulted in adjustments in development costs. A notable project is Capstone Copper Corp.'s Santo Domingo in Chile, which recorded the largest increase of $910 million, representing a 55% jump from the budget reported in the 2020 technical report. This escalation is primarily driven by the addition of a mine fleet, enhanced support infrastructure and expanded copper and magnetite circuits.

These changes are designed to process an additional 43.8 million metric tons of life-of-mine ore, boosting annual copper production to 68,500 metric tons from 62,000 metric tons and gold output to 22,000 ounces from 17,000 ounces. With the revised production profile and capex, Santo Domingo's capital intensity for copper now stands at $37,553/t/y, which is among the highest in our list.

Similar to other capital-intensive copper projects, Santo Domingo requires more complex processing. A common theme for low-capital-intensity projects is recovering a single product, allowing for a more straightforward approach. For instance, Ero Copper Corp.'s Tucuma project in Brazil ranks as the second-least capital-intensive and utilizes the conventional flotation method to recover copper concentrate.

Beyond processing methods, Tucuma's open-pit mining approach and favorable location have also contributed to its lower initial capital requirements. Regionally, majority of upcoming projects are concentrated in Asia-Pacific, with 10 assets, followed by eight in Latin America, seven in the US and Canada, and just one in Africa. Latin America has the lowest average capital intensity for copper, with values ranging from $10,566/t/y to $37,553/t/y, resulting in an average of $19,049/t/y. In contrast, the US and Canada region has the highest average, at $28,910/t/y. Development capex in this region spans from $421 million to $2.72 billion, with annual copper production ranging from 27,780 metric tons to 91,110 metric tons.

Three major copper projects in the US and Canada — Copper World, Gunnison, and Casino — illustrate the high capital intensity associated with large-scale, technically complex mines. These costs are driven by factors such as remote locations, stringent environmental regulations and advanced processing requirements. Hudbay Minerals Inc.'s Copper World project in Arizona deploys a two-phase development process over 20 years. It has an initial capex of $1.32 billion and a subsequent $367 million expansion for solvent extraction and electrowinning (SX-EW) and leaching systems, resulting in a capital intensity of $40,137/t/y. Gunnison, also in Arizona, and Casino in Yukon exhibit nearly identical capital intensities of approximately $30,000/t/y. Gunnison incurs additional costs for relocating a 2.8-mile section of Interstate 10, and Casino requires extensive infrastructure — including an airstrip, a 132-km main access gravel road, a processing plant and a campsite — and preproduction operations ahead of its anticipated 2030 commercial start. Despite Copper World's high upfront cost, its estimated all-in sustaining cost (AISC) of $2,936/t is substantially lower than Gunnison's $4,884/t. NorthMet in Minnesota, the most capital-intensive mine in the study, has been excluded from further analysis, because its primary commodity can be nickel, depending on the price environment.

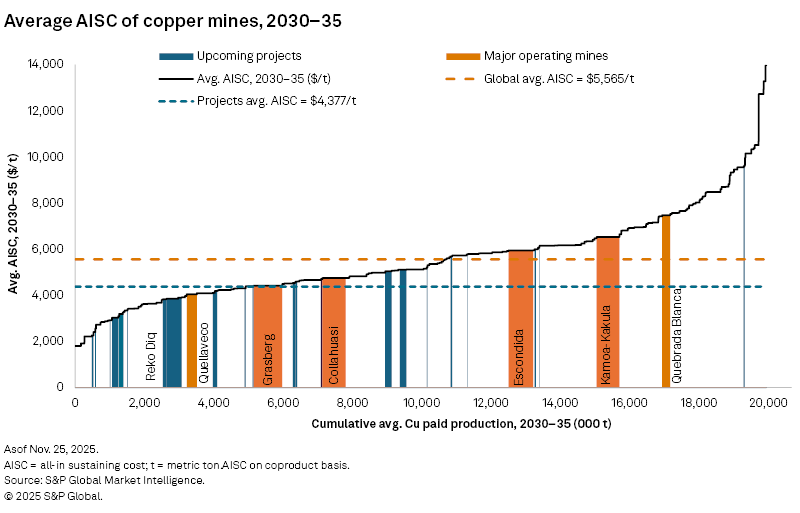

Another significant copper project to come online before 2030 is Barrick Mining Corp.'s Reko Diq in Pakistan, which hosts approximately 15 MMt of copper reserves — the largest among the projects in our analysis. Commercial production is scheduled to begin in 2028, with an anticipated annual output of 377,000 metric tons of copper over a 40-year mine life. This immense anticipated production at Reko Diq resulted in a $24,240/t/y capital intensity tracking close to the global average, despite having the highest development capex in the study of around $9.14 billion. Furthermore, the mine's AISC is estimated to average $4,047/t over the life of mine, positioning it comfortably below the study average of $5,565/t. In contrast, Highland Copper Co. Inc.'s Copperwood project in Michigan, US, leverages existing road networks and power substation, resulting in one of the lowest capital intensities at $14,708/t/y. However, the mine faces elevated operating costs, with an AISC of $6,014/t, placing it in the upper half of the copper cost curve. These higher costs primarily reflect the planned use of the room-and-pillar mining method for ore extraction, combined with the higher power rate associated with constructing and operating transmission lines and a substation.

The Reko Diq copper project is comparable in scale to the Kamoa-Kakula operation in Democratic Republic of Congo, which holds 17.7 MMt of copper reserves and began commercial production in 2021. Kamoa-Kakula's capital intensity of $10,177/t/y ranks among the lowest when compared with the current project pipeline, while its AISC averaged $5,054/t from 2021 through 2024 — within the lower half of the global cost curve. The AISC is expected to rise, however, with the 2030–35 forecast average to be 24% higher than the 2021–24 average.

Several structural factors are making copper mines around the world increasingly capital-intensive and operationally expensive, despite the rising energy transition demands. These include persistent inflation in equipment and labor costs, the need to develop more technically complex processing methods to treat lower-grade ore bodies, and stricter environmental and social permitting requirements. Furthermore, recent macroeconomic developments — including new tariffs on materials — are expected to add further cost pressures. Ultimately, the market will need to support a higher sustained copper price to incentivize the massive investment required to meet future demand and avoid a critical supply bottleneck in the future.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language