Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec. 2, 2025

By Keith Nissen

S&P Global Market Intelligence Kagan surveys conducted in the fall of 2025 highlight America’s love affair with watching sports and the engaged nature of fans of the Big Four US pro sports leagues: the National Football League Inc., Major League Baseball, National Basketball Association Inc. and the National Hockey League LP.

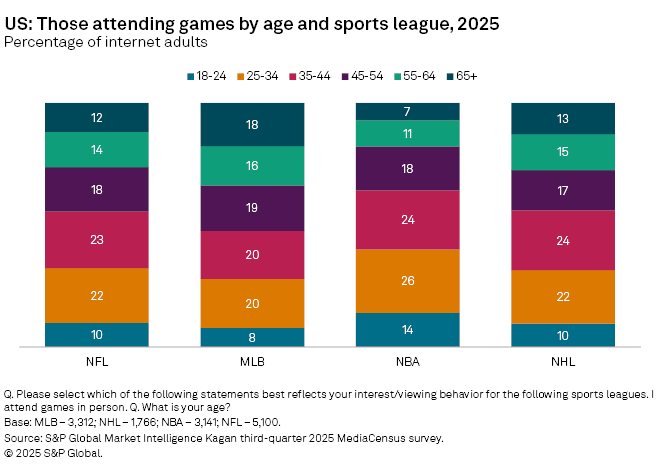

➤ Three-quarters of Americans watch live sports, with two-thirds of sports viewers indicating they have attended NFL, MLB, NBA or NHL games in person. The age distribution of NFL and NHL fans attending games is fairly even, with MLB attendees skewed slightly older, and younger adults favoring the NBA.

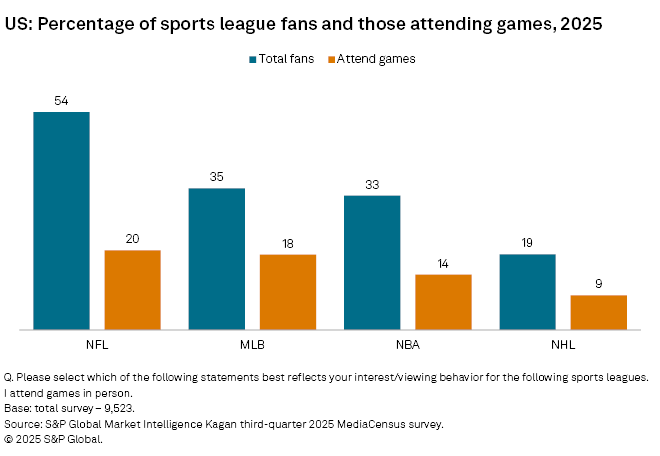

➤ While the NFL holds a wide lead in total viewing over the other major leagues, the gap is much smaller for live game attendance. Among total survey respondents, 20% said they typically attend NFL games versus 18% for MLB, 14% for NBA and 9% for NHL.

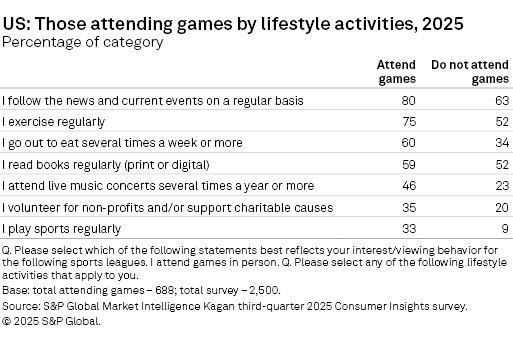

➤ Those attending professional live sports events typically lead active lifestyles and are much more likely to exercise, play sports, attend concerts and dine out at restaurants than those not attending games.

Results from S&P Global Market Intelligence Kagan’s Fall 2025 Consumer Insights and MediaCensus surveys showed that overall, three-quarters (74%) of Americans reported that they watch live sports either in person or on TV. The majority of Americans (54%) said they watch NFL football games, compared to one-third watching MLB baseball (35%), and NBA basketball (33%), while 19% watch NHL hockey. Americans follow two sports leagues, on average.

Two-thirds (68%) of US sports fans reported attending a live professional sports event, whether it was an NFL, MLB, NBA or NHL game. One in five (20%) surveyed US adults cited attending an NFL game, followed by MLB (18%), NBA (14%) and NHL (9%) games. Nearly half (47%) said they have attended games from multiple sports leagues.

The age demographics of those attending NHL hockey games closely mirror those attending NFL football games, despite NHL viewership being a fraction of those watching NFL football. The data shows that the majority of NHL and NFL event attendees were adults under 45 years of age. MLB baseball games attract a slightly older audience with 34% being adults 55 years of age and older. Approximately two-thirds (64%) of those attending NBA basketball games were adults under age 45 and only 18% were aged 55+.

Those attending NFL football, MLB baseball, NBA basketball or NHL hockey games lead a more active lifestyle than those not attending games. For example, three-quarters (75%) of game attendees said they exercise regularly compared to just over half of those not attending games. Game attendees were also substantially more likely to attend music concerts, play sports and eat out at restaurants than non-attendees.

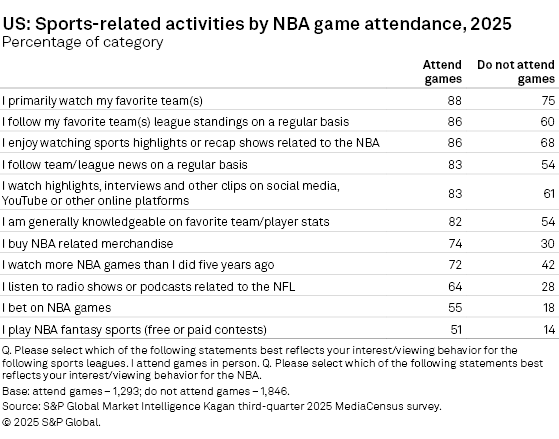

As might be expected, sports fans who attend games were more likely to closely follow their favorite sports leagues than fans that do not attend games. For example, the MediaCensus survey found that 86% of NBA game attendees follow their favorite teams’ standings compared to 60% among those that do not attend games. Game attendees were also much more likely to follow team/league news, buy team related merchandise, listen to sports podcasts, place sports bets and play free or paid fantasy sports contests than fans not attending games.

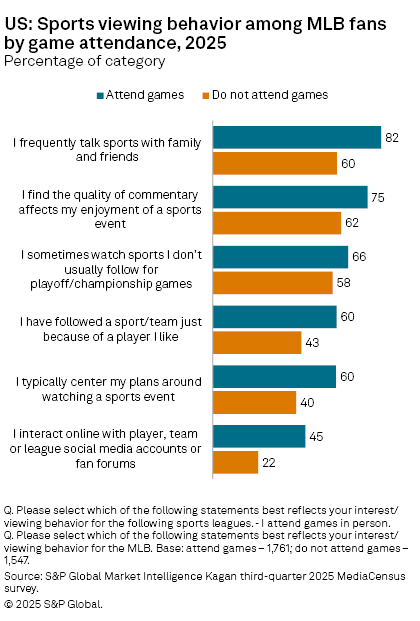

The MediaCensus survey also found that among those attending MLB baseball games, eight in 10 frequently talk sports with family and friends. A clear majority (60%) of MLB game attendees reported centering their daily plans around watching a baseball game compared to 40% among fans not attending live MLB games. The use of online MLB-related social media accounts and fan forums is also heavily skewed toward game attendees (45%).

The Kagan third-quarter 2025 MediaCensus survey was conducted during September 2025, consisting of approximately 9,528 internet adults. The third-quarter 2025 US Consumer Insights survey was conducted during September 2025, consisting of 2,500 internet adults. The margin of error is +/-1.9 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from S&P Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Segment

Language