Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — Nov. 19, 2025

What is CreditCompanion™ (Beta)?

CreditCompanion™ (Beta) is a GenAI chatbot for RatingsDirect® users, designed to efficiently uncover, analyze, and summarize credit research insights. Built on advanced NLP, LLM, and RAG technologies, it delivers accurate, relevant responses. By automating routine tasks like information retrieval, trend analysis, and peer comparisons, it helps credit analysts save time and enhance productivity.

Key Features:

Challenges Faced by Credit Analysts in Commercial Banks:

These challenges highlight the need for robust tools that streamline data aggregation, enhance scenario analysis, and automate workflows – enabling faster, more reliable, and insight-driven credit assessments.

How CreditCompanion™ (Beta) Addresses These Challenges:

CreditCompanion™ (Beta) aggregates ratings, outlooks, and financial data from S&P Global Ratings, reducing research time and ensuring accuracy.

By surfacing summarized insights through an intuitive conversational interface, it supports analysts across key workflows such as portfolio surveillance, counterparty analysis, and credit memo preparation – helping them access, interpret, and apply credit intelligence more efficiently.

Example Analyst Prompts:

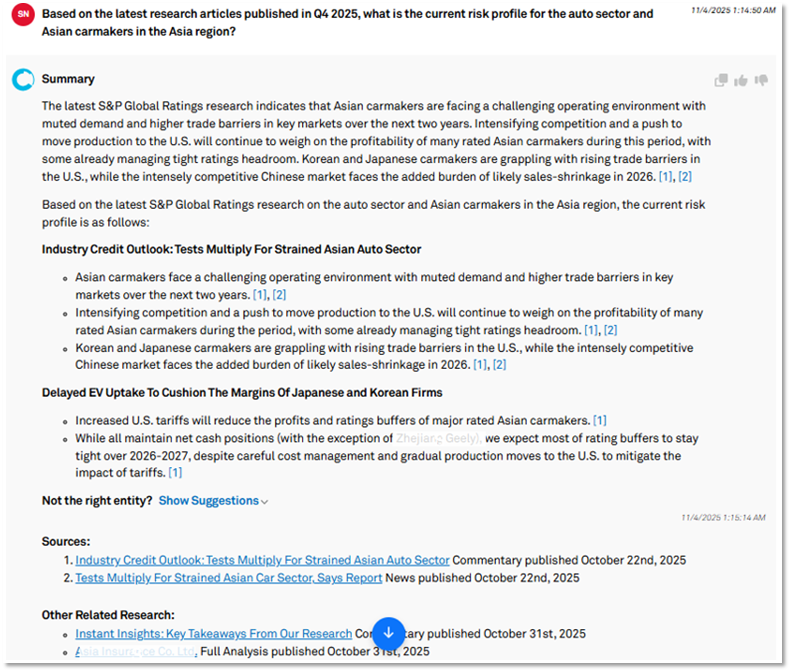

1. You can summarize sector-level credit drivers and key risks for your counterparty borrower drawing directly from S&P Global Ratings’ latest industry commentaries.

Source: CreditCompanionTM (Beta release) on RatingsDirect® on S&P Capital IQ Pro, S&P Global Market Intelligence. As of November 2025. For illustration only. CreditCompanionTM is powered by generative AI technology, which may produce inaccurate responses. Please review the Legal Disclaimer for more information. Graphics are blurred out to anonymize the entity names.

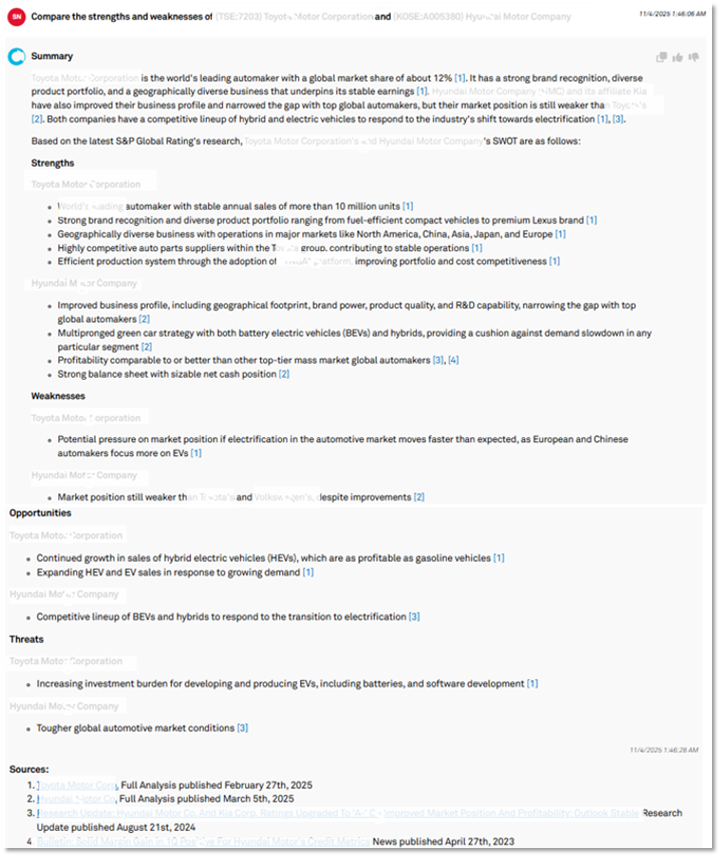

2. Next, you can compare counterparties within the sector to evaluate relative credit strengths and weaknesses.

Source: CreditCompanionTM (Beta release) on RatingsDirect® on S&P Capital IQ Pro, S&P Global Market Intelligence. As of November 2025. For illustration only. CreditCompanionTM is powered by generative AI technology, which may produce inaccurate responses. Please review the Legal Disclaimer for more information. Graphics are blurred out to anonymize the entity names.

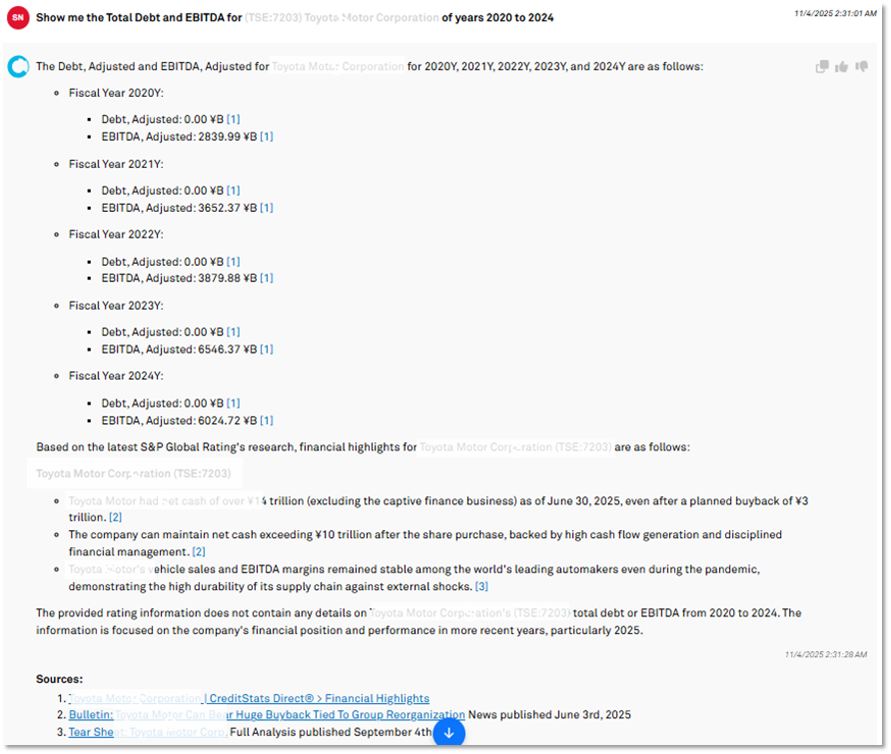

3. Finally, you can retrieve key financial metrics such as Total Debt and EBITDA for your borrower to evaluate leverage and performance trends.

Source: CreditCompanionTM (Beta release) on RatingsDirect® on S&P Capital IQ Pro, S&P Global Market Intelligence. As of November 2025. For illustration only. CreditCompanionTM is powered by generative AI technology, which may produce inaccurate responses. Please review the Legal Disclaimer for more information. Graphics are blurred out to anonymize the entity names.

Conclusion

This case study illustrates how CreditCompanion™ can transform the workflow of a commercial bank credit analyst by automating data retrieval, accelerating research synthesis, and enabling instant access to S&P Global Ratings insights — helping analysts work faster and focus on deeper, more informed credit analysis.

Disclosures for this article from S&P Global Market Intelligence: https://www.spglobal.com/marketintelligence/en/legal/disclosures#sp-global-market-intelligence

Content Type

Products & Offerings

Segment

Language