Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Nov. 13, 2025

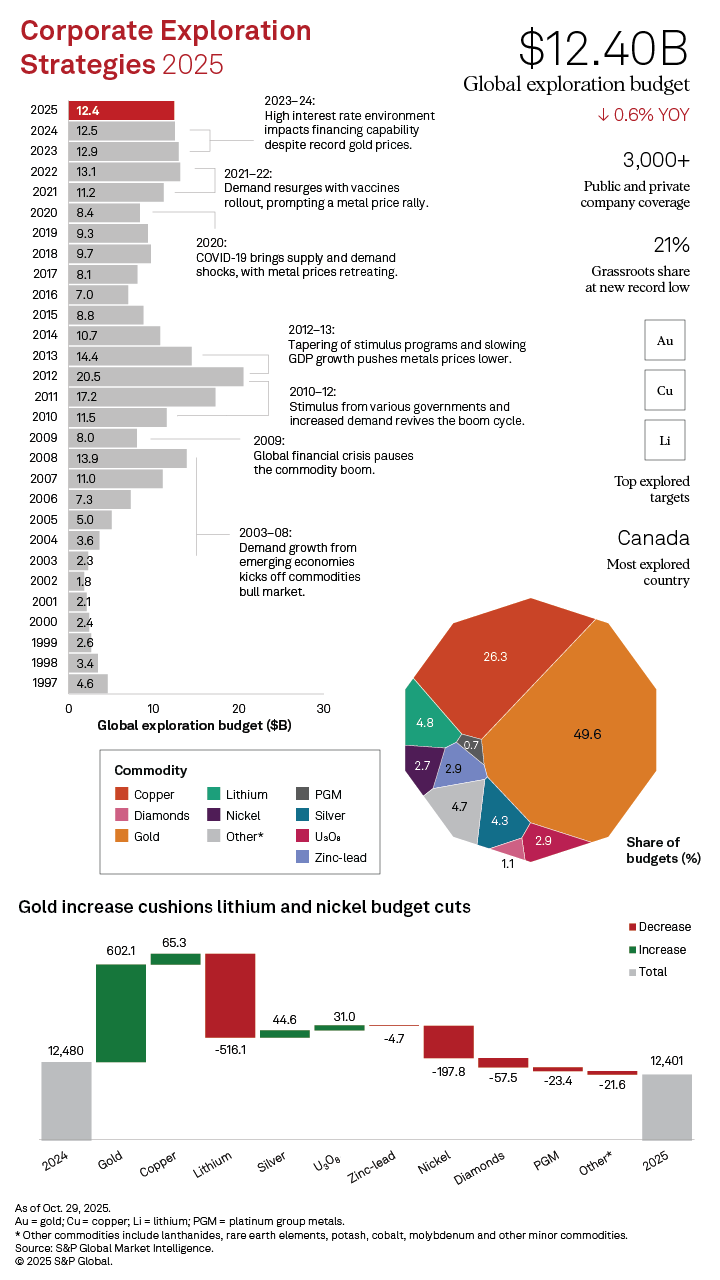

S&P Global Market Intelligence's latest Corporate Exploration Strategies (CES) study reveals a slight 0.6% dip in the global nonferrous exploration budget, totaling $12.4 billion in 2025, down from $12.5 billion in 2024. This marks the third consecutive year of decline, though mitigated by increased allocations to gold, which helped offset steep cuts in lithium and nickel budgets.

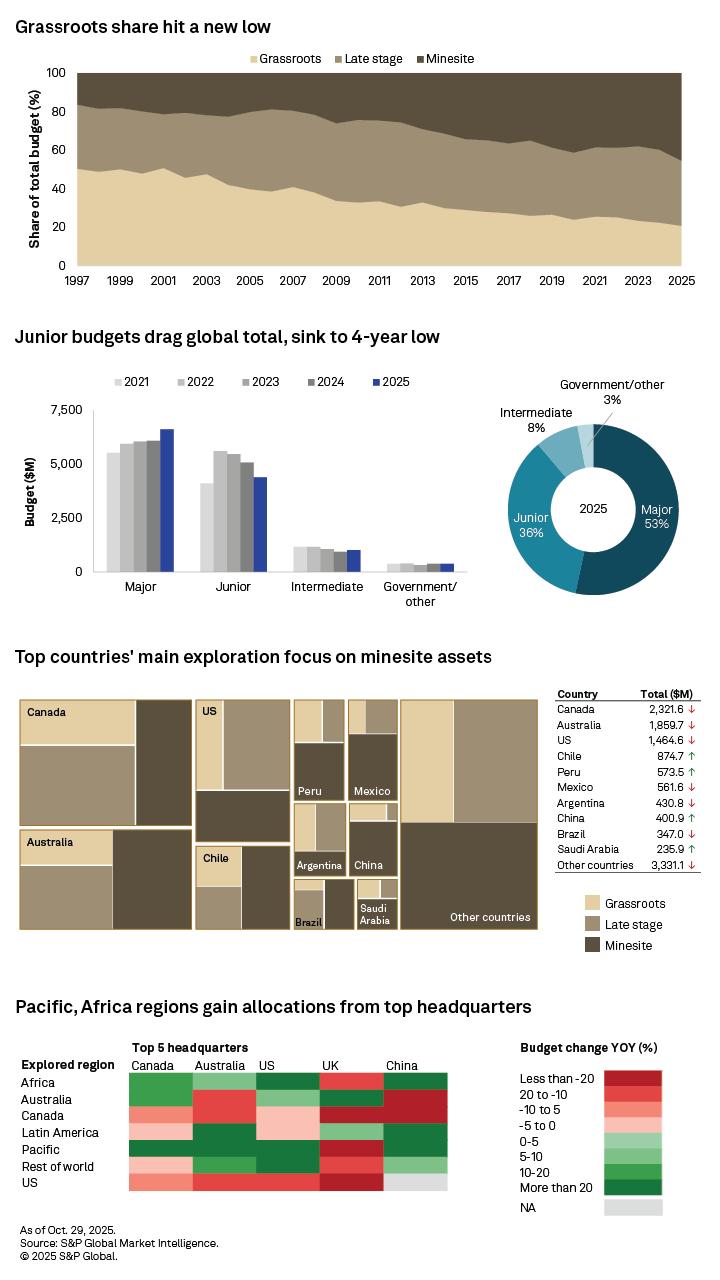

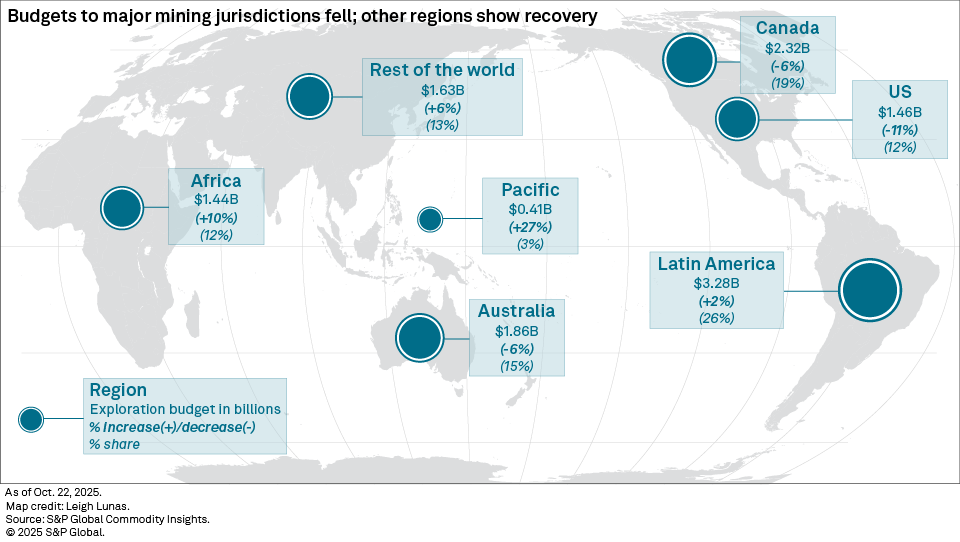

Gold remains the explorers' favorite, followed by copper, with both commodities enjoying the largest budget increases in dollar terms. In contrast, key critical minerals nickel and lithium recorded significant budget reductions. Exploration in all three top exploration hubs — Australia, Canada and the US — notably declined, largely due to their weakened junior sectors. Meanwhile, Saudi Arabia, Chile and Peru posted gains, driven by stronger gold and copper allocations.

The shift away from generative grassroots programs persists, with grassroots exploration budgets sinking to a record-low share. The number of active explorers also fell to 2,166 in 2025, from 2,210 in 2024.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language