Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Nov. 20, 2025

By Keith Nissen

While most Americans are maintaining their spending on subscription video-on-demand (SVOD) services, our latest US consumer survey shows that adding and dropping subscriptions seasonally has grown substantially.

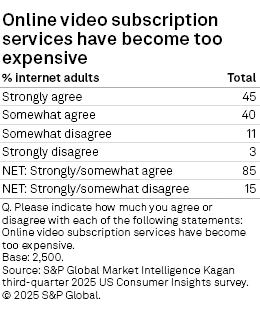

➤ Although 85% of Americans think SVOD services have become too expensive, the average number of SVOD subscriptions continues to rise.

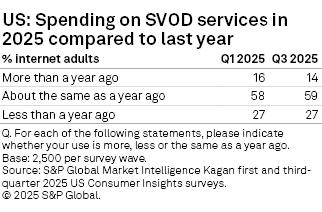

➤ Approximately three-quarters (73%) of Americans said they are spending as much or more money on SVOD subscriptions than they did during 2024.

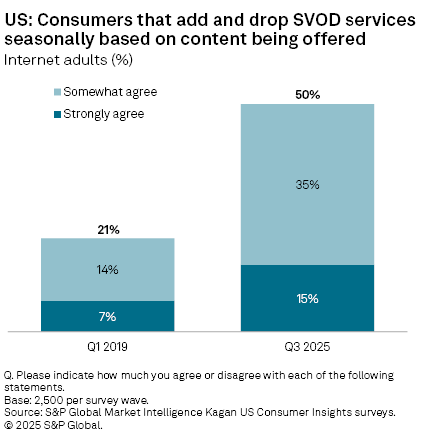

➤ At the same time, the percentage of consumers who added and dropped SVOD subscriptions seasonally skyrocketed from 21% in 2019 to 50% in 2025.

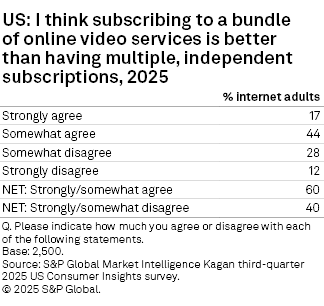

➤ The majority of Americans said they would prefer subscribing to a bundle of SVOD services, rather than maintaining multiple, independent subscriptions.

Results from the S&P Global Market Intelligence Kagan third-quarter 2025 US Consumer Insights survey reveal that 85% of internet adults think online subscription video (SVOD) services have become too expensive. Yet, two-thirds (66%) of surveyed Americans said they prefer watching on-demand TV/video content rather than scheduled broadcast TV programs. For detailed demographics and usage data click here.

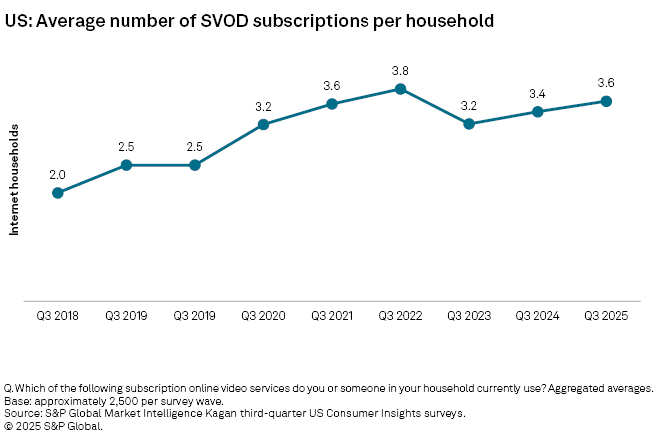

Historical survey data illustrates that consumers’ embracement of SVOD has grown over time. For instance, in 2018, US internet households subscribed to two SVOD services, on average, nearly doubling to 3.8 SVOD subscriptions in 2022. During 2023, following the COVID-19 pandemic, consumers cut back a bit to 3.2 SVOD services on average, but that number has since climbed back to an average of 3.6 SVOD subscriptions in 2025.

Additionally, there is no significant trend toward cost-cutting. When asked to compare their spending on SVOD services in 2025 to the previous year, nearly three-quarters (73%) of surveyed adults cited spending the same or more on SVOD services as in 2024. Data from both the spring and fall 2025 US Consumer Insights surveys did not reflect any significant change toward either SVOD downsizing or upsizing during the year.

While most Americans continue to maintain their spending on SVOD services, there is a growing trend toward adding and dropping subscriptions on a seasonal basis. Back in the first quarter of 2019, 21% of Consumer Insights survey respondents somewhat or strongly agreed with the statement “I add and drop SVOD services seasonally based on the content being offered.” In 2025, half (50%) of surveyed internet adults agreed, with those strongly agreeing doubling from 7% to 15%.

For SVOD service providers, one solution to this seasonal subscription behavior might be to offer consumers a bundle of online services. The survey found that six in 10 Americans would prefer subscribing to a bundle of online video services instead of having multiple, independent SVOD subscriptions. Finding a way to bundle independent SVOD services might also be a means of countering consumer opinions that SVOD has become too expensive.

Each of the US Consumer Insights surveys conducted between 2018-2025 consisted of approximately 2,500 internet adults per survey wave. The margin of error for each survey was +/-1.9 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Segment

Language