Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 16, 2025

By Keith Nissen

A recently completed US Kagan Consumer Insights survey found that the percentage of adults attending the cinema at least once a month has declined by more than half since 2019.

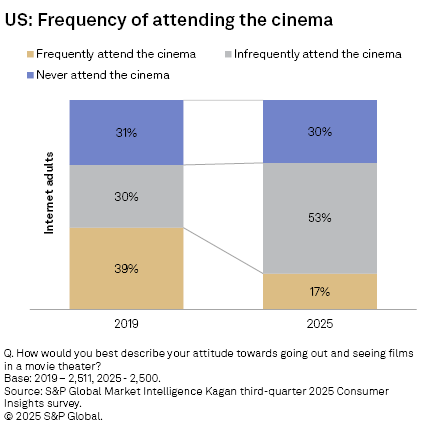

➤ Overall cinema attendance has remained flat since 2019, but the percentage of frequent movie-goers has dropped from 39% to 17% in 2025.

➤ One-third of survey respondents said they have attended the cinema less frequently in 2025 compared to the previous year. Cost was the primary reason for fewer visits to the movie theater.

➤ The commonality across frequent movie-goers in nearly all age brackets is their interest in a wide range of movie genres, spanning superhero, animation and adventure. But younger adults do not have as much interest as older Americans in movie franchises, such as Indiana Jones, that predate their adult viewing.

To assess US cinema attendance trends, results from S&P Global Market Intelligence Kagan US Consumer Insights surveys, conducted in first-quarter 2019 and third-quarter 2025 were compared. In 2025, 70% of surveyed internet adults reported going to see a movie at the cinema at least once over the past year, essentially the same as in 2019.

The frequency of cinema attendance is driven by multiple factors, including demographics, ticket prices, as well as movie releases. The survey data shows that the percentage of frequent movie-goers (those attending the cinema at least once a month) has declined 22 percentage points since 2019 to only 17% in 2025. Over the same time period, the percentage of infrequent movie-goers (those attending the cinema less than once a month) has climbed 23 percentage points reaching 53% this year.

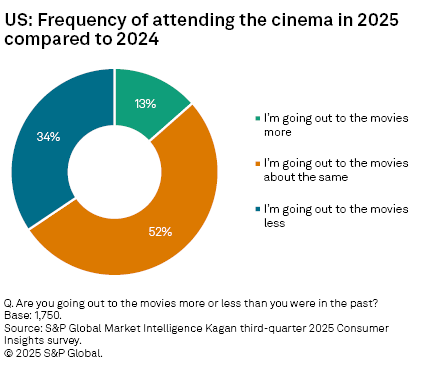

When asked about the frequency of cinema attendance in 2025 compared to the previous year, only 13% said they were going out to the movies more this year. About one-third (34%) said they were seeing fewer movies in 2025 compared to 2024, while half (52%) indicated they were attending the cinema about the same as a year ago.

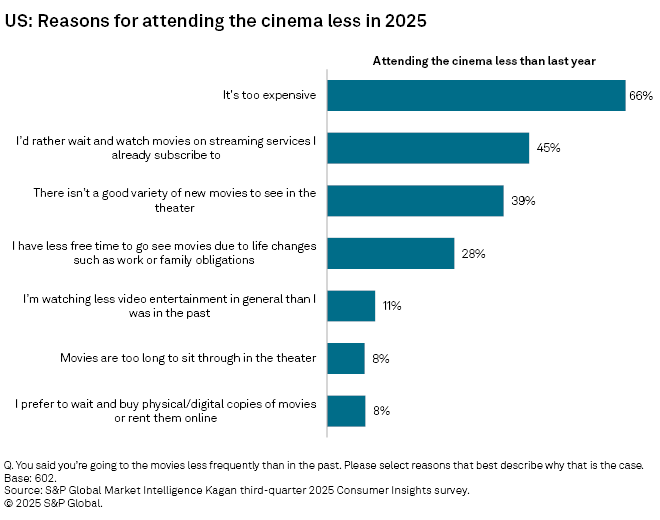

Among those who said they were attending the cinema less than last year, two-thirds (66%) reported that cost was a reason for fewer movie theater visits. Nearly half (45%) indicated they preferred to wait to watch the movies at home on streaming services they already subscribe to and 39% cited not having a good variety of movies to pick from.

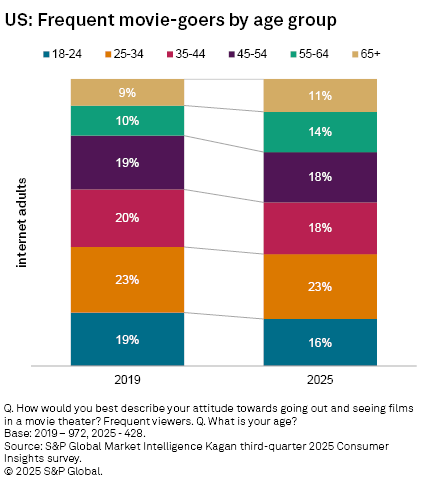

Examining frequent movie-goers by age group shows only a modest shift over the past six years. Adults between the ages of 25–44 have traditionally made up the largest portion of frequent movie-goers, representing 43% in 2019 and 41% this year. The percentage of 18–24-year-old adults attending the cinema frequently declined three percentage points to 16% in 2025, while older adults (those 55 years of age and older) grew six percentage points to 25% over the past six years.

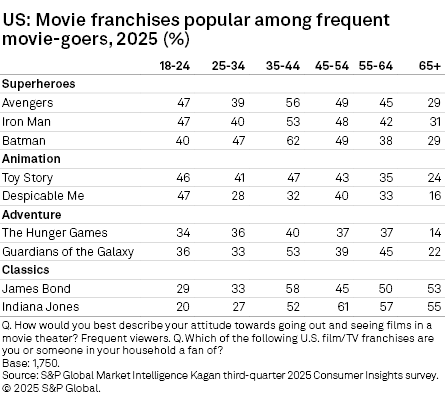

The 2025 survey data also reveals that the viewing interests of frequent movie-goers are largely age-independent. For instance, frequent movie-goers ranging from age 18 to 64 expressed a strong interest in viewing superhero franchise movies, such as The Avengers, Iron Man and Batman. They also expressed strong interest in viewing animated franchises like Toy Story and Despicable Me, and adventure franchises, such as The Hunger Games and Guardians of the Galaxy.

It is interesting to note that consumer interest in movie franchises appears to correlate directly with movie releases during their adult life. For example, half (50%) of frequent movie-goers aged 55–64 cited interest in the James Bond movies, and 57% expressed interest in the Indiana Jones movies, while interest in these movie franchises among 18–34-year-olds was substantially lower.

The 2019 survey data reflects a very similar set of characteristics across a much larger population of frequent movie-goers. This suggests that less frequent cinema attendance is not being driven by a lack of interest in the movies being released.

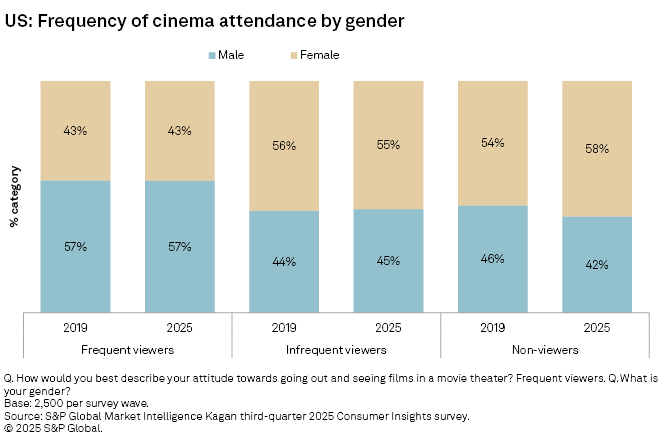

The gender distribution of movie-goers in 2019 was split fairly evenly, with 51% being men. The 2025 survey found the metrics had flipped, with women constituting 52% of total movie-goers. A comparison of the two surveys also shows that 57% of frequent movie-goers are men, unchanged over the past six years. The gender distribution of infrequent movie-goers is skewed toward women and is also virtually unchanged since 2019. The majority of those never attending the cinema were women, up four percentage points to 58% in 2025.

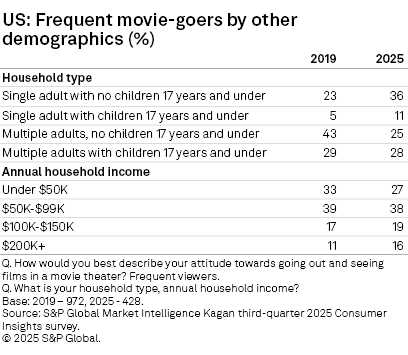

Single adults residing without children made up over one-third (36%) of frequent movie-goers in 2025, up seven percentage points from 2019. This increase was offset by a similar decline among multiple adult households with children.

Frequent movie-goers in 2025 also tend to be from higher-income households than in 2019. For example, over one-third (34%) of frequent movie-goers in 2025 had an annual household income of $100,000 or more, up from 26% in 2019. Likewise, individuals with an annual household income of less than $50,000 represented 27% this year, down six percentage points from 2019. The rising costs associated with the movie theater experience may be forcing lower-income adults to attend the cinema less frequently.

Other demographics of frequent movie-goers have shown substantial changes over the past six years. For example, in 2019, nearly three-quarters (72%) of frequent movie-goers resided in a household with multiple adults. By 2025, multi-adult households represented 52%, a decline of 11 percentage points. During the same period, the percentage of those from single-adult households attending the cinema frequently rose to 48%.

The data also reflects a modest trend among frequent movie-goers toward higher income adults. In 2019, one-third (33%) had an annual household income under $50,000. By 2025, the percentage of frequent movie-goers with low income dropped six percentage points to 27%. In contrast, the percentage of frequent movie-goers earning $200,000 and above increased five percentage points, from 11% in 2019 to 16% this year. That being said, two-thirds (65%) of frequent movie-goers in 2025 were still individuals with a relatively modest household income (under $100,000 per year), corresponding to the large percentage of single adults.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.