Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 20, 2025

By Neil Barbour

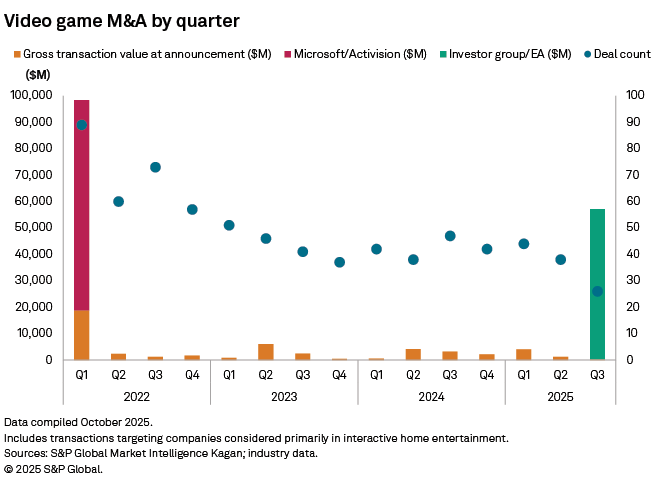

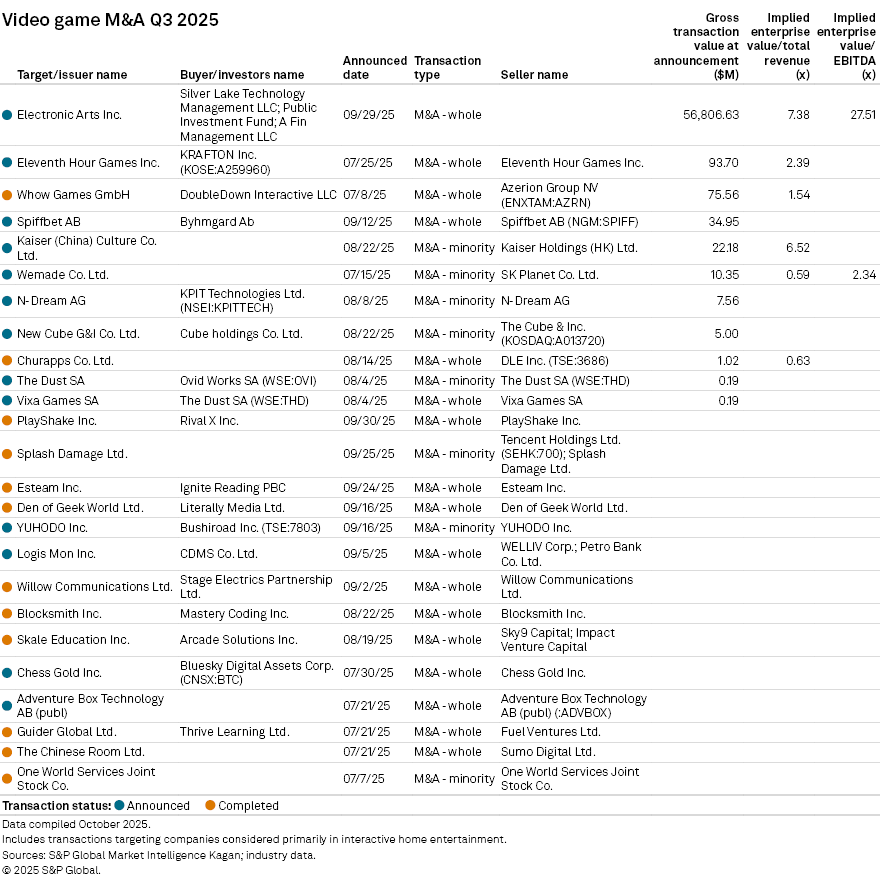

A $56.81 billion deal to take Electronic Arts Inc. private anchored the second-largest quarter for video game deals on record, behind the first quarter of 2022, when Microsoft Corp. announced it would purchase Activision Blizzard Inc. Those two periods dwarf the interim quarters.

Access data in Excel format here.

S&P Global Market Intelligence Kagan's video game M&A tracker compiles deal activity in the interactive home entertainment industry. The sector is mostly composed of publishers and developers of video game products. It also includes a minority of interactive education, fitness and gambling software. Deals are organized by their announcement dates.

Market Intelligence reporting indicates that investment bankers do not see the EA buyout triggering a wave of increased M&A, and we concur. There are few obvious targets or suitors for a deal of comparable size in the coming quarters.

However, after the EA deal closes, the new ownership may pursue some asset divestment to cut costs and service a significant debt load. For example, BioWare Austin, LLC and Codemasters Group Holdings Ltd. are well-regarded EA studios that have made relatively undersized impacts to the parent company's income statements in recent years.

Those potential divestments would be another opportunity for emerging players in the gaming space, such as Netflix Inc. and Amazon.com Inc., or established players, such as Sony Group Corp., to purchase sizable gaming operations on clearance.

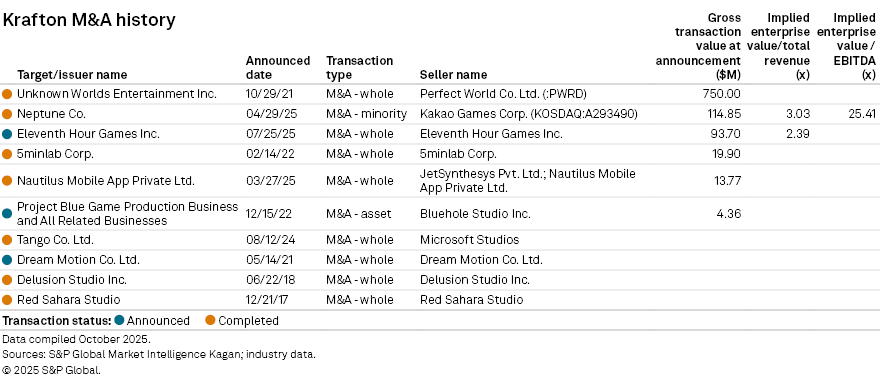

Judging by its recent M&A activity, KRAFTON Inc. may be another potential acquirer. The company has appeared in our quarterly video game M&A review as a buyer for three consecutive quarters. Its most recent deal, a $93.7 million play for Last Epoch developer Eleventh Hour Games Inc was the second largest in the quarter.

Krafton is rounding out its portfolio to augment its long-running battle arena shooter PUBG. The publisher agreed to pay $114.9 million for a minority stake in Neptune Co. in the previous quarter and $13.8 million to purchase Nautilus Mobile App Private Ltd. in March.

The Eleventh Hour deal differentiates itself from those prior two deals with its focus on hardcore PC gamers instead of casual or midcore audiences.

Last Epoch is a Diablo-style RPG available exclusively on the PC digital store Steam. The game was announced for PlayStation in September for a planned release in 2026. Tencent Holdings Ltd. has seen success taking a similar title, Path of Exile, to PlayStation.

The deal has an implied enterprise value divided by a total revenue multiple of 2.39x, slightly behind the Neptune transaction.

The third-largest deal in the third quarter was DoubleDown Interactive Co. Ltd.'s $75.6 million purchase of social casino developer Whow Games GmbH.

Tencent continues divesting

We have seen Tencent divest three companies so far in 2025. These deals involve relatively small operations, but taken together, they suggest that Tencent is leaning away from the development of stand-alone games without clear live service hooks.

In July, Tencent-owned Sumo Digital Ltd. sold Still Wakes Deep developer The Chinese Room Ltd to the company's management group. The developer's latest game, Vampire: The Masquerade – Bloodlines 2, is set to release Oct. 21 under publisher Paradox Interactive AB (publ).

Then in September, Tencent divested a minority stake in Splash Damage Ltd. to an undisclosed buyer. Splash Damage announced in 2023 that it was working on an open-world survival game in partnership with Twitch streamer Shroud.

In March, Tencent sold Secret Mode Limited to Emona Capital LLP. The publisher was the primary outlet for The Chinese Room among other PC- and console-focused developers.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.