Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 23, 2025

By Keith Nissen

A recent survey found that the differences between avid and casual sports fans are far fewer than one might think. The frequency of viewing and talking about sports are the two primary differentiating factors.

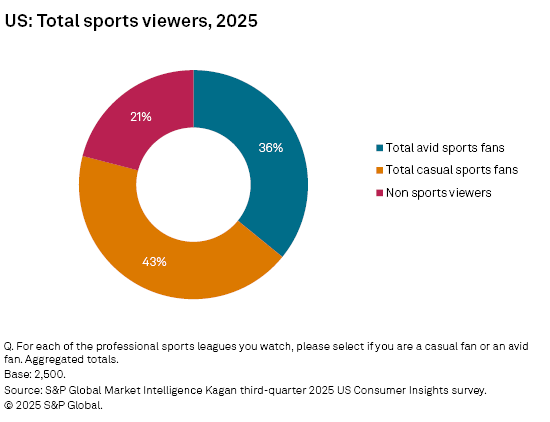

➤ Eight out of 10 Americans watch sports, with 36% considering themselves to be avid sports fans.

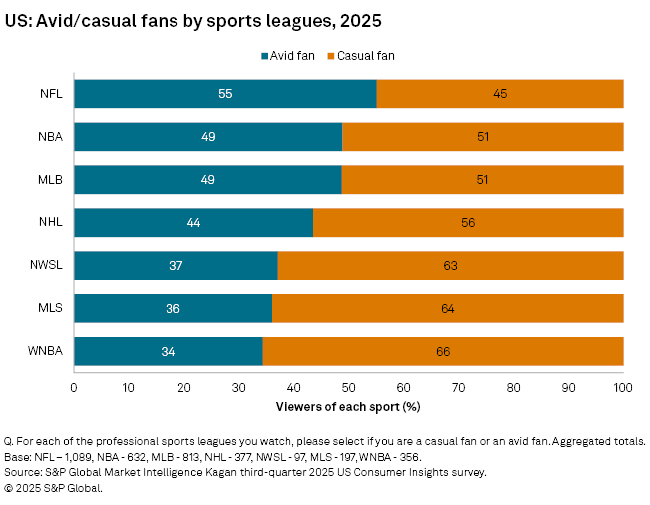

➤ The majority of NFL football viewers are avid NFL fans, with half of NBA and MLB fans being avid fans of their respective sports leagues.

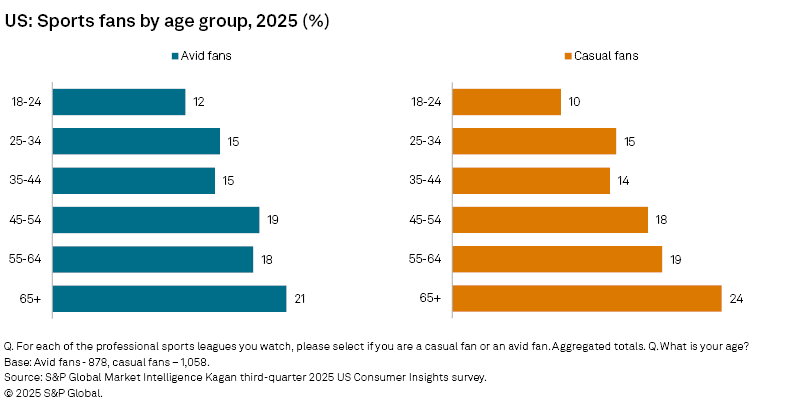

➤ There is very little difference in the age distribution of avid and casual sports fans. Two-thirds of avid fans were men, while casual sports fans have a fairly even gender split.

➤ Avid fans are more likely to talk about sports and interact online with sports content than casual fans.

Viewers of seven major US professional sports leagues — the National Football League (NFL), the National Basketball Association (NBA), Major League Baseball (MLB), the National Hockey League (NHL), Major League Soccer (MLS), the Women’s National Basketball Association (WNBA), and the National Women’s Soccer League (NWSL) — responding to the S&P Global Market Intelligence Kagan third-quarter US Consumer Insights survey were asked to identify themselves as either avid or casual sports fans. Over one-third (36%) of total survey respondents considered themselves to be avid sports fans, while 43% identified as casual fans. Half (50%) of the avid sports fans and 55% of casual sports fans indicated they watch only one sport. Two out of 10 (21%) survey respondents said they did not watch any of the major US professional sports leagues.

Examining the split between avid and casual fans by sports league reveals that the majority of NFL viewers consider themselves to be avid NFL football fans. Approximately half of NBA basketball and MLB baseball viewers cited being avid fans of each league, while NHL hockey viewers were skewed (55%) slightly toward being casual ice hockey fans. Nearly two-thirds of women’s soccer (NWSL), MLS soccer and WNBA basketball viewers considered themselves casual fans of each league.

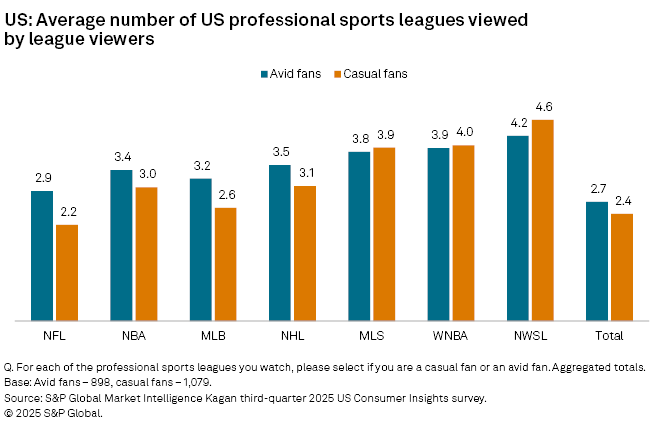

Overall, the survey found that avid fans watch 2.7 professional sports leagues on average, only slightly more than casual fans' average of 2.4. Avid NFL football fans watch three (2.9) sports leagues on average, with casual NFL fans watching an average of only 2.2 sports leagues. One-quarter (24%) of total NFL fans only watch NFL games. Only 16% of avid NFL fans and 34% of casual fans said they only watch NFL sports.

Once again, the variance between the number of sports leagues viewed by avid and casual fans appears modest. Only 8% of avid NBA fans and 14% of casual fans said they watch only NBA basketball. Similarly, 11% of avid MLB baseball fans and 17% of casual fans only watch MLB baseball. This suggests that the distinction between avid and casual fans is primarily frequency of viewing rather than one’s interest in specific sports.

There also does not appear to be a significant variance between the age distribution of avid and casual sports fans. For instance, 27% of avid sports fans were adults under the age of 35, with another 39% being viewers 55 years of age and older. In comparison, 25% of casual sports fans were under 35 years of age, and 43% were 55+ adults. Approximately two-thirds of avid sports fans and slightly more than half of casual fans (54%) were men.

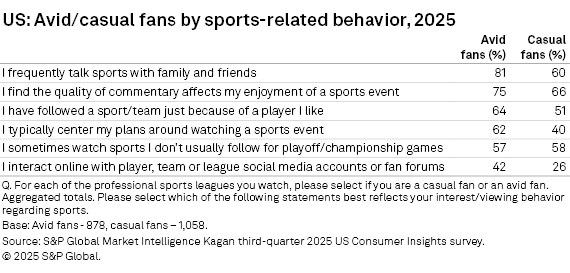

Other differences between avid and casual fans are evident in their sports-related behavior. For example, eight out of 10 (81%) avid sports fans said they frequently talk sports with family and friends, compared with 60% of casual fans. Avid sports fans are also more likely to center their plans around watching a sporting event (62%) than casual fans (40%). Avid fans are also more likely to interact online with sports-related media and fan forums (42%) than casual fans (26%).

Avid and casual fans both tend to follow a sport or a specific team because of a player they like. Casual fans are also just as likely to watch playoff and championship games of sports leagues they usually don’t watch as avid sports fans.

The Kagan third-quarter 2025 US Consumer Insights survey was conducted during September 2025, consisting of 2,500 internet adults per market. The margin of error is +/-1.9 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from S&P Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.