Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 23, 2025

By Tony Lenoir

By preserving the value and timeline of the Inflation Reduction Act of 2022 fiscal incentives for utility-scale battery energy storage systems, House Reconciliation Bill 1 (H.R. 1) ensures that more than 143 GW of planned US capacity could receive at least a 40% tax credit based on energy community criteria, as long as projects begin construction before 2034.

For planned battery energy storage system (BESS) projects in qualifying geographies, the overall tax break rises to 50% when certain domestic component quotas are met. Meeting these thresholds may be facilitated by the inclusion of Foreign Entity of Concern (FEOC) restrictions in the budget reconciliation bill signed into law on July 4, 2025.

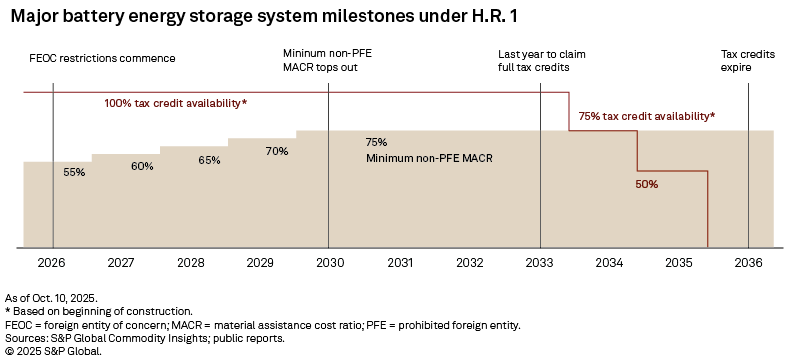

Starting in 2026, H.R. 1 will place limits on project costs associated with prohibited foreign entities (PFEs). To claim the tax breaks, BESS developers must meet minimum non-PFE material assistance cost ratios, starting at 55% in 2026 and escalating to 75% in 2030 and beyond. Upon meeting these conditions, 100% of the base tax credits will be available for projects that begin construction through 2033, with the credit tapering to 75% in 2034 and 50% in 2035, ultimately expiring in 2036.

While on paper limited to entities with connections to China, Russia, North Korea or Iran, the FEOC rule aligns with the Trump administration's agenda of reshoring domestic manufacturing and, more broadly, revitalizing the US industrial fabric — economic objectives essentially in line with what motivated the inclusion of the energy community special rule in the Biden administration's Inflation Reduction Act.

With the aim of reinvigorating communities historically reliant on fossil fuel extraction and transportation, the provision adds a 10% step-up to the base 30% investment and production tax credits for projects sited in qualifying geographies.

Based on S&P Global Market Intelligence data, nearly 56% of US BESS projects in the pipeline as of writing are to be located in territories that the US Energy Department identified as eligible energy communities in 2024. This amounts to 63.4% of the grid-scale BESS capacity currently in the works, including 68.6% and 60.0% of the planned colocated and stand-alone totals, respectively.

The bulk of the planned BESS capacity identified as eligible for the tax credit adder is found across the ERCOT, non-ISO West and CAISO footprints. This is not too surprising, given that:

1) These regions are exhibiting signs of solar generation saturation, leading to drops in energy prices during daytime hours and high levels of curtailment — powerful tailwinds for grid stakeholders to deploy battery storage on a massive scale. Combined, ERCOT, the non-ISO West and CAISO have a BESS pipeline of 182 GW, or more than 80% of the planned US total.

2) The territories overlap areas of dense energy community concentrations. Based on qualifying criteria, energy communities are mainly found across Appalachia, Texas, the US southwest and the Rockies.

Qualifying energy communities per the Inflation Reduction Act:

– Census tracts, and all adjacent ones, in which any coal mine has closed after Dec. 31, 1999, or in which any coal power plant has been retired after Dec. 31, 2009.

– Metropolitan and nonmetropolitan statistical areas where, after Dec. 31, 2009, fossil fuel occupations have accounted for at least 0.17% of direct employment or contributed 25% of local tax revenues and where the unemployment rate is at or above the national average for the previous year.

– Brownfield sites — broadly, land where the presence or potential presence of pollutants, contaminants or hazardous substances impedes development.

Together, H.R. 1's FEOC restrictions and the energy community step-up create a powerful incentive structure, encouraging developers to source materials domestically and to site projects in qualifying geographies, maximizing available tax credits for battery energy storage systems.

Data visualization by Chris Allen Villanueva.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights; 451 Research is part of S&P Global Market Intelligence.

S&P Global Commodity Insights and S&P Global Market Intelligence are divisions of S&P Global Inc.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Content Type

Theme

Products & Offerings

Segment

Language