Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 16, 2025

By Alex Johnston and Melissa Incera

Funding dollars continue to concentrate at the top of the AI market, with Anthropic PBC, Mistral AI SAS, Perplexity AI Inc. and Cognition AI Inc. pulling in over $16 billion combined this month — $13 billion of it from a massive round for Anthropic. NVIDIA Corp. was a big mover on the strategic investor front, announcing a $5 billion investment in Intel Corp. and a $100 billion investment in OpenAI LLC — a deal that will have implications for the competitive landscape, with the two front-runners in AI software and hardware becoming preferred partners.

September was a big month for Europe and its push toward a sovereign and competitive AI ecosystem. Switzerland's Swiss AI Initiative released Apertus, a transparent, open-source multilingual large language model (LLM) developed in full alignment with the EU AI Act, while Mistral AI secured new funding, reinforcing its role as Europe's leading homegrown AI contender. Mistral's round was led by ASML Holding NV, signaling strong regional collaboration and a shared commitment to building compliant, independent AI infrastructure. This month also saw a surge in regulatory scrutiny and legal action against AI model and chatbot providers, reflecting growing pressure from both governments and private citizens to hold companies accountable for potential harm. Most notably, Anthropic agreed to a settlement in a class-action copyright lawsuit brought by authors and publishers — setting a major precedent for damages tied to unauthorized data use. The case sends a clear warning to the industry about the legal and financial risks of training on unlicensed content, and is likely to accelerate a shift toward licensing and purchasing authorized datasets.

Product releases and updates

The Apertus open-source LLM was released as a Swiss national AI project by the Swiss Federal Institute of Technology in Zurich (ETH Zurich) and the École Polytechnique Fédérale de Lausanne, in partnership with the Swiss National Supercomputing Centre (CSCS). While the model is not troubling the top of the leaderboard, the release stresses training in languages underrepresented in other LLMs, with Swiss German and Romansh explicitly called out. The report released alongside the model also stresses "new standards for data compliance," which appear to primarily relate to the lack of verbatim memorization of training data to prevent direct reproduction of training sources, and the exclusion of any data sources that have opted out of AI crawling using the behavioral file robots.txt.

Google LLC released Gemini 2.5 Flash Image, nicknamed Nano-Banana, which supports text-to-image generation, multi-image fusion and advanced image editing. It is able to maintain strong character, object and subject consistency across iterative edits, which has proven a challenge for image editing models. The model supports precise prompt-based local edits and includes SynthID watermarking.

Bytedance Ltd. released Seedream 4.0, which supports both creation and image editing. Higher inferencing speeds than Seedream 3.0, support for multi-reference inputs and the ability to deliver images at a 4K resolution are core features cited in the release.

Cohere Inc. released Command A Reasoning, a 111 billion-parameter model that powers its North agentic platform. Cohere highlights benchmarks indicating that Command A Reasoning outperforms other privately deployable models on long-context reasoning, multi-step research and agent workflows. Cohere followed this announcement with Command A Translate, which is a translation model across 23 languages.

Voice AI firm Deepdub Ltd. has unveiled its latest proprietary speech model, Lightning 2.5, along with an upgraded inferencing engine that reportedly reduces latency to as little as 200 milliseconds. This speed improvement is positioned as a key advantage for real-time voice interactions.

Teradata Corp. announced several agent capabilities, including a low-code agent builder, an MCP server and a set of pre-built agents. Its competitive positioning highlights the ability to operate effectively across hybrid environments, a long-standing focus for Teradata, as well as the leveraging of industry-specific data models to enhance performance for domain-driven use cases.

Adobe Inc. announced the general availability of its AI agents for customer experience and marketing and the Adobe Experience Platform (AEP) Agent Orchestrator, which provides the underlying orchestration and reasoning capabilities. The agents cover audience management, journey orchestration, experimentation, data insight, site optimization and product support — all integrated across Adobe's enterprise applications. Adobe also introduced customization and developer tools to enable businesses to tailor agents and ensure interoperability with third-party ecosystems.

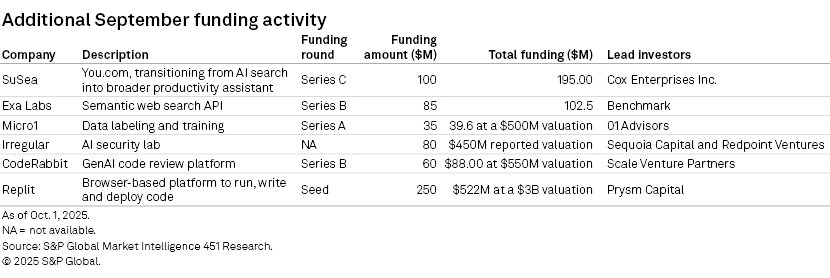

Funding and M&A

NVIDIA has announced a strategic partnership with OpenAI that includes an investment of up to $100 billion in the AI research company. The deal will be structured as two intertwined transactions, in which NVIDIA will invest in OpenAI for nonvoting shares, and OpenAI will use that capital to purchase NVIDIA's advanced data center chips and systems. This investment will be deployed progressively as OpenAI brings each gigawatt of computing capacity online, with the first phase of 1 GW expected in the second half of 2026 using NVIDIA's Vera Rubin platform. This deal guarantees OpenAI the funding and access to computing power to maintain its competitive edge in AI development, while solidifying NVIDIA's position as AI's leading chip supplier and securing a significant financial stake in a key customer.

Mistral AI has raised €1.7 billion in series C funding led by Dutch semiconductor supplier ASML, valuing the company at €11.7 billion. This announcement is viewed as symbolically important, with many European commentators concerned that the EU has fallen behind the US and China. It appears Mistral will be supporting ASML with its AI strategy.

Anthropic has secured a $13 billion series F funding round, valuing the company at $183 billion post-money. The round was led by ICONIQ, with Fidelity Management & Research Co. and Lightspeed Venture Partners participating. This comes amid massive growth for the AI company, which reportedly has scaled from $1 billion in run-rate revenue at the beginning of 2025 to over $5 billion by August.

OpenAI has reached a nonbinding agreement with Microsoft Corp. that would allow the AI startup to convert its for-profit arm into a public benefit corporation (PBC) while maintaining its nonprofit governance structure. OpenAI's nonprofit would retain control over operations and receive a stake in the PBC valued at over $100 billion. The transition requires approval from California and Delaware regulators. The restructuring could enable OpenAI to raise additional capital and go public in the future, and comes amid OpenAI's efforts to diversify beyond Microsoft, including recent cloud partnerships with Oracle Corp. and SoftBank Corp.

NVIDIA has announced a $5 billion investment in Intel, acquiring approximately 4% of the company at $23.28 per share, making NVIDIA one of Intel's largest shareholders. This strategic partnership comes just weeks after the US government took a 10% stake in Intel. The collaboration will focus on jointly developing PC and data center chips, with Intel designing custom data center CPUs that NVIDIA will package with its AI GPUs, connected via NVIDIA's proprietary high-speed links. This collaboration comes at a critical time for Intel and could set it up to be a major player in AI infrastructure.

Atlassian Corp. nabbed A Software Company Inc., a developer productivity platform better known as DX, for $1 billion in cash and restricted stock. This move addresses the need for companies to measure the return on investment of their AI tools and leverages the fact that most of DX's customers are already using Atlassian's products. It follows a $610 million deal for The Browser Company of New York.

Tempus AI Inc. is acquiring digital pathology company Paige.AI Inc. for $81.25 million, primarily through stock payment. The acquisition gives Tempus access to Paige's extensive dataset of nearly 7 million digitized pathology slides and associated clinical and molecular data from 45 countries, which should accelerate Tempus' development of its oncology foundation model. Paige had previously developed its own cancer foundation model using 1 million slides and secured partnerships with companies like Microsoft and Quest Diagnostics Inc.

AI coding startup Cognition AI has raised over $400 million in funding led by returning investor The Founders Fund. The round was raised at a post-money valuation of $10.2 billion, with Cognition suggesting it would use the proceeds to expand its engineering team and accelerate product development.

AI inference specialist BaseTen Labs Inc. announced a $150 million series D round, bringing total funding to just under $286 million. BaseTen Labs develops a managed platform designed to simplify the process of building and managing performant AI applications.

AI search startup Perplexity AI reportedly raised $200 million at a $20 billion valuation, bringing its total funding to $1.5 billion. The company has engaged in 10 disclosed funding rounds. Proceeds will likely be invested into its primary products: Ask, Research, Labs and Comet.

AI chip startup Groq Inc. has secured $750 million in new funding at a post-money valuation of $6.9 billion. This represents more than double the company's $2.8 billion valuation from August 2024 and brings Groq's total funding to over $3 billion, according to market estimates. Groq is gaining attention for its alternative to NVIDIA's AI chips, offering what it calls language processing units rather than traditional GPUs, with specialized "inference engines" optimized for running AI models efficiently.

Politics and regulations

Anthropic has agreed to a proposed $1.5 billion settlement with authors over the use of pirated books to train its Claude AI models, with payments of approximately $3,000 per infringed work. While (at the time of writing) the settlement awaits court approval, it is considered the largest copyright recovery in US history. Legal analysts suggest that this case could serve as a benchmark for future copyright infringement claims against AI companies, potentially pressuring model developers to source training data more legitimately and pursue licensing agreements for copyrighted content.

The US and UK signed a new "UK-US Tech Prosperity Deal" with a heavy focus on AI investment. It includes major investments in AI infrastructure, with companies committing over £30 billion to expand cloud, compute and supercomputing capacity in the UK. It establishes an "AI Growth Zone" in Northeast England and supports "sovereign AI" development through projects like Stargate UK, aimed at reducing foreign dependency on critical compute infrastructure. The deal also strengthens AI safety and research collaboration, linking US and UK institutions to work on standards, talent exchange and scientific AI applications.

Perplexity AI is being sued by Encyclopedia Britannica and Merriam-Webster for alleged copyright and trademark infringement, claiming the "answer engine" diverts traffic and revenue from their websites by using their content without permission. Hallucinations with incorrect responses attributed to the dictionary are cited as being reputationally damaging. Perplexity's web scraping has received significant attention recently, with Cloudflare Inc. challenging the company for its crawling behaviors and Japanese media companies Nikkei and the Asahi Shimbun filing a joint lawsuit against the AI startup.

Warner Bros. Discovery Inc. has filed a lawsuit against AI image generator Midjourney Inc., alleging the company stole copyrighted characters to train its AI service. Warner Bros. claims Midjourney was aware of its wrongdoing, noting that the company temporarily blocked subscribers from generating videos with infringing images before lifting this protection last month. The lawsuit follows a similar June filing by Walt Disney Co. and Universal against Midjourney.

The Federal Trade Commission has issued orders to seven major tech companies, including Alphabet Inc., Meta Platforms Inc., OpenAI and X.AI LLC, seeking information about their consumer-facing AI chatbots and potential impacts on children and teens. The inquiry focuses on how these companies measure and mitigate negative effects of AI chatbots that can simulate human-like relationships, which may lead children to form emotional connections with the technology. It will examine how companies monetize engagement, develop characters, monitor for negative impacts, enforce age restrictions and handle personal information collected through chatbot interactions.

The Italian government approved an AI law in alignment with the broader EU AI Act. The legislation introduces prison sentences of one to five years for spreading harmful AI-generated content like deepfakes, requires parental consent for children under 14 to access AI systems, and establishes clear copyright protections for AI-assisted works. It also implements stricter transparency requirements for AI use in workplaces, healthcare, education and other sectors. The Italian government has allocated up to €1 billion from a state-backed venture capital fund to support AI development. All will be enforced by the Agency for Digital Italy and the National Cybersecurity Agency.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Market Intelligence 451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Content Type

Products & Offerings

Segment

Language