Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sep 30, 2025

By Neil Barbour

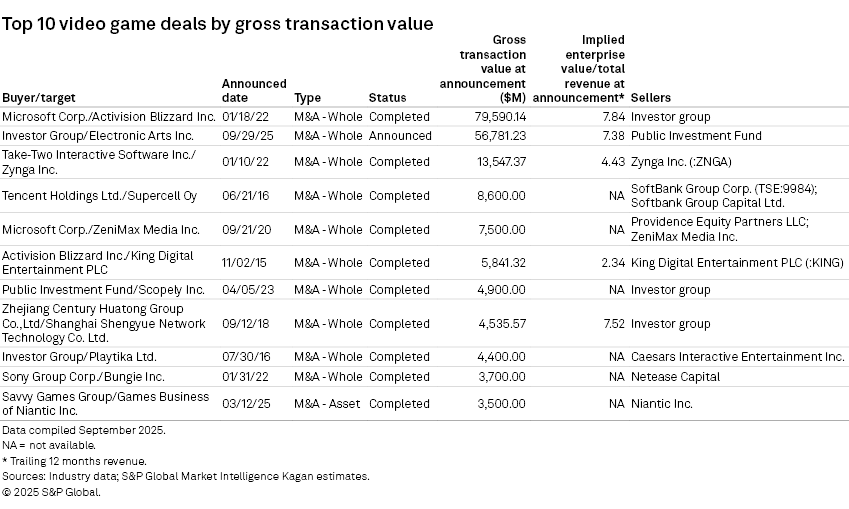

An investor group's $56.78 billion deal to take Electronic Arts Inc. private would be the second-largest deal on record for the video game industry, solidly besting Take-Two Interactive Software Inc.'s purchase of Zynga Inc. but well behind Microsoft Corp.'s acquisition of Activision Blizzard Inc.

The transaction will be funded by a combination of cash from each of Silver Lake Technology Management LLC, Saudia Arabia's Public Investment Fund, and Jared Kushner's A Fin Management LLC, as well as a roll-over of the Public Investment Fund's existing stake in EA, constituting an equity investment of approximately $36 billion. The deal also includes $20 billion of debt financing fully and solely committed by JPMorgan Chase Bank, N.A., $18 billion of which is expected to be funded at close.

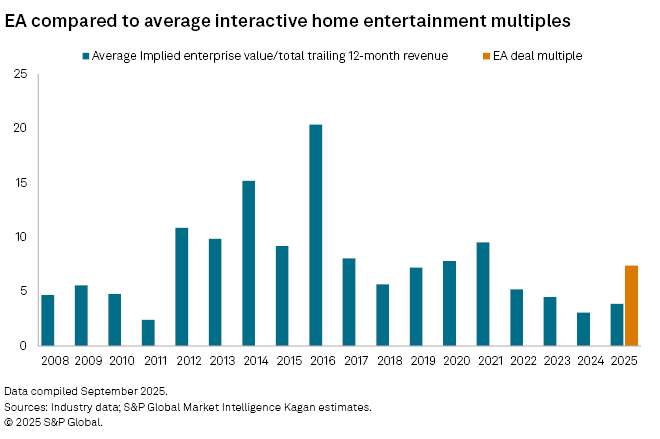

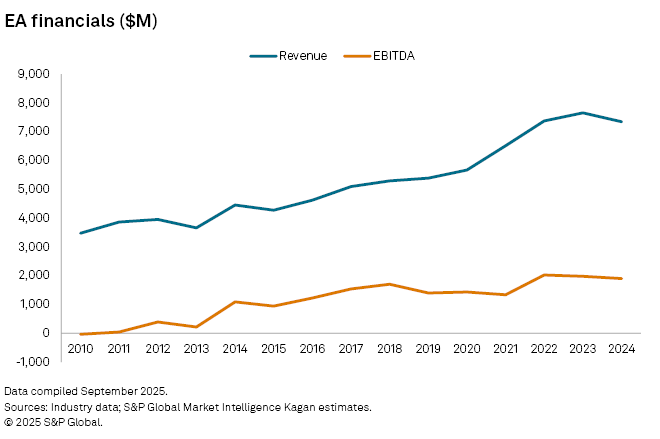

The EA deal is only slightly behind the Activision deal in terms of implied enterprise value divided by trailing 12-month revenue at 7.38x. However, it solidly outpaces the average 3.8x multiple for interactive home entertainment deals announced so far in 2025 for which we have available data. The multiple is a sign that the buyers have a high degree of confidence in EA's revenue generation potential. In addition, we would expect significant cost-cutting measures, as the deal has a 27.51x implied enterprise value/trailing EBIDTA multiple.

The company's core business revolves around releasing two sports titles, EA FC (formerly FIFA) and Madden, on an annual basis. Each is sold as a stand-alone piece of software retailing for $70, but they also drive significant revenue through their Ultimate Team modes. These in-game purchases allow players to assemble their own squads out of randomized "packs" resembling trading cards. Outside of sports simulation, the company has also seen success with The Sims, Apex Legends and Star Wars Jedi in recent years.

However, the deal finds EA at a crossroads. Its sports-focused model ran out of momentum in 2024, with the company reporting its first decline in revenue since 2015.

Management is hoping to return to topline growth by reviving the Battlefield series. Battlefield 6 is scheduled to release Oct. 10, with a free-to-play battle royale to follow later that month. The game is being overseen by Vince Zampella, who is seen as one of the key creative forces in Activision's Call of Duty and who went on to develop Apex Legends for EA.

Battlefield is aiming for the transformational growth arc that Call of Duty benefited from when it released its own free-to-play battle royale mode in 2020, and the deal takes some pressure off EA to make an immediate impact. A poor reception at launch would have pressured the stock price, forcing EA into a fight-or-flight position that could have negatively impacted long-term development. Now that investors are shored up with a pending deal, EA may have some cover to let the game grow and evolve organically.

Testing regulatory waters

In the wake of the Activision Blizzard deal announcement in 2021, we expected further consolidation in the console and PC gaming space. And while a handful of deals followed, including Sony Group Corp.'s $3.70 billion acquisition of Destiny developer Bungie Inc., there was nothing quite on the same level.

We suspect the chilly regulatory reception to Microsoft, which already had a large market share in gaming, kept other tech-adjacent suitors on the sidelines. While the investor group in the EA deal does not wield as much market share as Microsoft, Saudi Arabia brings with it some exposure to the gaming space. The Public Investment Fund purchased mobile developer Scopely Inc. for $4.90 billion through its Savvy Games Group division in 2023, and Scopely would go on to purchase the games business of Niantic for $3.50 billion in March 2025.

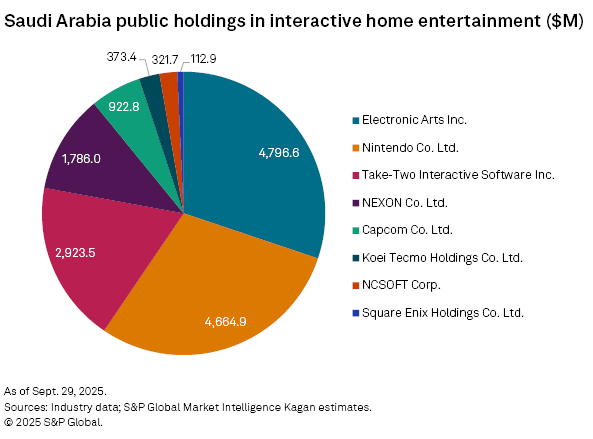

And in addition to Saudi Arabia's existing public holding in Electronic Arts of 9.91% of shares outstanding valued at $4.79 billion as of Sept. 29, the Public Investment Fund also holds significant stakes in Nintendo Co. Ltd., Take-Two, NEXON Co. Ltd. and Capcom Co. Ltd.

The inclusion of Kushner, who is President Trump's son-in-law, may give the parties involved some confidence that the deal will be approved in the US, but other territories in which EA does significant business will want to weigh in as well.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.