Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 4, 2025

TXNM Energy Inc. and Blackstone Infrastructure Partners LP formally filed their petition with the Public Utility Commission of Texas for approval of Blackstone's proposed acquisition of TXNM Energy on Aug. 25.

The transaction will also be subject to review by the New Mexico Public Regulation Commission and various federal agencies before it can proceed.

➤ The proposal comes a little less than 18 months after Avangrid Inc. terminated a transaction to acquire TXNM Energy (TXNME), then known as PNM Resources Inc. (PNMR). That transaction was approved by the Public Utility Commission of Texas (PUC) in 2021 but languished before New Mexico regulators for more than two years. Both jurisdictions are known to have relatively stringent merger review standards.

➤ In their filing before the PUC, TXNME and Blackstone Infrastructure Partners (BI) are offering substantial financial commitments, including rate credits for customers, contributions to economic development programs and enhanced charitable giving. In addition, the companies propose governance and board structure provisions consistent with those required to achieve PUC approval of the failed Avangrid transaction.

➤ Regulatory Research Associates views the regulatory climate in Texas as restrictive from an investor point of view.

State law requires the PUC to issue a decision within 180 days of the date a filing is deemed "sufficient": in other words, after it is deemed to comply with the state's filing guidelines related to changes of control. In addition, the proceeding may be extended for up to an additional 60 days. If the PUC has not ruled by the end of the extended period, the transaction would be deemed approved.

To reduce processing time, the commissioners voted on Aug. 21 to hear the case directly, rather than sending it to the state office of administrative hearings to be overseen by an administrative law judge.

On Aug. 26, the PUC issued an order directing the staff to make a recommendation regarding the application's sufficiency by Sept. 15, and the parties to file a proposed procedural schedule by Oct. 1.

In addition to Texas and New Mexico regulators, the proposed transaction is subject to review by federal regulators, including the Nuclear Regulatory Commission, the Federal Communications Commission, the Department of Justice via the Hart-Scott-Rodino Act and the Federal Energy Regulatory Commission. TXNME shareholders also need to approve the transaction.

The companies have stated that they expect the deal to close in the second half of 2026.

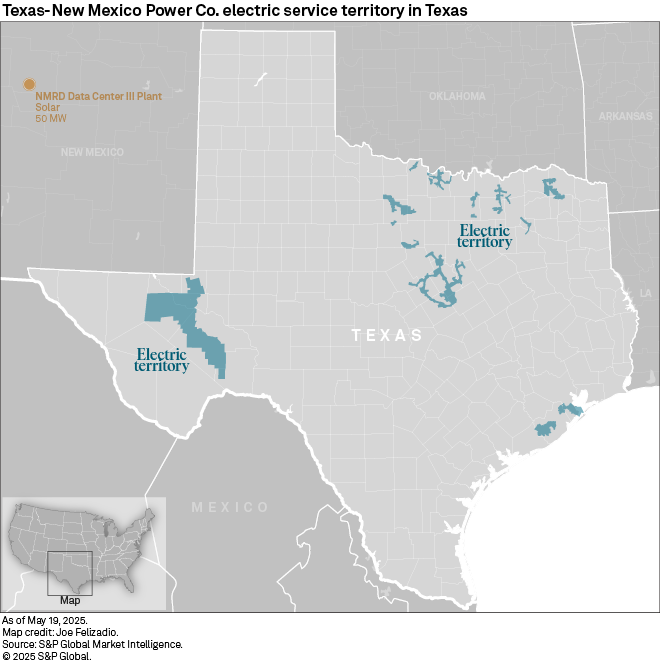

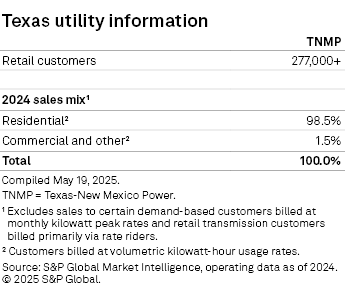

Based in Albuquerque, New Mexico, TXNME is a utility holding company with two regulated utility subsidiaries — Texas-New Mexico Power Co. (TNMP) and Public Service Co. of New Mexico (PSNM). In Texas, TNMP provides electric transmission and distribution (T&D) service within the Electric Reliability Council of Texas Inc.

Generation service is competitively provided; retail electric providers package T&D service with generation supply and make the bundled service available to customers. The T&D utilities do not have provider-of-last-resort obligations. In addition, TXNME owns unregulated generation assets that sell power into the ERCOT market; these operations are separate from the utility.

The companies claim that the transaction is in the public interest because it will provide substantial, tangible and quantifiable benefits to TNMP's customers and the broader Texas community. The companies contend that the acquisition is organized in a manner intended to ensure that TNMP remains a Texas-focused utility with robust local oversight and management, and to insulate TNMP and its customers from risks associated with affiliated entities.

Merger commitments

Ratepayer commitments

– TNMP will provide rate credits totaling $35 million over the 48 months following the close of the acquisition.

– The Blackstone affiliate that would hold the TXNME assets, Troy ParentCo LLC, would contribute $10 million in economic development funds over a period of 10 years to fund one or more of the following: job training and apprenticeships or scholarships in utility-related areas of industry.

– TNMP would make incremental charitable contributions within TNMP's service territory of $500,000 per year for 10 years after closing.

– TNMP would not seek to recover any transaction-related goodwill or acquisition premium in rates, rate base, cost of capital, or operating expenses. Push-down accounting would not be employed, and no incremental goodwill would be reflected in TNMP's financial statements.

– TNMP would not seek recovery of transaction or transition costs from customers.

Regulatory authority preservation

– TNMP would not build assets outside ERCOT or take actions that impair the PUC's jurisdiction without prior approval. TNMP and its affiliates would not argue that the PUC is preempted by the Federal Power Act from determining cost recovery of affiliate costs.

– TNMP would file annual compliance reports with the PUC for five years after the closing. TNMP would accord the PUC access to the relevant books and records needed to review affiliate transactions, and any changes to these regulatory commitments require prior PUC approval.

Corporate governance and ring-fencing provisions

– After closing, TNMP's board would consist of seven members, including three independent directors as defined by the New York Stock Exchange, at least two of whom will be Texas residents; one director with utility executive experience; and the president and CEO of TNMP. All directors would be US citizens. TNMP would have the duty to act, subject to applicable Texas law, in the best interests of TNMP.

– The TNMP board will have sole decision-making authority over dividend policy, debt issuance, issuance of dividends or other nontax distributions, capital expenditures, shared service fees, operation and maintenance expenditures and appointment or removal of officers.

– Unless approved by the PUC, dividends or nontax distributions would only be paid if TNMP's credit rating is investment grade. TNMP would limit such distributions to an amount not to exceed its net income as determined in accordance with generally accepted accounting principles. TNMP would be required to maintain stand-alone credit ratings from at least two major agencies and to notify the PUC if its credit rating falls below the rating TNMP was given on May 18, 2025.

– The independent directors could, by a majority vote, prevent TNMP from paying any dividends at any time during the first five years if the TNMP board reduces capital expenditures below the current five-year plan based on limited equity financing availability. If TNMP management seeks approval of a capital project or a series of projects that would be in excess of the approved annual budget by more than 10%, such projects or series of projects would require a majority of the TNMP Board, including a majority of the independent directors.

– A vote of a majority of the independent directors could also prevent TNMP from making distributions, if necessary to meet debt-to-equity commitment. TNMP would maintain a minimum equity ratio, as set by the PUC in a general rate case based on a 13-month rolling average. The PUC's most recent rate case decision for TNMP was issued in 2018, when the PUC adopted a settlement authorizing the company a $22.8 million retail base rate increase, equal to a $10 million net overall electric rate increase after consideration of a $12.8 million reduction in wholesale transmission rates. The rate change reflected a 9.65% return on equity (45% of a hypothetical capital structure) and a 7.89% return on rate bases of $520.3 million for retail delivery operations and $314.9 million for wholesale transmission operations.

– The compensation for a TNMP director would not be tied to, reflect, or be related to the financial, operating, or other performance of any entity or interest other than TNMP. The board would set the compensation and benefits for a TNMP director, subject to the approval of Troy.

– All independent directors would have equal terms (with initial terms staggered). Removing an independent director before the expiration of any such term would require the affirmative vote of a majority of the TNMP board.

– TNMP would be held by a bankruptcy-remote special purpose entity (Troy), and TNMP's sole purpose would remain to provide T&D service as a utility. TNMP would maintain an identity, name and logo separate and distinct from that of any parent organization or affiliated entity. Troy would be required to obtain a non-consolidation legal opinion that provides that, in the event of a bankruptcy of Troy or any affiliate of Troy, a bankruptcy court will not consolidate the assets and liabilities of TNMP with Troy or any affiliate of Troy.

– TNMP would be prohibited from pledging assets, stock, or revenues for the benefit of any entity other than TNMP, and from taking on any new debt in conjunction with the acquisition. It would hold ratepayers harmless for any increased costs due to refinancing of existing TNMP debt caused by the acquisition. The company is also prohibited from engaging in intercompany debt or lending with Troy or any affiliate, unless approved by the PUC, other than existing arrangements with TXNME; sharing credit facilities with Troy or its affiliates, except for joint revolving facilities that have no cross-default provisions; entering into credit or debt agreements that have cross-default provisions tied to affiliates; transferring material assets (over $1 million) to affiliates except at arm's length and consistent with PUC standards; commingling funds, assets, or cash flows with those of affiliates without prior PUC approval; and recovering from ratepayers costs associated with an affiliated retail electric provider's bad debt or bankruptcy.

Local control commitments

– TNMP would continue to make minimum capital expenditures at a level equal to its current five-year budget for the period beginning Jan. 1, 2025.

– TNMP's headquarters would remain in Texas within its service territory for as long as Troy owns the utility. Troy would maintain a controlling interest in TNMP for at least 10 years after the closing of the acquisition.

– TNMP's president and CEO and officers would have day-to-day control over operations. TNMP would not implement any involuntary workforce reductions for at least three years after closing and would honor all existing labor contracts.

Prior transaction

In January 2024, with a New Mexico appellate review pending, Avangrid Inc. formally ended its pursuit of acquiring TXNME (then PNM Resources).

Regulators in Texas had approved the transaction in May 2021. The PUC adopted a unanimous settlement that incorporated numerous regulatory commitments, including customer rate credits, a corporate management restructuring agreement, formalized non-competition/divestiture agreements pertaining to affiliate entities operating within ERCOT, and numerous ring-fencing measures.

Texas PUC merger review criteria

The Texas PUC has had review authority over mergers since 2007. Statutory authority applies to changes of control involving as little as 1% of voting securities or transactions valued at $10 million.

The law requires the commission to determine whether the action is consistent with the public interest. In reaching its determination, the commission is to consider the reasonable value of the property, facilities or securities to be acquired, disposed of, merged, transferred or consolidated and determine whether the public utility will receive consideration equal to the reasonable value of the assets when it sells, leases or transfers assets.

The PUC must also consider whether the transaction will adversely affect the health or safety of customers or employees, result in the transfer of jobs of Texas citizens to workers domiciled outside the state or result in the decline of service. If the commission finds that a transaction is not in the public interest, it may take the effect of the transaction into consideration in ratemaking proceedings and disallow this effect if the transaction will unreasonably impact rates or service.

In addition, the PUC must find that the transaction is in the public interest after considering whether the transaction would adversely affect the utility's reliability or cost of service.

Since TXNM owns competitive generation assets, the PUC must determine that the transaction would not result in a violation of Section 39.154 of the utility code, which prohibits a power generation company from owning or controlling more than 20% of the installed generation capacity available to serve a specific power region. If the commission finds that the proposed transaction would violate Section 39.154, the PUC may conditionally approve the transaction, provided that the proposal is sufficiently modified to mitigate any potential market power abuses.

RRA perspective on Texas regulation of electric utilities

RRA views the Texas regulatory climate for electric utility investors as more restrictive than average, implying a higher-than-average degree of regulatory risk.

The returns on equity authorized for electric utilities in Texas have declined over the past few years and have been somewhat below prevailing industry averages for each industry segment. Regulatory lag is a challenge as the PUC relies on test periods that are historical at the time a case is filed. Though several mechanisms are in place that allow the utilities to update rates on an interim basis between rate cases to reflect new investments, these adjustments are also based on historical test years. Most recent rate cases have been settled. Even so, more than half have extended well beyond the statutory time period for a decision.

State law requires the utilities to file for base rate reviews no less frequently than every 48 months, but the PUC may grant extensions at its discretion. TXNM has not had a rate case since 2018. Under the PUC rules, a case would have been conducted in 2022, but the PUC has granted three annual extensions. As a result, TXNM is expected to file a rate case by the end of 2025, but additional extensions may be granted due to the expected merger filing.

The framework in Texas has been the subject of intensive public and legislative scrutiny over the past five years or so due to severe weather impacts and concerns regarding resource adequacy. Turnover at the commission and two prolonged vacancies on the five-member panel contribute to the level of risk. This uncertainty comes at a time when the PUC is grappling with the mandates imposed by the legislature the last three legislative session and challenges created by increasing demand from high-volume users, such as datacenters.

RRA accords Texas regulation of electric utilities a Below Average/1 ranking.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

Content Type

Theme

Products & Offerings

Segment

Language