Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 18, 2025

By Steve Piper

US coal market prices were mixed in August, as the summer peak demand season supported growth in domestic coal prices, while export prices turned lower.

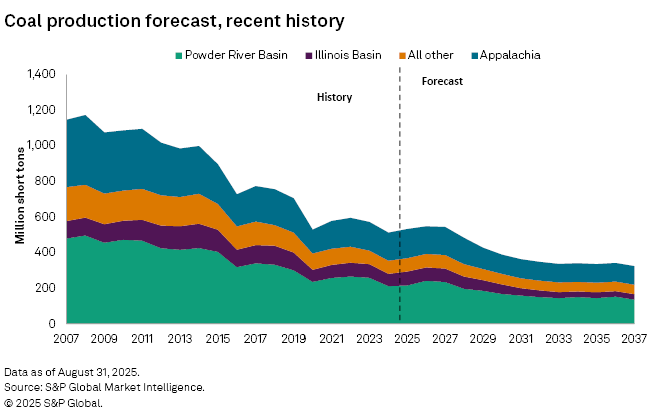

Through 2027, firm natural gas prices are expected to support increased coal generation, driving stable or growing coal production. After 2027, the US coal market is forecast to face pressure from the expansion of zero-carbon electricity, incentivized in part by broad-based tax credits. Overall, the S&P Global Market Indicative Power Forecast projects 44.3 GW of coal plant retirements by 2035, while 808.4 GW of renewable capacity is forecast to come online. Coal plants are forecast for significantly reduced generation over this period, as US electricity demand for coal declines by 50.7% and generation from coal plants accounts for just 7.0% of total generation.

However, a recent report by S&P Global Commodity Insights estimates that a full repeal of green energy tax credits could boost coal's 2035 generation share to 7.9%, compared to previous forecasts. While overall declines in coal demand remain likely, the enactment of the budget reconciliation bill called the One Big Beautiful Bill Act, combined with recent increases in gas generation construction costs, could improve coal's generation share relative to current forecasts.

➤ US coal prices were mixed in August, with production and shipments showing year-over-year growth despite declines in exports.

➤ The S&P Global Market Indicative Power Forecast predicts 44.3 GW of coal plant retirements by 2035, with coal's share of electricity generation expected to decline significantly as renewable energy capacity increases.

➤ Current coal shipments averaged 11.0 million short tons for the four weeks ending Aug. 23, 6% higher than July and a 7% increase year over year.

➤ The production outlook varies by region, with the Powder River Basin and Illinois Basin expecting stable production through 2027, while Appalachian coal production is forecast to decline due to reduced domestic demand and limited export growth.

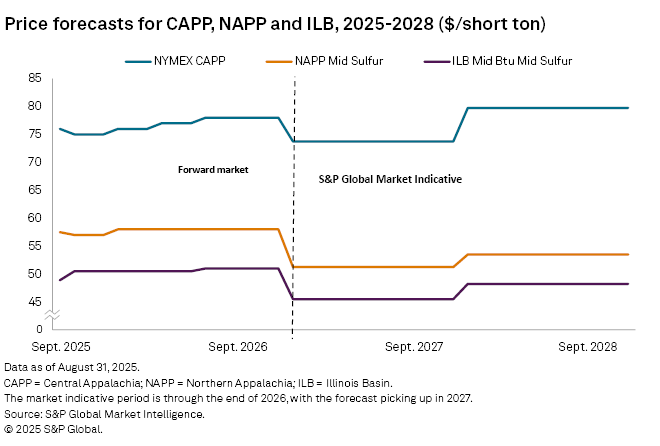

Domestic benchmark coal prices gained in August on firm natural gas prices combined with peak summer electricity demand. Export coal prices moved lower however, with CAPP region export benchmarks down $1/short ton to $78.00/short ton (1.3%), NYMEX CAPP down $2/short ton to $75.00/short ton (2.6%), and NAPP Pittsburgh Seam 13,000 Btu per pound down $1/short ton to $57.00/short ton (1.7%). Illinois Basin 11,500 mid-sulfur moved the most, up $3.25/short ton and closing August at $50.50/short ton, while the NYMEX Powder River Basin benchmark eased higher by $0.10/short ton to $14.40/short ton.

While the summer peak season supported domestic coal prices, natural gas prices declined modestly during August, with weather generally less severe than previous summers. Henry Hub spot gas opened at $2.99/MMBtu and fell to a low of $2.76/MMBtu the last week of August before closing the month at $2.90/MMBtu. Spot prices averaged $2.92/MMBtu for August, trending lower than July. Storage was drawn down slightly during the month, with working gas at 3,217 BCF as of Aug. 22. This is 154 BCF above the five-year average, and 112 BCF below the same week of 2024.

Without a strong electricity demand signal, regional gas market discounts widened somewhat in August. Chicago Gate averaged $2.63/MMBtu, a $0.29/MMBtu discount to Henry Hub. TCO Pool's discount increased to $0.58/MMBtu at $2.34/MMBtu, while TETCO M3's discount was $0.65/MMBtu at $2.27/MMBtu. SoCal Border's discount also grew, to $0.22/MMBtu, for an average monthly spot price of $2.70/MMBtu.

The US Energy Information Administration estimated June 2025 coal stockpiles at 117 million short tons (MMst), a 3 MMst decrease from May as summer demand picked up.

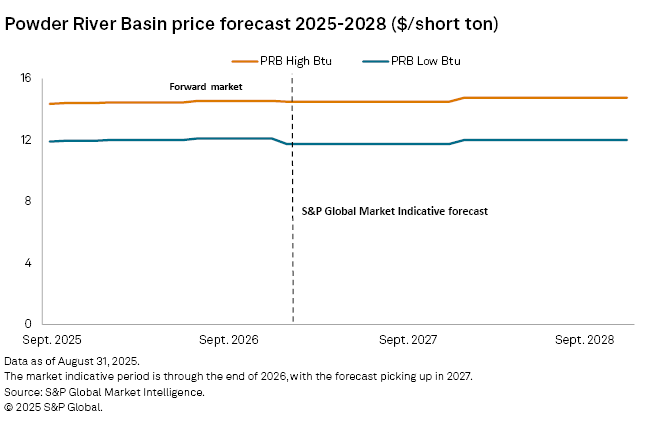

Current forward pricing for PRB coal remained flat and stable, reflecting sufficient inventories at power plants and mining capacity to increase production as needed against firmer natural gas prices. After 2027, lower natural gas prices and declining coal demand is forecast to restrain price growth.

Bituminous coal price levels are primarily influenced by export markets, with current price levels making domestic coal generation generally less competitive against Northeast natural gas. Firmer eastern natural gas prices nevertheless boosted demand in the first half of 2025, even as seaborne coal demand is expected to decline 7.7% year over year due to reduced demand from India and China.

Pricing benchmarks exceeding $65/short ton suggest sustainable returns for eastern bituminous coal. After declining in 2024, bituminous coal demand for electric generation is expected to remain stable through 2027 on higher electricity demand and more supportive natural gas prices. Declines in steam coal demand are expected to resume after 2027 and overall Eastern US coal demand is forecast to decline 200 MMst in 2025–30.

Outlook for US coal production, demand

For the four weeks ending Aug. 23, coal shipments averaged 11.0 MMst, 7% higher year over year. While prices have firmed up modestly, lower natural gas prices and mild weather have limited gains in coal demand.

The chart below compares the current production forecast with recent history. We forecast increased coal demand against higher natural gas prices through 2027. Gas to coal switching during the first quarter of 2025 reduced coal inventory surpluses from the end of December 2024, setting up production growth in 2025. We now forecast coal production at 533 MMst, an increase of 21 MMst (4.1%) from 2024 levels. Coal generation is forecast to further gain market share from natural gas through 2027 until relative coal and gas pricing normalizes and expanding green energy again puts pressure on coal generation. The overall coal market, including domestic demand and exports, is forecast to decline by 164 MMst between 2025 and 2030.

Production outlook — Powder River Basin

The 2025 June quarter production reports of the Mine Safety and Health Administration (MSHA) indicate production for the first half of 2025 at 110.4 MMst, an annualized rate of 220.9 MMst. Production is now forecast at 216 MMst in 2025, with higher inventories potentially constraining the 2025 second half production. Through 2027, production is forecast for modest growth against higher natural gas prices. By 2030, Commodity Insights projects that coal generation retirements in the Midwest and a substantial expansion of wind generation in Powder River Basin's core markets will shrink coal demand to 164 MMst, further declining to 145 MMst through 2035.

Production outlook — Illinois Basin

The 2025 June quarter production reports of the MSHA indicate the 2025 first half production at 34.7 MMst, or an annualized rate of 69.5 MMst. We forecast stable annual production through 2027, ranging 76-78 MMst per year. After 2027, the expansion of wind generation incentivized by the Inflation Reduction Act of 2022 and announced coal retirements are forecast to erode the Illinois Basin coal demand. Coal production in the Illinois Basin is forecast to fall to 54 MMst by 2030, further declining to 33 MMst by 2035.

Production outlook — Appalachian basins

The 2025 June quarter production reports of the MSHA indicate the 2025 first half production at 80.2 MMst, or an annualized rate of 160.4 MMst. Appalachian coal demand tends to be more sensitive to global seaborne markets than to domestic natural gas prices, compared to the Powder River Basin or the Illinois Basin. While the Illinois Basin and Powder River Basin are forecast for improved demand against natural gas generation, gains in Appalachian coal will, therefore, be more limited. We forecast production at 164 MMst, 4.5% higher than 2024. As remaining domestic demand erodes after 2027, with only modest offsets from export growth, Appalachian production is forecast to fall to 108 MMst by 2030.

Further information

Market indicative coal forecasts by Commodity Insights represent forward curves for spot-traded instruments analogous to a strip of contracts. The shorter tenors — current year and prompt year, plus additional years, if available — are driven by the observed/assessed market. The longer tenors — typically forecast years three to 20 for physically assessed markers — are driven by fundamental estimates of cash costs of production, accepted returns to capital, regional productive capacity, and forecast supply and demand. For the long-tenured portion of the curve, Commodity Insights forecasts prices for specific coal markers and defines the remaining markers via historical spreads.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

Content Type

Theme

Products & Offerings

Segment

Language