Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 4, 2025

By Katherine Matthews and Jason Holden

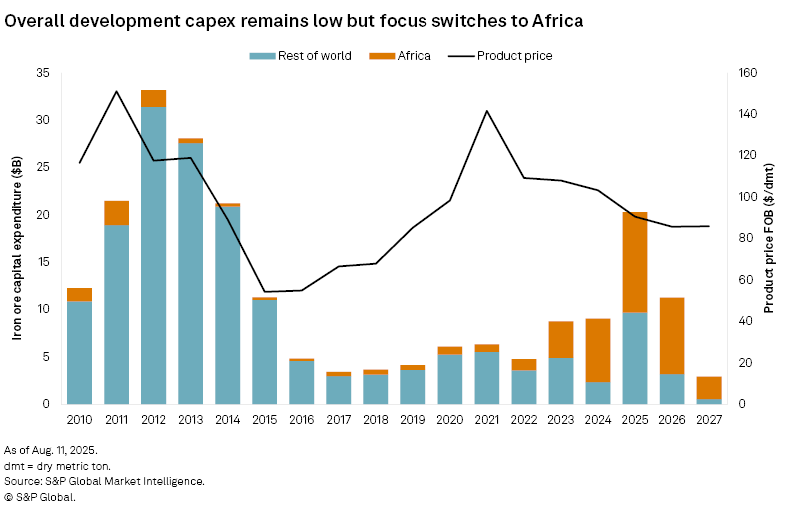

Today, we are witnessing a resurgence in capital expenditure focused on iron ore, contrasting with the overall capital decline in the mining industry. Notably, a significant portion of this investment, focused on iron ore, is directed toward Guinea and the Simandou Blocks 1 & 2 and Simandou Blocks 3 & 4 projects. Simandou is a particularly high-grade deposit, with grades averaging 65.8% iron content and low impurities. The orebody has similar characteristics to the banded iron formations found in the mineral-rich Carajás province of Brazil; comparable deposits include Vale SA's Northern System. As such, it is one of the most desirable iron ore projects in the world.

Once the projects reach commercial production, increased supply from both sites ("Simandou") will exert downward pressure on iron ore prices and will particularly impact lower-grade, high-cost producers. The high-grade nature of Simandou ore could support premium pricing for certain market segments, aligning with steel mills moving to consume higher-grade products in their decarbonization efforts.

➤ The Simandou orebodies are akin to those found in Brazil's "Iron Quadrangle," where banded iron formations have undergone supergene enrichment, resulting in high-grade ore.

➤ This high-grade product is expected to attract a premium and will be favored by steelmakers looking to reduce their carbon footprints.

➤ With the production capacity peaking at 120 million metric tons, Simandou has the potential to reshape global seaborne iron ore trade.

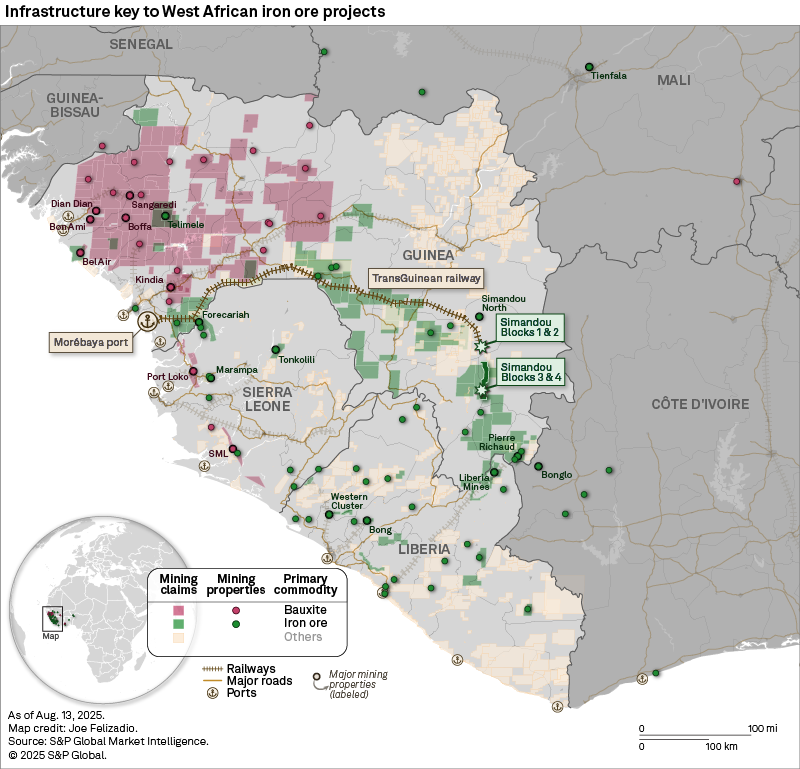

Simandou is recognized as one of the largest undeveloped iron ore deposits globally and is poised to substantially increase the supply of high-grade iron ore in the seaborne market. The project is divided into two sections: Simandou North (Blocks 1 & 2), controlled by the Winning Consortium Simandou SAU, a company known for its successful bauxite mine developments in Guinea, and China Baowu Steel Group Co. Ltd. — and Simandou South (Blocks 3 & 4). The Southern mine is jointly owned by Rio Tinto Group, Aluminum Corp. of China and the government of Guinea.

Rio Tinto anticipates beginning first production from Simandou South later this year, with the operation expected to contribute approximately 10 MMt to mined supply by 2026 and a gradual ramp-up to about 60 MMt over the next five years. However, infrastructure bottlenecks, particularly regarding the railway and port development, pose challenges to achieving these targets.

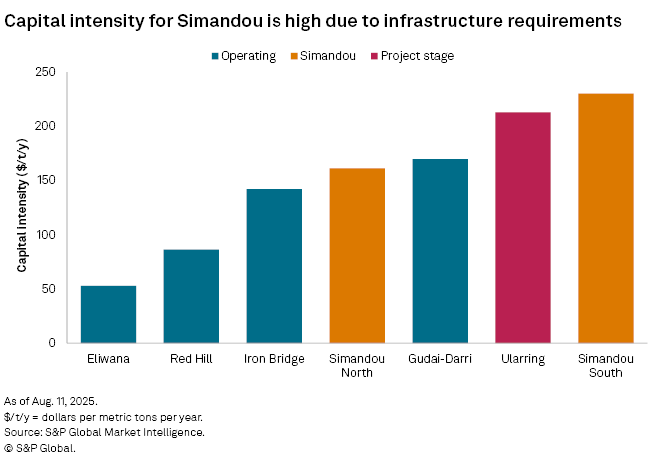

Simandou's capital intensity is notably high due to the substantial infrastructure investments required for the project. Under construction is the TransGuinéen heavy haulage railway, which will span over 620 km, along with rail spurs that will link the two operations to this main line. Comprising 12 stations, 206 bridges and four tunnels, this railway is the longest modern railway in Guinea and a strategic driver of regional economic growth under the Belt and Road Initiative.

Comparing similar bulk iron operations during the project phase, Eliwana had a markedly lower capital intensity due to the simple nature of the mine. The project, owned by Fortescue Ltd. and located in Australia's Pilbara region, is a drill-and-blast operation, producing lump and fines and is relatively close (140 km) to its Solomon Hub asset, so much of the infrastructure was preexisting. Conversely, another Western Australian deposit, Ularring, appears to have been put on hold. The most recent technical report released by its owner, Macarthur Minerals Ltd., envisaged the operation producing a concentrate, requiring a significantly greater capital input for crushing, grinding and separation infrastructure. However, due to the project's small scale and falling prices, it has been paused.

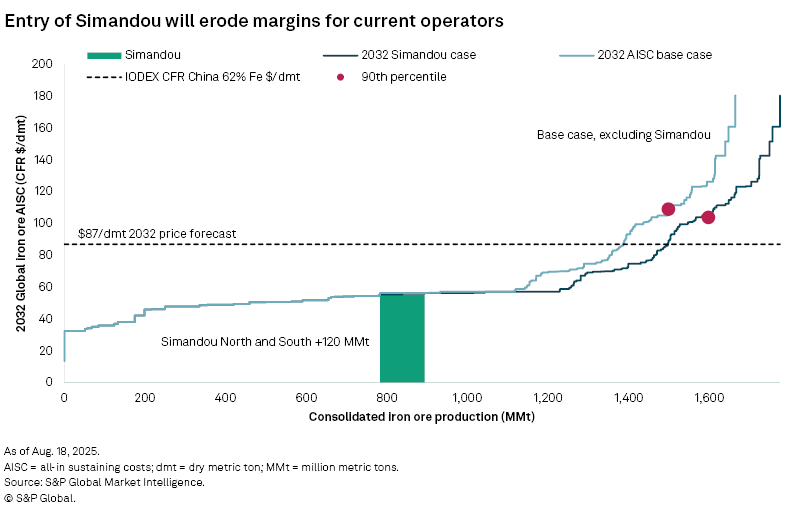

The entry of Simandou material into the iron ore market is expected to exert downward pressure on prices, particularly impacting lower-grade, high-cost producers. The premium pricing potential for its high-grade ore aligns with the steel industry's shift toward using superior feedstocks to facilitate its decarbonization efforts. With both Simandou mines projected to operate at a combined rate of 120 MMt when fully operational, they would account for approximately 4.8% of global iron ore supply, equivalent to 9.7% of China's iron ore import demand in 2024.

As the Simandou operations approach full capacity by 2030, we estimate an all-in sustaining cost in the range of $55-$60 per dry metric ton. Despite high capital intensity and transportation costs, economies of scale will play a crucial role in the viability of the projects. Under our current scenario, with a projected 62% iron ore price of $87/dmt in 2032, approximately 270 million metric tons of global iron ore production will be under pressure, likely leading to the closure of many higher-cost operators. As shown in the following chart, both Simandou operations are likely to fall just into the third quartile for production costs, while the major producers are firmly in the lower and second quartile.

Evaluating margins, we can factor in the impact of realized prices and production costs. Higher-cost pellets and concentrates favored by steel producers in places such as the US, Canada, Europe, the Middle East and Brazil command higher prices, but consequently have increased processing costs. Lumps and fines, particularly those from Australia and South Africa, require minimal processing, resulting in lower mining costs; however, they fetch comparatively reduced prices. As we can see in the following chart, high-grade premiums are likely to stay low in the short-term but expand in the mid- to long-term as the steel industry moves. This is particularly important for the European steel industry, which is poised to lead the shift, transitioning to scrap-charged electric arc furnaces (EAF) and direct reduced iron (DRI) modules. As the steel industry faces increasing pressure to cut carbon emissions, the use of high-grade iron ore presents a viable solution to aid in decarbonization. This will occur through increased usage of high-grade ore in blast furnaces and DRI plants.

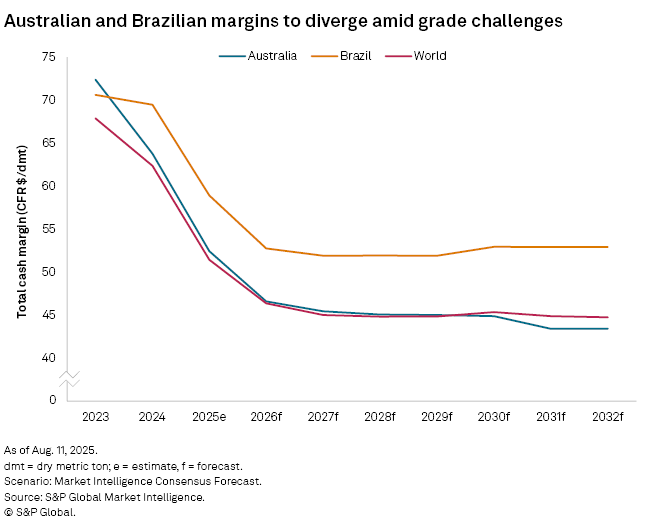

Current margins in major producing countries, such as Australia and Brazil, are closely aligned at about $51/t. Countries with greater margins, such as Sweden and Kazakhstan, benefit from high-grade assets; countries such as Sierra Leone, China and India face challenges. The ongoing transition in the steel industry from blast furnaces to EAFs, with Europe anticipated to lead the way, is expected to influence high-grade premiums. While short-term prospects for premium pricing remain subdued due to overcapacity in the steel sector, the long-term rise of premiums is likely, as China curbs excess capacity and decarbonizes its steel industry. This trend is highlighted by the increasing divergence in margins between Brazil's higher-grade products and Australia's lower-grade offerings.

Is Simandou still on track to come online in 2025?

The Simandou project has faced significant setbacks due to fatalities, extreme rainfall and political uncertainties. Following an incident in October 2024, port construction was suspended for an investigation, and heavy rainfall during Guinea's 2024 wet season has further hindered progress. A fatality occurred on-site in August 2025, prompting renewed scrutiny of safety protocols and operational practices. This incident has raised concerns among stakeholders about the project's ability to maintain momentum amid ongoing challenges. Despite these challenges, development efforts have intensified, with 10,800 personnel now engaged across mining, rail, and port operations in the South block.

Evaluating available satellite imagery, road construction began in early 2022 in Simandou North, paving the way for mine development that appears to have begun in the last quarter of 2023. In the South, road construction began in late 2021, followed by mine development around 2022-end. As previously mentioned, the first shipment from Simandou South is being accelerated for November 2025, with production expected to ramp up over 30 months. We forecast the mines to ultimately reach 120 MMt annually on a combined basis by 2030.

Simandou North (Block 1 & 2) time lapse from December 2021 to June 2025

Simandou South (Blocks 3 & 4) time lapse from November 2022 to June 2025

Morebaya Port time lapse from January 2022 to March 2025

Simandou's premium product destined for Chinese ports

Aligned with mine supply, Simandou fines material is anticipated to pivot global iron ore seaborne trade to a notable surplus from 2026, with exports forecast to reach 6.4% of the total volume in 2030. Exports from Guinea during 2026–2030 are forecast at a compound annual growth rate of almost 37%. With the venture share leaning heavily toward Chinese-owned entities and significant investments into Guinea by these companies, it is anticipated that the majority of exports out of the Morebaya port will be bound for the country. With dampening grades coming out of Western Australia, Rio Tinto is in a position where it may blend the higher-grade ore from Simandou with its Pilbara material.

The port facilities at Morebaya will have the capacity to match operational production, with the ability to export 120 MMt per year. The port is being constructed in a co-development arrangement, with the Northern companies developing a 60 MMt per year barge wharf and the Southern conglomerate an equivalent transhipment vessel port. It is estimated that 170 capesize bulkers will be required to ship this ore out of West Africa for delivery to international buyers. These vessels have the capacity to transport 170,000 deadweight tonnage on average and, due to their size, need to utilize maritime routes that pass the Cape of Good Hope versus the Suez Canal, for example. However, these longer shipping routes are balanced by the larger bulk capacities that the capesize ships can carry and overall lower emissions. In anticipation of Simandou reaching commercial production, China is reportedly further investing in the purchase of capesizes, meaning that the country has had financial involvement in every facet of the mine-to-mill chain.

All eyes on Simandou

The Simandou iron ore projects represent a pivotal development in the global iron ore landscape, with the potential to reshape supply dynamics and pricing structures. As the operations progress to commercialization, stakeholders will need to navigate the associated challenges while capitalizing on the opportunities presented by this high-grade deposit. The full impact of this orebody may not be realized until 2030, when peak production is expected to be reached.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.