Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 11, 2025

By Brian Bacon

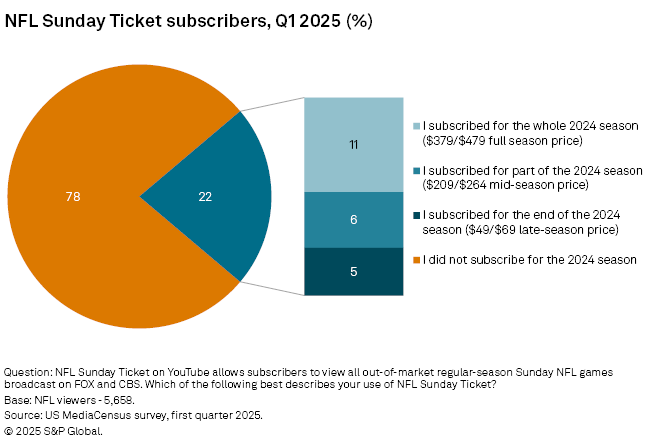

Less than a quarter of National Football League Inc. viewers subscribed to NFL Sunday Ticket on Alphabet Inc.'s YouTube for the 2024 season, according to data from S&P Global Market Intelligence Kagan's US MediaCensus online consumer survey, conducted in the first quarter of 2025.

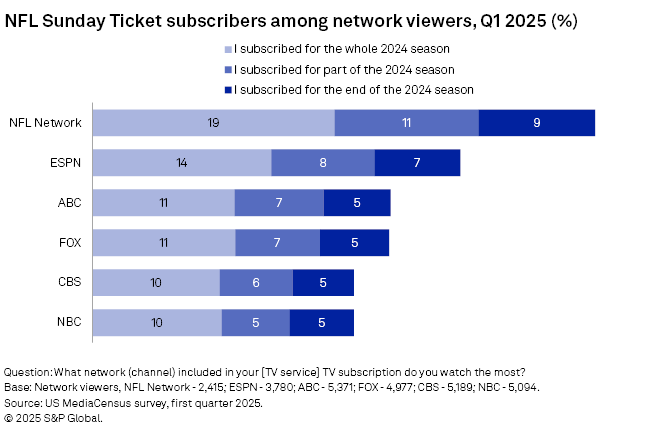

➤ Forty percent of NFL Network viewers indicated that they subscribed to NFL Sunday Ticket.

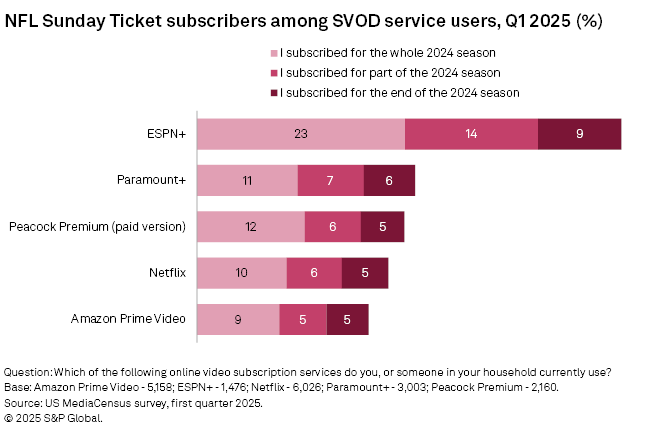

➤ Among SVOD services with live NFL games, ESPN+ had the largest share of users subscribed to NFL Sunday Ticket.

➤ The Miami-Ft. Lauderdale TV market had the largest share of NFL viewers indicating they subscribed to NFL Sunday Ticket at 42%.

NFL Sunday Ticket remains a niche offering with only 22% of NFL viewers indicating they subscribed for the 2024 season, up from 19% the year prior. Among subscribers surveyed, half (11%) subscribed for the whole season. About half as many (6%) subscribed at the mid-season price while another 5% subscribed at the highly discounted end of season price.

Access data in Excel format here.

Examining viewers of the NFL's TV network partners shows that the NFL Network (US) had the largest share of viewers who subscribed to Sunday Ticket at 40%. ESPN (US) viewers were the next most likely to subscribe to Sunday Ticket at 29%, followed by 24% for both ABC (US) and FOX (US) viewers, while CBS (US) and NBC (US) viewers were the least likely at 21%.

Nearly half (46%) of Walt Disney Co.'s ESPN+ users indicated they subscribed to Sunday Ticket, far outstripping other streaming services offering live NFL games. While CBS and NBC broadcast games are also streamed on Paramount Skydance Corp.'s Paramount+ and Comcast Corp.'s Peacock Premium – in addition to exclusive games on Peacock – the users of these services were much less likely to have also subscribed to Sunday Ticket at 24% and 23%, respectively. Netflix Inc. showed two exclusive games in 2024, with 21% of users indicating they subscribed to Sunday Ticket. Amazon.com Inc.'s Prime Video, home of Thursday Night Football, had the lowest share of users who also subscribed to Sunday Ticket at 19%.

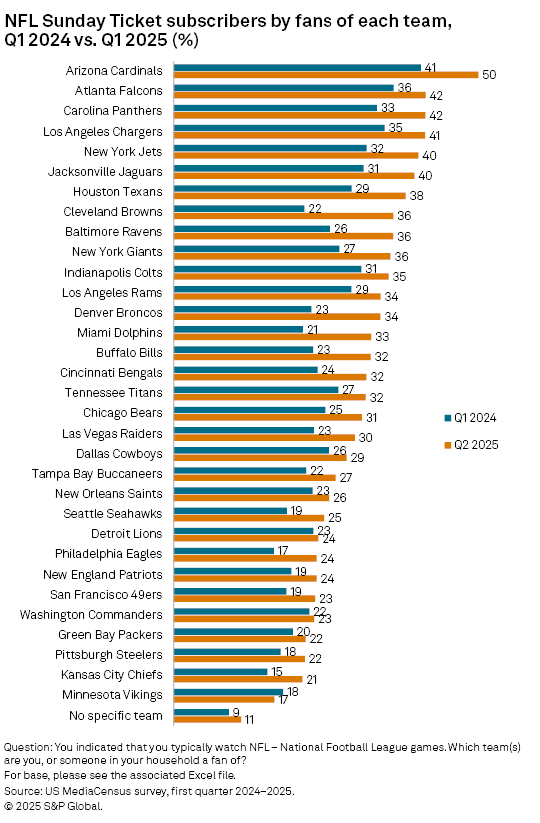

Half of Arizona Cardinals fans (50%) indicated they subscribed to Sunday Ticket, up from 41% in 2024. Percentages of fans from all the teams who subscribed to Sunday Ticket increased from last year, except among Minnesota Vikings fans, who declined by only one percentage point from 18% to 17%. The largest increase was among Cleveland Browns fans, who stepped up from 22% to 36%.

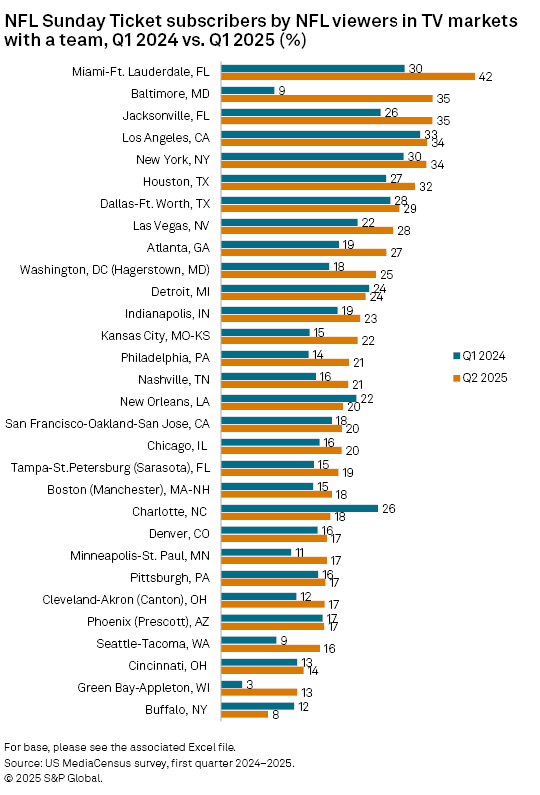

Examining Sunday Ticket use by TV market shows that Miami-Ft. Lauderdale had the largest share of NFL viewers who indicated they subscribed at 42%, up from 30% in 2024. Baltimore had the largest growth, with the share of respondents in that market subscribing to Sunday Ticket, growing from 9% to 35%. Charlotte, NC had the sharpest decline, dropping from 26% to 18%.

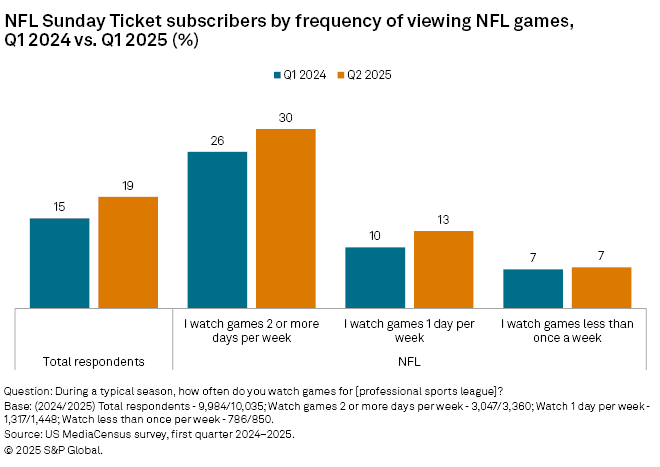

The increase in Sunday Ticket subscriptions was driven in large part by those who watch games two or more days per week, increasing from 26% to 30%. The share of those watching one day per week also increased from 10% to 13%.

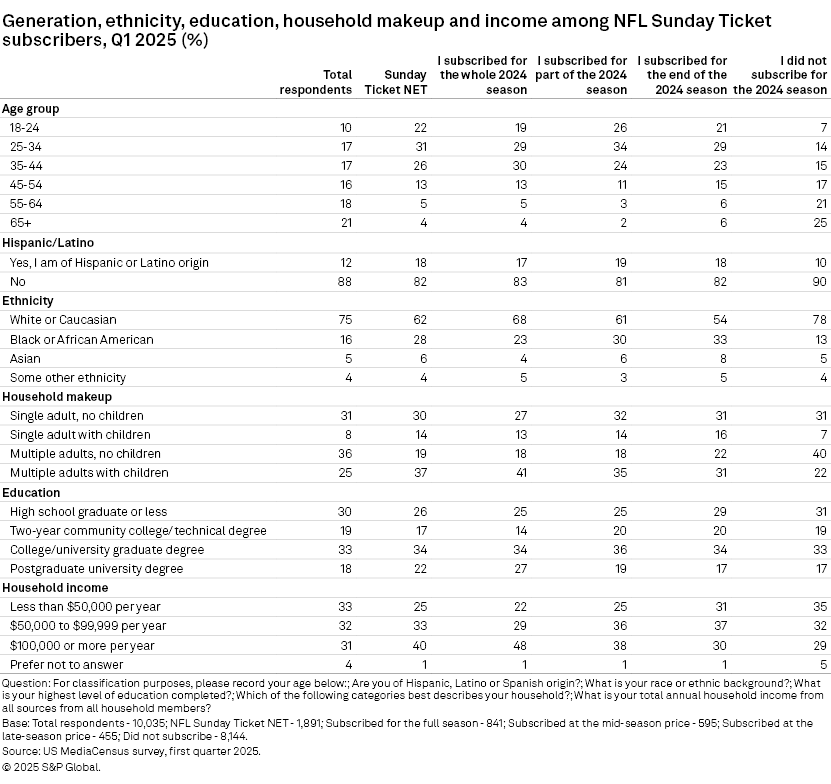

Over half of Sunday Ticket subscribers (52%) surveyed were under the age of 35, while 47% of those who didn't subscribe were 55 or older. Those who were subscribed for the whole season stood out the most, with 41% living in households of multiple adults with children. These subscribers were also more likely to hold a post-graduate degree at 27%, and nearly half (48%) were in households earning $100,000 or more per year.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Data presented in this article was collected from Kagan's US Consumer Insights survey conducted in the first quarter of 2025. The survey totaled 2,501 internet adults with a margin of error of +/-1.9 percentage points at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Content Type

Segment

Language