Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 18, 2025

By Neil Barbour

Smart glasses vendors have a clear window to ramp their sales volumes in the year ahead, with 48.2% of respondents to a recent survey who do not already own a pair reporting that they are interested in such a purchase within the next year.

Purchase interest is far from a perfect proxy for actual purchase behavior, but the strong showing for smart glasses is further evidence that the segment has reached or is at least approaching a "compelling combination of price and feature set," as we put it in our recent five-year forecast.

This is the second in a series of articles analyzing the results from our 2025 consumer metaverse survey, which polled more than 4,000 online adults across the US, UK, Canada, China, France, Germany, India and Japan in May and June.

The web-based survey sampled a range of adults across varying locations, incomes and ages, but respondents were heavily tilted toward millennials in urban settings. This dynamic likely produced an outsized representation of digital natives, or virtual environment "early adopters," which while not an accurate representation of the overall population, still provides valuable insights into a wide range of consumer perceptions.

Respondents' interest in smart glasses outpaced VR headsets by roughly 7 percentage points. The advantage is striking because VR headsets are a much better-defined product class compared to smart glasses in 2025, with more devices widely available in more places.

On the other hand, the fact that 40% of respondents were still interested in purchasing a VR headset may be surprising considering that the VR market lost most of its sales momentum over the past two years. More affordable headsets and a more robust software ecosystem would likely go a long way toward converting interest into sales.

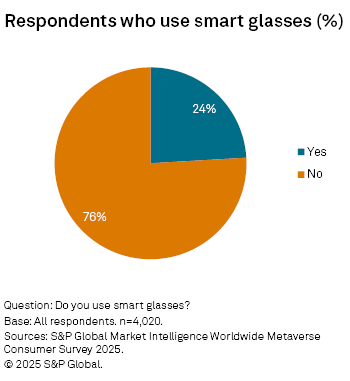

Nearly a quarter of respondents to our survey reported that they are already using smart glasses.

Respondents from North America and the Europe, Middle East and Africa region (EMEA) reported a usage rate around 20% while those from the Asia-Pacific pushed the overall average higher with a 35% usage rate.

See the attached Excel and PowerPoint files for more detailed regional breakouts.

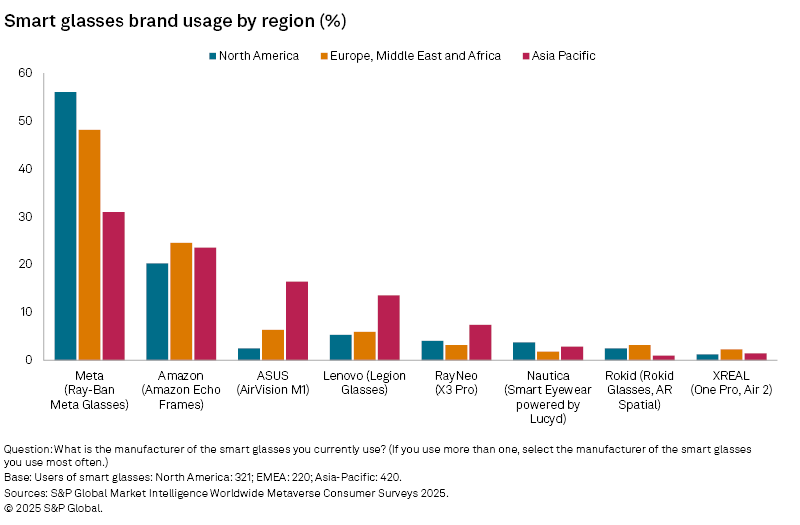

The most-used smart glasses were from Meta Platforms Inc., with Amazon.com Inc. running a distant second.

It would be a stretch to call Meta Ray-Bans a breakout success in the broader consumer electronics market, but the company has been able to turn a robust marketing campaign into growing sales and consumer awareness.

Considering we know very little about any plans Apple Inc., Samsung Electronics Co. Ltd. or Alphabet Inc. may have around smart glasses over the next 12 months, Meta is likely in the best position to harvest any near-term purchasing interest.

Smart glasses from ASUSTeK Computer Inc., Lenovo Group Ltd. and RayNeo drew between 5% and 10% of respondents in our survey, with much of that usage leaning toward Asia-Pacific, where those companies are based.

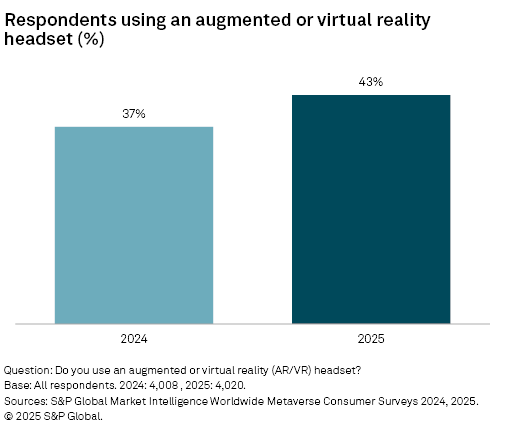

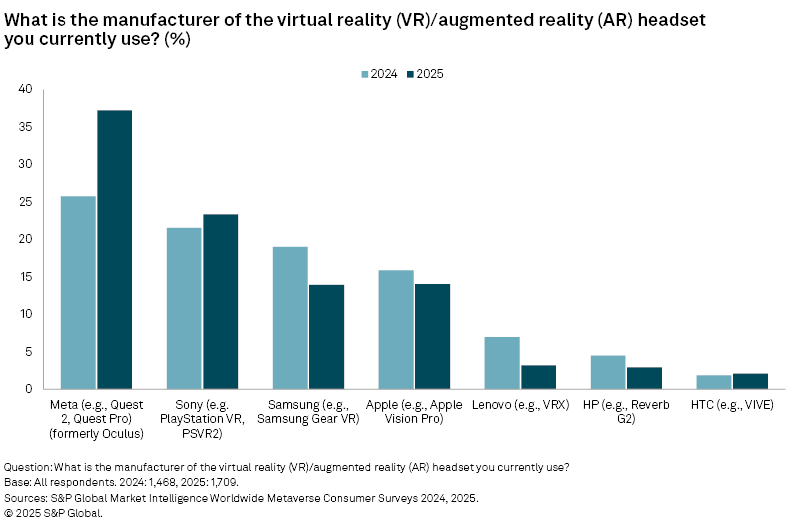

Turning back to headsets, our survey found 43% of respondents using VR headsets, up from 37% in the year-ago survey.

Once again, the Asia-Pacific region tracked higher than the other regions in our survey with 54% of respondents saying they use an AR or VR headset. In North America, 41.6% of respondents answered in the affirmative to AR/VR headset usage while 34.6% of EMEA respondents did so.

In terms of devices used, Meta was the top vendor with 37.2% of headset users saying they used a Quest or Oculus device. The improvement over Meta's year-ago result reflects Meta's strong grip on the stand-alone headset market, particularly in the US.

Sony Group Corp. was the only other vendor to grow its user base year over year. This is the first survey since the device began supporting PC, which may have added to its popularity. The device is primarily used as a peripheral for the PlayStation 5, where it continues to be supported by a handful of big-name titles a year.

Samsung lost traction with users, suggesting its Odyssey and Gear VR headsets continue to churn out of the installed base.

Apple ticked down from 16% of respondents in the year-ago survey to 14% in 2025, evidence that the Vision Pro is struggling to find an audience in its current configuration.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Streaming Media is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.