Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 18, 2025

By Ruilin Wang and Patricia Barreto

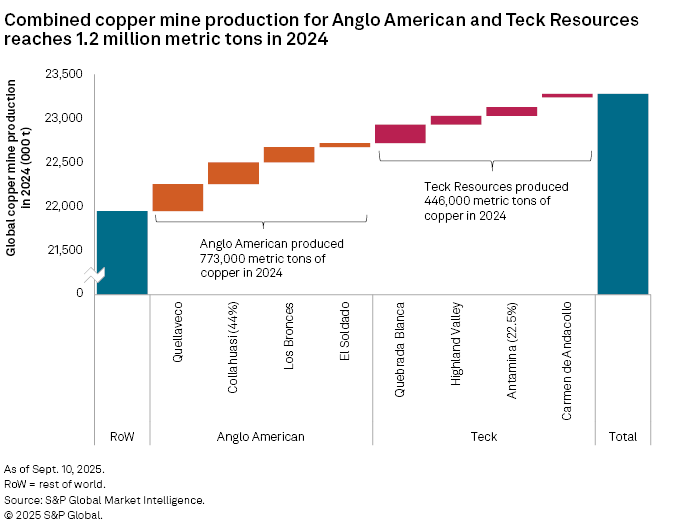

In a pivotal development for the global copper market, Teck Resources Ltd. and Anglo American Capital PLC announced Sept. 9 an all-share merger of equals valued at approximately $53 billion. The merged entity, Anglo Teck PLC, is poised to become the fifth-largest copper producer globally, with combined production approaching 1.2 million metric tons per year, which is forecast to grow about 10% by 2027 to an estimated 1.35 MMt. This growth is anchored on a portfolio of long-life, cost-competitive assets with strong resource bases.

➤ The $53 billion merger will make Anglo Teck the fifth-largest copper producer, targeting 1.35 MMt of output by 2027.

➤ Major operational synergies and cost savings are expected, including $1.4 billion in projected annual EBITDA from mine integration and $800 million in recurring annual pretax savings.

➤ The combined company's robust growth pipeline includes brownfield expansions and new copper projects across the Americas and Europe, but faces typical merger risks and project reprioritization.

The companies expect recurring pretax synergies of roughly $800 million annually within four years of closing, with 80% of savings targeted within two years. Anglo Teck will be headquartered in Vancouver and be listed on several major exchanges. Ownership is to be split roughly 62.4% to Anglo American shareholders and 37.6% to Teck Resources shareholders.

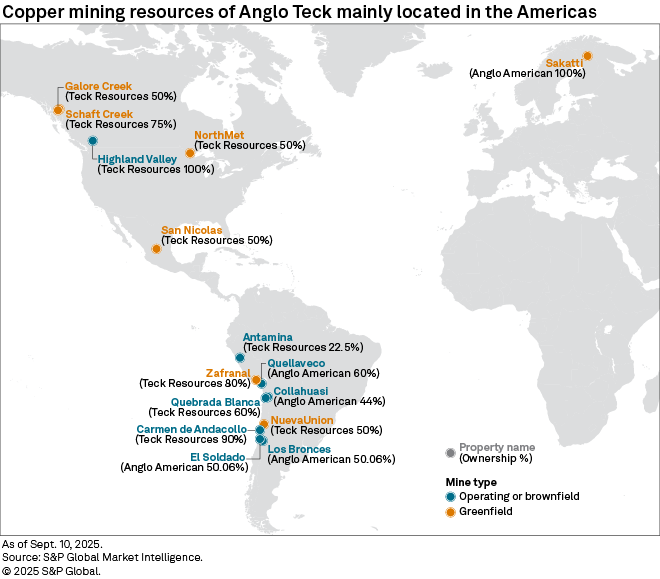

From an operational perspective, the merger offers significant synergy potential, predominantly from asset adjacency and functional integration. A standout opportunity lies in the adjoining Collahuasi and Quebrada Blanca mines in the Atacama Desert in Northern Chile. Collahuasi is the third-most-productive copper mine in the world, with an annual output of around 560,000-630,000 metric tons in recent years. Quebrada Blanca is currently ramping up its QB2 expansion. Teck Resources recently downgraded its 2025 guidance for the expansion to 210,000-230,000 metric tons from the previous forecast of 230,000-270,000 metric tons due to ongoing challenges with the mine's tailings storage system, which is necessitating additional capital and restricting production capacity.

Since Quebrada Blanca is just 15 km west of Collahuasi, by combining infrastructure, processing and logistics, their integration is expected to generate approximately $1.4 billion in additional underlying EBITDA annually (100% basis) between 2030 and 2049. It also has the potential to increase copper output by 175,000 metric tons per year. Such integrations are rare, offering both capital-efficient production uplift and cost reductions.

Beyond individual mines, the combined entity will realize synergies in procurement, technology sharing, management and maintenance improvements across six world-class copper mining sites. The merger is also expected to enhance the technical expertise pool, advancing mining digitalization, water management and sustainability practices.

Anglo Teck inherits a robust pipeline of copper mining projects encompassing brownfield expansions and greenfield developments. Near-term growth will likely be driven by projects aimed at extending mine life and optimizing production at existing sites, such as Collahuasi, Quebrada Blanca and Highland Valley. Teck Resources' approved life-extension investment of C$2.1 billion-C$2.4 billion in Highland Valley will sustain production through 2046 and secure considerable employment levels while improving operational sustainability and throughput. Investments in infrastructure, processing capacity and operational improvements offer tangible returns and risk mitigation.

On the greenfield side, the pipeline includes promising copper deposits such as Galore Creek and Schaft Creek in British Columbia, which have attracted sustained interest due to their scale and grade potential. Other advanced projects in line for development include NuevaUnion in Chile and Zafranal in Peru. Anglo Teck's additional prospects include San Nicolas in Mexico, NorthMet in the US and Sakatti in Finland, diversifying geographical and geological risk while enhancing growth optionality. These projects, while promising, may face altered timelines or scaled-back ambitions depending on executive prioritizations, commodity price trajectories and permitting progress.

Among the greenfield projects in the US, NorthMet stands out for having been granted FAST-41 status by the US government. The program, designed to expedite and increase transparency for the permitting of critical infrastructure projects, should shorten permitting timelines for the copper and nickel deposit. NorthMet is currently controlled by a Glencore PLC-Teck Resources joint venture.

Anglo Teck plans to significantly bolster exploration investment, committing at least C$300 million over the next five years in Canada alone, focusing on innovation and technology-driven mineral discovery. However, historically, merged companies often have smaller combined exploration budgets compared to their previous individual expenditures. The integration should also enable streamlined permitting, financing and project execution, speeding up time to market for promising projects.

With copper demand set to surge amid the global push for electrification and sustainability, the Anglo Teck merger consolidates premier assets and operational synergies, offering a pathway to significant growth in copper production. The consolidation of world-class mines in Chile, Peru, Canada and the US, coupled with a pipeline of brownfield expansions and greenfield projects, establishes the merged entity as a critical pillar in securing future copper supply.

However, it is important to view this optimistic growth in the context of merger dynamics, where one of the key risks involves reprioritization of projects within a larger portfolio. Historically, large mining mergers tend to result in strategic portfolio reviews aimed at focusing capital investment on the highest-return and lowest-risk projects. This process can create uncertainty or delays for certain greenfield developments, especially those with regulatory, technical or social complexities, which might be deferred or restructured to favor near-term cash flows and operational stability.

This reprioritization risk must be balanced against the critical reality facing global copper supply. We forecast a copper concentrate deficit of 3.2 MMt by 2035 due to slowing discovery, dwindling ore grades, volatile geopolitical landscapes and extended development cycles, which could constrain the green energy transition and industrial growth.

Consequently, Anglo Teck's scale, geographic diversification and operational synergies provide an advantage in navigating the supply-demand squeeze, but the market and stakeholders must monitor how pipeline decisions evolve post-merger, as deferrals or cancellations of key projects could exacerbate global copper scarcity. The merger is not only a consolidation of assets but a critical test of strategic capital allocation and regulatory agility under growing pressure to deliver robust, timely copper supply.

A related article on how Anglo Teck will position itself within the global copper market cost curve is currently being developed and will be published soon. The analysis will help clarify the merged entity's cost competitiveness relative to peers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.