Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Webinar

Live Webinar

Can the rebound survive the current upheaval?

After a prolonged slowdown, European equity capital markets (ECM) have been showing strong signs of recovery, with IPO activity gaining momentum and M&A dealmaking accelerating. With investor confidence improving, companies were returning to public markets, unlocking capital that had been sidelined during previous economic volatility. However, tariff announcements have hit capital markets hard, including in Europe, and the recovery is now under threat.

This webinar, hosted by the Financial Times in partnership with S&P Global Market Intelligence, will assess the durability of the recovery and whether it can survive the current shocks. Experts will discuss the longer-term impacts on market liquidity, valuations and investment flows.

Discussion points:

Financial Times

Financial Times

Markets Columnist

Katie Martin is a columnist and member of the FT's editorial board. She writes the weekly Long View column on market trends as well as other opinion pieces, and appears weekly on the Unhedged podcast. Previously, she spent four years as the FT's markets editor, and also several years on the FT's live news service. Prior to joining the FT in 2015, she spent 11 years at the Dow Jones/Wall St Journal group, also covering markets.

S&P Global Market Intelligence

S&P Global Market Intelligence

Associate Director, EMEA Sell-Side Business Development

Thomas Mercieca is an Associate Director in EMEA Sell-Side Business Development at S&P Global Market Intelligence, specialising in data and research solutions for investment banks.

With a background in Financial Institutions Group (FIG) advisory, Thomas helps sell-side professionals leverage cutting-edge data and analytics to drive better decision-making in M&A, equity research and capital markets.

J.P. Morgan

J.P. Morgan

Managing Director, Co-Head of EMEA Cash Equity Franchise Sales

Jojo Sanders, Managing Director, is the Co-Head of EMEA Cash Equity Franchise Sales looking after all of the people responsible for selling the global cash equity product to clients in EMEA.

Ms Sanders re-joined J.P. Morgan in 2019 having started her career here in 2002. In the interim she spent 10 years at Bank of America Merrill Lynch and 3.5 years at Berenberg covering a broad range of accounts on a global and UK basis connecting key decision makers across geographies and products.

From life on the nascent J.P. Morgan hedge fund desk in 2002 to running the Europe to Asia franchise at Berenberg she has wide understanding of different client needs. She has a PPE degree from Wadham College, Oxford

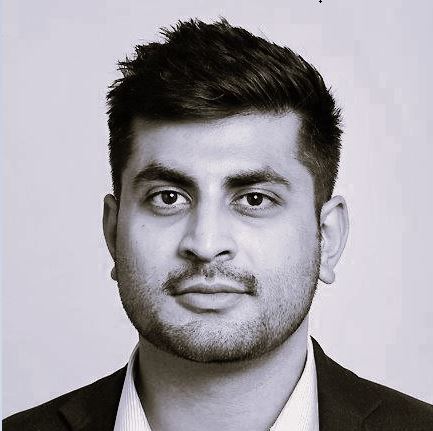

Deutsche Bank

Deutsche Bank

Director of EMEA Equity Capital Markets Syndicate

Harsh Patel is a Director on the EMEA Equity Capital Markets (ECM) Syndicate team at Deutsche Bank. He is responsible for the execution of EMEA ECM mandates at the bank, including IPOs, follow-ons, rights issues and equity-linked transactions.

He was previously at Citigroup and has a total of more than 10 years of experience within ECM.

He has a BSc in Economics from the London School of Economics and Political Science.

Goldman Sachs

Goldman Sachs

Co-head EMEA Equity Capital Markets Origination

Please contact us if you need more information or have trouble accessing the webinar.