Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Ratings acknowledges a high degree of uncertainty about the rate of spread and peak of the coronavirus outbreak. Some government authorities estimate the pandemic will peak about midyear, and we are using this assumption in assessing the economic and credit implications. We believe the measures adopted to contain COVID 19 have pushed the global economy into recession (see our macroeconomic and credit updates here: www.spglobal.com/ratings). As the situation evolves, we will update our assumptions and estimates accordingly.

By Jose Perez-Gorozpe, Tatiana Lysenko, Elijah Oliveros-Rosen, and Sudeep Kesh

Highlights

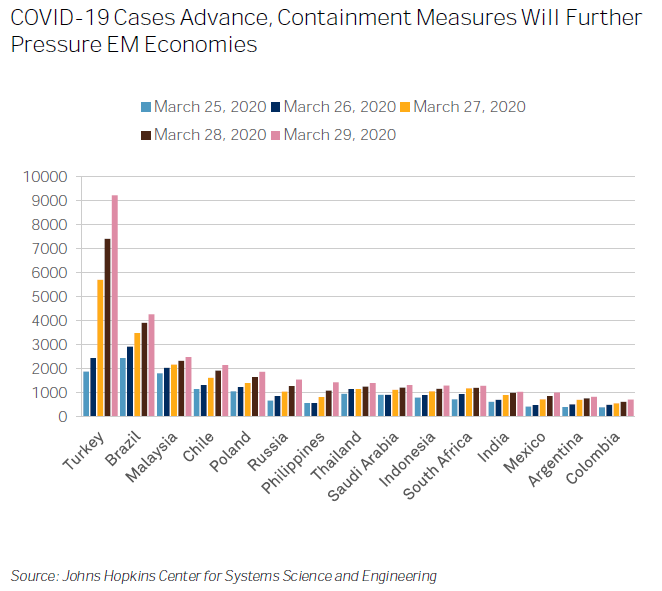

Emerging markets (EMs) are facing severe stress resulting from three simultaneous shocks, as COVID-19 pandemic spreads globally. All key emerging economies that we cover will fall into recession or see sharply lower growth in 2020.

We believe stress could become more significant in the coming weeks given that most EMs are only beginning to show an escalation of COVID-19 cases. As the epidemic accelerates, measures to contain the spread of the virus will compound the hit to economic activity from external shocks.

The strength of eventual recovery will crucially depend on policy measures to cushion the blow and limit economic dislocation. Policy space differs across EMs.

A permanent influence on modes of working is likely. Significant portions of respondents expect policies implemented in response to the coronavirus outbreak to be permanent. These include work-from-home policies (38%), travel limitations (23%) and reduced event attendance (16%).

Downside risks are significant. Prolonged outbreak will depress activity and stress health systems. Extended shock to investor sentiment could result in heightened refinancing risk, especially for low rated issuers.

Outlook. EM economies are heading for a recession, amid financial market volatility. The external shock from COVID 19 is now compounded by measures to contain the epidemic as the virus spreads across EMs.

Risks. Prolonged outbreak will depress activity and stress health systems. Tightening financing conditions, if sustained, will bring additional stress to issuers across EMs. Refinancing risks could rise.

Credit. Current conditions will pressure high yield ratings and defaults could be expected in the most vulnerable issuers.

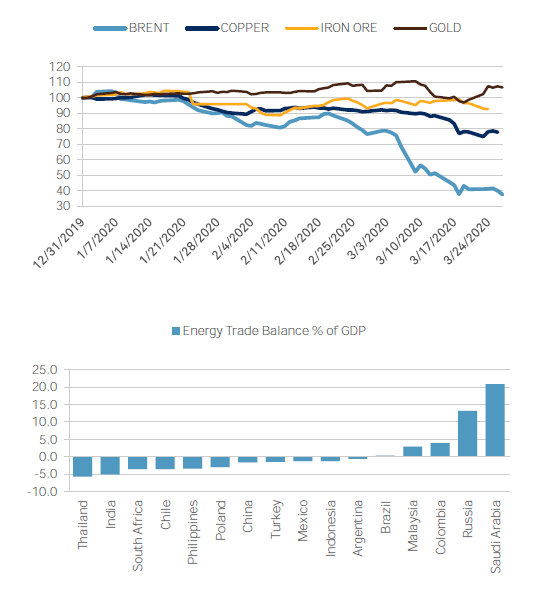

Outlook. The effects of COVID 19, along with tensions in the OPEC+ group, pressured commodity prices. We have reviewed our assumptions for key commodities for 2020 including oil and metals. We expect the shock to be temporary.

Risks. Declining commodity prices curtail investor confidence for emerging markets, given that such conditions are usually driven by soft global growth and volatile markets.

Credit. While some EMs might benefit from lower fuel prices, factors for such conditions, including slower global growth and tighter financial conditions, will pressure credit quality across EM economies.

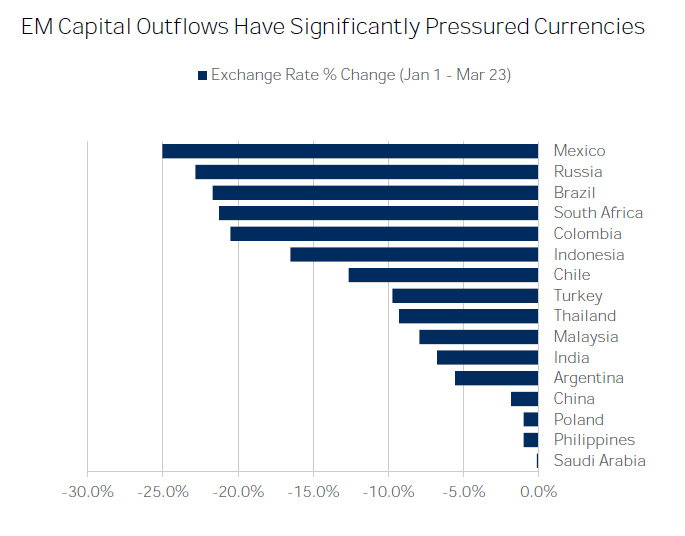

Outlook. Significant questions about the depth and breadth of COVID on global economy and supply chains caused extreme capital outflows from EMs to risk free assets . Speed of outflows from EMs is without precedents.

Risks. Adverse investor sentiment towards EMs is pressuring currencies and liquidity. Continued outflows could ultimately elevate refinancing risk and inflationary pressures. Many EMs have little space for maneuver.

Credit. Extended shock to investor sentiment could result in heightened refinancing risk, especially for low rated issuers.

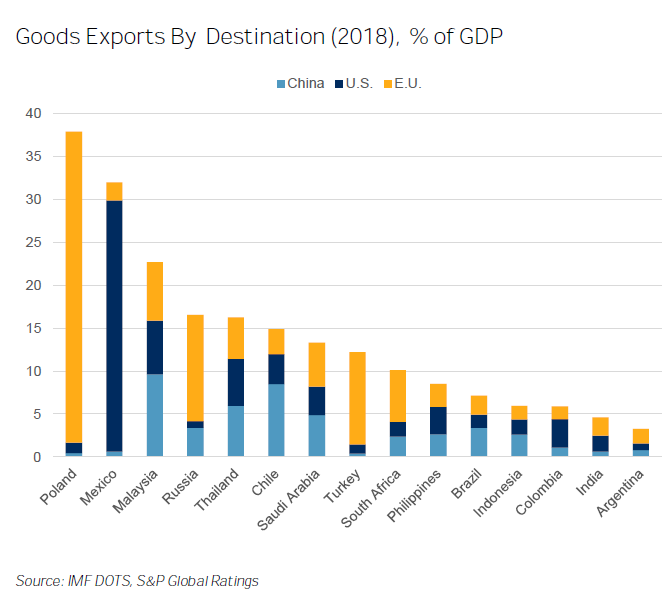

Trade disruptions will be felt across EMs. The shock to demand, especially in the regions that are most affected by the virus China, the U.S., and Europe will take a heavy toll on EM exports.

Trade exposure varies. Russia, Poland, and Turkey rely heavily on European demand for their exports. Malaysia, Chile, and Thailand are highly exposed to China, meanwhile Mexico sends nearly 30% of GDP worth in exports to the U.S.

Imports also matter. Several EMs also rely on imported inputs from areas heavily affected by COVID 19, causing supply chain disruptions.

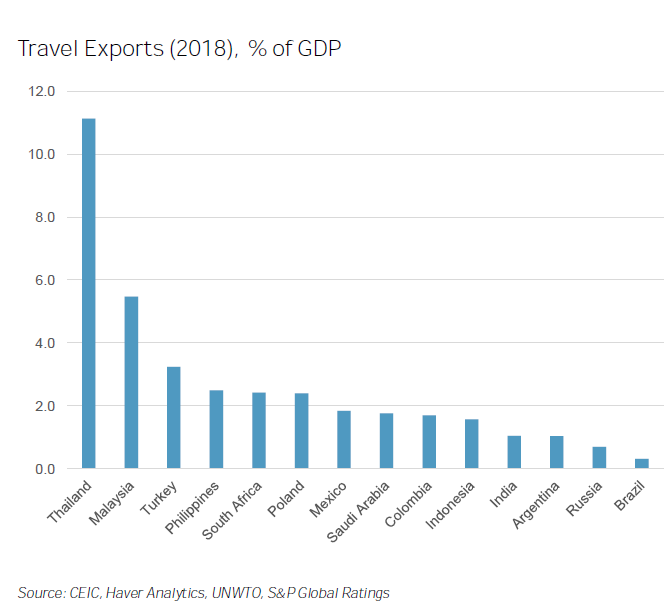

Tourism at a halt. Travel bans have paralyzed the tourism sector, which will result in significant job and revenue loses in several EMs.

Sizeable hit to GDP. Revenue from international tourists alone accounts for more than 2% of GDP in several major EMs.

Uncertainty on when tourism will recover. As travel bans start to get relaxed, loss of income and economic uncertainty could delay the recovery in discretionary spending on items such as travel.

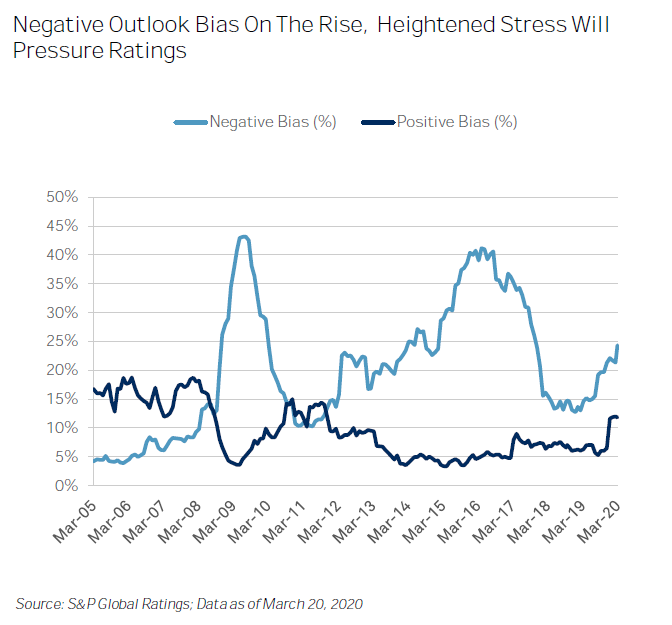

Negative outlook bias is already on the rise, and we expect it will accelerate over the coming weeks as COVID 19 spreads across EM economies and containment measures are implemented.

There is a large number of issuers rated in speculative grade level across emerging markets, which will suffer most as economic and financing conditions deteriorate.

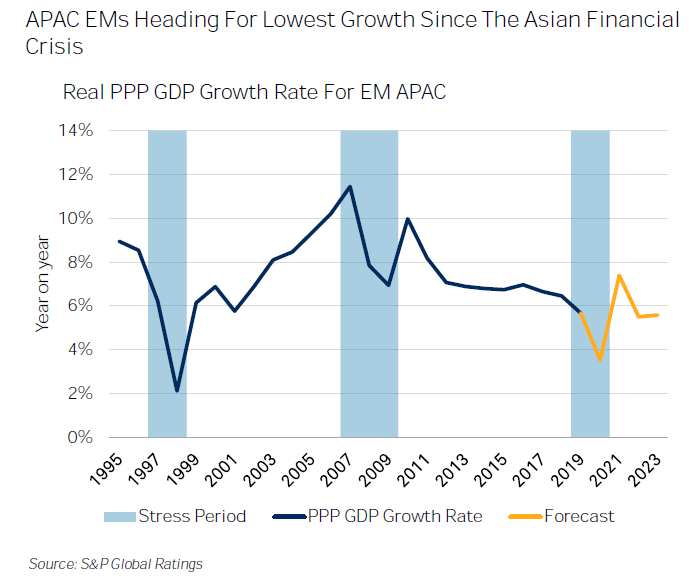

Growth. Discretionary consumption will be battered due to virus prevention efforts. Lockdowns across the world mean that tourism and related spending will collapse. We forecast growth of 3.5% for EM APAC in 2020, the lowest since 1998.

Policy. There has been targeted fiscal stimulus that will cushion the blow to growth. We expect further monetary easing; however, tighter external financial conditions constrain room for policy measures.

Risks. Further spread of the virus is the chief risk that could lead to sharp welfare and economic losses. Healthcare infrastructure in parts of the region remains patchy.

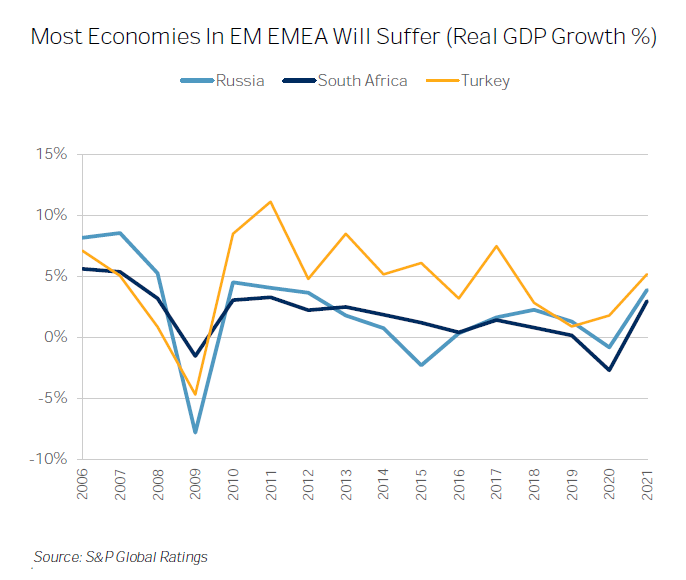

Growth: While external exposure varies across EMEA EMs, from commodity exports to tourism, most economies will be hit hard. Domestically, containment measures are ratcheting up, which will depress activity.

Policy. Room for further monetary easing might be constrained in the risk off environment. Limited clarity on fiscal support measures at this point.

Risks. Prolonged outbreak will result in higher costs. Policy mistakes may impede the recovery.

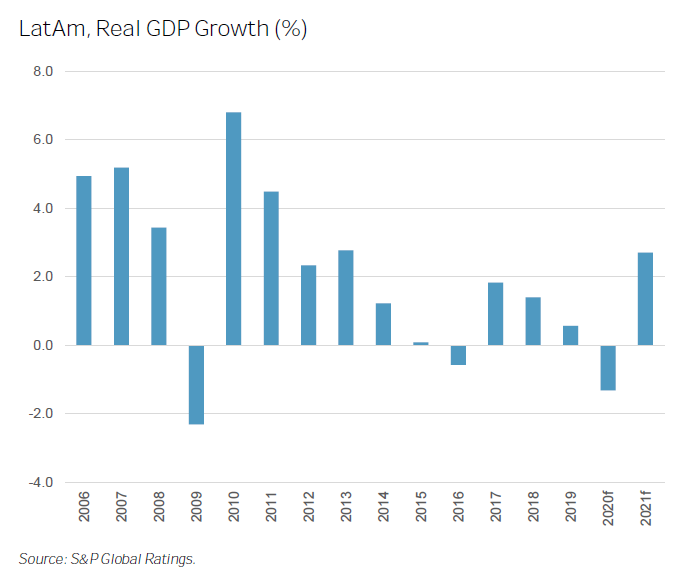

Virus no longer just an indirect impact . The sharp increase in confirmed cases across the region is prompting travel bans, social distancing measures, and factory closures.

Bad timing . Several economies in the region were already experiencing some of their weakest growth rates since the GFC, and this health crisis will push most LatAm countries into a recession this year.

Risks to speedy recovery . We expect economic activity will start to recover towards the end of 2020 and into 2021. However, policy mistakes and failure to mitigate the spread of the virus could slow or delay the expected recovery.

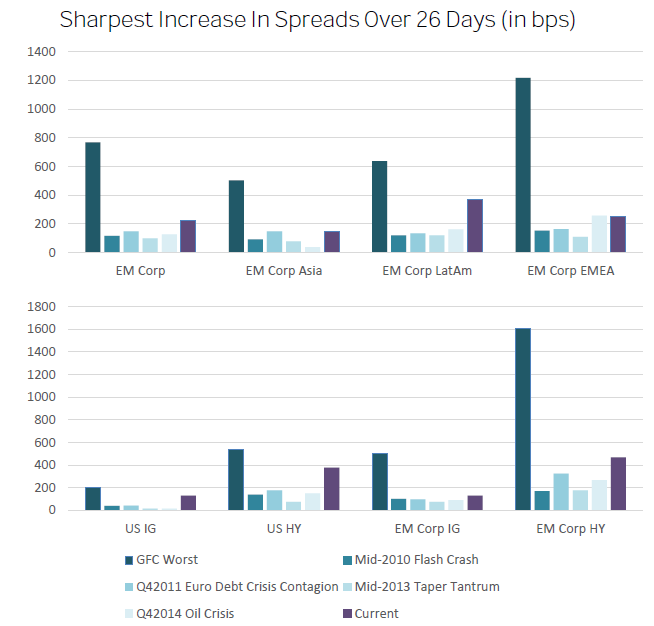

Elevated risk aversion. EMs' bond spreads quickly escalated to the highest levels and at the fastest pace in a decade, owing to a flight to quality as COVID 19 wreaks havoc on capital markets.

Risks. Weak investor confidence will likely constrain debt issuances, despite accommodative monetary policy across most emerging economies due to reduced capital needs and weakening demand for goods and services across most economies.

Issuances Cumulative corporate bond issuances across EMs total $247 billion through March 10, 2020, after new debt capital stalls due to COVID 19 choke on demand.

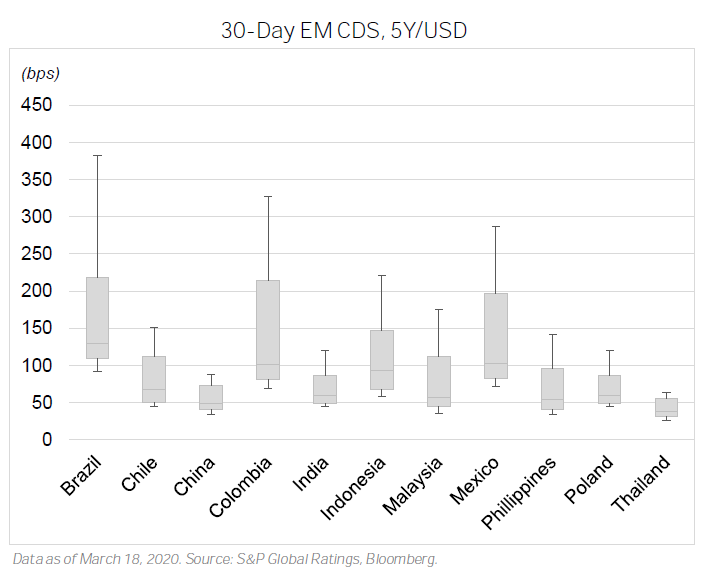

Widening spreads. credit default swaps (CDS) have rapidly expanded, signaling sizable investor concern about sovereign financial health.

Flashing signals. Spreads widened an average of 130 bps across EMs in the past 30 days.

Increasing leverage . Stimulus measures by various governments used to provide liquidity, calm market sentiment, and fund public health efforts against COVID 19 are invariably adding additional leverage to an already highly levered market.>

Downgrades outpace upgrades . In 2020 so far, downgrades are outpacing upgrades by a slightly larger margin than in 2019.

Sovereign downgrades . Argentina, Lebanon, Zambia, and Emirate of Sharjah all saw downgrades (and default in the case of Argentina and Lebanon) so far in 2020.

Upgrades limited. Idiosyncratic conditions limit upgrades in 2020 as they had in 2019.

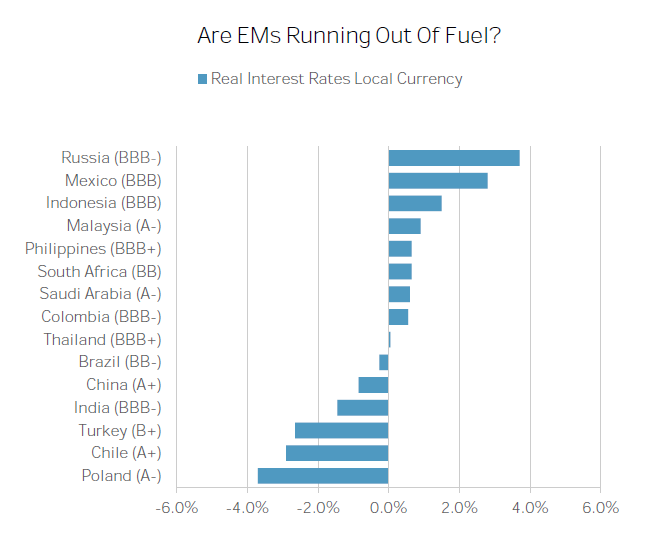

On average, key EMs have lowered their policy rates 70 bps since January.

Some EM economies still have space to cut rates and challenging conditions demand monetary stimulus. Although, currency pressures and pass through to inflation effects might prevent central banks from further easing.>

Content Type

Location

Language