Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 12 May, 2020

By Anu Ganti

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

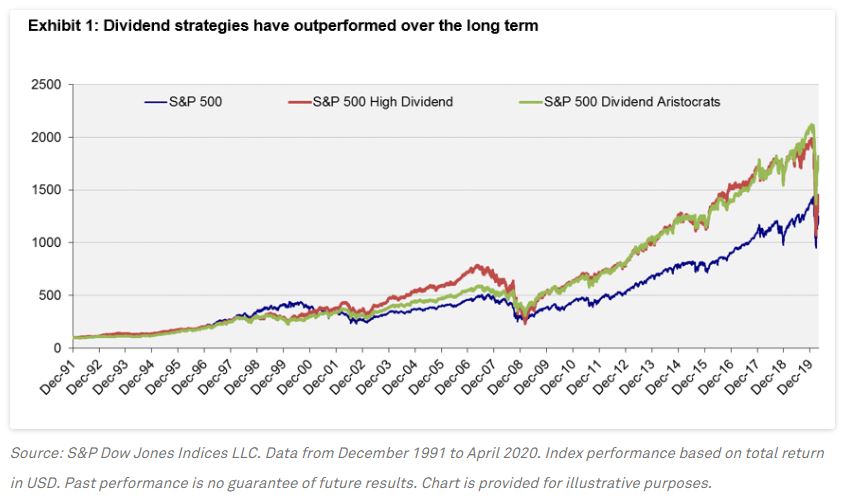

Dividends play a vital role in many investors’ approach to the market, although there is more than one way to approach dividends. Some investors are most concerned with dividend yield per se, while others are more sensitive to the growth of dividends over time. Both approaches, of course, can be readily indicized. Within the U.S. large capitalization universe, the S&P 500 High Dividend Index comprises the highest-yielding companies in the S&P 500. The S&P 500 Dividend Aristocrats, in contrast, consists of S&P 500 members that have increased their dividends annually for at least 25 years. Exhibit 1 shows that both strategies have outperformed the S&P 500 over the long term.

In the short run, however, investor attention has turned increasingly to the sustainability of dividends, as more companies continue to cut or suspend their payouts. We previously discussed the tradeoff between the level versus the safety of dividend payments, and illustrated the durability of the S&P High Yield Dividend Aristocrats compared to an equivalent universe of high-payers. Here we conduct a similar analysis for large-cap Aristocrats, comparing them to the S&P 500 High Dividend Index, and see similar results: The S&P 500 Dividend Aristocrats’ dividends are safer than their high yielding peers.

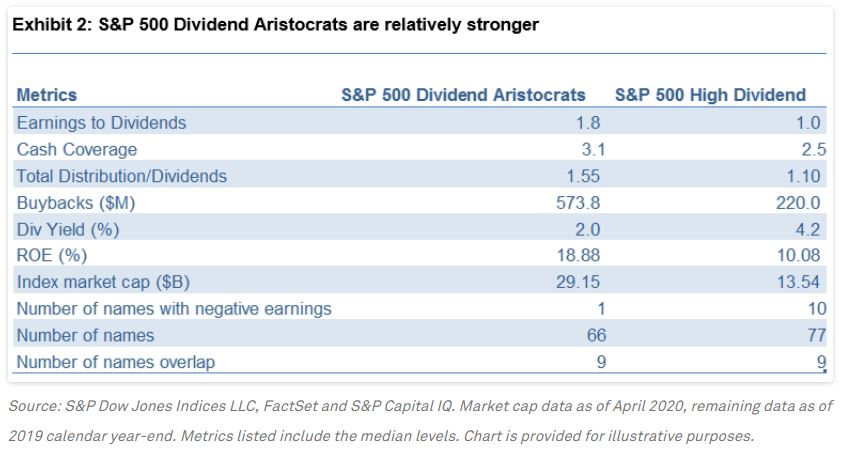

Exhibit 2 compares the median values of the 500 Dividend Aristocrats and the High Dividend Index on a number of fundamental metrics that measure the strength of companies making dividend payouts.

The S&P 500 Dividend Aristocrats appear stronger across the board. For example:

We again caution that while we do not know how many more companies will cut or suspend their dividends or how severe the impact will be, we can conclude that the dividends of large-cap companies with consistent dividend growth are in healthier shape to withstand economic and market declines.