Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Sep, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

As the global race to net-zero intensifies, all eyes are on Europe as a model for a sustainable future. The region leads the world in adopting climate policy and regulation, green bond issuance, and renewable energy integration.

The European Union’s expansive “Fit for 55” climate roadmap, announced in July, introduced a dozen sweeping legislative proposals to help sectors across the economy curb greenhouse gas emissions by 55% below 1990s levels and utilize renewables for 40% of gross final energy consumption by 2030. Although the path to implementation will be challenging, the package “is the most comprehensive suite of policies announced by any government to date to achieve broad decarbonization of an economy," according to S&P Global Platts Analytics. The E.U. has since introduced further climate regulation proposals—targeting financial institutions’ climate risk and overall sustainable finance disclosures—that no other economy has yet been able to match or emulate.

The aggressive climate action is necessary to combat compounding climate risk. Across many areas of Europe, water stress will be the biggest climate-related risk three decades from now, according to S&P Global Trucost data.

"The fossil fuel economy has reached its limits," European Commission President Ursula von der Leyen said when announcing the “Fit for 55” climate package. "Europe was the first continent to declare to be climate neutral in 2050, and now we are the very first ones to put a concrete roadmap on the table. Europe walks the talk on climate policies through innovation, investment, and social compensation.”

Europe’s green bond issuance is likely to catapult global green bond issuance to record highs this year as new European green bond standards and international decarbonization efforts attract more investors to sustainable finance. European green bond issuance in the second quarter marked a 30% year-over-year increase, to total $53.37 billion, and pushed global issuance to $202.09 billion in the first half of 2021, according to the U.K. non-profit Climate Bonds Initiative. Similarly, sustainability-linked issuance in Europe has continued the upward trajectory seen during the first half of the year.

In pursuit of the global energy transition from fossil fuel generation to clean energy sources, European policymakers and oil and gas majors are leading the world in both offshore wind and hydrogen investments. The region’s largest coal plant is set to permanently shut down by 2036. Investors are expressing interest in Spain’s thriving renewables market, and Greece has made strides to reform its power market to lure in the same frenzy of international attention.

“Europe has established itself as a seat of offshore technology on the back of advanced know-how, supportive policies, and governments' targets,” S&P Global Ratings said in a recent report. “The continent's push to cut greenhouse gas emissions to 55% below 1990 levels by 2030, and become climate neutral by 2050, implies a huge increase in renewable energy sources.

Europe aims to install more than 100 gigawatts of offshore wind capacity by 2030, from today’s 25 gigawatts, and may need to install at least 400 gigawatts more of capacity in order to achieve net-zero by 2050, according to S&P Global Ratings. The U.K. has solidified its position as the world’s leader in the technology with new offshore wind projects and investments, having long been the global economy’s offshore wind forerunner.

S&P Global Platts Analytics projects that the amount of current European electrolyzer project proposals is close to the EU's 6 gigawatts capacity target for 2024, which would be able to produce up to 1 million metric tons per year of renewable hydrogen. European governmental agencies have urged market participants to go all in on green hydrogen, and large natural gas companies in the region are pushing forward with new hydrogen projects in the immediate term, according to S&P Global Market Intelligence. These include the Italian natural gas company Snam, which is spending half of its four-year €7.4 billion investment budget on preparing its infrastructure for hydrogen, and industrial players like Ireland’s Linde and France’s Air Liquide that have reimagined themselves as producers of low-carbon hydrogen.

"We could very comfortably just wait another 10 years to see which direction the market goes and then adapt … [But] I think there's a lot of value to be created in being a first mover,” Snam CEO Marco Alverà told S&P Global Market Intelligence. "I think we're doing the right things. We're not doing it in a defensive way. We're building these [energy transition ventures] so that, over time, they can become, hopefully, as profitable as our core business, which means the company will grow four, five times in size… We're much more part of the solution than part of the problem… There's just a lot that a company can do in 30 years.”

Today is Monday, September 27, 2021, and here is today’s essential intelligence.

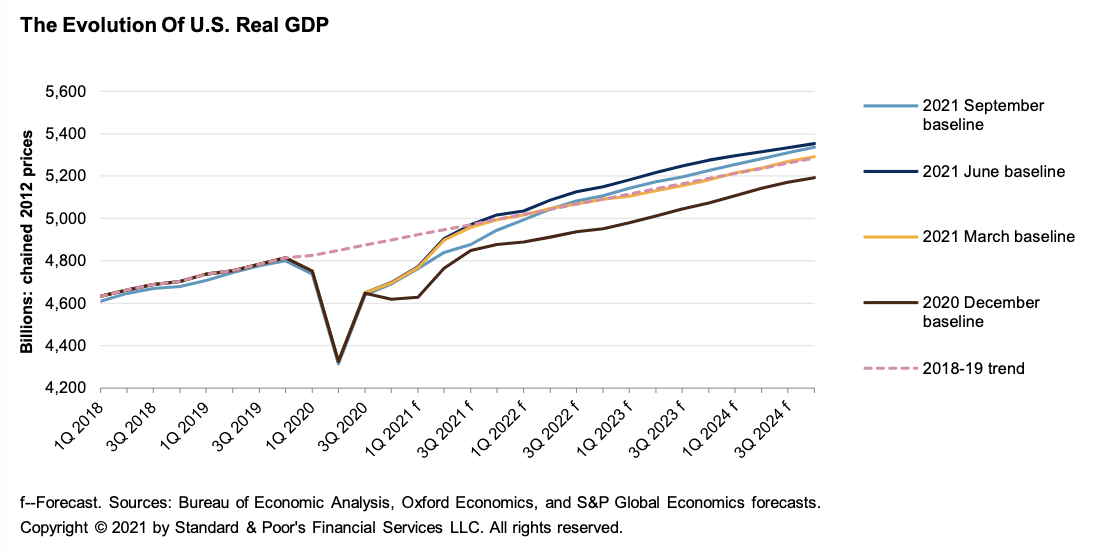

Economic Outlook U.S. Q4 2021: The Rocket Is Leveling Off

While still running hot, the U.S. economy has cooled as summer ends. Supply disruptions remain the leading suspect slowing the world's biggest economy, and the delta variant is now an additional drag.

—Read the full report from S&P Global Ratings

Higher Claims Severity, Driving Activity May Create Bumpy Road For Auto Insurers

Higher U.S. private auto insurance claims severity could start to seriously weigh on business line results as loss frequency rebounds to pre-pandemic levels.

—Read the full report from S&P Global Market Intelligence

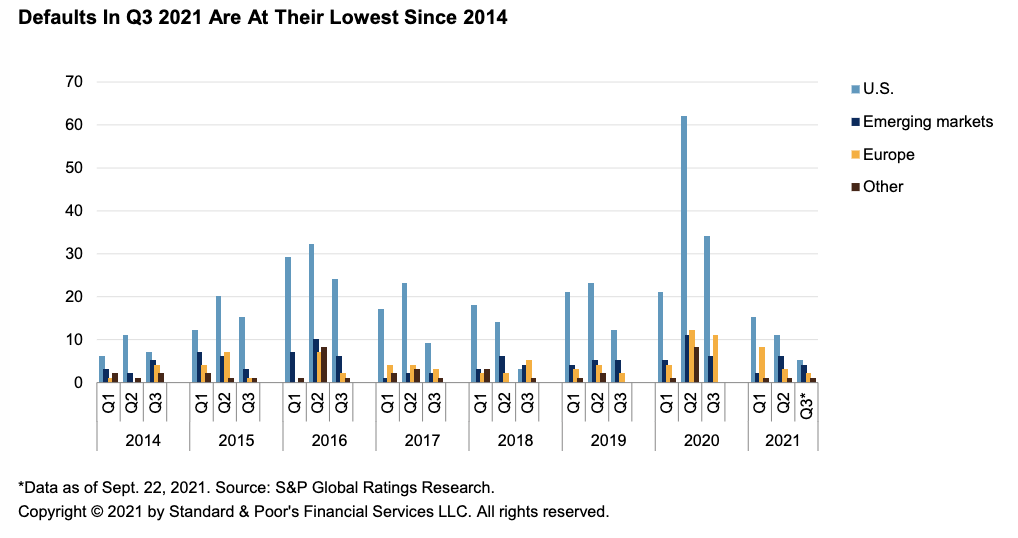

Default, Transition, and Recovery: Array Canada Becomes The First Default In September

The 2021 global corporate default tally remained at 59 this week after Toronto-based marketing services provider, Array Canada Inc., defaulted this week and one confidential issuer was removed from the tally due a monthly reconciliation process.

—Read the full report from S&P Global Ratings

U.S. Housing Finance Agency Ratings Hold Strong Despite Pandemic Pressure

U.S. state housing finance agency (HFA) issuer credit ratings generally remained strong from 2020 through the first nine months of 2021. Of 23 state HFAs rated, all but one are rated 'AA-' or higher.

—Read the full report from S&P Global Ratings

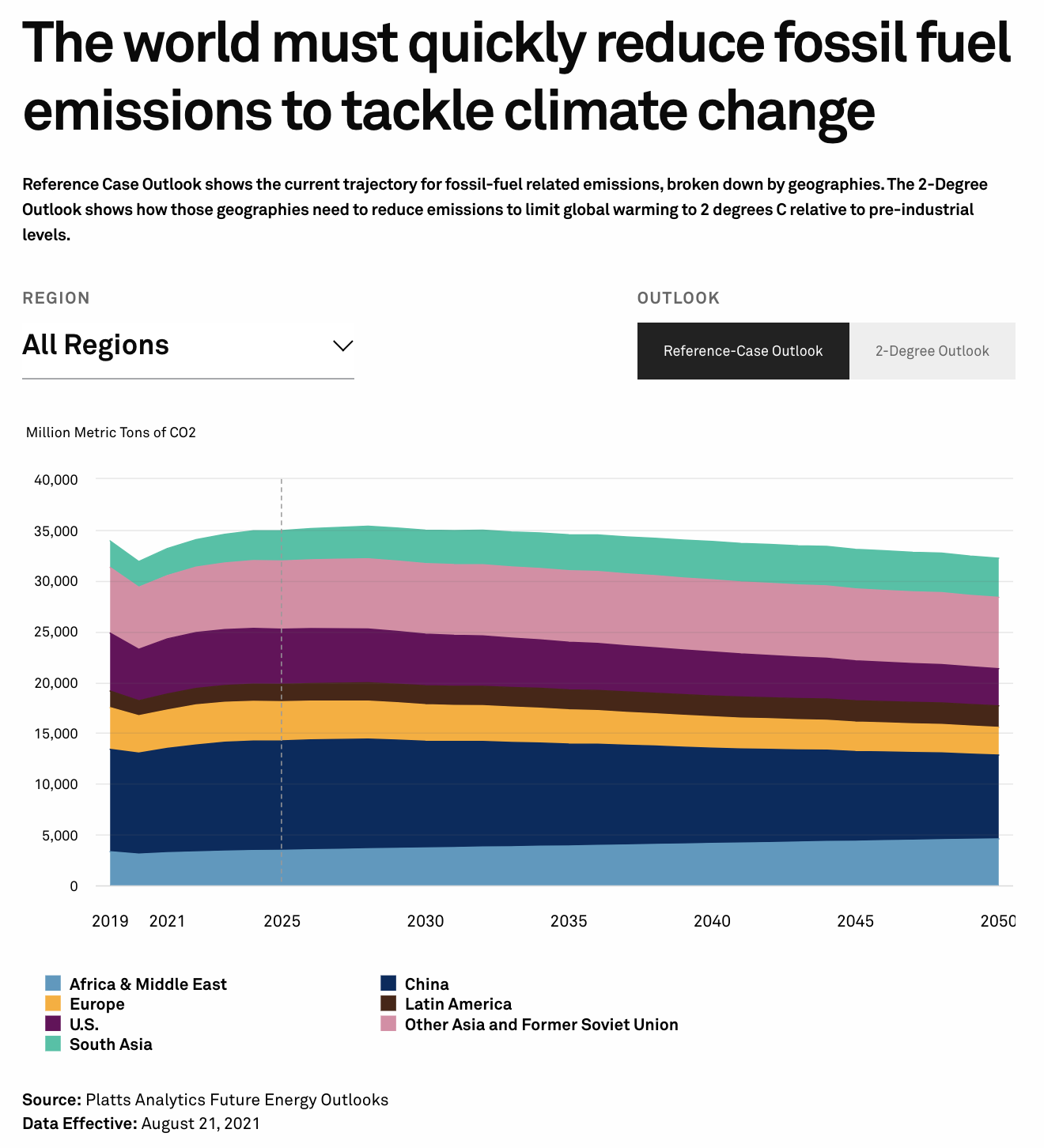

2025 Could Mark a Tipping Point for the Low-Carbon Energy Transition

Even though most national net zero targets are decades away, the world would need to make significant strides in decarbonizing energy-related emissions within the next four years to achieve net zero emissions by 2050.

—Read the full report from S&P Global Sustainable1

High Metal Prices Could Slow The Race To Zero Carbon

Rising metal prices could slow the world's transition to clean energy by stalling efforts to cut the price of electric vehicles and battery storage systems.

—Read the full report from S&P Global Market Intelligence

Hydrogen Threatens To Drive Wedge Between Democrats, Climate Activists

After U.S. Energy Secretary Jennifer Granholm met with grassroots organizers in Brooklyn in June, the leader of Latino community organization UPROSE was optimistic about the Biden administration's outreach to citizens on climate policy. However, the community leader expressed concerns over one of the administration's energy policy priorities: harnessing the potential of hydrogen coupled with carbon capture and sequestration.

—Read the full report from S&P Global Market Intelligence

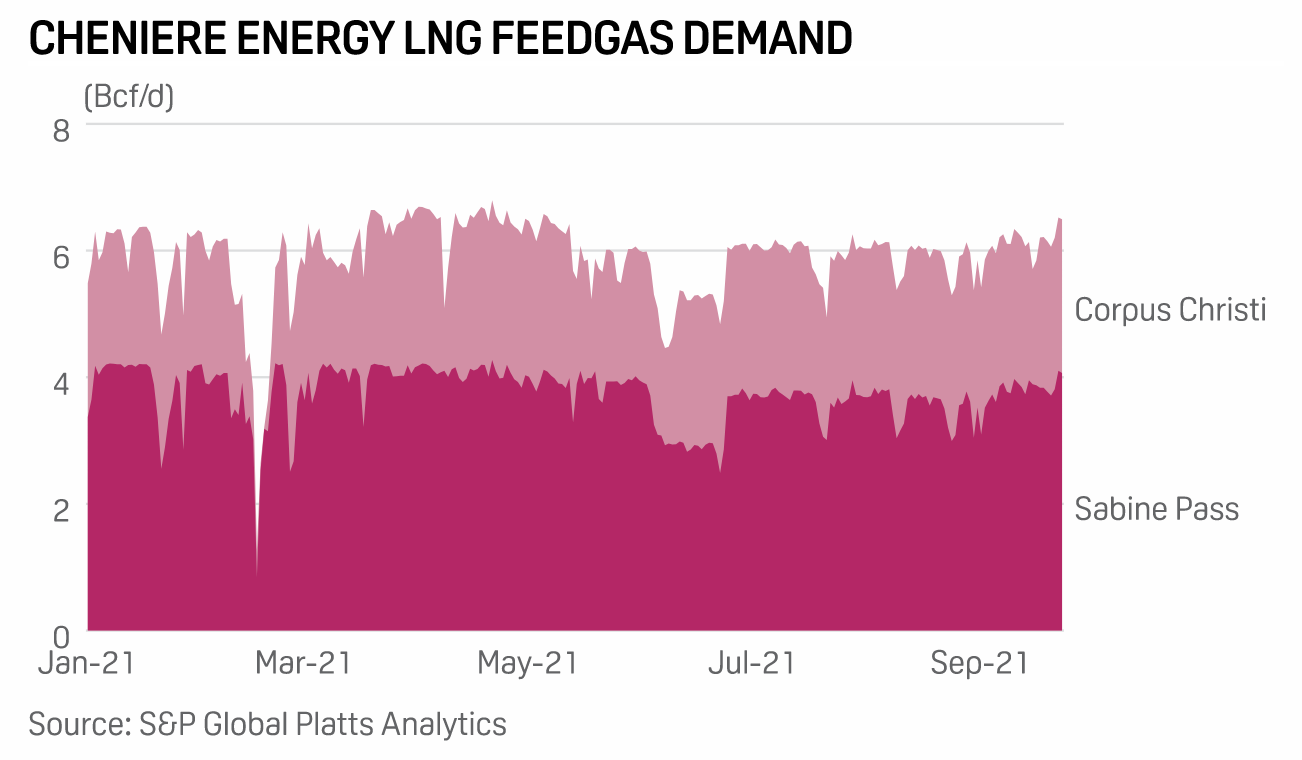

Cheniere Feedgas Demand Hits 4-Month High Amid Sabine Pass T6 Commissioning

Feedgas deliveries to Cheniere Energy's Sabine Pass liquefaction facility in Louisiana hit their highest level since May after the terminal was given the go-ahead to begin flows to its sixth train as part of commissioning.

—Read the full report from S&P Global Platts

Feature: Singapore Bunker Market Set To Consolidate Further Amid Fierce Competition

Intense competition in the Singapore delivered bunker market that has squeezed margins, particularly for IMO-complaint low sulfur bunker fuel, is limiting the ability of some players to operate profitably, industry sources told S&P Global Platts in the week to Sept. 24.

—Read the full report from S&P Global Platts

Analysis: China Steps Up Natural Gas Supply For 2021-22 Winter-Spring Season

China, the world's largest natural gas consumer, has been shoring up gas supply for the coming 2021-2022 winter-spring heating season, in a bid to prevent a supply shortage similar to the one it experienced in the previous winter.

—Read the full report from S&P Global Platts

Liberty Plans To Restructure Belgian Steel Plants; Galvanizing Line Closure Expected

Liberty Steel Group is planning a possible restructuring of its Belgian steel plants, Liberty Liège's Flemalle and Tilleur, to ensure their sustainable long-term future, a group spokesperson said Sept. 23.

—Read the full report from S&P Global Platts

Ukrainian steelmakers suffer as natural gas prices boom, but Russian metals companies unscathed

Ukrainian metal companies have started to feel the effects of rising natural gas prices on their production costs, but their Russian peers are relatively shielded because of state regulation of the natural gas market and because of the sheer number of gas providers, according to several industry sources.

—Read the full report from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Language