Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Sep, 2023

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Nearshoring Provides Opportunity for Mexico

Profound opportunities lay before Mexico as companies with and without existing operations in the North American country engage in a new round of nearshoring investments.

Low costs and geographic proximity to the world's largest market make Mexico a near-ideal destination for nearshoring, yet some challenges remain. Mexico's energy dependence and transmission infrastructure are key challenges preventing it from becoming a nearshoring hub.

On the energy production and power generation side, Mexico depends heavily on natural gas imported from the US and has limited renewable capacity. On the transmission side, infrastructure is concentrated in industrial corridors that emerged after the North American Free Trade Agreement (NAFTA) was established in 1994. These corridors are, however, saturated and require more transmission infrastructure, independent consultant Rosanety Barrios told S&P Global Commodity Insights.

Competition from other nearshoring destinations, such as Vietnam, is another challenge to Mexico's future as a reshoring hub. Vietnam has lower labor costs and operational risk scores than Mexico, but Mexico's proximity to the US helps balance that.

But what's driving this new wave of nearshoring investments and supply chain shuffling?

Several geopolitical factors play important roles. Supply chains for every industry, are adjusting not only to the impacts of COVID-19 and the war in Ukraine, but also to trade spats between the US and China and the renegotiation of NAFTA that resulted in the US-Mexico-Canada Agreement.

Rafael Amiel, director of Latin America and Caribbean economics at S&P Global Market Intelligence, said that the new agreement gives Mexico preferential access to the US market and increases stricter rules of origin to pressure companies to increase production in North America.

Mexico also has several demographic assets that attract companies. The country’s labor force availability, for example, is attractive for companies looking to reshore as the median age in Mexico is 29, according to Emily Crowley, a principal economist in S&P Global Market Intelligence's Pricing and Purchasing labor team.

While the opportunity exists, Mexico's energy generation and transmission infrastructure around industrial corridors require work to enable it to fully realize the benefits of becoming a reshoring hub.

Today is Monday, September 11, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

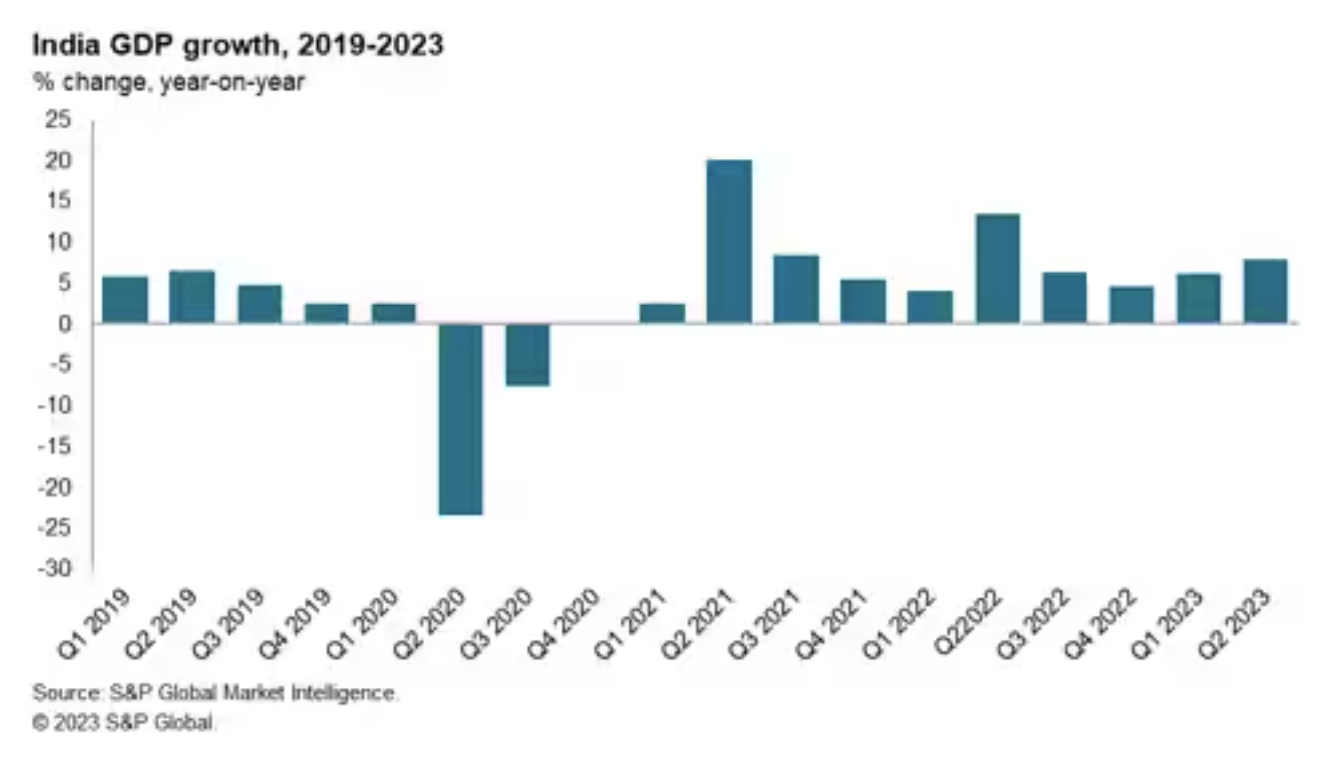

India's GDP Growth Remains Buoyant In 2023

India is expected to be the fastest growing nation in 2023 among the G-20 grouping of the world's largest nations that attended the G-20 Leaders' Summit hosted by India in New Delhi on Sept. 9-10. After rapid economic growth of 7.2% in the 2022-23 fiscal year, economic momentum has remained strong in the April-June quarter of 2023, with GDP growth of 7.8% year-on-year (y/y). The S&P Global India Services PMI Business Activity Index for August also signaled continued rapid positive momentum for output and new orders, while the August Manufacturing PMI survey showed strong expansion.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Short Interest Grows Across The Property Sector

As interest rates have continued to climb over the last twelve to eighteen months so has short interest across the property sector. Not only has the increase in interest rates decreased potential buyers' purchasing power whilst simultaneously increasing the risk-free rate of return for investors, but following the working from home revolution that was adopted during COVID, office space remains under-utilized and companies are looking to downsize to reduce costs.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Maritime And Trade Talk | Episode 20: A Long War In Ukraine

Roughly 18 months ago, Russia invaded Ukraine, sending shock waves through financial and commodities markets. Since then, we've seen rounds of sanctions from the US and EU, an expansion of NATO and an attempted mutiny in Russia. Still, the war grinds on. In this episode, hear about the outlook for the Russia-Ukraine conflict from Alex Kokcharov, S&P Global Market Intelligence's principal country risk research analyst. How long is the conflict likely to last? What risk factors could influence its trajectory?

—Listen and subscribe Maritime and Trade Talk, a podcast from S&P Global Market Intelligence

Access more insights on global trade >

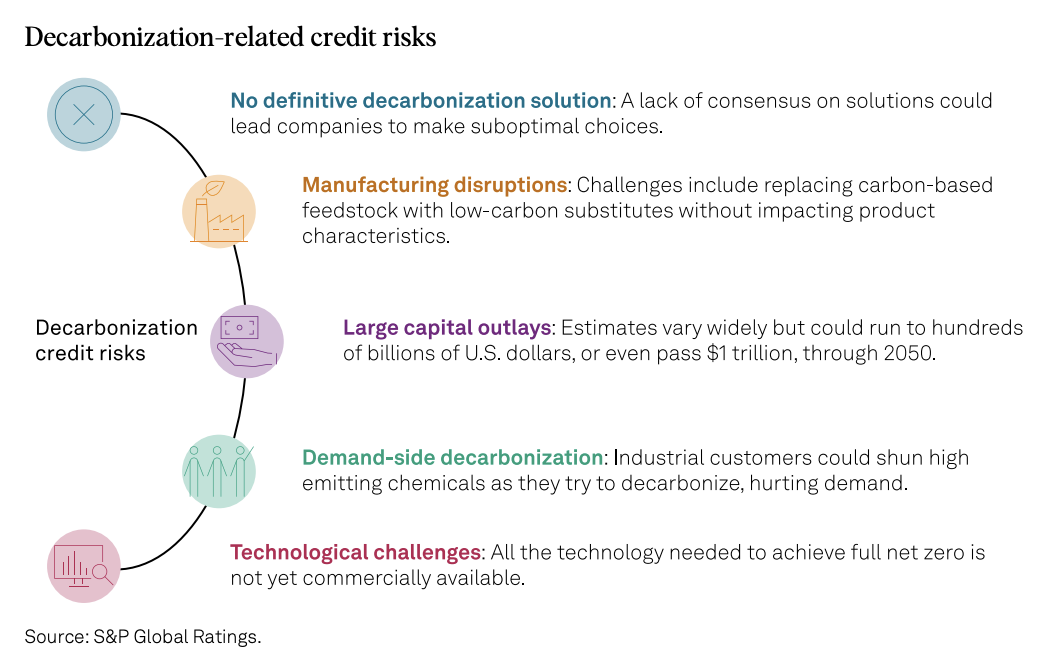

Sustainability Insights: Research: Decarbonizing Chemicals Part Two: The Credit Risks And Mitigants

There is no quick fix to decarbonize the chemical sector. The sector’s numerous (over 70,000) and heterogenous products, and dependence on carbon-based fuels and feedstock, create risks relating to decarbonization technology, costs and regulations. S&P Global Ratings assumes that companies will benefit from the future technological evolution and development of decarbonization options, thereby mitigating some credit risks. Decarbonization could create new markets and applications for some chemicals. While it sees potential risks for chemical companies, in S&P Global Ratings’ view the sector's credit risks are currently manageable under existing regulatory policies.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

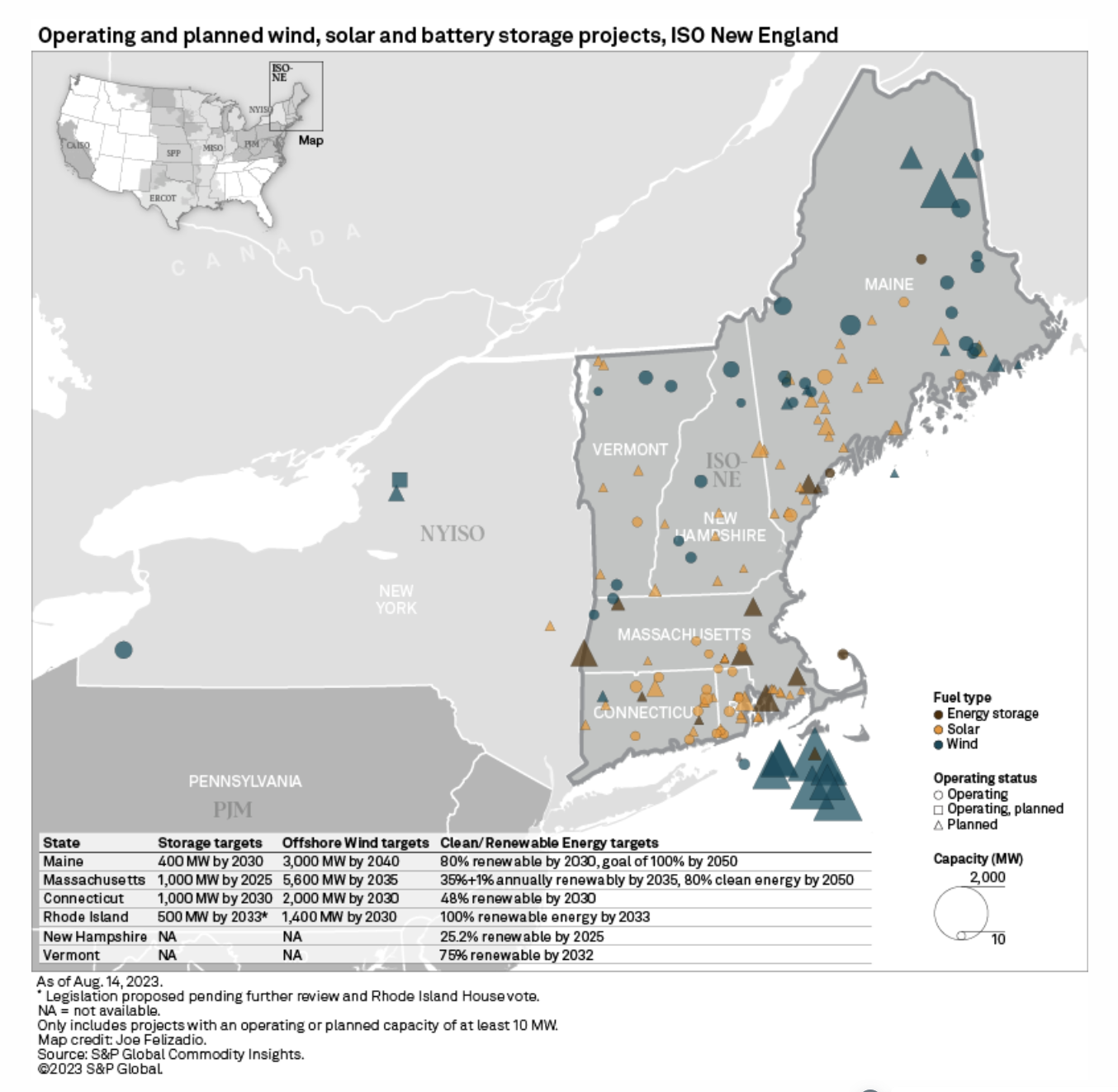

Proposed Offshore Wind Capacity Boosts Battery Storage Economics In New England

Grid-scale battery storage has yet to gain a firm foothold in ISO New England, with roughly 330 MW currently operating, mostly in the form of small projects of 5 MW or less. Prospects for battery storage are improving across the region due to state-level clean energy requirements and storage-specific targets. Robust renewable growth driven by offshore wind development is expected to add sufficient arbitrage revenue to make battery storage increasingly profitable through 2035, according to the Commodity Power Forecast for the second quarter of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

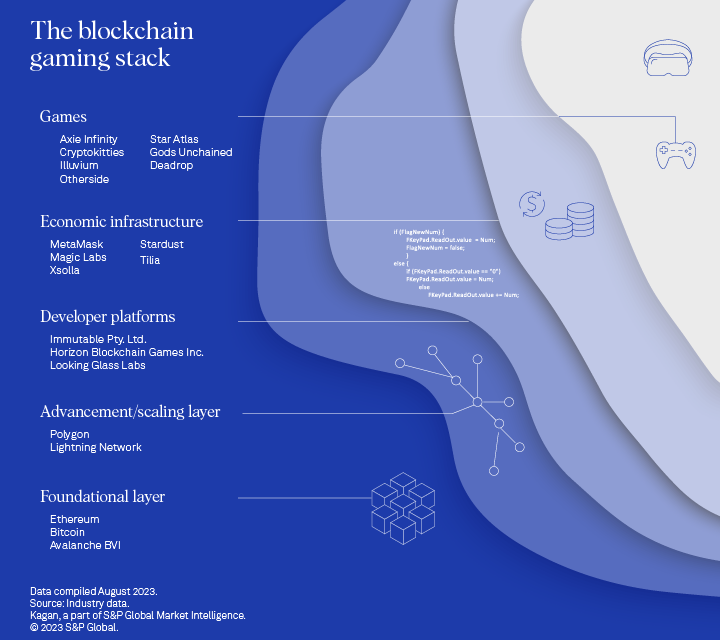

Blockchain Gaming Reaches Out For Microsoft, Xsolla

Blockchain service operators rolled out a wave of new announcements in August aiming to simplify the onboarding process for developers and players as the blockchain gaming market struggles to remain relevant after losing its momentum to the cryptocurrency crash in 2022. Blockchain gaming, sometimes known as crypto gaming or Web3 gaming, refers to interactive entertainment that leverages smart contracts tracked and stored on a decentralized ledger. The primary function for this model is the minting and trading of non-fungible tokens tied to in-game assets.

—Read the article from S&P Global Market Intelligence