Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Drought in China

In China, there’s just no beating the heat this summer. Intense heat waves, falling river levels and droughts in China’s southwestern provinces have limited hydroelectric power, affected supply chains and reduced agricultural yield. The knock-on effects of China’s drought may soon be seen everywhere, from lithium prices to reinsurance and banking.

China made ambitious commitments under the Paris Agreement on climate change to transition from fossil fuels over the next few decades, including a commitment to use renewable fuels for 18% of its total energy consumption by 2025. But declining river levels, particularly in China’s Sichuan province, have limited hydroelectric generation to a fraction of normal output. A drought in Europe is causing similar problems for European hydroelectric power plants. Power shortages from reduced hydroelectric capacity have coincided with increased power demand for air conditioning during the heat wave. As a result, coal production grew 11.5% over the past seven months compared with the same period in 2021, according to S&P Global Commodity Insights.

The electricity curbs introduced by the Chinese government in response to falling hydroelectric capacity will slow industrial production in the provinces of Sichuan, Jiangsu, Anhui and Zhejiang. With industrial growth activity slowing and supply chains stretched to breaking point, further energy shortages may lead to supply chain challenges for corporate sectors, particularly nonferrous operations. Because Sichuan contributes 20% to 30% of global lithium production, a prolonged energy shortage could affect prices.

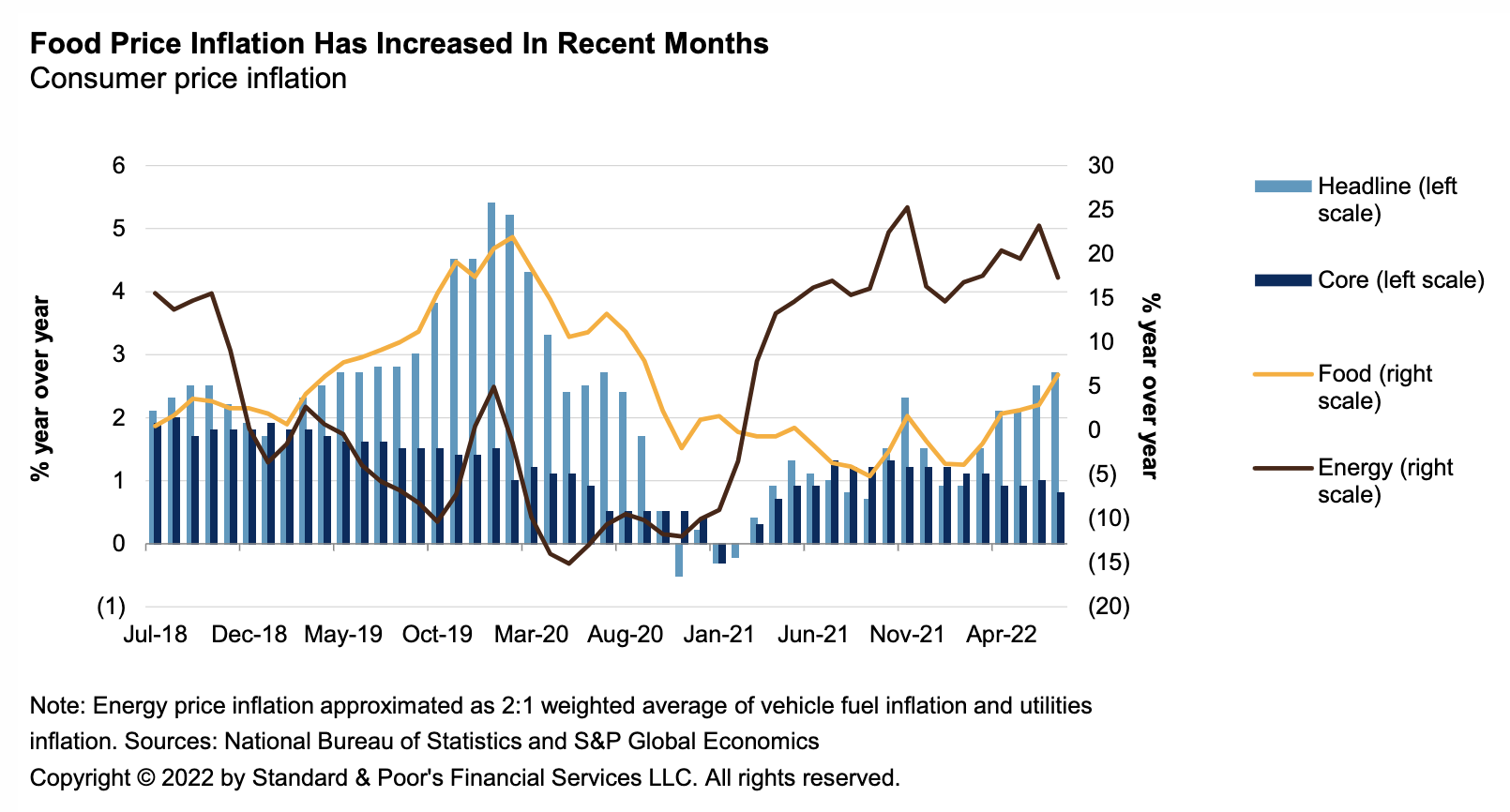

Food price inflation and food security are other areas of concern. Food prices in China have been rising this year. That is likely to continue due to high agricultural input costs and feed prices. Drought and heat waves may make this problem worse. The government has already implemented water sprinklers, cloud seeding, diversion of water resources and early harvesting to preserve the fall harvest.

Chinese banks have been operating in a difficult environment due to issues in the real estate sector. The drought is creating further challenges for the agricultural sector and rural communities. Agricultural Bank of China, Postal Savings Bank of China, rural commercial banks, rural cooperative banks and rural credit cooperatives have the largest exposure to drought-affected sectors and communities.

S&P Global Ratings analysts have looked at how the drought might affect the Chinese insurance industry. Insurers with large agriculture exposure in drought-affected regions could face increasing claims. Ultimately, domestic reinsurance demand and costs may rise if natural catastrophes continue to increase in frequency and intensity.

Droughts and heat waves are affecting much of Europe, the western U.S. and China. Ironically, a warming climate has reduced renewable energy capacity and increased thermal coal usage.

Today is Thursday, September 1, 2022, and here is today’s essential intelligence.

The next edition of the Daily Update will be published Tuesday, Sept. 6.

Written by Nathan Hunt.

China's Summer Struggle: Drought, Food Inflation, And Shortages

China is under strain this summer. Prolonged and intense heatwaves and droughts across its southwest have crippled hydropower generators, forcing energy curbs in some cities. With production halted, the stress on supply chains could have knock-on effects globally. All this at a time when China's economic growth has substantially slowed. Policymakers were already pushing for more sustainable energy sources to power industries.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Foreign Banks Reap Higher Profits From Russian Units As Putin Closes Exit Route

For foreign banks still contemplating the future of their Russian operations, President Vladimir Putin's decree banning the disposal of such businesses has complicated matters. There is a silver lining — these subsidiaries are increasingly profitable. OTP Bank Nyrt., Raiffeisen Bank International AG and UniCredit SpA, three of the foreign banks most exposed to Russia, all reported higher second-quarter profits for their subsidiaries in the country as the ruble surged amid soaring commodity prices, reduced imports to Russia and capital controls introduced by the central bank.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

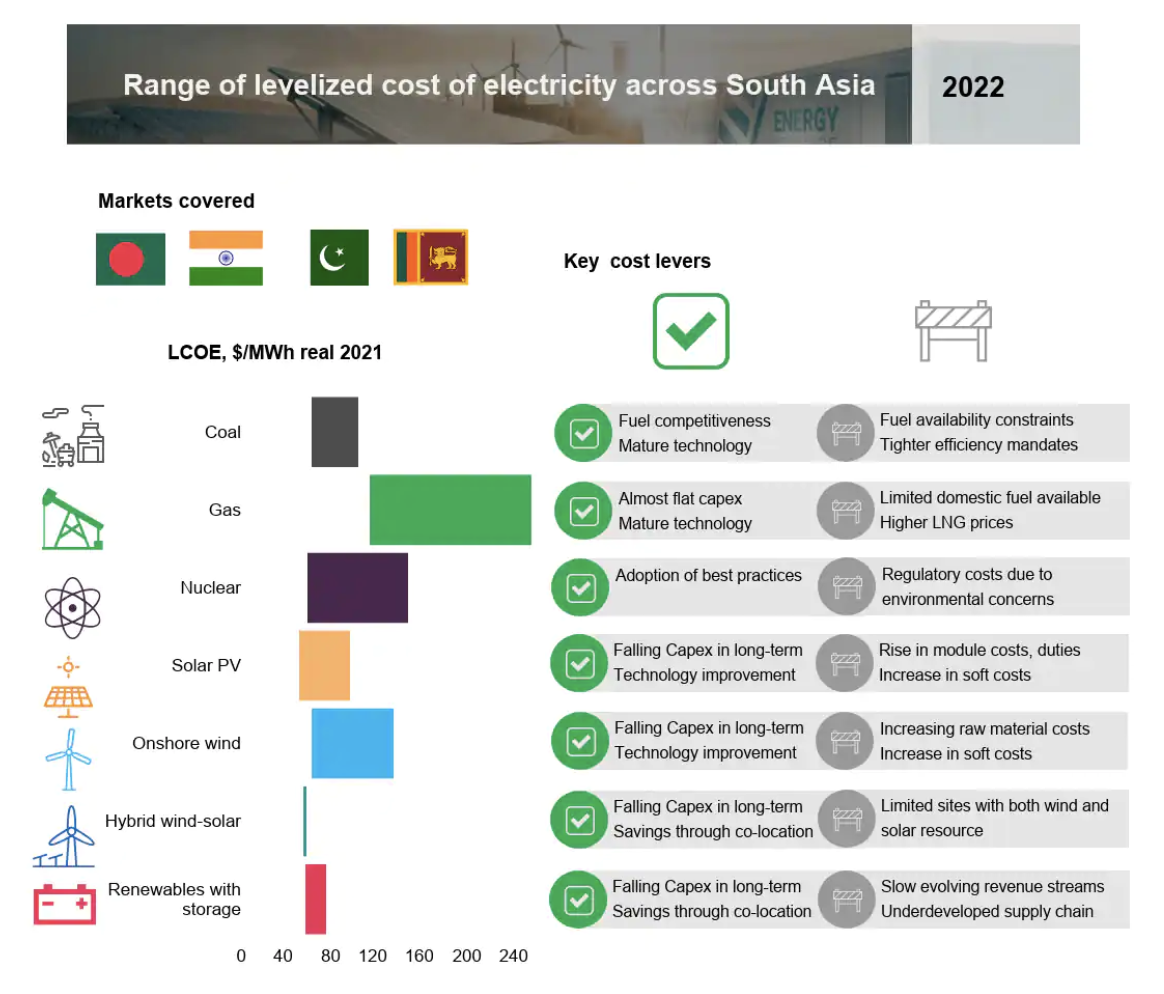

Supply Chain Constraints And Fuel Shortages Increase Costs For All Power Generation Technologies In South Asia

The levelized cost of electricity (LCOE) for conventional technologies — coal, gas, hydro and nuclear is primarily driven by capital costs, fuel prices and utilization rates. Higher fuel prices in the short term and higher weighted average cost of capital results in increase of LCOE for coal and gas power projects in 2022. The LCOE of coal-fired projects across South Asia ranges between $35/MWh to $90/MWh, primarily driven by the differences in costs of domestic versus imported fuel, supporting infrastructure and the financing costs.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

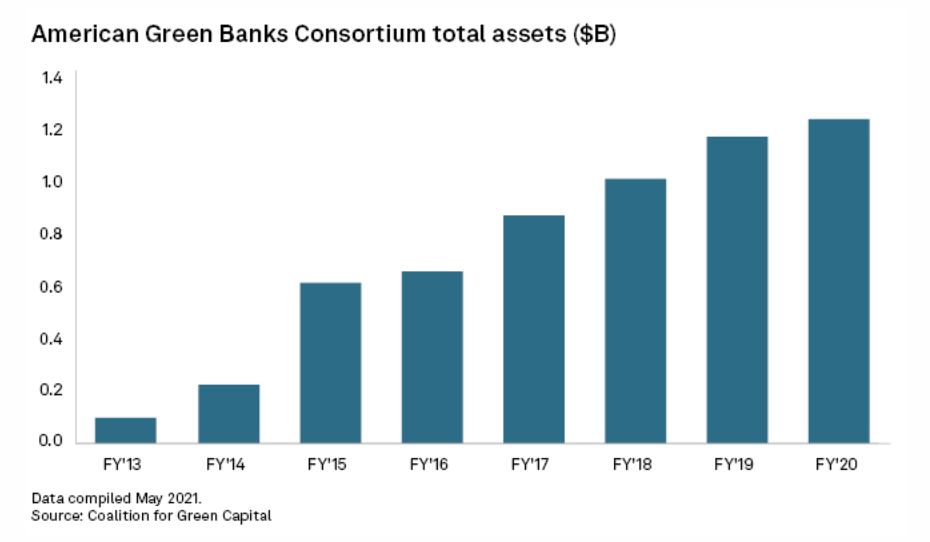

Green Banking Groups Want New Federal Money To Create National Bank

Some industry leaders are advocating for billions of dollars in new federal funding for green banks to go toward a national nonprofit institution that could jump-start the clean energy market and help state and local banks. A green bank is a public, quasi-public or nonprofit institution that uses public funds to attract private investment in clean energy funds. More than 20 such banks now exist at the state and local level in the U.S. The Inflation Reduction Act, signed by President Joe Biden on Aug. 16, provides a total of $27 billion for green banks through the Greenhouse Gas Reduction Fund.

—Read the article from S&P Global Market Intelligence

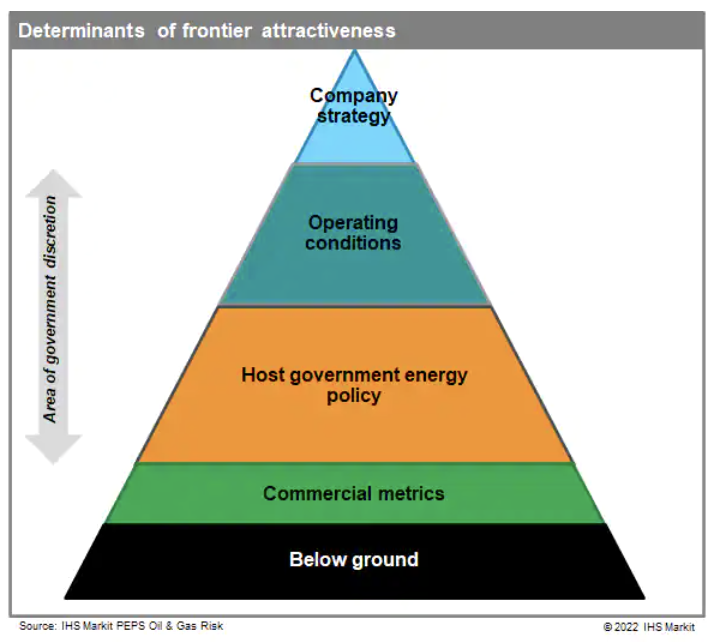

Closing Door Or Window Of Opportunity? The Prospects For Frontier Oil And Gas Producers

The recent spike in prices for crude and natural gas, caused in part by recovery from the pandemic and the repercussions of the Russian invasion of Ukraine, has given frontier and early-stage producers what may be a final opportunity to realize the value of their hydrocarbon resources before the energy transition increases the barriers for entry to all but the most cost-effective or geopolitically advantaged barrels.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Less Money, More Problems For U.S. Tech Companies As Economic Woes Continue To Rise

With recession risk creeping up, technology issuers in the 'B' rating category find themselves battling higher interest rates, softer demand, high inflation and ongoing supply chain disruptions. Some lower-rated technology companies are less well positioned to navigate through the headwinds, especially hardware companies with uncompetitive products, services or operational challenges. The biggest risk for these companies remains the sluggish economy, leading to customers reducing IT budgets. S&P Global Ratings has identified 22 technology companies that are at risk of negative rating actions over the near term. The list is growing as macroeconomic conditions deteriorate.

—Read the report from S&P Global Ratings

Access more insights on technology and media >