Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

How important is entrepreneurial leadership in addressing America’s current challenges in a post-pandemic economy? The coronavirus crisis has exacerbated the U.S.’ income, wealth, and opportunity inequalities, the risks and effects of climate change, the impact of systemic racism, and the polarizing political environment. But expansive research sponsored by S&P Global—written by Robert Litan, former director of economic studies at the Brookings Institution; Ella Bell Smith, professor of business administration at Dartmouth’s Tuck School of Business; Matthew Slaughter, the Paul Danos Dean of the Tuck School of Business at Dartmouth; and Robert Lawrence, Albert L Williams Professor of International Trade and Investment at Harvard Kennedy School and Non-Resident Senior Fellow at The Peterson Institute for International Economics. —argues that the federal government can’t be expected to solve these challenges on its own. Instead, the article argues that entrepreneurs outside of federal spaces across the U.S. public and private sectors meeting the needs of consumers and other stakeholders can overcome barriers to success and become the change agents that can solve the country’s social challenges coming out of the pandemic. Entrepreneurial leadership can expand opportunity, address climate change, tackle systemic racism, and reinvigorate democracy. “Americans cannot rely solely on the federal government to fully address the four main challenges the country faces. This is not to deny the importance of federal policy … Looking ahead federal government policies will be important in addressing each of the four main post-pandemic challenges we now face,” the Oct. 27 report said. “Those challenges will not be fully overcome, however, without changes in mindsets, behaviors, and social norms—all of which cannot be achieved purely through a top-down approach but rather need to be deeply internalized at the individual and local level. These changes, in turn, will require entrepreneurial leadership in all sectors, public and private, to lead the way.” To accomplish this, non-profits’ and governments’ social policies and interventions should be rigorously evaluated and linked to positive evaluations against objective benchmarks, accounting, and transparency disclosures to ultimately create social capital markets that mirror how capital is allocated in private markets. The creation of accelerators and networks for social entrepreneurs can succeed in the same manner than incubators support startups. To change mindsets and spur rapid social change, organizations that provide solutions to the nation’s inequality, climate, racial, and political changes can be spotlighted broadly. “Change, by definition, is often highly disruptive, especially if sudden and seemingly unexpected. One thing is clear, however, about such unexpected shocks [like the pandemic]: the remarkable resilience of people and companies in the private sector who do not have the luxury or inclination to wait for the government to come to their rescue,” the report argues. “In many contexts across the United States, entrepreneurial leaders who were unsatisfied with these deep changes [affecting the economy] have mobilized efforts to respond—often with surprisingly quick and broad impact. These entrepreneurial leaders should be a source of comfort and encouragement to those who may despair of this country’s need to achieve more inclusive opportunity and thereby help heal our social and political divisions in the process.” Today is Thursday, October 28, 2021, and here is today’s essential intelligence.

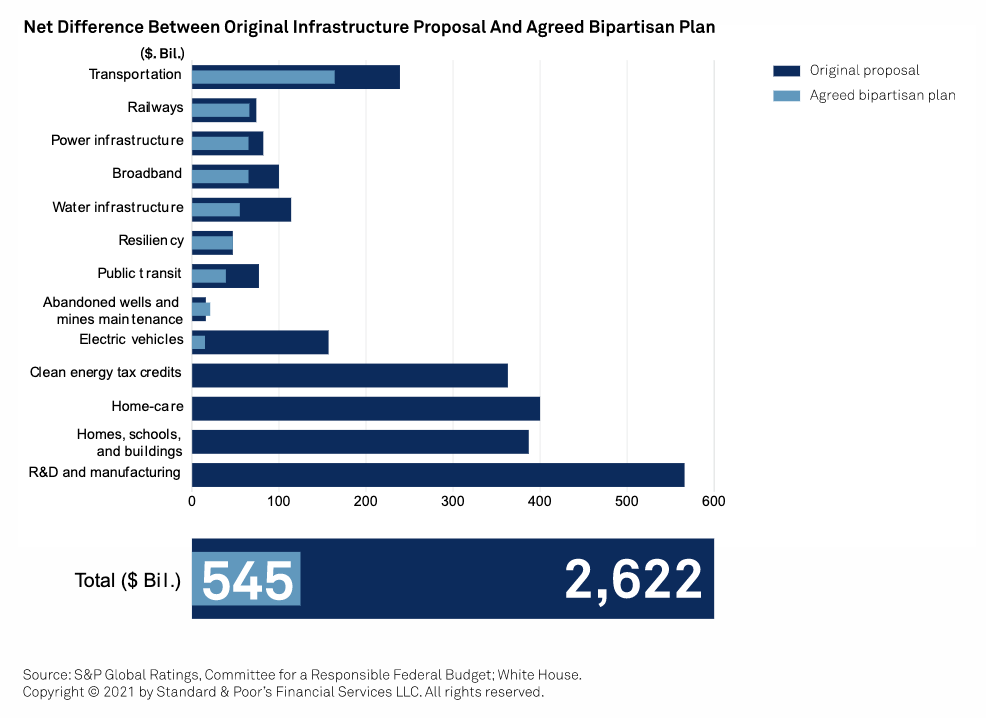

House Views: S&P Global Ratings Analysts Discuss The Biden Administration’s Infrastructure Plan

A recent S&P Global Ratings' Infrastructure conference panel considered the potential impacts of the roughly $545 billion bipartisan infrastructure bill as part of the larger Biden infrastructure agenda. The implications of the bill were discussed at length by the S&P Global panelists who cover key areas such as transportation, telecommunication, power, sustainability, and economics.

—Read the full report from S&P Global Ratings

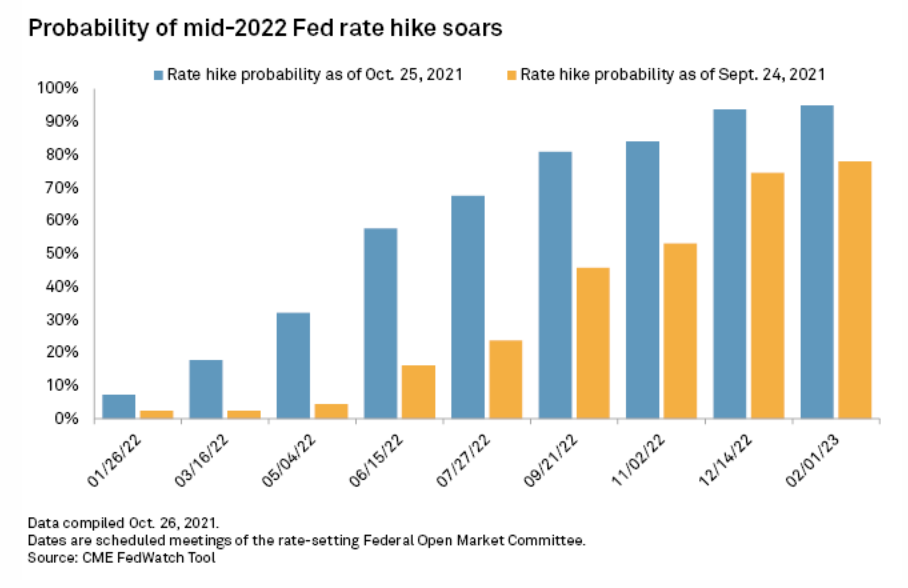

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises

About 58% of investors on Oct. 25 expected at least one hike following the Federal Open Market Committee's June 2022 meeting, up from 16% a month earlier, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market.

—Read the full article from S&P Global Market Intelligence

A Deeper Dive Into The Digital Assets Ecosystem

S&P Dow Jones Indices launched the S&P Cryptocurrency Indices in May. The indices have shown historically high annualized returns accompanied by significant volatility and downside risk. One of the goals of indexing is to bring accessibility and transparency to markets, and S&P Dow Jones Indices believes that launching indices with a trusted price provider, Lukka, has allowed market participants to understand the relative growth of various cryptocurrencies, and the overall cryptocurrency market, over time.

—Read the full article from S&P Dow Jones Indices

Hong Kong Exchange Points At Record IPO Pipeline After Weak Q3 Results

Hong Kong Exchanges and Clearing Ltd., or HKEX, hosted 27 new listings in the three months ended Sept. 30, in which a total of HK$73.9 billion was raised, a 40% year-on-year drop. In the first half of 2021, a total of HK$212 billion was raised from 46 listings in Hong Kong.

—Read the full article from S&P Global Market Intelligence

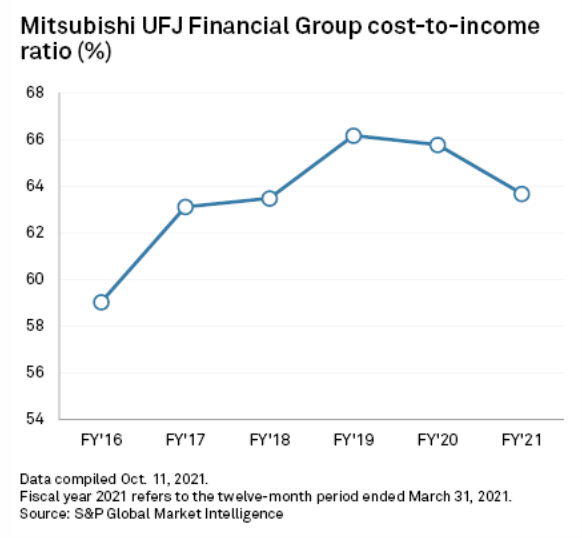

Mitsubishi UFJ May Look At Japan, Vietnam Bank Stake Sales After U.S. Exit

Mitsubishi UFJ Financial Group Inc. may follow the $8 billion planned sale of its U.S. retail banking arm with divestments at home and in Vietnam as Japan's largest megabank works to cut costs, stabilize risk assets, and accelerate digitalization.

—Read the full article from S&P Global Market Intelligence

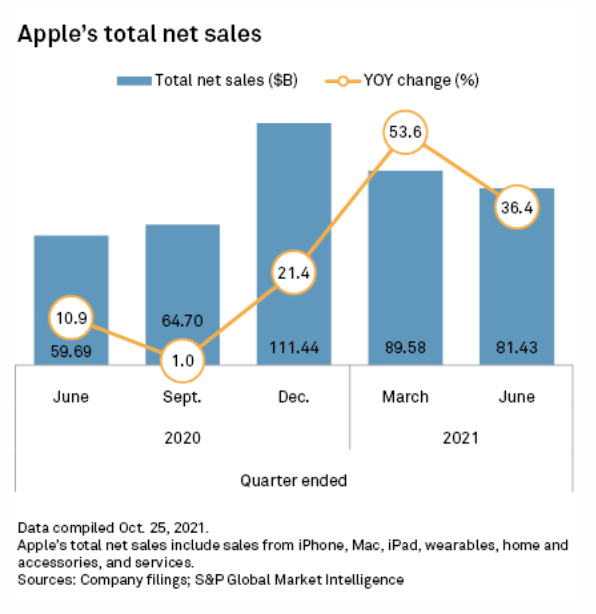

Apple Set To Power Through Chip Shortages With Steady Growth

The global chip shortage is plaguing companies around the globe, and Apple Inc. is no exception. But several industry analysts who follow the company think it will fare better than its competitors due to the combined strength of its market power and burgeoning services business.

—Read the full article from S&P Global Market Intelligence

Alphabet Leads Tech Peers In Median Employee Salary As CEO Pay Ratio Gap Shrinks

Alphabet Inc. reported median employee compensation of $273,493 for 2020, an increase from $258,708 in 2019, according to company filings. The figure is well above the median employee pay of $111,130 for the top 20 U.S. publicly traded information technology firms by market capitalization in 2020.

—Read the full article from S&P Global Market Intelligence

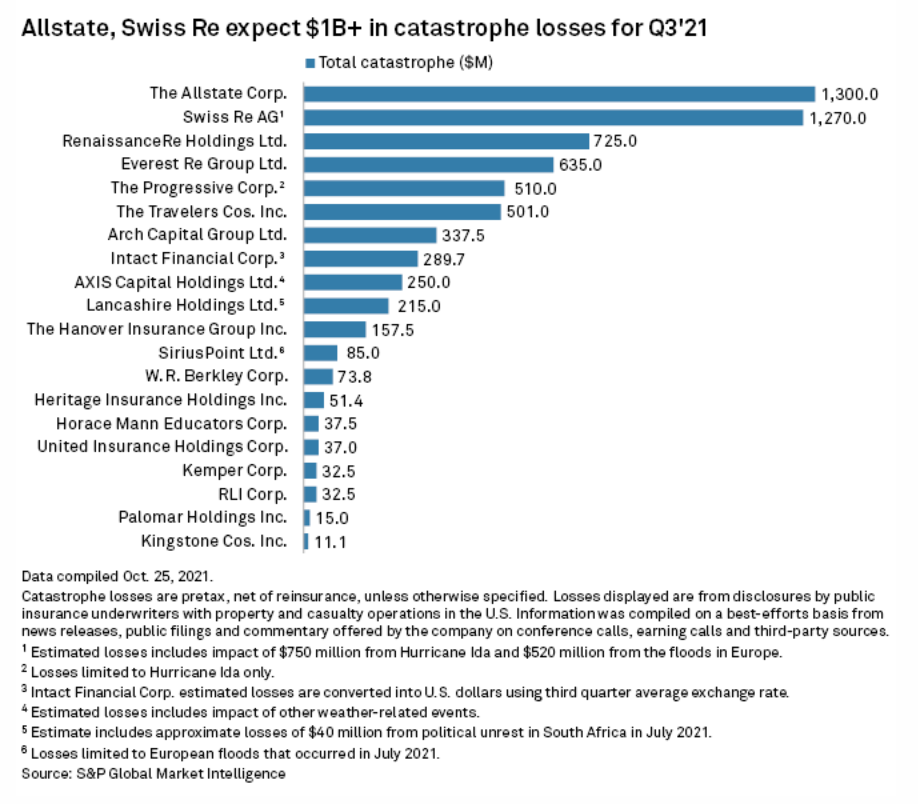

Reinsurers Bearing Q3 Catastrophe Loss Load From Ida, European Floods

Global reinsurers have, thus far, reported three of the five highest total catastrophe losses for the third quarter, according to an S&P Global Market Intelligence analysis, reinforcing analyst expectations that the sector will bear the brunt of losses for multibillion dollar events such as Hurricane Ida and summer European floods.

—Read the full article from S&P Global Market Intelligence

SoCalGas Envisions Electrification, Clean Fuels Paving Way To Carbon Neutrality

A clean fuels network would deliver low-carbon hydrogen, renewable and synthetic natural gas, and biofuels to end-users throughout the coming decades, even as the electric grid meets a growing share of California's energy demand.

—Read the full article from S&P Global Market Intelligence

Updated Climate Commitments Still Falling Short Of Global Temperature Goals: UNEP

Current commitments by countries leave the world on track for a temperature rise of at least 2.7 degrees Celsius this century—well above a global goal to limit warming to 1.5 degrees C above pre-industrial levels.

—Read the full article from S&P Global Platts

IAI Models 1.5-Degree Decarbonization Scenario To Reduce Aluminum Industry Emissions

The modelling was based on the International Energy Agency's Net-Zero by 2050 scenario and complements existing work from the International Aluminium Institute, such as detailed historical emissions, the 'business as usual' scenario to 2050, and the previously released 'beyond 2 degrees' scenario, IAI Director of Scenarios and Forecasts Marlen Bertram told a pre-COP26 virtual media briefing.

—Read the full article from S&P Global Platts

COP26: Paris Article 6 Can Generate $1 Trillion/Year Of Capital Flows By 2050: IETA

Article 6 is a key outstanding element of the Paris "rulebook" that has yet to be agreed by countries and could be a breakthrough item at the UN Climate Change Conference in Glasgow running Nov. 1-12. Agreement on the rules could bolster interest in the market for voluntary carbon offsets and unleash a wave of investment and liquidity in the market, which is tipped to grow by a factor of at least 15 by 2030.

—Read the full article from S&P Global Platts

China's Steel Industry May Already Have Hit Peak Carbon Emissions: Sources

China's State Council released the national carbon peaking action plan late Oct. 26 that called for steel industry to continue capping its iron and steel making capacity, especially around Beijing, Tianjin, and Hebei regions. Such move, the council said, would help in reaching peak carbon emissions by 2030.

—Read the full article from S&P Global Platts

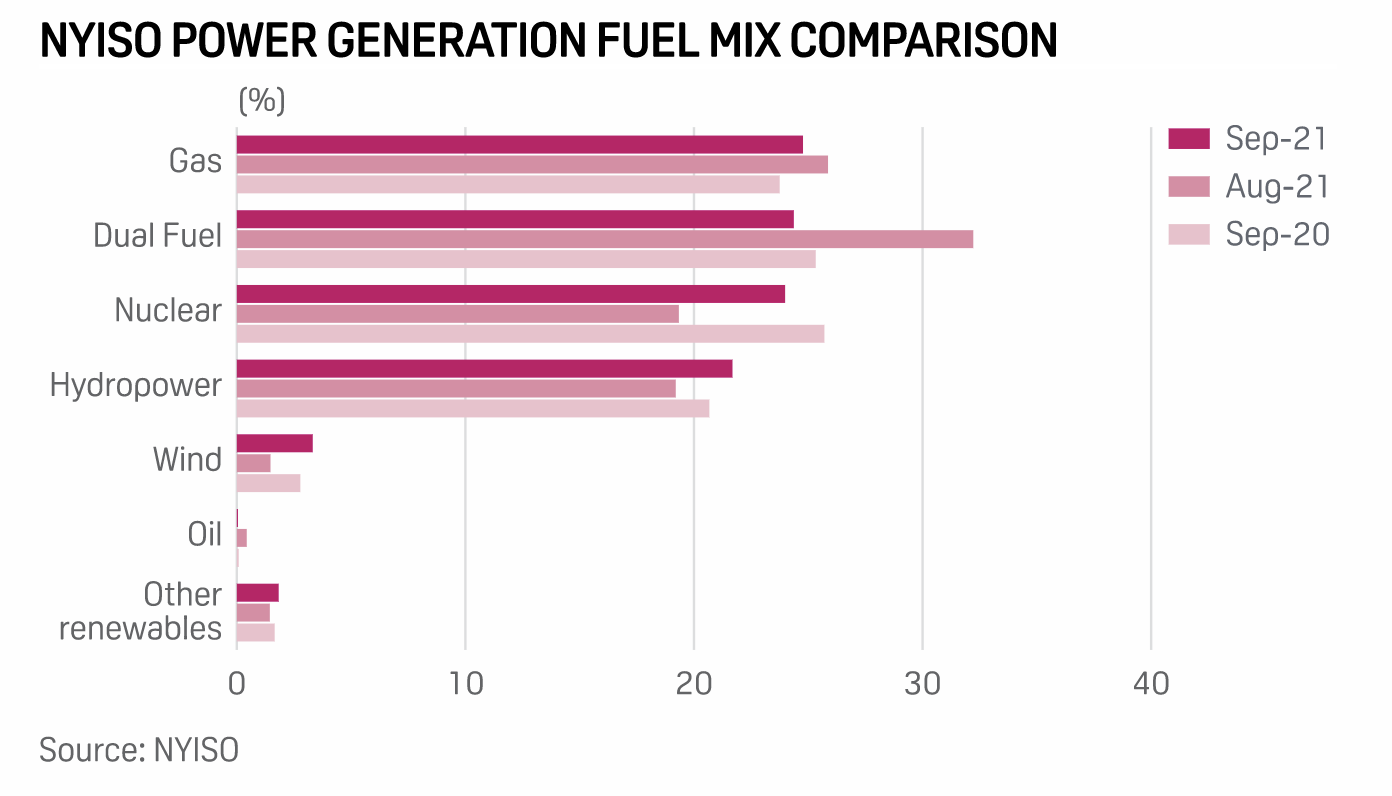

New York Regulators Deny Permits For Two Gas-Fired Power Generation Projects

The New York State Department of Environmental Conservation Oct. 27 denied applications for two proposed natural gas-fired power plants, finding that both would be inconsistent with the state's ambitious climate law and are not needed for power grid reliability.

—Read the full article from S&P Global Platts

Interest In OPEC Crudes Doesn't Fit Tight Market Narrative

OPEC's claim that there is no shortage in the physical oil market appears at odds with the upward trajectory of the futures market. Varying appetites for different quality and regional crudes is the missing link.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language