Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Shipping Cleans Up

According to UN estimates, international shipping contributes 2%-3% of global greenhouse gas emissions every year. In July, the International Maritime Organization set targets to reduce shipping emissions 20%-30% by 2030 and 70%-80% by 2040, compared with 2008 levels. By 2050, the organization set a goal of net-zero emissions. The process to achieve these goals remains unclear, requiring new fuels, infrastructure, technology and regulations.

Global seaborne trade is set to grow 2.4% this year. Box shipping is both the biggest source of greenhouse gas emissions and the biggest investor in exploring alternative fuels such as methanol, hydrogen and ammonia.

Idling ships waiting to enter ports are responsible for a disproportionate share of shipping emissions. In 2021, due to global port congestion, there was an almost 5% year-over-year growth in emissions. In its efforts to decarbonize, the industry is working to reduce wait times as well as speed up cargo loading and unloading and ship departure processes. Improved container port performance would reduce emissions, save money and improve customer satisfaction.

World Shipping Council President and CEO John Butler told S&P Global Commodity Insights that container lines are leading the drive to adopt more sustainable marine fuels with support from eco-conscious customers. Some shippers and carriers have announced bilateral agreements to coordinate shipments using low-emission fuels. This process of reducing emissions through efficiency and improved fuels is known within container markets as carbon insetting, as opposed to carbon offsetting. Some industry participants have called for the further adoption of carbon insets and carbon taxes to force industry laggards to meet International Maritime Organization goals.

Market forces, port performance and carbon insetting alone will not allow the industry to achieve net-zero emissions by 2050. Robust regulations on global shipping are needed to achieve sector-wide decarbonization. EU officials announced an intention to extend the EU Emissions Trading System to cover maritime transportation from 2024. In addition, Brussels intends to apply FuelEU Maritime regulations on the greenhouse gas intensity to bunker fuels in 2025. Sotiris Raptis, secretary general of the European Community Shipowners' Associations, believes that more pressure should be put on marine fuel suppliers to provide green alternatives if the industry is going to decarbonize.

Some shipping groups have previously set aggressive goals on decarbonization and new fuels that they have had to roll back because marine fuel suppliers could not meet demand. Danish logistics group DFDS had committed to adding a “green ship” by 2025 using e-methanol, a carbon-neutral fuel, but the timeline proved too optimistic. DFDS CEO Torben Carlsen expects to have at least two methanol-capable ships by 2030, when the infrastructure and capacity of methanol is further developed, the CEO told S&P Global Commodity Insights in a recent interview.

Today is Thursday, October 26, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

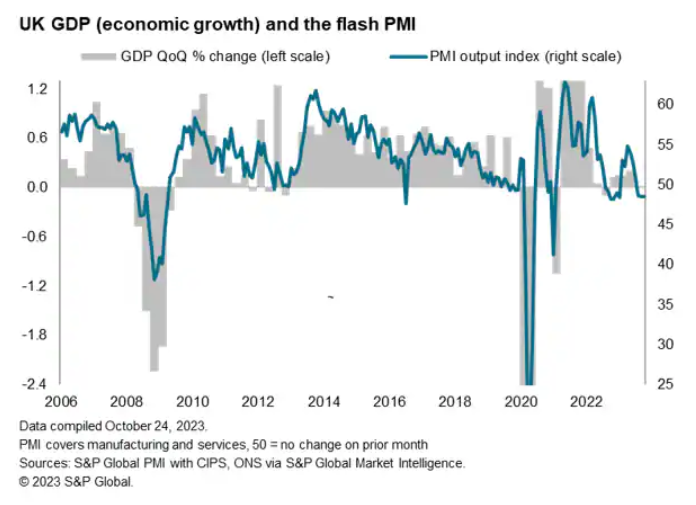

Flash PMI Points To UK Economic Downturn Extending Into Fourth Quarter

The UK economy continued to skirt with recession in October, as the increased cost of living, higher interest rates and falling exports were widely blamed on a third month of lower output. The overall pace of decline remains only modest, signalling a mere 0.1% quarter rate of GDP decline, but gloom about the outlook has intensified in the uncertain economic climate, boding ill for output in the coming months. A recession, albeit only mild at present, cannot be ruled out.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Eurozone Banks: Higher Reserve Requirements Would Dent Profits And Liquidity

Eurozone banks' liquidity and profits could take a hit if the European Central Bank (ECB) hikes the minimum required reserves (MRR). The ECB recently embarked on a review of its operational framework, namely, the range of instruments that it uses to manage short-term market interest rates, and it expects to conclude this review by spring 2024. This includes setting the minimum reserve requirements for banks. The reserve requirement rate is currently 1% and represents the share of deposits, debt securities and money market paper that banks operating in the eurozone must hold at the ECB.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

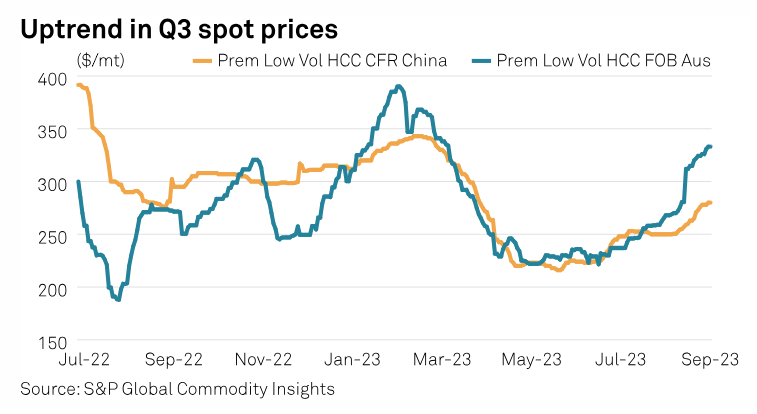

Asia Met Coal Could See Supply-Side Tightness Ease In Q4 As Buyers Resell Cargoes

The seaborne metallurgical coal market has entered the fourth quarter facing continued supply tightness, although some respite could be in sight as sources point to greater availability in the prime hard segment, buoyed by the reselling of cargoes by buyers. The benchmark Platts premium low-volatile hard coking coal prices on FOB Australia basis jumped $100/mt, or 43%, on the quarter to $333/mt towards end-Q3, while the PLV CFR China prices rose $56/mt, or 25%, over the same period to $280/mt Sept. 29, according to S&P Global Commodity Insights data.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

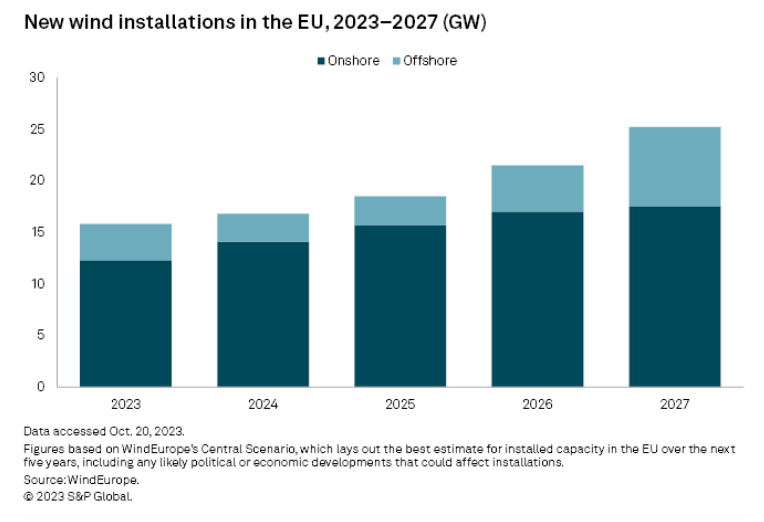

EU Wind Support Package To Address Auction Design, Permitting, Underutilization

The EU's new support package for the struggling wind industry, to be announced Oct. 24, will focus on measures including auction design and permitting in a bid to counter suboptimal growth, supply chain stress and the potential threat of cheaper suppliers from China. Contrary to solar, where costs are falling rapidly amid an oversupply of panel imports from China, European wind is still facing rising costs, with the supply chain firmly in Western hands but struggling to turn a profit.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

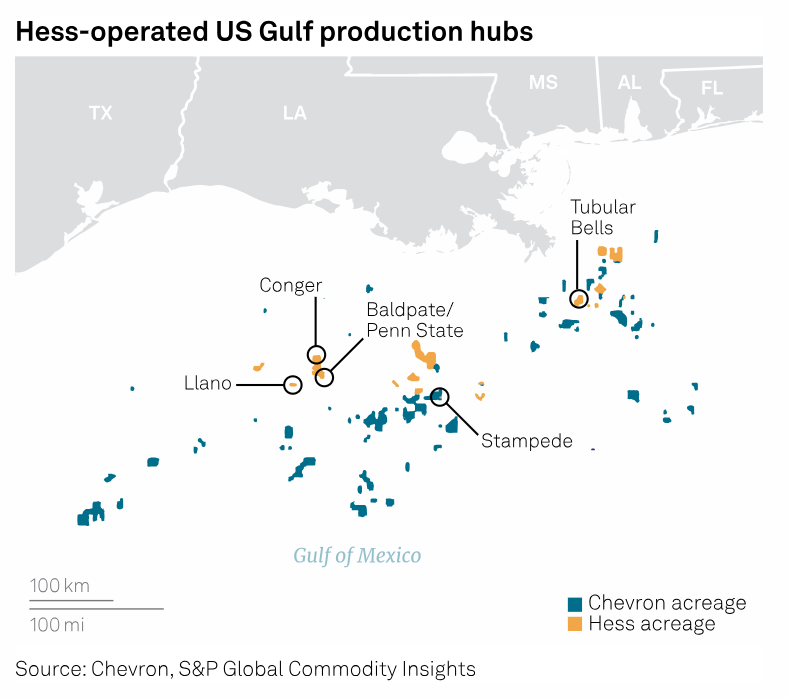

Chevron Buys Hess In $53 Billion Guyana, US Shale Expansion

Chevron agreed to buy US independent upstream operator Hess in an all-stock deal of $53 billion, which would add billions of barrels of resources offshore Guyana and in the Bakken Shale and substantively diversify the US major's asset portfolio, the two companies' top executives said Oct. 23. The definitive agreement, signed off by both companies' boards, comes less than two weeks after ExxonMobil's $59.5 billion announcement of its intent to purchase Pioneer Natural Resources. That deal focused on US Permian Basin shale resources and intensified consolidation momentum in the US onshore amid mounting inventory depletion concerns.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech Episode 138: Technology In Depth

So many of our perspectives on technology are driven by end user studies and numbers can be informative, but there can be much more to the story. The in-depth interviews that are part of much of the study work we do can offer nuance and Amy Hedrick, who manages this process, discusses the insights with host Eric Hanselman. The real world thoughts on current technology and its transitions can aid planning and decision making.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence