Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Peak Oil Remains a Contentious Topic

When people use the phrase “peak oil,” they are referring to a moment in time when the maximum rate of global oil production is reached. While achieving the maximum may sound like a good thing, oil producers typically dislike talk of peak oil because of the implication that production would decline from that level.

Peak oil is not a new concept. Since Pennsylvania oil production peaked in 1891, industry observers have anticipated the decline of the oil industry. However, much like the proverbial pot of gold at the end of the rainbow, when you go looking for peak oil, it always appears to be just over the horizon.

Discussions of peak oil tend to become emotional. From a climate perspective, achieving peak oil is seen as a crucial milestone in the eventual decarbonization of the global energy mix. For oil-producing countries, the question is existential. Many countries of OPEC+, consisting of OPEC and its allies, rely on oil revenues to fund most of their budgets.

Analysts at S&P Global Commodity Insights estimate that oil will continue to make up about 31% of the global energy mix through 2030. Global oil and biofuel demand will peak at about 110.3 million barrels per day in 2031, at which point the growth of renewables will begin to impact global oil demand.

In May 2020, the International Energy Agency (IEA) published its net-zero road map, calling for a halt to new oil and gas project spending to accelerate the arrival of peak oil and decarbonize the economy. The road map came under immediate and sustained criticism from across the oil sector, although some observers acknowledged that peak oil was inevitable. Since the road map was published, the IEA has attempted to soften its message, suggesting that global demand for fossil fuels will likely peak before the end of the decade.

Oil-producing countries have not been mollified by the new published scenarios. On Sept. 14, OPEC's secretary general accused the IEA of ideologically driven fearmongering that would destabilize the world economy. OPEC has repeatedly pushed back its own forecasts of peak oil, with demand estimated to not peak until at least 2045, according to the group’s latest forecast.

IEA Executive Director Fatih Birol insisted that energy companies continue spending on existing oil and gas fields to manage the steady decline in production volumes. But Birol also suggested that oil and gas facilities are in danger of becoming stranded assets with the renewable energy transition. The IEA expects renewables to provide over 80% of emissions reductions and suggested that electricity will become the new oil for the global economy. Already, some countries are believed to be at or near peak oil. Industry observers suggested that in the coming three to five years, China's oil demand will peak, then decline.

"We see first coal, followed by oil, followed by natural gas peaking before 2030 and then slowly declining," Birol said.

Today is Wednesday, October 25, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

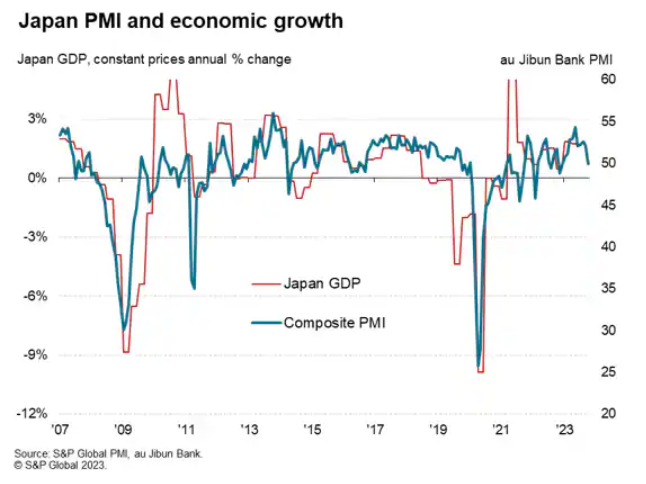

Japan's Flash PMI Points To Stalling Private Sector Economy At Start Of Fourth Quarter

October's flash PMI data revealed that Japan's private sector economy concluded the eight-month growth streak that commenced in January 2023. This was attributed primarily to a sharper fall in manufacturing production, though services activity growth also slowed to the weakest in the year-to-date. At the same time, forward looking indicators outlined the likelihood for further paring of growth momentum within the service sector while manufacturing production is expected to remain in contraction, especially with sharper dips in new orders and backlogs noted.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: A Glimpse Into The Fourth Quarter

The European Central Bank (ECB) meeting on Thursday will be one of the key events this week. Markets expect the ECB to maintain rates amid increased global uncertainty and despite the inflationary impact of higher oil prices. A hold is also expected by the Bank of Canada (Wednesday), while for the U.S. — in a blackout period for the Federal Reserve — the major data release will be the first estimate of third-quarter GDP (Thursday). Looking further afield, a suite of global flash purchasing managers' index data for October (Tuesday) will give a glimpse into fourth-quarter economic activity. This might also be complemented by the start of third-quarter earnings season led by technology and financial institutions.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: Biden’s Got 99 Problems But Geopolitical Doldrums Ain’t One

Some 50 years after the 1973 Arab oil embargo, the oil markets are again bracing for potential disruptions after Hamas’ surprise attack on Israel and Israel's subsequent bombardment of Gaza. ClearView Energy Partners managing director Kevin Book joined the podcast to discuss the possible impacts to global oil supplies from the Israeli-Hamas fight and how its links to Iran could play out with regards to sanctions and a change in Washington’s posture toward Tehran. He also touched on potential difficult decisions ahead for President Joe Biden as he enters an election year where voters will be assessing his actions to mitigate climate change and looking for relief at the pump that hinges on keeping more barrels in the global market.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Partnerships Can Help Close The Climate Finance Gap

Today’s episode of the ESG Insider podcast explores several big themes from Climate Week NYC that will inform conversations at COP28, the UN’s climate conference taking place in Dubai later this year. Guests talk about closing the climate finance gap; the role of partnerships and collaboration in driving decarbonization; and how credible and just transition plans will incorporate the needs and voices of local communities.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

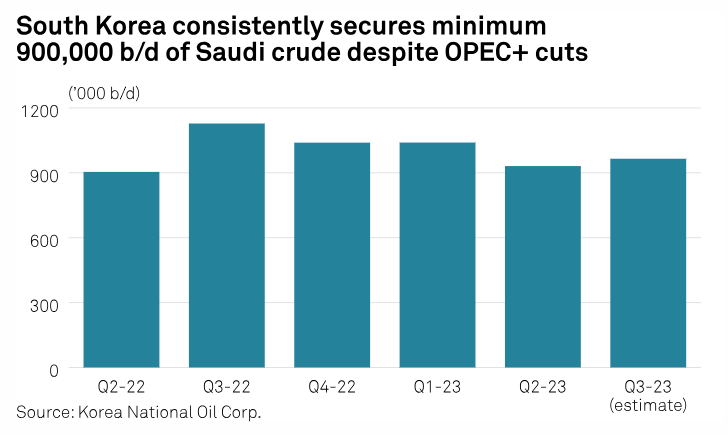

Korea National Oil Corp. To Store 5.3 Mil Barrels Of Saudi Crude Oil

State-run Korea National Oil Corp. will store 5.3 million barrels of Saudi Arabian crude oil in a joint inventory management deal with Saudi Aramco, which would be used as strategic reserves for South Korea, the company said Oct. 23. The deal was signed on the sidelines of summit talks between South Korean President Yoon Suk-yeol and Saudi Crown Prince Mohammed bin Salman during Yoon's state visit to Saudi Arabia.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

AI's Big Promises Start To Deliver For Miners Adopting New Tech

The global mining sector is tapping into cutting-edge artificial intelligence to uncover faster and better ways to get minerals from the ground and processed. Advances in AI — primarily driven by machine learning that mimics human brains — are increasingly being used to monitor for costly equipment failures, to find difficult to locate lodes, flag disruptions in the supply chain and tease out more valuable materials from the production process. While some in the industry say the most significant gains from AI in mining are years from being realized, early adopters are capturing a clear competitive advantage, according to interviews and feedback from 11 mining industry executives and experts.

—Read the article from S&P Global Commodity Insights