Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The future of the world, work, and wealth is in limbo as an uneven economic recovery from the ongoing pandemic proliferates across developed and emerging market countries.

The coronavirus crisis will leave significant scars and “lasting damage” across the global economy—visible in high unemployment, productivity loss, bankruptcies, and entire sectors becoming obsolete, according to the International Monetary Fund’s biannual World Economic Outlook.

“The cumulative loss in output relative to the pre-pandemic projected path is projected to grow from $11 trillion over 2020–21 to $28 trillion over 2020–25,” IMF Chief Economist Gita Gopinath said while announcing the report on Tuesday. “This represents a severe setback to the improvement in average living standards across all country groups.”

The fund now anticipates global growth to contract 4.4% this year, down 0.8% percentage point from its forecast in June. Advanced economies are likely to shrink 4.7% and emerging economies by 8.1%.

S&P Global Economics forecasts global GDP to decline 4% this year, with risks remaining on the downside.

In the third quarter, many key economies enjoyed growth that exceeded expectations. “The majority of advanced economies surprised on the upside, while developments in emerging markets were mixed,” S&P Global Ratings Chief Economist Paul Gruenwald said in a recent report.

The pandemic’s exacerbation of gaps between advanced and developing countries is creating a recovery that looks different across economies within the same bracket—particularly in wealthier countries.

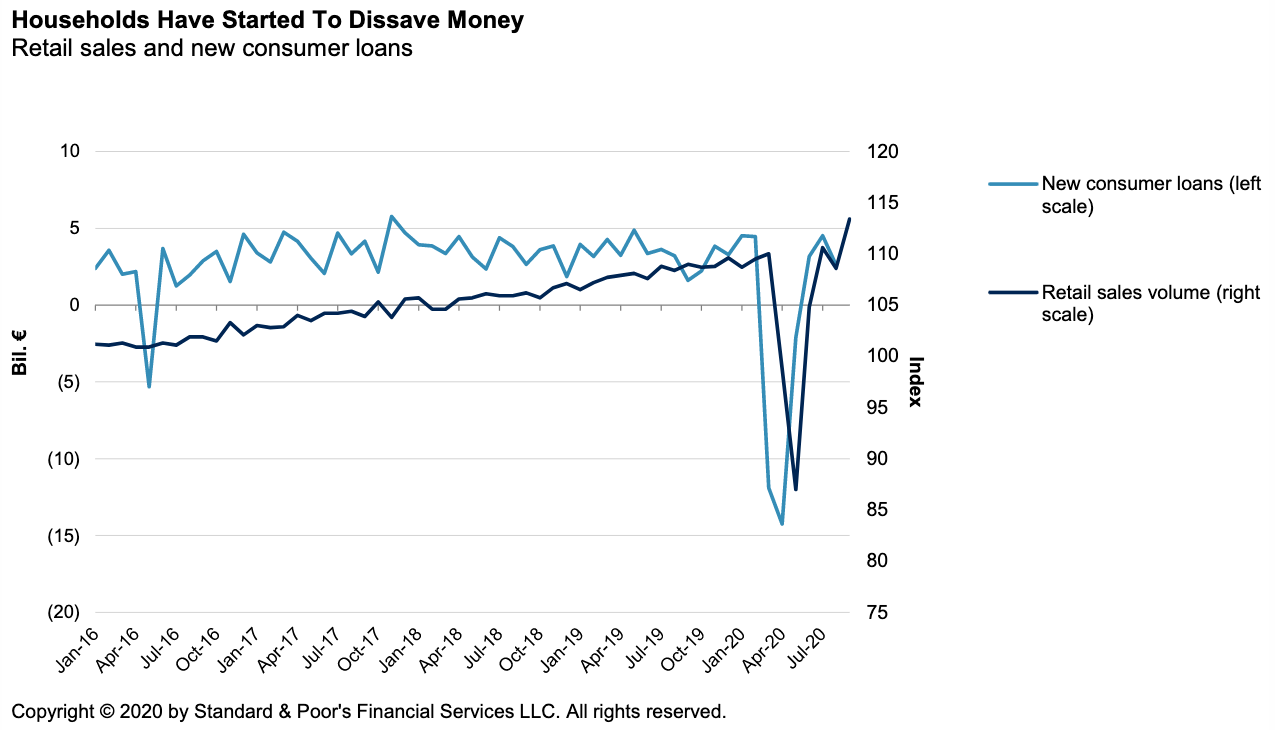

The European economy’s “better-than-expected third-quarter economic rebound” will soon confront the reality that “government support measures will gradually end at the turn of the year, but it won't be until mid-2021 at the earliest that European recovery plans will kick in,” according to S&P Global Ratings Chief EMEA Economist Sylvain Broyer, who described it as a “tricky transition period.” Still, with demand lacking across the region due to the pandemic, the crisis pushed the European Commission to create the €750 billion Green Deal, and EU citizens have accumulated an abundance of savings that is likely to result in a rebound.

“It's clear that the transition won't be smooth, but there is reason to believe the glass might be half full,” Mr. Broyer said.

Circumstances in the U.S. look different. There, the recovery is decelerating as rising numbers of coronavirus cases, expiring federal stimulus, and consumer concerns hamper demand and activity. “Risks of policy intervention are still tilted to the downside at this time, while initial unemployment claims remain 4x the pre-pandemic level and job openings in cities are well below normal,” according to S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino.

The U.S. economy added 661,000 jobs in September, falling short of a forecast for 894,000 jobs by economists polled by Econoday, according to S&P Global Market Intelligence. The majority of these jobs (70%) were in consumer-focused sectors. While the renewable-power industry has swelled in the U.S., which hasn’t centered on climate change in its stimulus plans like the EU has, only 2,300 renewable-power industry jobs were added to the workforce in September, according to an analysis of government data by BW Research Partnership. The analysis found that 13% of renewable industry workers, or 75,700 people, have remained unemployed.

Of the 184 corporate borrowers that have defaulted worldwide so far this year, U.S. companies in the consumer products sector have accounted for 26—the most of any industry, according to S&P Global Ratings’ latest tally. An unprecedented 470 U.S. companies have gone bankrupt this year as of Sept. 7, according to an S&P Global Market Intelligence analysis. This marks the most filings during any comparable period since 2010.

The IMF proposed increasing taxes on companies and countries’ high-earners as a solution to help relieve the conditions in the U.S., EU, and economies around the world.

“Although adopting new revenue measures during the crisis will be difficult, governments may need to consider raising progressive taxes on more affluent individuals and those relatively less affected by the crisis (including increasing tax rates on higher income brackets, high-end property, capital gains, and wealth) as well as changes to corporate taxation that ensure firms pay taxes commensurate with profitability,” Ms. Gopinath said.

Today is Wednesday, October 14, 2020, and here is today’s essential intelligence.

Economic Research: Keynes And Schumpeter Are What The European Economy Needs Right Now

"Glass-half-empty" observers of the European economy see the better-than-expected third-quarter economic rebound as just a mechanical bounce-back from the pandemic-related lockdown. That was the easiest part of the recovery, they say. From now on, we are in for a tougher, slower climb. The pessimists are right to point out that the European economy is clearly entering a tricky transition period--phase 3, as some say. Government support measures will gradually end at the turn of the year, but it won't be until mid-2021 at the earliest that European recovery plans will kick in.

—Read the full report from S&P Global Ratings

U.S. Auto Sales Down 9% in Q3 as Coronavirus Continues to Curb Demand

U.S. auto sales fell more than 9% year over year in the third quarter of 2020 amid the ongoing coronavirus pandemic as sales of SUVs and trucks continued to fare better than cars, according to an S&P Global Market Intelligence analysis. Overall, nonseasonally adjusted U.S. vehicle sales for the third quarter declined 9.2% to 3.9 million vehicles from 4.3 million vehicles in the year-ago period. Sales, however, improved from the 33.3% decline in the second quarter.

—Read the full article from S&P Global Market Intelligence

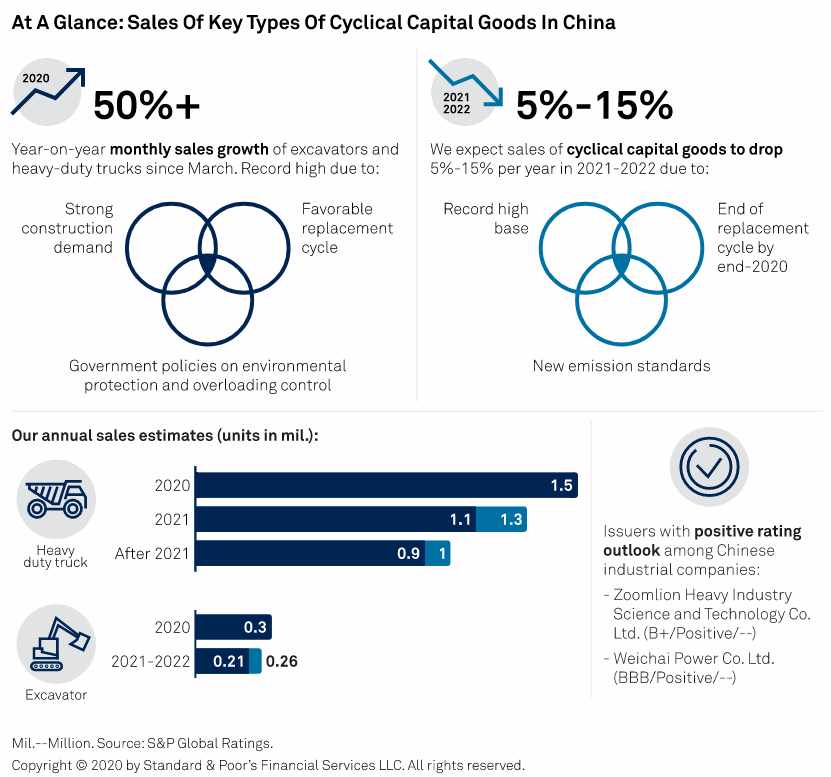

China's Cyclical Capital Goods Makers Brace For Downcycle

China's cyclical capital goods makers are facing a downturn. Key types of construction machinery and heavy-duty trucks have posted monthly sales growth of 50%-plus year on year since March. S&P Global Ratings anticipates that, from this very high base, conditions are ripe for a moderate correction in 2021, particularly as stricter emission standards and fleet-replacement cycles work against producers.

—Read the full report from S&P Global Ratings

Bearish Equity Market Sentiment Adds To European Real Estate Companies' Credit Risks

The gap between European real estate companies' share prices and private appraisal values is the widest it has ever been following five years of steady divergence. The small asset devaluations that European real estate investment trusts (REITs) reported in the first half of 2020 were insufficient to offset the equity discount to their net asset value (NAV) due to the COVID-19 pandemic putting additional pressure on equity market sentiment.

—Read the full report from S&P Global Ratings

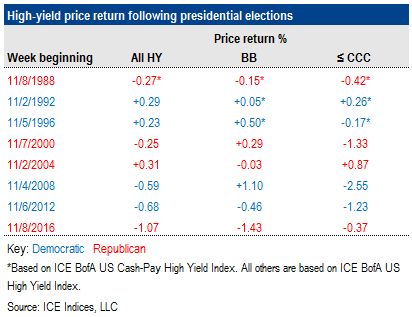

Too Close to Call — The Impact of Election Results on High-Yield returns

The analysis below explores two aspects of the upcoming election. First is the historical record of the immediate price impact of the outcome, with a focus on which party's candidate emerges victorious. The second focus is historical high-yield returns by party during presidential returns.

—Read the full article from S&P Global Market Intelligence

U.S. Individual Life Premiums Record Rare Q2 Decline

Individual life insurance premiums fell year over year in a second quarter for the first time in more than 10 years. As the country battled the COVID-19 pandemic during the spring, the industry recorded $36.23 billion in individual life premiums, compared to $36.36 billion in the prior-year period. The decrease was relatively small, but it was the first such year-over-year decline of any kind in a second quarter since 2009.

—Read the full article from S&P Global Market Intelligence

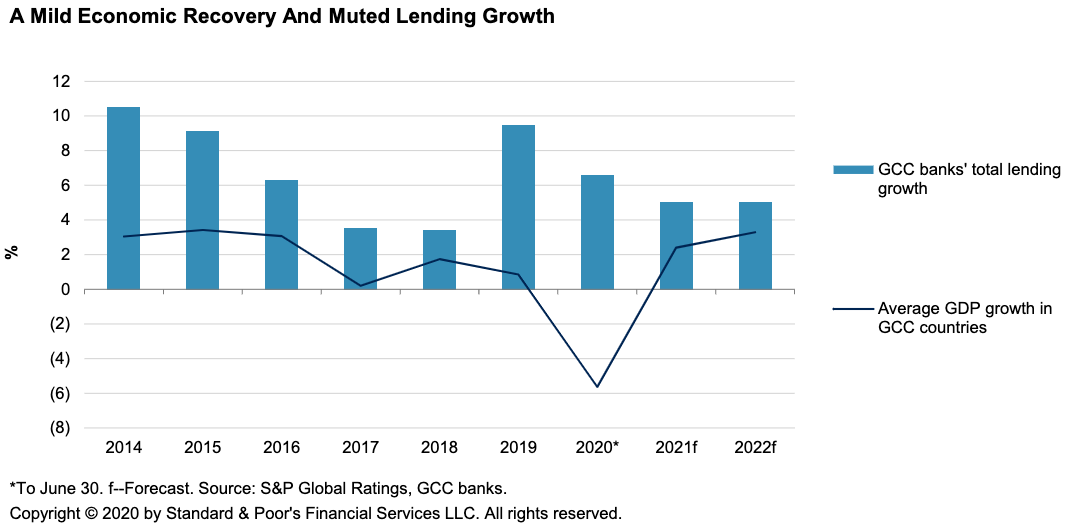

GCC Banks: Lower Profitability Is Here To Stay

Rated banks in the Gulf Cooperation Council face an uphill struggle in the next 18 months due to the protracted nature of the economic recovery and the expected gradual withdrawal of regulatory forbearance measures. S&P Global Ratings' base case is that a COVID-19 vaccine will be widely available by around mid-2021 and that the oil price will stabilize at an average of $50 per barrel. We also foresee that the GCC economies will expand by an average of 2.4% in 2021, compared with a contraction of 5.6% in 2020.

—Read the full report from S&P Global Ratings

European Investment Banks Expected to Cede More Ground to U.S. Rivals

Europe's investment banks have been fighting an uphill battle to remain competitive against U.S. peers on global markets, and it is unlikely any will become a dominant global player, according to analysts and industry experts. The European companies have been gradually losing market share, while the U.S. banks boast scale and diversification.

—Read the full article from S&P Global Market Intelligence

Financial Companies Favor Ireland, Germany for Post-Brexit EU Bases

Ireland has attracted the highest number of global financial institutions looking to relocate out of the U.K. to maintain access to European markets ahead of the end of the Brexit transition period on December 31. At least 35 commercial lenders, investment banks, brokerages and insurers have chosen to set up subsidiaries in, or relocated staff to, Britain's neighbor, or are in the process of doing so, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

Australian Banks Poised for a Slow and Long Recovery

The recovery for Australia's banks will be a drawn-out affair. Earnings at the country's banks should remain adequate to absorb elevated credit losses. However, banks will struggle to regain pre-COVID earnings metrics even as credit losses recede. Overall, we believe that Australian banks should be able to preserve their creditworthiness in the next two years. This is despite the unprecedented economic disruption due to the COVID-19 outbreak and containment measures.

—Read the full report from S&P Global Ratings

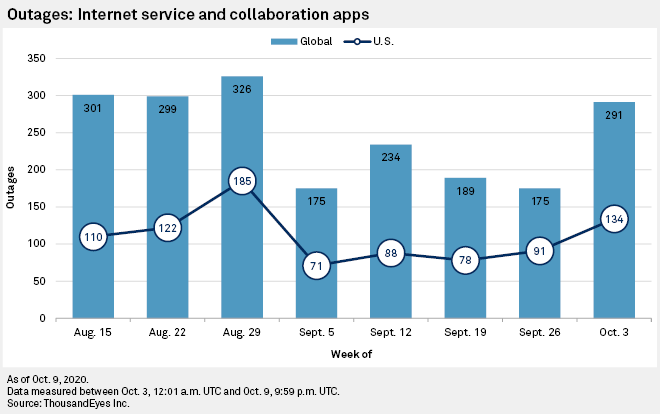

Global Internet, App Outages Spike, Disrupting Work Hours for More Users

Outages of internet service and collaboration applications that support work-from-home employees spiked the week ended October 9, including a notable outage at Slack Technologies Inc. that lasted a full business day for some workers. Globally, outages jumped 66% week over week to 291 between Oct. 3 and Oct. 9, marking the largest percentage increase since April, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. In the U.S., outages rose 47% week over week to 134.

—Read the full article from S&P Global Market Intelligence

Coronavirus Prompts Amazon, Other Retailers to Push Online Holiday Sales Early

Amazon.com Inc. and other retailers are starting their holiday selling season earlier than usual this year, a move experts say will help lock in online sales from budget-conscious consumers still cautious during the coronavirus crisis and reduce supply-chain bottlenecks during the crucial fourth quarter. Historically, the holiday season kicks off on Black Friday, the day after Thanksgiving, when consumers typically form long lines outside stores for door-buster deals on toys, electronics and other in-demand merchandise.

—Read the full article from S&P Global Market Intelligence

Walmart's Subscription Service Needs Better Perks to Compete with Amazon Prime

If Walmart Inc. wants its new subscription service to seriously compete with Amazon.com Inc.'s Prime program, the big-box retailer needs to offer more perks to consumers such as video streaming services and special discounts on exclusive products, retail experts said. The Bentonville, Ark.-based retailer rolled out its Walmart+ program Sept. 15 right as its e-commerce sales are soaring due to the coronavirus pandemic. Walmart's second-quarter online sales jumped 97%.

—Read the full article from S&P Global Market Intelligence

ESG Monthly: Innovations in Sustainable Finance

European policymakers have pushed ahead with climate-focused policies despite the impact of the coronavirus crisis on their economies. Meanwhile, U.S. Democrats have advocated modern, sustainable infrastructure upgrades and aggressive action on climate change if Joe Biden wins the White House.

—Read the full report from S&P Global

Grappling with Blade Recycling, Wind Sector Buys Time with Life Extensions

As aging wind turbines across Europe near the end of their useful lives, the sector is grappling with recycling solutions to avoid filling landfills with the remains of obsolete machines. While steel from the towers and nacelles is recyclable, turbine blades are filled with a composite material that cannot be easily broken down. According to industry group WindEurope, about 14,000 blades will be decommissioned across Europe by 2023.

—Read the full article from S&P Global Market Intelligence

'Solar to Become Ding of Electricity Markets': IEA Report

Solar energy is likely to become the leading solution to meet global growth in electricity demand, as governments around the world seek a recovery from the COVID-19 pandemic, the International Energy Agency said in its World Energy Outlook 2020 report released October 13. The IEA's flagship report considered several scenarios, and all of them foresee significant growth in solar power as the technology falls in cost, and increasingly competes with other energy sources.

—Read the full article from S&P Global Platts

Pandemic Hits Investment in Energy Transition: IEA Chief Economist

The spread of the COVID-19 pandemic had not hastened the decarbonization process despite the energy sector being shaken to its core bythe economic shock triggered by the virus, Laszlo Varro, Chief Economist at the International Energy Agency, said Oct. 13, adding that investment in the energy transition was instead set to fall by a fifth this year. "Climate change is still very much with us," Varro told delegates at the 2020 Flame conference.

—Read the full article from S&P Global Platts

Hurricane Delta's Impacts on Chemical Facilities Appear Less Serious than Laura

Hurricane Delta appears to have wreaked minimal damage to chemical facilities in Lake Charles, Louisiana, just six weeks after Hurricane Laura blew through the region, severely damaging major electricity transmission lines that left facilities offline for weeks.

—Read the full article from S&P Global Platts

Market Movers Europe, Oct 12-16: Risks to Oil Supply and Demand in the Spotlight

In this week's highlights: Key players in the world of oil are set to speak at the Energy Intelligence Forum; German power operators are due to set the green levy component of 2021 consumer bills, and the World Steel Association will release its 2021 steel industry outlook against an uncertain backdrop.

—Watch and share this video from S&P Global Platts

Global Oil Demand Set to Plateau, Not Decline by 2040: IEA

Global oil demand is still set to flatline rather than peak in the coming two decades, the International Energy Agency said October 13, despite growing expectations that the pandemic could trigger a rapid shift away from oil to cleaner energy. After recovering from the "exceptional ferocity" of the COVID-19 crisis, world oil demand will rise from 97.9 million b/d in 2019 to 104.1 million b/d in 2040, according to the IEA's base-case scenario in its latest annual World Energy Outlook.

—Read the full article from S&P Global Platts

Key Oil Market Forecasts from the IEA's 2020 World Energy Outlook

The International Energy Agency published its latest World Energy Outlook on October 13, containing closely watched, long-term forecasts for energy supply and demand to 2040. Below are the main projections for the oil sector in the IEA's central 'Stated Policies' scenario.

—Read the full article from S&P Global Platts

COVID-19 Spells Volatility for Long-Term Oil Supply, Risk of Shortfalls: IEA

The coronavirus pandemic has set the stage for greater volatility in world oil supply, with US shale less able to act as a "shock absorber," and a heightened risk that global production will fall short, the International Energy Agency said in its World Energy Outlook October 13. The document, presenting scenarios for the period to 2040, said low-cost producers within the OPEC+ group were relatively well positioned, contrasting with producers in sub-Saharan Africa, where output is unlikely to reach 2019 levels any time in the period.

—Read the full article from S&P Global Platts

IEA Cuts 2040 Global Gas Demand Forecast, Sector Facing 'Significant' Uncertainty

The International Energy Agency expects global gas demand to reach 5.22 Tcm by 2040, it said in its latest World Energy Outlook published October 13, down from the 5.4 Tcm it was predicting in last year's outlook. The IEA said demand in the world's advanced economies is forecast to dip by 2040 -- the first time it has made such a forecast -- with the 30% total increase in consumption by 2040 driven almost entirely by Asia and the Middle East.

—Read the full article from S&P Global Platts

Aramco CEO sees Global Oil Demand Fully Recovering from Pandemic by 2022

Saudi Aramco CEO Amin Nasser said Oct. 13 he expects global crude demand to recover to pre-pandemic levels by 2022, provided a coronavirus vaccine is developed by the end of next year. "The worst is definitely behind us," said Nasser at the Energy Intelligence Forum. "We are seeing a recovery; we are looking at [global oil demand of] 90 million [b/d] currently and it is picking up."

—Read the full article from S&P Global Platts

A Year after Abqaiq Attacks Saudi Aramco Still Seen Vulnerable

Attacks on Saudi Aramco's giant Abqaiq crude processing plant last September threatened a heart attack moment for the global oil market and the kingdom's cherished reputation as a reliable supplier. Disaster was averted by speedy repairs, but the episode has left lingering doubts among some experts over its readiness to prevent a copycat strike from penetrating its defenses.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language