Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

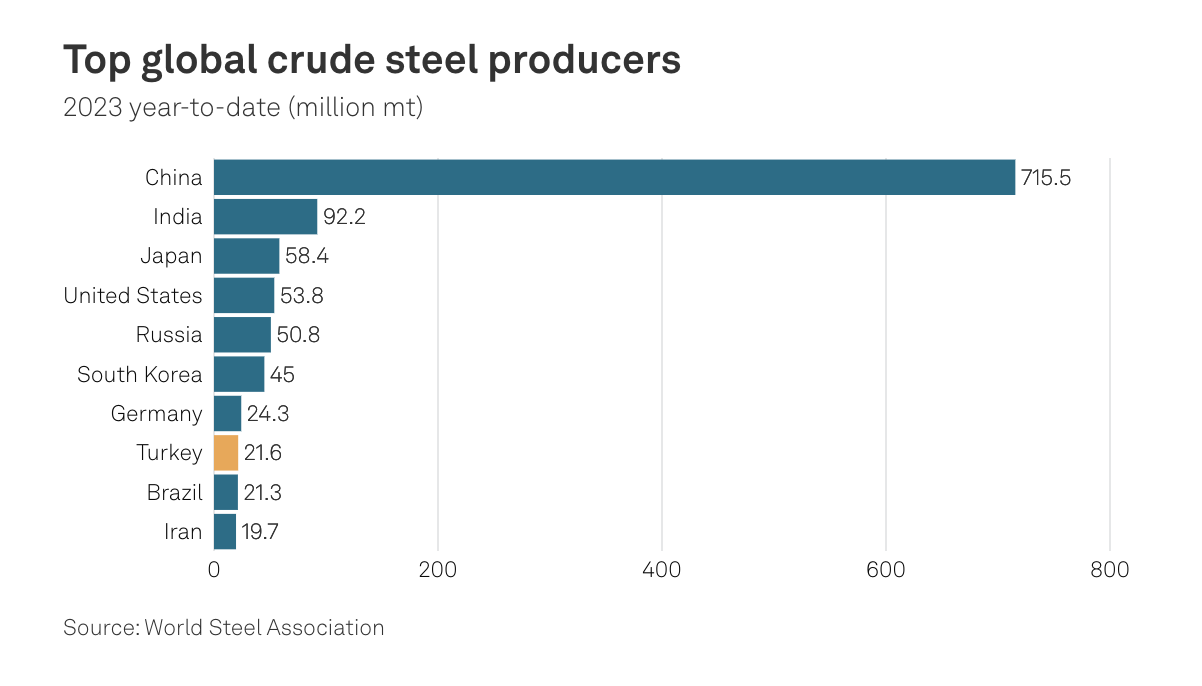

The Turkish Steel Market at the Center of a Shifting World

S&P Global Commodity Insights published an in-depth report on Turkish steel. The report analyzes shifting trade flows, Platts benchmarks, the futures market, Turkish steel and the Carbon Border Adjustment Mechanism. The following is the introduction to that report.

Turkey has a long and storied history as a center of international trade, afforded by its position straddling the southeast of Europe and western Asia and the Middle East. The country’s unique location between continents — with easy access to the important shipping lanes of the Mediterranean and control over access into it from the Black Sea — situates it naturally to be a regional and global player.

In a shifting world, what happens in Turkey matters for global trade and geopolitics, but this is especially true for the global steel industry. Not only does Turkey have large, steel-intensive end-user industries, it is also both a major importer and exporter of steel around the world as well as being a big importer of steel raw materials, notably ferrous scrap. This has made it highly influential for global trade flows in the steel sector.

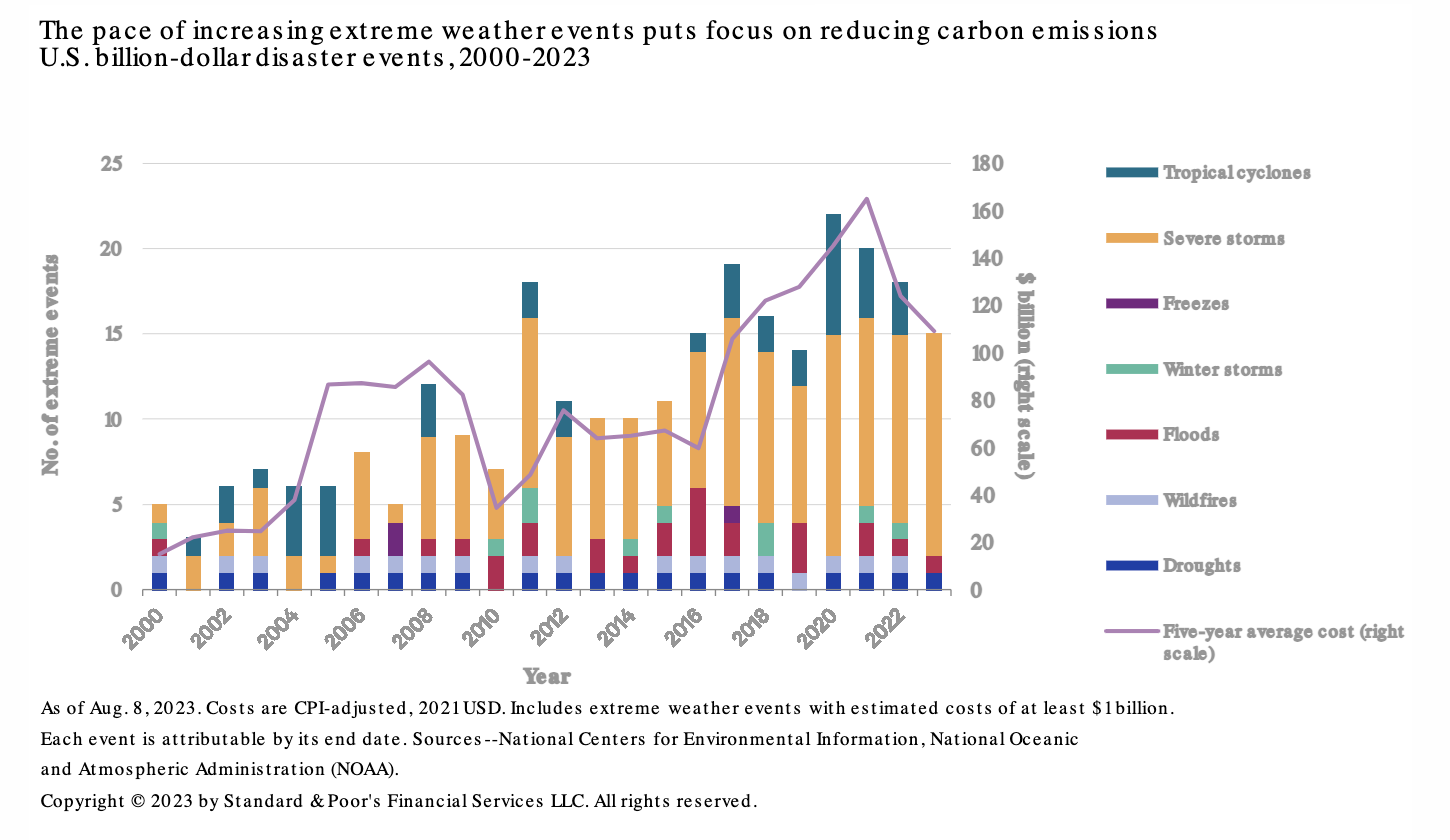

But the country’s steel and related industries are having to adapt to rapid change in the economic and political landscape, domestically and globally. The framework for steel is changing fast with the drive to lower CO2 emissions, and Turkey’s steel industry is under pressure to get ahead in the race towards greener steel production in order to avoid eventually being closed off from important export destinations such as the European Union.

Closer on the horizon, the breakdown in relations between Europe and Russia over Ukraine threatens a lucrative trade for Turkish mills that process Russian semi-finished steel, as the key trading bloc expands its sanctions regime against Moscow.

Meanwhile, there is growing competition from existing competitors and newly emerging countries in the international steel trade that are targeting some of Turkey’s traditional export markets, leaving Turkish steel producers with a struggle on their hands to maintain their trading power. The energy transition is making that task even more challenging.

S&P Global Commodity Insights here takes a closer look at the importance of the Turkish steel market on the international stage, its role in the evolution of steel price benchmarks and futures markets in recent years, and the issues it faces now and going forward.

To view the complete report on Turkish steel from the team at S&P Commodity Insights, click here.

Today is Wednesday, October 11, 2023, and here is today’s essential intelligence.

Written by Rabia Arif, Laura Varriale, Roman Kramarchuk, Cenk Can and Paul Bartholomew.

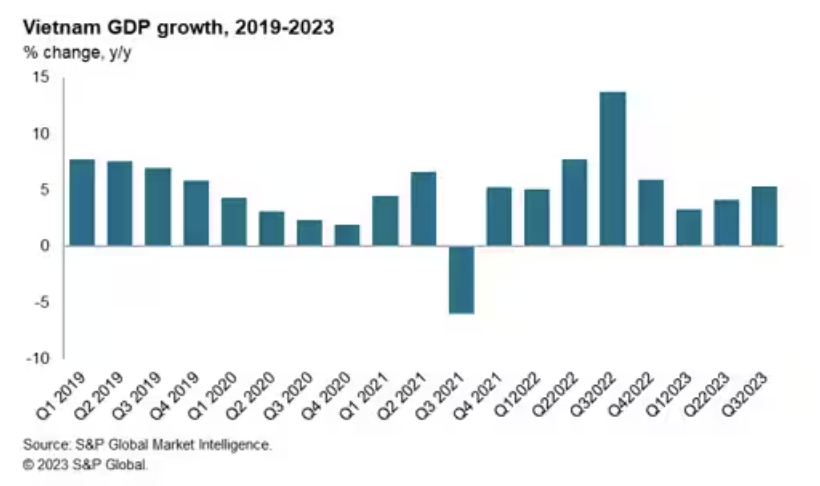

Vietnam GDP Growth Improves In Third Quarter Of 2023

Vietnam's GDP growth rate improved to a pace of 5.3% year-over-year (y/y) in the third quarter of 2023, compared with 4.1% y/y in the second quarter. Industrial production grew by 5.1% y/y in September, after having contracted by 0.4% y/y in the first eight months of 2023. In the near term, Vietnam's manufacturing export sector is still facing significant headwinds due to weak growth in the US and EU, which are two key export markets accounting for around 42% of Vietnam's goods exports. Vietnam's goods exports fell by 8.2% y/y in the first nine months of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Why Do U.S. Mid-Cap Equities Matter?

Take a deep dive into the S&P MidCap 400 as S&P DJI’s Hamish Preston and Sherifa Issifu explore what makes the S&P 400 relevant globally and the distinctive sector and risk/return characteristics of this slice of the US equity market.

—Watch the video from S&P Dow Jones Indices

Access more insights on capital markets >

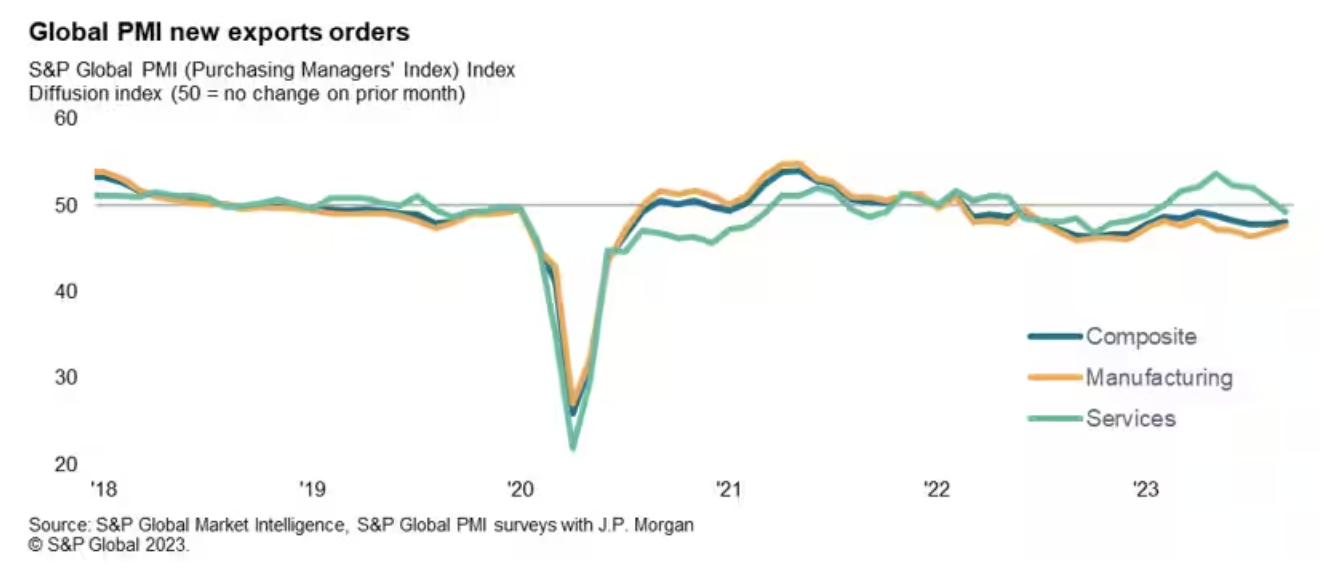

Trade Conditions Continue To Deteriorate At End Of Third Quarter

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a nineteenth successive monthly deterioration in global trade in September, albeit at a slightly more modest pace than seen in July and August. The seasonally adjusted PMI New Export Orders Index rose from 47.9 in August to 48.1 in September, signaling a slower contraction of global trade. That said, the index averaged 47.9 in the third quarter, down from 48.8 in the second quarter, thereby indicating that trade conditions deteriorated at the fastest quarterly rate so far this year.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Sustainability Insights: Managing Renewables Risk Is Increasingly Integral To US Power Utilities Credit Quality

Investments in renewable power sources are supporting energy transition in the US power sector. Renewables typically have negligible variable costs, but the required technologies as well as transmission and storage needs, among other factors, could boost capital costs and weaken a utility's financial metrics in the long term. Intermittent power production and a changing regulatory landscape could create operational risks that may require adaptation by US power utilities to stabilize credit quality amid the sector's evolution toward renewable generation sources.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

The Turkish Steel Market At The Center Of A Shifting World

Turkey plays a pivotal role in the steel market, exporting globally and importing large amounts of ferrous scrap and other raw materials. The sector now faces unprecedented challenges including geopolitical upheaval, economic pressures and the drive to decarbonize, but there are signs of adaptation, from rising activity in the futures market, to plans for green steel production.

—Read the report from S&P Global Commodity Insights

Access more insights on energy and commodities >

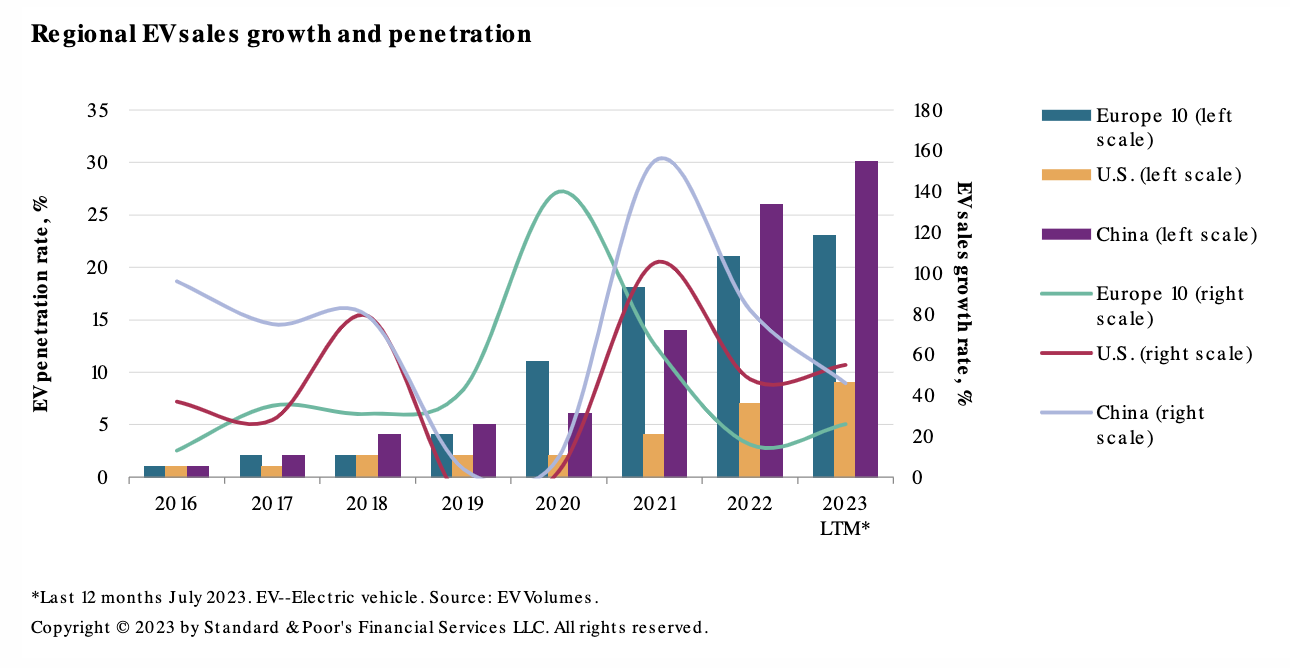

Global Auto Sales Forecasts: The Pricing Party Is Coming To An End

A slowdown in demand is likely in Europe and North America after a buoyant year so far, while China returns to its 2019 sales volumes. Global demand for light vehicles unexpectedly surged 8% in the first half of 2023, largely outperforming our earlier 3%-5% forecast for 2023. As a result, S&P Global Ratings has revised upward its full-year 2023 base-case forecasts. Momentum was strongest in Europe (+17%) and in North America (+13%), despite high inflation, rising interest rates and the Russia-Ukraine conflict.

—Read the report from S&P Global Ratings