Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Jan, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Despite Resolutions, Coal Markets Remain Strong in Asia

Coal is not lovable. Despite providing 36% of the world’s electricity — more than any other source — coal is rarely mentioned except as the fossil fuel to phase out first. Coal is a dirty fuel, contributing as much as 40% of global CO2 emissions. The problem is that coal is cheap, and cheap electricity has a lot of appeal in markets where any electricity is still viewed as a luxury. This means that while developed markets are committing to phase out the fuel, countries in Asia are picking up much of the slack in the market.

The 2023 UN Climate Change Conference in Dubai, United Arab Emirates, witnessed further commitments from countries to phase out coal power on an accelerated timeline. The US, Czech Republic, Cyprus, Dominican Republic, Iceland, Kosovo and Norway joined the Powering Past Coal Alliance, which is committed to phasing out unabated coal-fired power generation by 2030. Later in the conference, the UAE and Malta also joined the group. In all, 58 countries committed to phasing out unabated coal power generation. Germany is also set to retire many of its oldest coal-fired power stations this year, accelerating an earlier commitment to phase out coal by 2029. This reflects a trend for countries across the EU that have been retiring coal plants despite concerns over natural gas prices. Poland and the Czech Republic are the two European countries that still depend substantially on coal for power.

The US is also moving away from coal for domestic energy production. This year, for the first time, wind and solar are projected to provide more generating capacity for US customers than coal. However, the US continues to be a major exporter of coal to other countries.

One paradoxical impact of coal being phased out in the US and Europe is that lower demand means lower prices for the rest of the world. In addition, warmer weather forecasts are anticipated to reduce demand for winter heating, resulting in a glut of coal in the market and cheaper prices. Some power sector analysts believe that the current low prices for coal futures could change if natural gas prices rise. S&P Global Commodity Insights projected that Atlantic thermal coal markets will be calmer this year after the wild price swings of 2023.

There are a group of countries that view lower coal prices as an opportunity. Last year, China was a major importer of coal, creating vast stockpiles while prices were low. China is responsible for half of global energy production from coal, with the next three largest contributors — India, the US and Japan — accounting for about 25% of the total. India is viewed as one of the largest growth markets for thermal coal, with imports projected to grow in 2024 and 2025. Neither China nor India joined the Powering Past Coal Alliance at the 2023 UN climate conference.

Today is Tuesday, January 9, 2024, and here is today’s essential intelligence.

Written by Nathan Hunt.

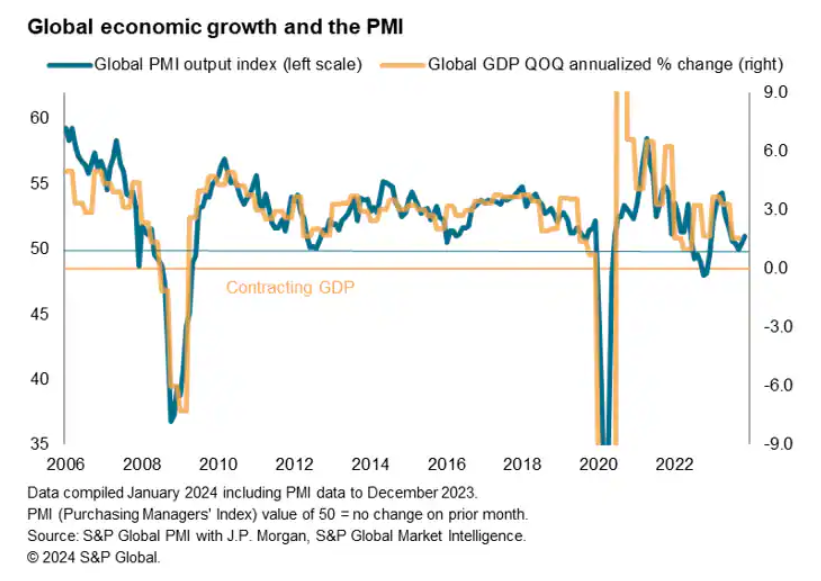

Global PMI Ends 2023 On Brighter Note, But Wide Divergences Persist

Global output growth accelerated slightly in December, according to the S&P Global PMI surveys, spurred by improved inflows of new orders. Confidence about the year ahead also lifted higher. However, all of these three gauges remain weak by historical standards, consistent with only modest global GDP growth and subdued hiring, the latter having largely stalled. Recession risks remain most elevated in the eurozone, and business activity stagnated in Japan. But modest expansions were seen in the US and UK, and growth accelerated in mainland China, though it was India's performance which was again by far the most impressive.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Top 10 Themes For Global Banking In 2024

Following the failure of several prominent banks in the US and the forced rescue of Credit Suisse in the first quarter, financial sectors remained largely resilient in 2023. This upheaval, triggered by concerns around banks' unrealized losses, was more pronounced than anticipated in the US, prompting sizeable support measures from the Federal Reserve to contain risks and restore depositor confidence in small-to-medium sized banks there. These negative effects were largely contained to the US.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

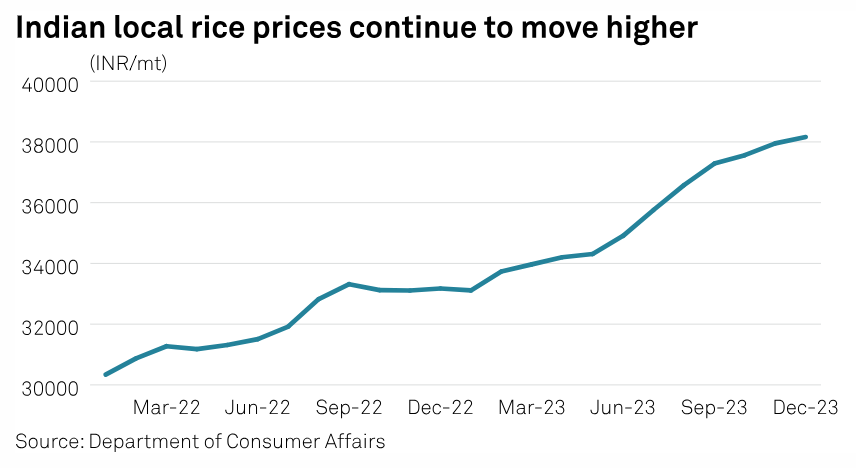

Commodities 2024: Indian Rice Exporters Brace For A Challenging Year Amid Policy Risks, High Prices

The road to normalization of rice exports from India is likely to be long due to policy uncertainty and firmness in local prices despite the trade restrictions. In response to the increasing domestic prices and exports, in 2023 the Indian government banned the export of non-Basmati white rice, imposed 20% duty on parboiled rice exports and fixed a minimum export price of Basmati at $950/mt.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

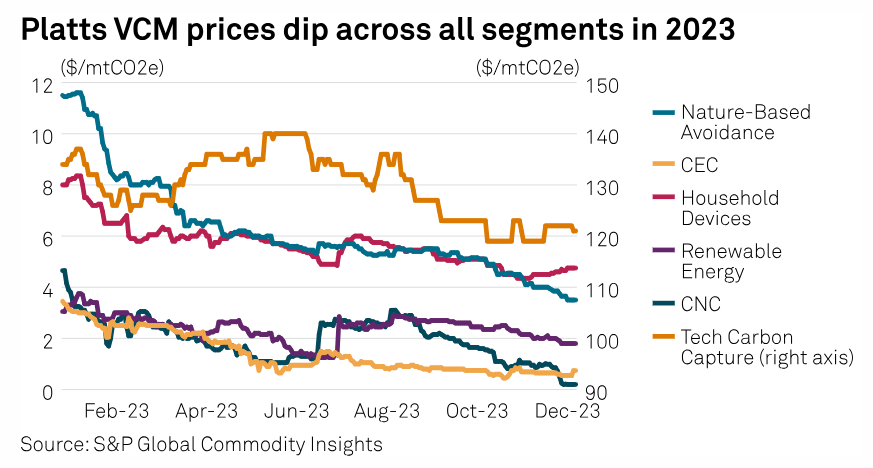

Commodities 2024: Price Slump In 2023 Clouds Outlook For Voluntary Carbon Market

Sharp declines in carbon credit prices in 2023 have clouded the outlook for the voluntary carbon market, or VCM, in 2024, with market participants pessimistic about a swift recovery after questions arose regarding the integrity and credibility of nature-based REDD+ credits issued by Verra. Verra is a major standard for certifying carbon credits to offset emissions.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

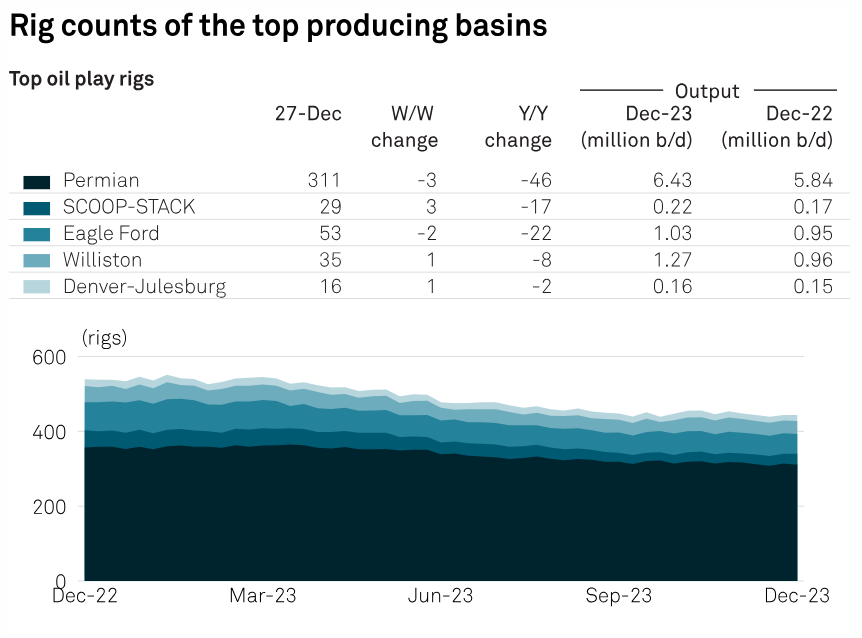

US Oil, Gas Rig Count Stumbles Near 25-Month Low Amid Bearish Price Outlook

The US oil and natural gas rig count sputtered through late December, hovering just above a two-year low as E&Ps continued to dial back drilling activity amid a souring outlook for commodity prices. In the week to Dec. 27, the number of operating US rigs edged up to 677 marking a gain of just two from the prior week when the total dropped to its lowest in just over two years. At the close of 2023, the US drilling fleet has now contracted by nearly 24% in the 12 months since reaching a post-coronavirus pandemic high at nearly 890 rigs, legacy IHS rig data from S&P Global Commodity Insights showed.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 148: Media Deals In The Premier League And NWSL

A set of significant deals in sports media rights have just closed and Richard Berndes returns to explore their impacts with host Eric Hanselman. There’s a shifting mix of free-to-air, pay TV and streaming providers competing for the rights to air games. The English Premier League just settled a four year deal with a record total valuation and the US National Women’s Soccer League closed one at forty times its previous. All of this cash may be aiding gender parity in coaching pay, as well.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence