Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Stubborn Dryness of Dry Powder

In the days of muskets and muzzle-loading cannons, keeping gunpowder dry was a military necessity. Powder that had been exposed to rain or humidity was less likely to ignite or have the necessary propulsive force. With military technology being what it is today, the phrase “dry powder” is more likely to refer to investment capital held in reserve, ready to deploy as needed. In private equity and venture capital circles, investors — also known as limited partners — will commit to investing a certain amount of money in a fund, but the private equity firm — also known as the general partner — won’t ask for that money until it is ready to invest. This means that there is always a pool of money that has been committed but not yet deployed. It is this money that is referred to as dry powder. Because limited partners prefer to deploy capital to earn returns rather than hold it in highly liquid cash or cash-equivalent investments waiting on a private equity firm, dry powder is something of a misnomer. However, the money is presumably available for investment at any time.

According to S&P Global Market Intelligence, the quantity of global private equity dry powder had ballooned to $2.49 trillion by mid-2023. Part of the reason that so much committed capital remains undeployed is that private equity and venture capital investment opportunities appear to be scarce. It is hard to track valuations of private companies, but a sharp decline in exits, deals, M&A activity and fundraising indicates that private company valuations have fallen, owners of assets aren’t willing to sell at lower valuations and buyers of assets aren’t willing to pay prices in line with previous, higher valuations. Part of the reason for the standoff may be the continued presence of dry powder. Asset owners may assume that the dry powder will need to be deployed eventually, driving prices up. Asset buyers may be waiting until prices come down before deploying their dry powder.

Thus far, the powder has stayed dry. Data from S&P Global Market Intelligence indicates that private equity investments in the third quarter of 2023 fell 44% year over year and the number of private equity deals dropped 36%. Both the value and the number of deals decreased in every sector globally compared with a year ago.

When a venture capital or private equity firm sells an investment, this is called an exit. Successful and profitable exits are the whole point of private market investment. Exit deal volumes were relatively flat in the first nine months of 2023 compared with the same period a year earlier. On the bright side, the third quarter saw a modest year-over-year increase in private equity exits.

Some of the decline in investment may be attributed to geopolitical issues. Third-quarter US private equity and venture capital investments in mainland China were down 40.9% year over year. By comparison, private equity and venture capital investments across Asia-Pacific, excluding Japan, were only down 20% over the same period.

Private equity and venture capital fundraising also experienced a drop this year. The total capital raised up to the third quarter was down 14% year over year and the number of funds that closed declined. While it might appear that fewer funds with less capital would lead to less dry powder, 75% of the existing dry powder was raised within the last three years, and a dearth of investment opportunities may mean the total estimated amount of dry powder will continue to increase.

Today is Monday, November 6, 2023, and here is today's essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of Nov. 6, 2023

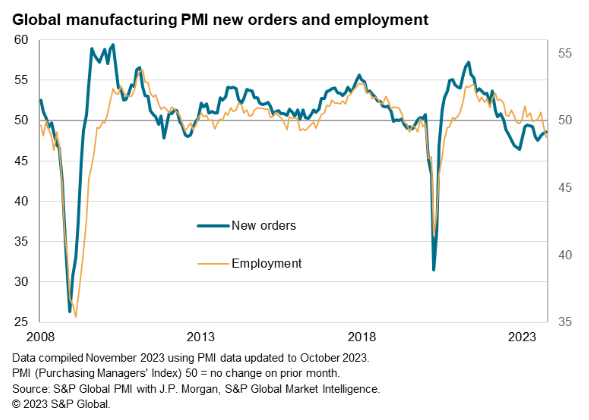

The upcoming week continues to pack a multitude of data releases including global services PMI release and more detailed sector PMI data. The Reserve Bank of Australia also convenes for their penultimate meeting of the year, though the focus may be with inflation and trade figures from mainland China in APAC. Meanwhile UK Q3 GDP will be a key highlight while further US economic data releases including trade figures will be watched post-FOMC. For further insights into US investors' thoughts, the S&P Global Investment Manager Index will be due Tuesday.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

US Home Prices Soar To Record Highs In August

US home prices climbed at a faster pace in August, marking the seventh consecutive month of increases as high mortgage rates kept buyers and sellers off the market. The S&P CoreLogic Case-Shiller US National Home Price NSA Index, covering all nine US census divisions, ticked up 2.6% annually in August, compared to a 1% year-over-year increase in July after seasonal adjustment.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Russian Oil Exports Climb To Five-Month High As Crude Flows Rebound

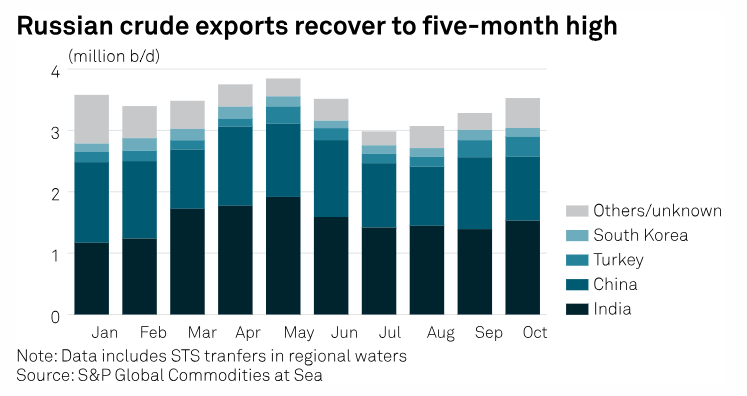

Russia's seaborne oil exports rose to a four-month high in October as its crude flows rebounded above its pledges to OPEC+ while the country's ban on road fuel exports pushed oil product flows close to post-Ukraine war lows. Crude shipments from Russian export terminals averaged 3.53 million b/d in October, a 7.4% rise on the month to the highest since May and above the average pre-war level of 3.1 million b/d, according to tanker-tracking data from S&P Global Commodities at Sea (CAS).

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

ICE Exchange To Launch Platts-Based Ammonia Derivates Contract

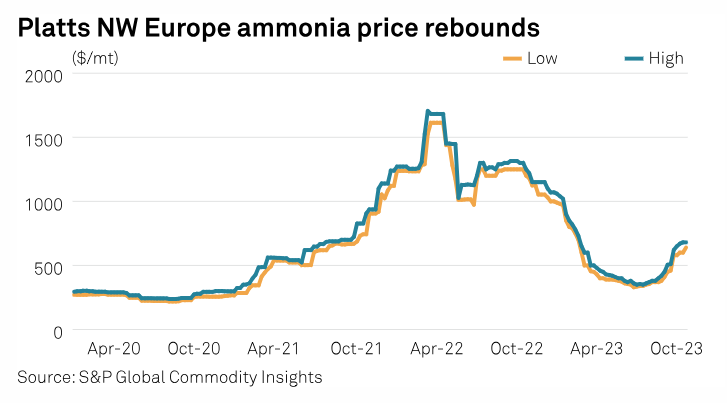

ICE Futures Europe is to launch a new ammonia futures contract based on Platts weekly CFR Northwest Europe assessment, with a first trade date scheduled for Monday, Dec. 11, the exchange said Oct. 31. Platts, part of S&P Global Commodity Insights, last assessed the price at $640-$680/mt Oct. 26, up 6.67% week on week.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Chevron To Move Neutral Zone Facilities To Khafji By January 2026

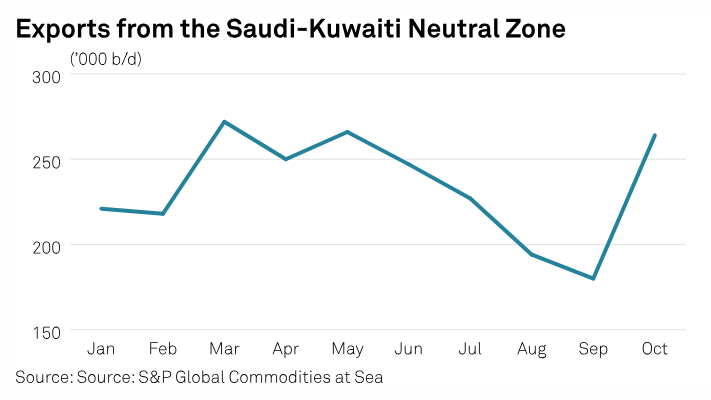

"SAC [Saudi Arabian Chevron] is targeting occupation of the new headquarters in January 2026," a spokesperson for Chevron told S&P Global Commodity Insights. The company is currently in the middle of moving its headquarters as well as vital infrastructure including tank farms, facilities to Khafji, a source close to the development told S&P Global Commodity Insights Oct. 30.

—Read the article from S&P Global

Access more insights on energy and commodities >

China's Chip 'Moon Shot' — The Response To Restrictions

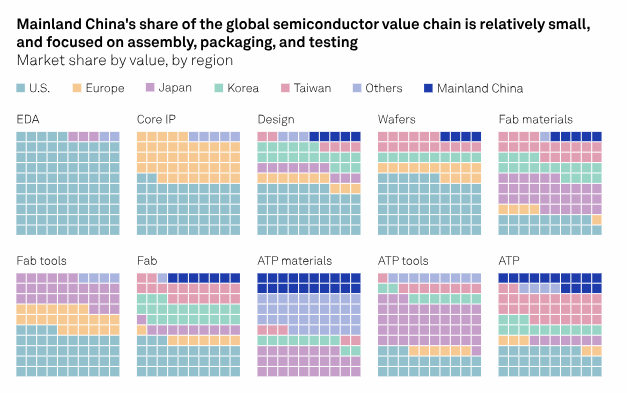

Mainland China has a large mature-chip industry, but it remains unable to make cutting-edge chips without imported technology. This dependence means recent US-led bans on the export of advanced chips and equipment to China will pose significant challenges to China's efforts to catch up. The country will channel its considerable resources across the public and private sectors to close the gap; the recent trade restrictions have only made that call more urgent.

—Read the report from S&P Global Ratings