Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Global Auto Sales Boom To Fizzle Out on Weak Economy, End of Post-COVID Surge

Global auto sales growth will cool in 2024 due to a weak economy and the end of a post-COVID-19 demand surge, according to S&P Global Ratings.

Worldwide year-over-year sales for light vehicles will only rise 1%-3% next year and 2%-4% in 2025, according to S&P Global Ratings, trimming earlier forecasts. Sales will likely jump as much as 7% year over year in 2023 due to pent-up demand following the pandemic and the easing of supply constraints that contributed to a decline in volumes in 2022.

The three biggest global auto markets — China, Europe and the US — could all experience flat sales next year due to slowing economic growth in China and the prospect of protracted high interest rates, weak growth and sagging consumer demand in the US and Europe. The US and European markets are both unlikely to rebound to pre-pandemic levels through the end of 2025.

“A slowdown in demand is likely in Europe and North America after a buoyant year” in 2023, S&P Global Ratings said, and China is likely to “cease driving global growth of auto industry sales.”

China has missed out on the 2023 global auto sales boom, with volumes little changed versus a year earlier, after car buyers took advantage of government stimulus measures in 2022. Demand is unlikely to accelerate much next year in a market that has already returned to pre-pandemic sales levels.

“Soft consumer sentiment amid macro headwinds will constrain growth in 2024,” according to a separate S&P Global Ratings report.

The US auto market will likely be hampered by a weak economy over the next couple of years, and annual sales will probably remain below the pre-pandemic level of 16 million vehicles. Hitting that mark will depend on further supply chain improvements, labor availability at manufacturing plants and consumer demand, according to an S&P Global Ratings note.

Labor is a key question because of ongoing strikes at US auto plants. These stoppages add “some uncertainty” to US automakers’ 2023 cash flow and earnings, the note said. Still, the strikes are unlikely to affect credit ratings because S&P Global Ratings’ analysts “incorporate a meaningful cushion for industry volatility” into financial risk assessments.

Consumer demand could be a drag on the auto market due to higher vehicle prices, ongoing inflation and the prospect of sustained high interest rates. This weakness may become more apparent in 2024 as a post-COVID-19 boom in fleet sales cools off, the note said.

A similar pattern is already evident in Europe; private sales fell 36% year over year in the third quarter, following a 12% full-year slump in 2022. This decline has been masked by sales to fleet managers, such as companies, rental operators and governments, which are less directly exposed to failing purchasing power and ramped up buying after supply constraints.

“As the purchasing cycle of fleet buyers normalizes, we expect the weakness of the private component to more clearly emerge,” S&P Global Ratings’ analysts said.

Today is Thursday, November 16, 2023, and here is today’s essential intelligence.

Written by Neil Denslow.

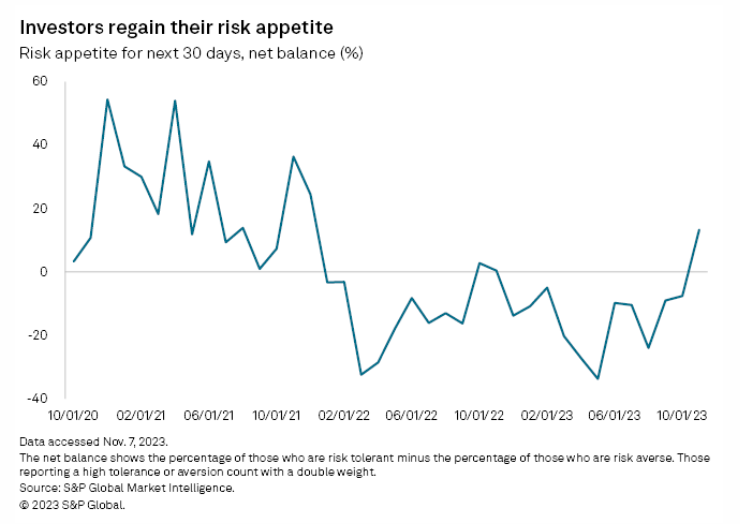

Equity Investors' Risk Appetite Hits Highest Level In Almost 2 Years

Risk tolerance among US equity investors appears to be turning the corner following a two-year period of mostly negative market sentiment, according to the latest results from S&P Global's Investment Manager Index survey. The survey's Risk Appetite Index surged to 13% in November, up significantly from negative 8% in October. That marked the first time the index touched double-digit positive territory in nearly two years, helped by a growing stance that interest rates have peaked.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Private Equity Investment Plunges In Troubled Drug Retail Sector

Global private equity and venture capital investments in drug retail companies slowed in 2023 with deal value at $560 million across eight deals for the year through Oct. 22, or only a quarter of the $2.23 billion investment total in full year 2022 across 24 transactions, S&P Global Market Intelligence data shows. Deal count in 2023 is on track to be the lowest since 2019.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

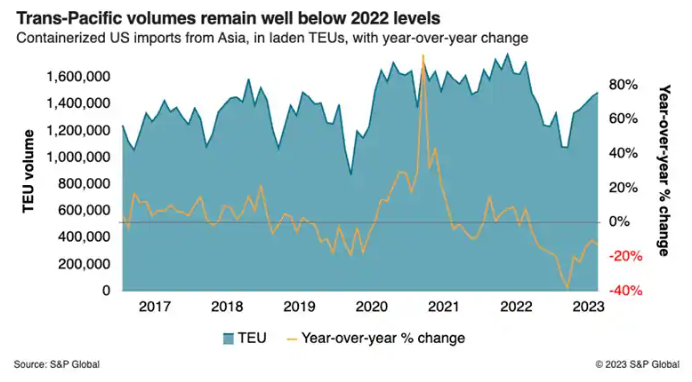

Ocean Carriers Survey Changing Market And Ponder Next Course Of Action

If there's one question looming above all others as the era of extreme carrier profitability recedes into the past, it is this: What will ocean carriers do next? Behind that question is a truism often forgotten in container shipping, which is that whatever happens to pricing and service is not the result of outside forces such as recession or consumer spending exerting pressure on the market beyond the ability of the industry to control. Rather, what ultimately happens is entirely in the hands of the carriers, with their decisions determining how an unpromising year such as 2024 actually plays out.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

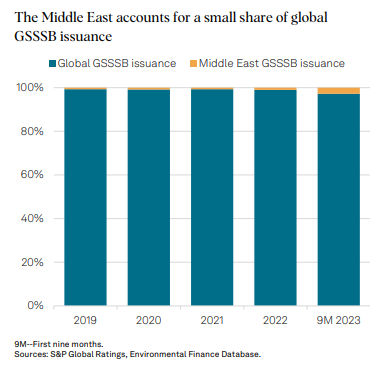

Sustainability Insights Research: Middle East Sustainable Bonds May Expand Further

GSSSB issuance in the Middle East should continue to increase in the coming years, supported by government initiatives and the relative nascency of certain markets. The UAE and Saudi Arabia will likely remain the leaders of the region's GSSSB market, particularly through green bonds, which S&P Global Ratings expects will continue driving regional issuance over the next three to five years. Gulf Cooperation Council (GCC) government-related entities (GREs) in fossil fuel dependent sectors are aligning strategies with national sustainability targets, but implementation may be delayed. The demand for GSSSB issuance in the region is sensitive to oil prices, inflation and interest rates; these factors could impact funding and regulations.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

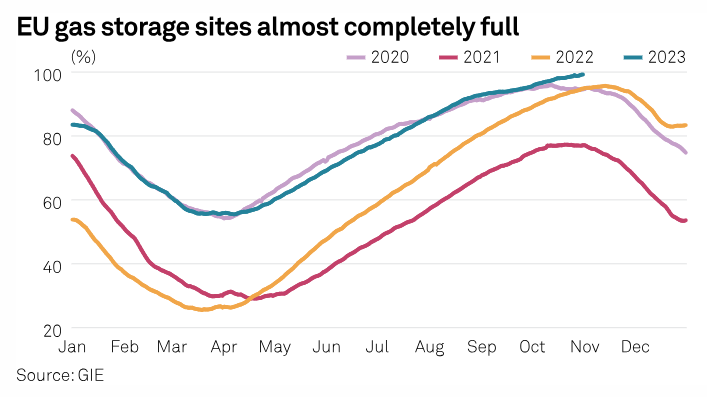

EU Needs 'Big' Gas Storage Buffer At The End Of Current Winter: EC Official

The EU will need to have a "big buffer" of gas in storage at the end of the current winter to help prepare for the following winter, a senior European Commission official said Nov. 14. Paula Pinho, energy security director at the EC's energy directorate, said Brussels was maintaining a "very high level of monitoring and preparedness."

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Gen AI Is Writing A New Credit Story For Tech Giants

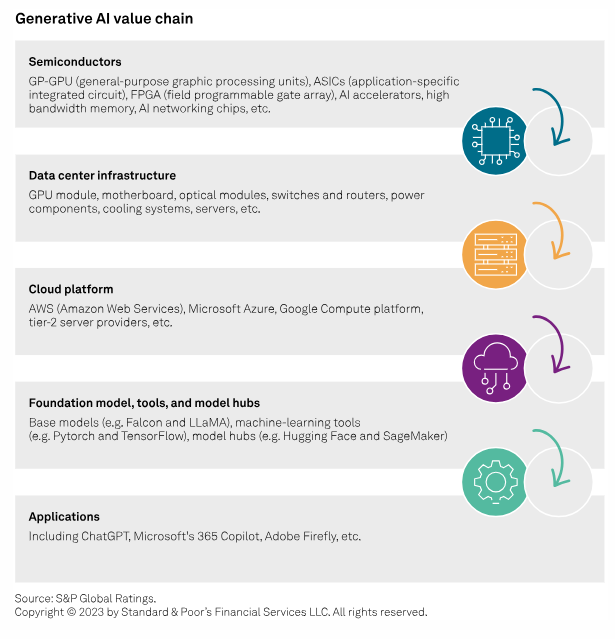

The generative AI market is poised for explosive growth. The debut of ChatGPT in late 2022 revealed the potential of generative artificial intelligence (AI). Like other transformative technologies such as the internet, generative AI will require large upfront investment to develop and to commercialize. S&P Global Ratings sees clear winners and potential followers for at least the next three years. Yet the long-term implications are less certain and depend on tech firms' adaptability to the evolving AI market, with properly paced and timed investments, good execution and financial discipline.

—Read the report from S&P Global Ratings