Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Looking At Sovereign Debt & Defaults

The outlook for sovereign credit quality is evolving against the backdrop of the persistent pandemic and geopolitical turmoil—with sovereign ratings weaker now than pre-COVID, while sovereign borrowing is expected to remain high.

Governments’ fiscal consolidation challenges are likely to be compounded this year by the war in Ukraine and aggressive monetary policy tightening, which will pressure borrowing costs. Sovereign borrowing is likely to reach $10.4 trillion in 2022, marking a nearly one-third increase from the average levels seen prior to the onset of the COVID crisis, according to S&P Global Ratings. Local and regional government borrowing is expected to likewise remain elevated, totaling $2.35 trillion annually worldwide from 2022-2023.

Despite the stabilization of sovereign credit quality that started last year, risks are expanding—as evidenced by recent sovereign rating performance.

“Sovereign ratings were much more stable in 2021 after the onset of the COVID-19 pandemic led to a sharp rise in defaults and downgrades in 2020,” S&P Global Ratings said in research published this week. “But with the growing number of speculative-grade ratings and the sharp fiscal and economic shocks that countries are facing as a result of the pandemic, the number of 'CCC'/'CC' category sovereigns remains higher than before the pandemic, with eight issuers at the beginning of 2022. This pool of issuers in the highest-risk rating category suggests that defaults could remain elevated in coming years.”

Against the backdrop of pandemic pressures, the Russia-Ukraine conflict is amplifying strains on governments in various ways.

While S&P Global Ratings believes that Asia-Pacific sovereigns will feel the effects in increasing prices, their government debt is likely to roar to a new high above $20 trillion due to COVID’s continuing burden on fiscal performances. For the 30 developed sovereigns across Europe, the Middle East, and Africa, S&P Global Ratings anticipates borrowing will decline year-over-year by $263 billion, to roughly $1.6 trillion in gross long-term commercial paper, as strong growth momentum softens the costs of energy subsidies, defense spending, and refugee assistance. Commercial borrowing in both North and Latin America is also expected to decline this year, by nearly 20% to $4.768 trillion.

Pathways for emerging and developed sovereigns appear likely to continue diverging throughout the year. In 2021, “while the economic recovery lifted credit quality broadly, credit quality in the developed market fared better than in emerging and frontier markets, many of which had less fiscal flexibility, less supportive financing conditions, and delayed access to COVID-19 vaccines,” S&P Global Ratings said in the report this week. Now, credit quality is recuperating for developed markets’ major government borrowers while emerging market local and regional governments' borrowing may remain elevated to combat fiscal shocks.

Today is Wednesday, May 4, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

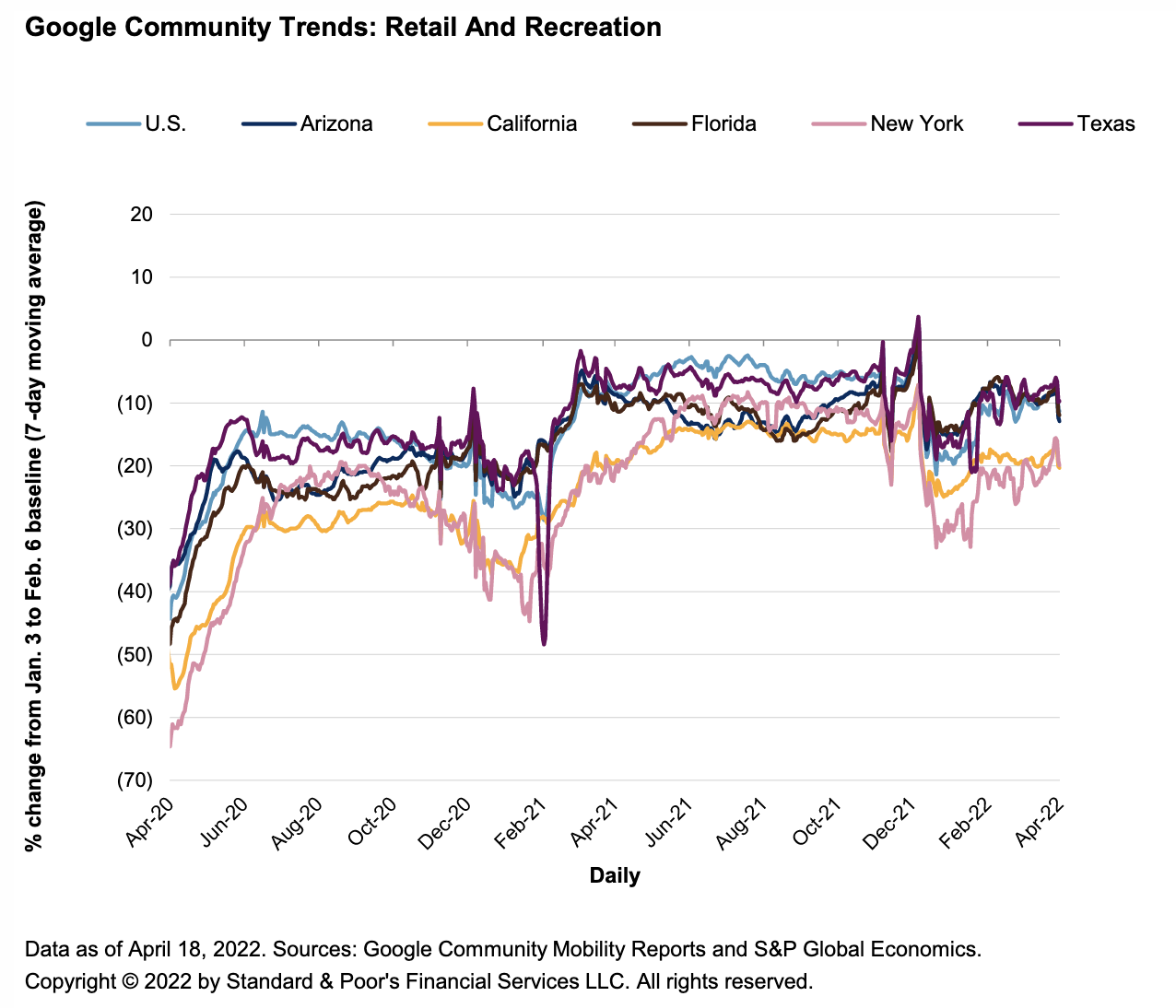

Economic Research: U.S. Real-Time Data: Spending Remains Steady Amid Price Pressure And Slowing Mobility

S&P Global Economics' U.S. real-time economic trackers show mobility in retail and recreation was 11% below the pre-pandemic trend through April 18, though certain measures of mobility, such as seated diners at restaurants, air traffic, and hotel occupancy rates, held close to their 2019 rates. While the recent pickup in new COVID-19 cases may be discouraging those activities, with daily new cases (seven-day moving average) increasing by 35% over one week to 52,340 as of April 26, this figure remains 94% below its Jan. 15 all-time high.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Asia-Pacific Finance M&A Hit By Geopolitics, Supply Chain Disruptions In Q1

Geopolitical tensions and the drag from global supply chain disruptions may dampen M&A deals in Asia-Pacific after the number of such deals fell in the first three months of 2022. A total of 123 finance sector M&A deals were reported in the January-to-March quarter, compared with 165 in the same period of last year, S&P Global Market Intelligence data show. The ongoing war in Ukraine, supply chain bottlenecks, and inflation concerns slowed down deal-making in the first quarter. "We expect to see deals start and stop as companies try to time when best to take the plunge," said Sophie Mathur, partner and Asia head of corporate at Linklaters, a law firm. Despite the emerging opportunities, businesses will find themselves questioning the market timing as the strongest headwind will be market volatility, Mathur said.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Feature: Middle East Marks Eid Holiday As Food Becomes More Costly

The Middle East celebrated the Eid holiday with food a centerpiece of many gatherings, but as Russia's war on Ukraine pushes prices higher for all kinds of basic ingredients, the gatherings this year will pack a wallop on family budget and have governments nervously eyeing their economies. The Eid holiday marks the end of the Ramadan fasting month for Muslims and is marked by family gatherings and large meals. Prices for Russian wheat exported from the Black Sea have climbed 45.9% in the past year to $394/mt as of April 29, according to Platts assessments from S&P Global Commodity Insights. Expensive wheat has resulted in rising prices for flour and bread.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Understanding Methane One Commodity At A Time

Methane is everywhere, but it poses a particular problem in natural gas production. Head of Low Carbon Commodities Deb Ryan is joined by Emmanuel Corral and Paula VanLaningham to discuss the unique problems posed by methane emissions in the fight against climate change and S&P Global Commodity Insights' new Methane Intensity assessments. Using a top-down approach to measuring methane intensity through satellite data and the pricing transparency generated by the Methane Performance Certificate market, Commodity Insights has brought new transparency to the cost of methane emissions generated through natural gas production.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

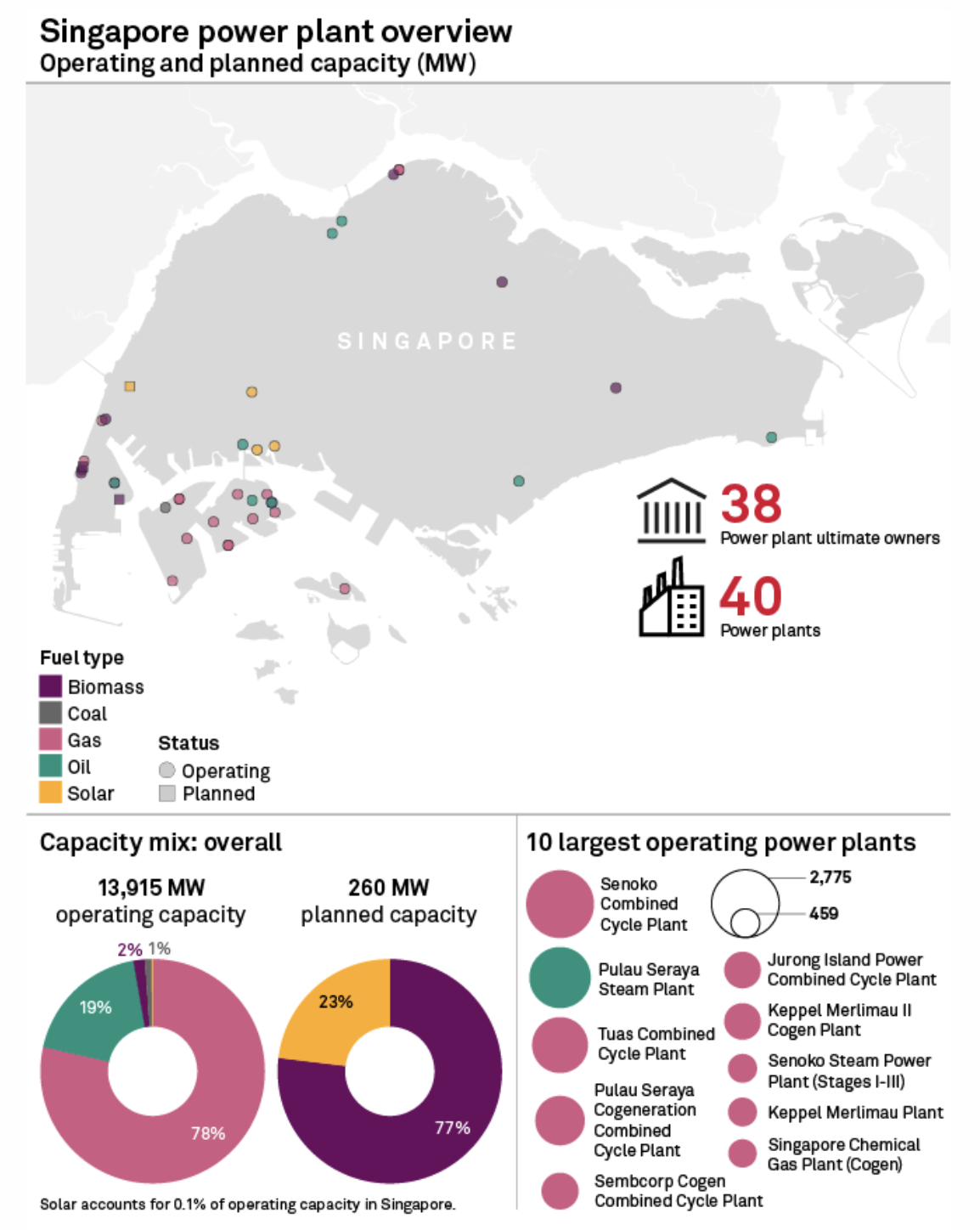

Singapore Relies On Gas, Oil For Power Generation

Two power stations provide more than half the generating capacity in the island nation of Singapore, according to S&P Global Market Intelligence data. More than three-fourths of the nation's nearly 14 GW of generating capacity is fueled by natural gas and another 19% is currently fueled by oil. Planned capacity in Singapore totals 260 MW, from a mix of biomass and solar. The largest single operating power plant in Singapore is the 2,775-MW Senoko Combined-Cycle Plant. Its owner, Senoko Energy Pte Ltd., is made up of a consortium including Japanese firms Marubeni Corp., Kyushu Electric Power Co. Inc., and Kansai Electric Power Co. Inc. and France-headquartered Engie SA.

—Read the full article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 63: Women In Technology Study Results

Women’s experiences in the technology workplace are many and varied. Research directors Katie Darden and Melanie Posey join host Eric Hanselman to explore the results of the Women in Technology study. Produced in collaboration with the California Technology Council and WE Global, the study looks at different aspects, including the power of virtuous circles that women role models can create in tech and how perspectives differ across age groups.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence