Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Supply Chains Are the Canary in the Coal Mine for New Geopolitical Reality

Geopolitical risk is not new, nor did it suddenly reawaken after a multidecade slumber. There have always been alliances of convenience or sentiment that shape the flow of trade and capital around the world. However, competition and alliances have grown more overt in the last few years. Before, supply chains and the bonds of trade waxed and waned over decades. Now, we are seeing rapid shifts brought on by political and historical grievances. These shifts manifest in the global flow of goods and services. Looking at detailed supply chain data allows us to identify the signal and noise of geopolitical conflict and to decipher the importance of political rhetoric.

According to Carlos Pascual, former US ambassador to Mexico and Ukraine and current senior vice president of geopolitics and international affairs at S&P Global Commodity Insights, “Russia's invasion of Ukraine shattered the post-World War II rules-based international order which has underpinned global prosperity and energy markets for the last 70 years.”

The war in Ukraine and the sanctions imposed by the NATO alliance have changed the understanding of what is possible in a multipolar global order. For China, there is concern that the US and its European allies can restrict international capital, sensitive technologies and considerable price caps on Russian oil and gas sales. This creates a perceived incentive to restructure an international system of trade that is dominated by US policies and US dollars.

Looking at supply chain data from China, the impact this competition is having on everything from semiconductors to commodities is clear. Given the extent of the remaining trade relationships between China and the US, or between China and Europe, it is wrong to overstate the intensity of the geopolitical shift. But the nature of these relationships has shifted from cooperation to competition. China is clearly focused on expanding trade relationships with other partners, both through its Belt and Road Initiative and through improved bilateral trade relationships.

India is the wild card in these geopolitical shifts. Given its favorable demographics and growing economy, India is careful not to take sides in geopolitical conflicts that are not core to the country’s strategic interests. Despite pressure from Western governments, India has been a willing market for discounted Russian oil and gas.

Lindsay Newman, S&P Global Market Intelligence’s executive director of Economics & Country Risk, described India’s approach as exemplifying “a new pragmatism, in which [countries] cooperate across spheres of mutual interest and simultaneously contest across spheres of national interest.”

Finally, Russian and Ukrainian supply chains and trade have changed the most due to the war. Russia has lost, perhaps permanently, its largest market for natural gas exports in Europe. Europe has been scrambling to reestablish energy security in the absence of Russian sources through LNG, hydrogen, nuclear power and renewables. Trade in grains and cooking oils has been badly disrupted, with normal shipping routes through the Black Sea growing precarious. Russia’s economy has proven unexpectedly resilient to Western sanctions, but restrictions on technology, trade and capital may continue to affect Russia for years to come.

Today is Thursday, May 18, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

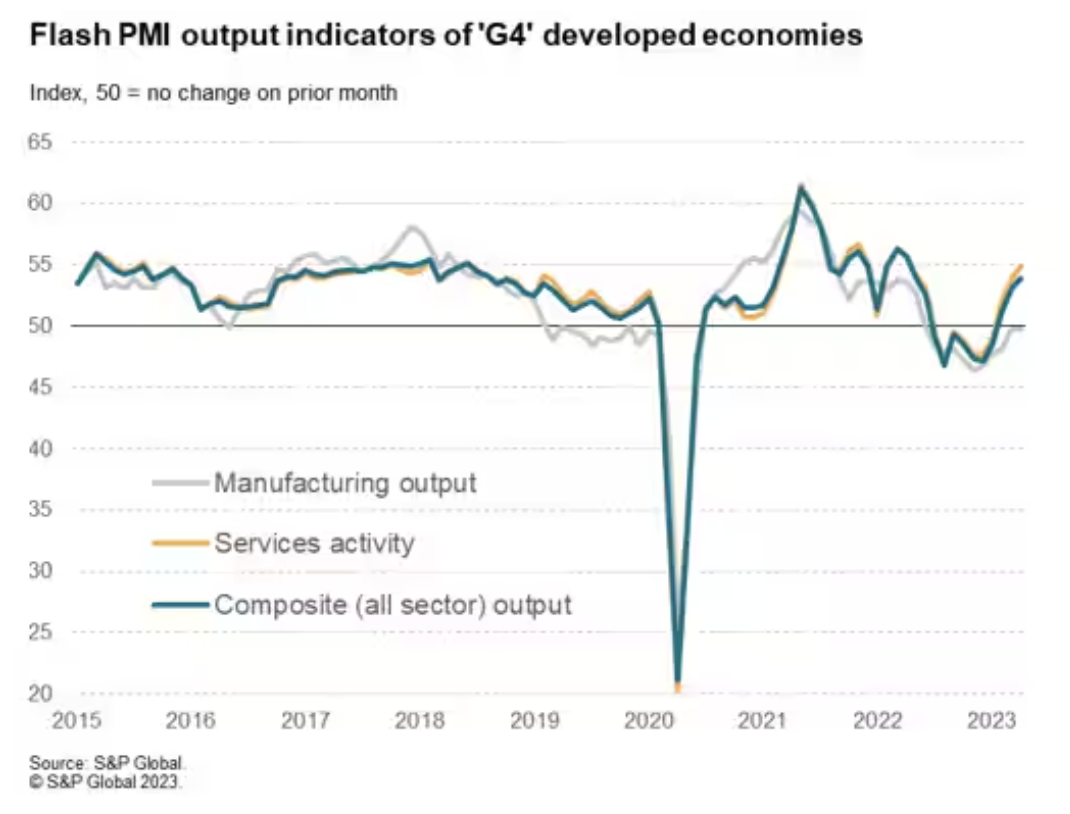

Previewing The May Flash PMI Surveys: Assessing Growth Resilience And Inflation Indicators

Ahead of the flash PMI releases for the US, Eurozone, UK, Japan and Australia, released on May 23, S&P Global Market Intelligence recaps the latest survey findings from the April S&P Global PMI surveys and pick five key themes to watch in the upcoming releases. April's surveys pointed to better than anticipated performances, beating expectations in all four major economies. US output rose for a third successive month and at the fastest rate for 11 months as growth accelerated in both manufacturing and services.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Default, Transition And Recovery: Global Corporate Default Tally Reaches 50

With 13 defaults in April, the global default tally increased to 50 as of April 30, more than 75% higher than the same period in 2022 and 25% higher than the 10-year average. Eight different sectors contributed to the default tally in April, signaling broadening credit pressures. Latin America saw four defaults in April alone and is responsible for all emerging market defaults so far this year. While the pace of monthly corporate defaults declined for the second month in a row, weakest links continue to rise, pointing to a potential future increase in global defaults.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

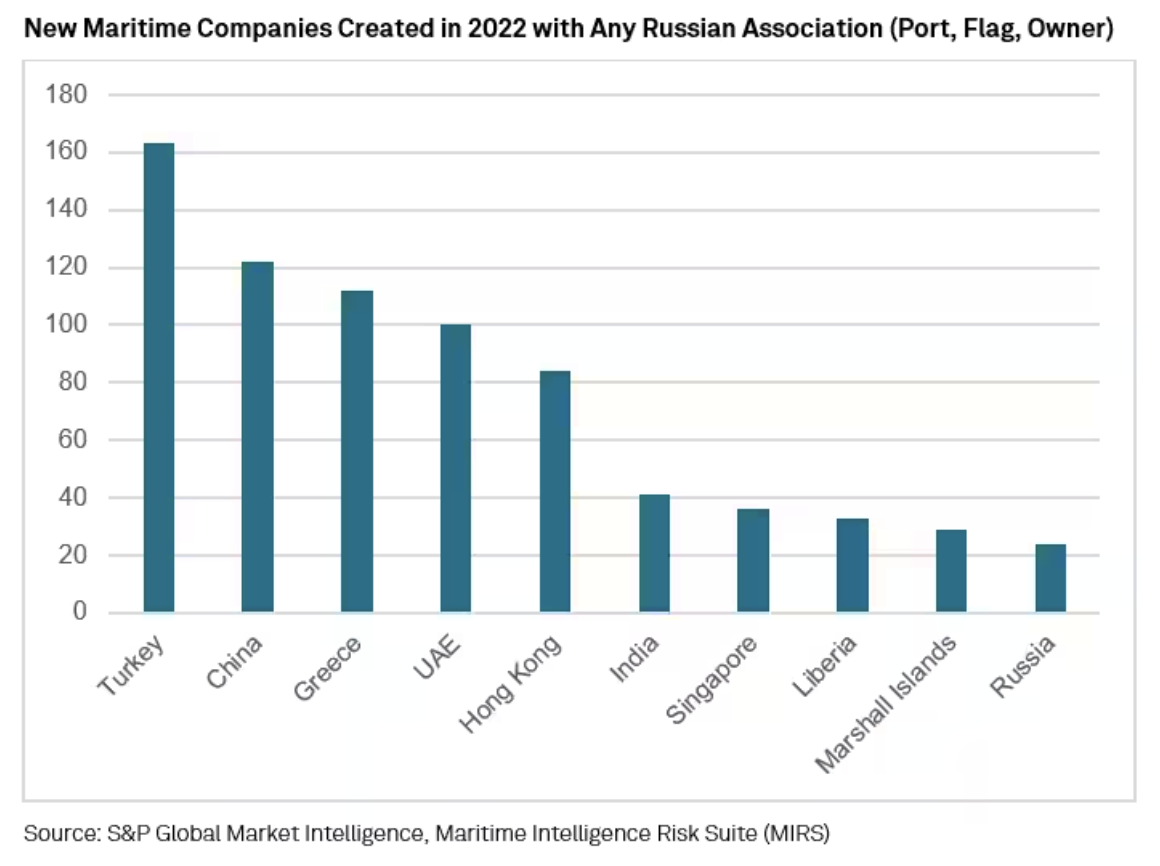

Russian Shadow Shipping — Emerging New Owners

Prior to the introduction of the G7 oil price cap in December 2022, a number of vessels moved from direct Russian ownership or nationality to new companies domiciled in India and the United Arab Emirates. These new, primarily, tanker owners have created fleets of vessels with direct and indirect links to Russian entities while retaining a general level of opaque ownership information, especially in regard to the ultimate group owner. In the meantime, these new owners have helped Russian oil continue to flow when more traditional and conventional fleet owners exited the Russian market.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

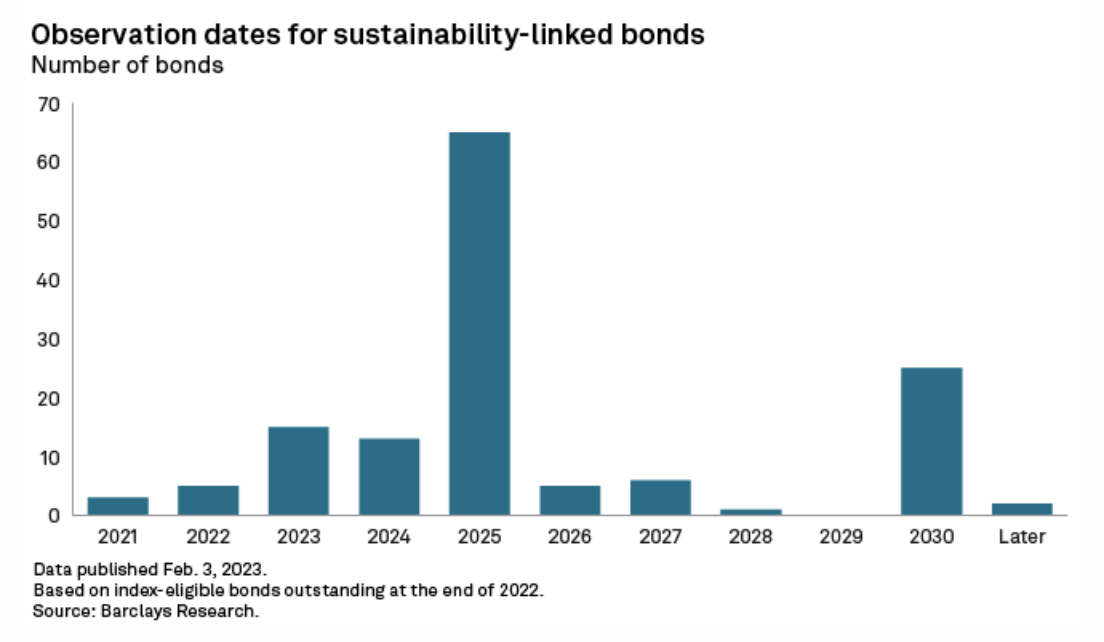

Higher Costs Loom For Sustainability-Linked Bond Issuers As Deadlines Approach

The nascent sustainability-linked bond market faces one of its biggest tests to date as a growing number of issuers approach their first target deadlines. Fifteen index-eligible sustainability-linked bonds (SLBs) have observation dates in 2023, according to Barclays research. Several issuers risk higher coupon payments as external factors, such as the war in Ukraine and the resulting energy crisis, have impacted their sustainability performance, the research found.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

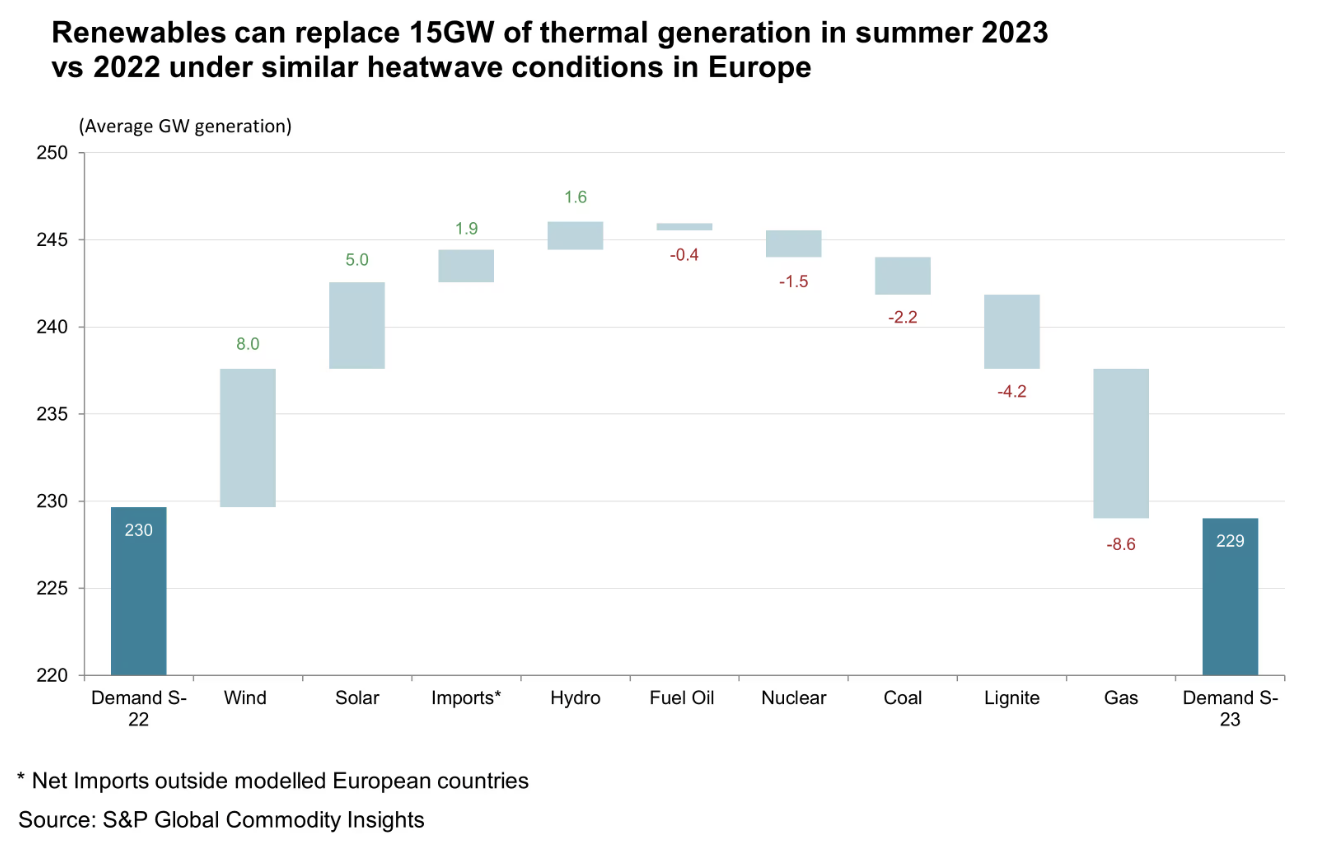

Europe Is Better Equipped To Handle A Recurrence Of Last Summer’s Heat Wave, But Remains Sensitive To Changes In Gas Supply

Through all uncertainties, S&P Global Commodity Insights believes the upside for electricity prices and power sector gas demand this summer is relatively muted.

First, what happened last summer? Extraordinarily high temperatures lifted power demand from air conditioning and fans while droughts reduced hydroelectric generation to historic lows. Nuclear generation also dropped with cooling water restrictions curtailing production. Last summer was also notably affected by high gas prices due to the Russia-Ukraine war. However, with gas supply looking stable this year, we see the primary source of price upside to be from a recurrence of heat wave conditions.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

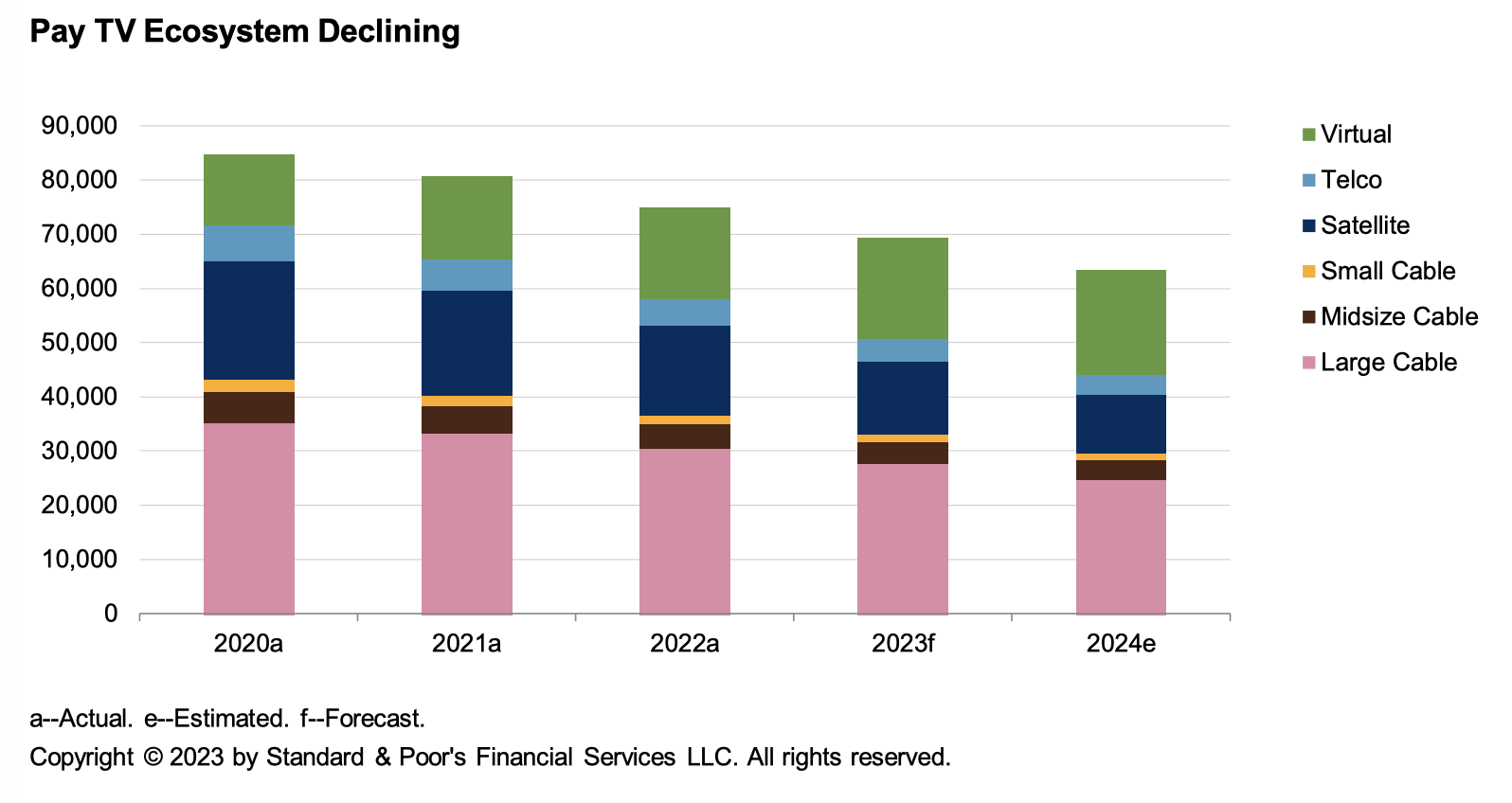

Cord-Cutting Worsens, Raising Questions About Future Of U.S. Pay-TV Ecosystem

The two largest cable companies, Comcast Corp. and Charter Communications Inc., recently reported aggregate residential video subscriber losses of 9.1% for the first quarter of 2023, significantly higher than 1Q22's 6.0% pace and well ahead of S&P Global Ratings' forecast. With this report S&P Global Ratings is updating its U.S. pay-TV video subscriber forecast, which it bases on a roll-up of its individual company forecasts, and commenting on how it could affect its ratings on companies within the U.S. pay-TV ecosystem.

—Read the report from S&P Global Ratings