Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Downside for North American Economies

North America’s macroeconomic and credit conditions will be shaped by the outcomes of the Federal Reserve’s monetary policy normalization, supply chain disruptions intensified by the Russia-Ukraine conflict, and the persistence of inflationary pressures.

Because companies are confronting higher input costs and supply disruptions that are expected to last until at least the second half of this year, investors may soon start repricing risk. Geopolitical uncertainties may also burden trade, capital flows, market confidence, and business conditions. As these risks rise, growth in the U.S. is set to slow (while Canada’s may stay steady)—and corporate borrowers may see remarkably favorable financing conditions come to an end, according to S&P Global Ratings’ second-quarter economic outlook and analysis of regional credit conditions.

S&P Global Economics now expects the U.S. Federal Reserve to raise interest rates seven times this year, including a 50 basis point (bps) hike, and followed by four to five rate increases next year. Supply bottlenecks, higher prices, and the Fed’s sooner and faster rate hikes will likely trim 70 basis points from U.S. GDP growth this year, which S&P Global Economics forecasts at 3.2%, and 2.1% for 2023. Meanwhile, S&P Global Economics maintained Canada’s GDP growth for 2022 at 3.7%, considering that higher prices, interest rates, and the pressures of the Russia-Ukraine will weigh on growth in the following two years—with GDP softening to 2.6% in 2023 and 1.9% in 2024, from 2.7% and 2.1%, respectively.

“As the impact from omicron has lessened in North American economies, the Russia-Ukraine conflict has emerged as a preeminent risk creating both headwinds and uncertainty. But both the U.S. and Canada have buffers to weather the shocks,” S&P Global Ratings Chief North America Economist Beth Ann Bovino told the Daily Update. “The overarching concern facing U.S. growth is extreme price pressures, exacerbated by the Russian-Ukraine conflict. The Fed has already indicated an aggressive tightening stance, betting that the U.S. can absorb the shock. While we see U.S. buffers will provide the cushion that the economy needs to withstand the Fed policy drag, we increased our U.S. risk of recession over the next 12 months to 25%, with a wide band given increased uncertainty. This is a concern for both the U.S. and its northern neighbor.”

The Fed’s aggressive action and Russia’s invasion of Ukraine have resulted in a notable slowdown across primary bond markets, evidenced by nonfinancial corporate issuance declining more than 50% year-over-year through March 16. Because bond yields have quickly recovered to pre-pandemic levels in less than three months, many issuers may be staying out of the market until it finds a new level for rates. Companies have also reduced their debt burdens for 2022-2023 to secure low interest rates or longer funding commitments and have contributed to a delayed peak in bond maturities to 2028, according to S&P Global Ratings.

Still, with heightened geopolitical tensions adding to already-heavy price pressures and supply constraints, and the Fed beginning to battle nagging inflation with what promises to be an aggressive cycle of monetary tightening, borrowers in North America may soon see the run of remarkably favorable financing conditions come to an end.

“We see a high risk that investors could soon demand significantly higher returns because of an escalation in the Russia-Ukraine conflict, the continuation of historically high inflation, or other unexpected adverse events,” S&P Global Ratings Regional North America Credit Conditions Chair David Tesher said in the report, published today. “This could result in the repricing of financial and real assets, higher debt-servicing costs, and tighter financing conditions—which is especially concerning against the backdrop of high debt levels, and could hurt lower-rated borrowers in particular. Moreover, we think this risk will likely worsen in the next 12 months.”

Today is Tuesday, March 29, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

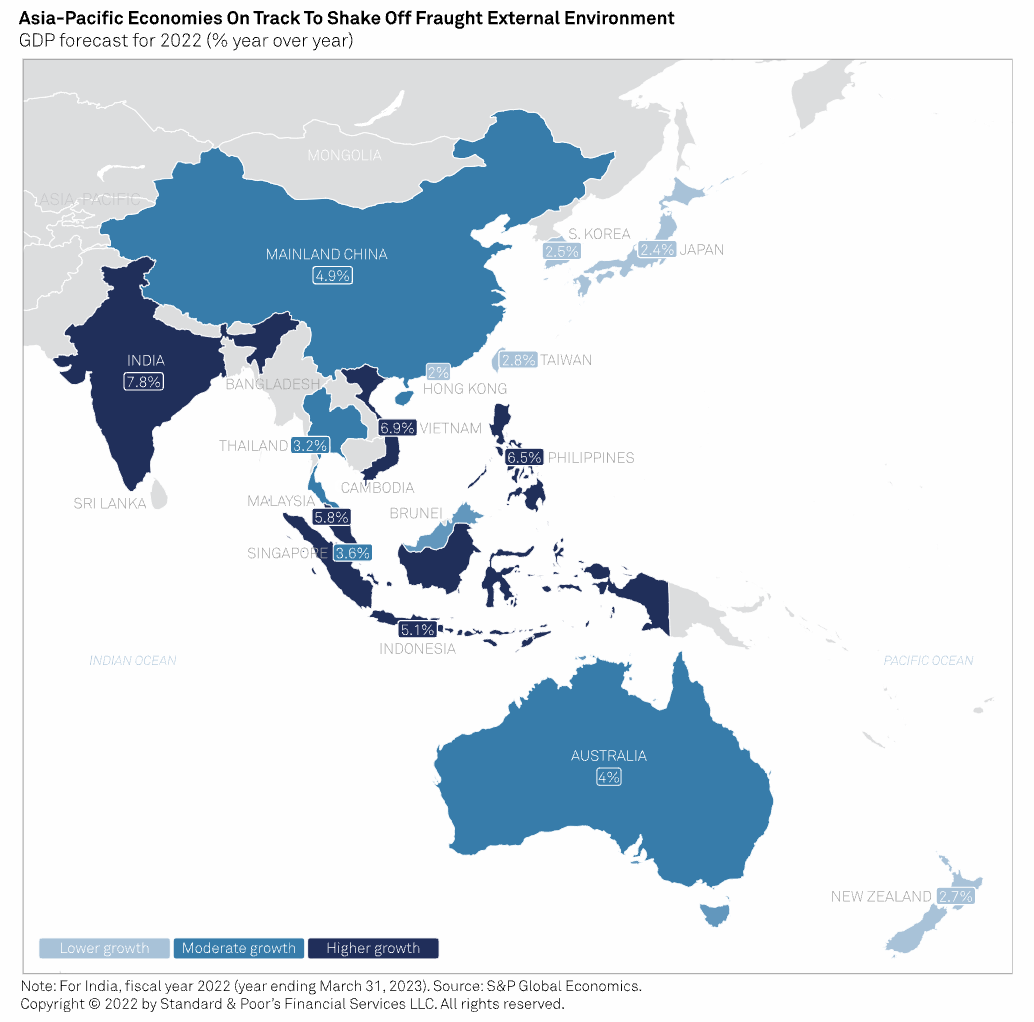

Economic Research: Asia-Pacific Economic Risks, Thy Name Is Inflation

The risks are stacking up for Asia-Pacific's incipient recovery. The war in Ukraine, U.S. policy rate rises, spiking energy prices, and escalating COVID cases in China are complicating the outlook for what has been healthy expansion in regional economies. S&P Global Ratings believes these new risks will generally present as inflation, and that they will dent an otherwise strong rebound from the pandemic. Most Asia-Pacific nations are moving to a stance of living with COVID, with robustly positive economic effects. Vaccination levels are typically high. Governments and businesses have become better at adapting to outbreaks. The mood in many nations is that the pandemic is manageable, and that people can resume normal activity.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Russia's Pivot To China For Payment Alternatives Offers Limited Gains

Russia is turning to China to explore workarounds after several Russian banks were banned from the Society for Worldwide Interbank Financial Telecommunication, or Swift. The central banks of the two nations are "establishing cooperation" between their financial messaging systems, Anatoly Aksakov, head of the financial committee in Russia's lower house of parliament, said March 16. The move for Russia's System for Transfer of Financial Messages, or SPFS, and China's Cross-Border Interbank Payment System, or CIPS, aims to "get rid of risks associated with maintaining trade turnover," Aksakov said in the video posted on his website.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

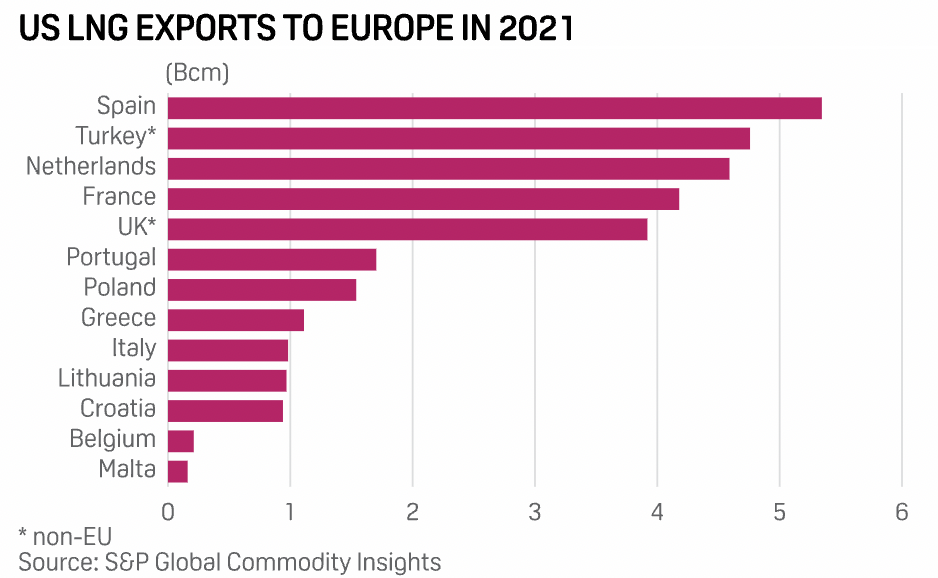

Gas Industry Eyes Regulatory Support To Meet U.S.-EU LNG Goals; Enviros Cry Foul

A U.S. pledge March 25 to supply an additional 15 Bcm of LNG to the EU in 2022 and potentially hike that to 50 Bcm/year by 2030 came with White House assurances to maintain "an enabling regulatory environment" that the gas industry hopes will ease hurdles and create a more positive investment environment for bringing gas infrastructure online. At the same time, environmental groups in the U.S. are raising alarms that the Biden administration should be doing more to accelerate the transition to renewable energy without locking in more fossil fuel production and assets.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

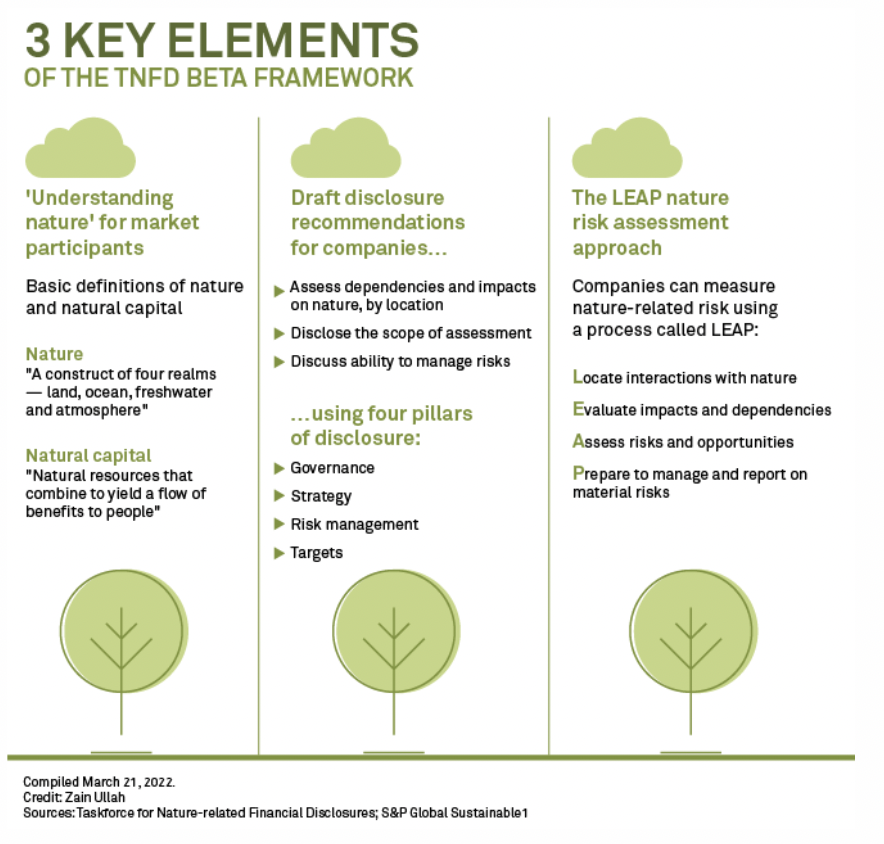

No Planet B: A New Framework Aims To Recognize The Role Of Nature In Business Decisions

Most people would say they value nature—but that isn’t always reflected in business decisions. Companies and investors are increasingly aware of their dependence and impact on nature and are looking for ways to translate this awareness into financial value. In fact, the World Economic Forum estimates half of global GDP—$44 trillion—relies on nature. Still, the pace and magnitude of biodiversity loss and ecosystem destruction has never been higher, meaning there is critical need for companies, governments, and investors to pay attention to their interaction with natural capital. This week, the Taskforce for Nature-related Financial Disclosure, or TNFD, released its beta framework to help link business decisions to nature.

—Read the full article from S&P Global Sustainable1

Listen: Global Food Security At Stake As Russian War Shakes Up Agriculture Markets

Global food security, just like energy security, has emerged as a major risk from Russia's war in Ukraine. The latest episode of Capitol Crude takes a look at the shakeup in agriculture markets with Peter Meyer, S&P Global's head of grain, oilseed, and feedstock analytics. He explains the role of Russia and Ukraine in growing wheat, corn, and other crops for the world, how major buyers like China are reacting, whether U.S. farmers will be able to meet any of these new demands, surging fertilizer costs, and how farmers are navigating these risks. Stick around after the interview for Starr Spencer with the Market Minute, a look at near-term oil market drivers.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

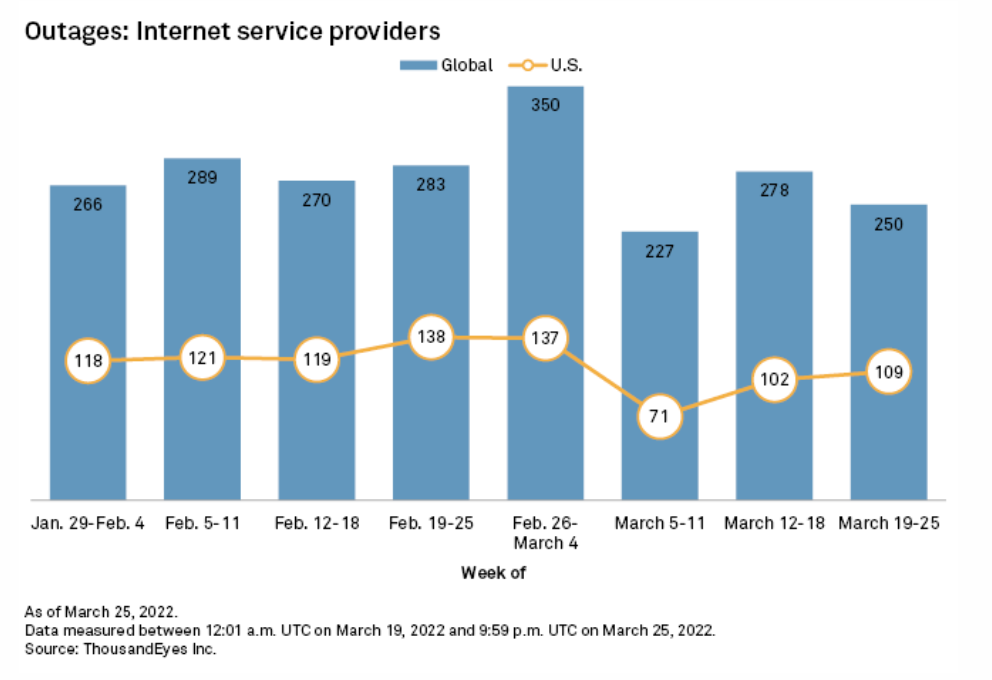

Global Internet Outages Fall 10%, U.S. Disruptions Increase In March

Global internet outages totaled 250 in the week of March 19, down by 10% from 278 in the previous week, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. U.S. disruptions, however, increased 7% to 109 from 102 in the measured period, comprising 44% of all global outages, compared to 37% in the prior week. ThousandEyes detected two notable outages in the previous week, including one on March 21 that affected downstream partners and customers of Fremont, Calif.-based Hurricane Electric LLC in multiple countries including the U.S., Canada, Nigeria, Australia, Malaysia, Germany, China, Denmark, Egypt, Norway, Japan, and Belgium.

—Read the full article from S&P Global Market Intelligence